- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

The emergence of Saudi America

U.S. a contender to become world’s largest oil producer

- By Eric Lundin

- February 10, 2014

- Article

- Arc Welding

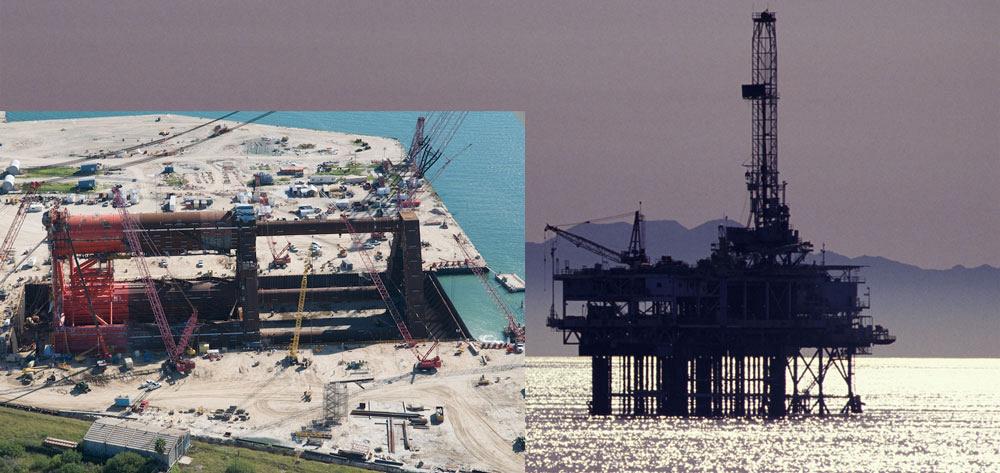

The number of oil rigs in operation in North America hit a low point, 98, in August 1999, according to the Baker Hughes rotary rig count. The number has varied between 1,000 and 1,400 since June 2011. This has been a boon to both rig workers and the contractors who build rigs such as the ATP Titan (inset).

Few inventions have changed the dynamics of world trade more than the internal combustion engine. The four-stroke engine was perfected around 1876 in Duetz, Germany, shortly after the first commercially viable oil well was drilled in 1859 in Titusville, Pa. Just a few decades later, light, sweet crude was found in vast quantities in the Middle East, and Saudi Arabia quickly emerged as the production leader.

In the early 1970s, dicey Middle East politics revealed just how much the U.S. depended on oil purchased from the members of the Organization of the Petroleum Exporting Countries (OPEC). U.S. support for Israel during the Yom Kippur War led to the oil embargo, which ran from October 1973 to March 1974, and ushered in a recession and probably contributed to the stagflation that dominated the U.S. economy for the rest of the decade. Nearly every presidential candidate since that time has advocated an end to U.S. dependence on foreign oil, and for decades that sounded like a pipe dream.

The embargo notwithstanding, OPEC has been both friend and foe. This collection of suppliers occasionally would agree to restrict production and send oil prices skyward. The chief country of the cartel was Saudi Arabia, which sits atop nearly 70 percent of the world’s proven oil reserves. Lost in the rhetoric is the fact that the U.S. always has been somewhat self-sufficient in oil production. Even at its lowest point, late 2005, the domestic oil production industry supplied nearly 25 percent of U.S. demand; these days it’s closer to 50 percent. Meanwhile, the role of the U.S.’s largest foreign supplier, Canada, has grown considerably. Its supply to the U.S. has grown from less than 10 percent of U.S. demand in 1973 to more than 17 percent in 2013.

Modern drilling techniques—specifically, horizontal drilling and hydraulic fracturing—enable petroleum companies to get at formerly inaccessible oil by cracking layers of shale, releasing trapped oil. The oil sands in Canada, the Peace River, Athabasca, and Cold Lake deposits, have quite a bit to offer, but are recoverable only when coaxed from the earth with a lot of steam, which heats the oil so it can flow.

These techniques use more pipe than conventional drilling, which has led to a boom in demand for all manner of tube and pipe for the oil and gas industry.

For tube and pipe producers interested in entering this market, or fabricators in a position to supply any of the myriad components that go into an oil rig or a refinery, the potential is vast and growing. The world’s demand amounts to about 84 million barrels of oil per day, and it is expected to continue to grow for the foreseeable future.

Pipe Production, Testing, and Finishing

“Many of the Tier 1 companies made investments in capital equipment years ago, companies like U.S. Steel and ArcelorMittal,” said Doug Nidy, technical sales engineer for Fives Bronx, a manufacturer of tube and pipe mills, straighteners, end finishing equipment, and hydrostatic testing equipment. “More recently it has been the Tier 2 companies investing in electric resistance welded [ERW] mills, finishing floors, and other equipment,” he said. Like others interviewed for this article, he identified the Houston area as the hotbed of activity. One Fives Bronx customer, TPCO Enterprise Inc. (a subsidiary of Tianjin Pipe Corp.), has ordered three straighteners and two mills for making 3-in.-OD, 0.250-in.-thick drill pipe.

Nidy also noted that the use of API premium thread has grown, which requires straighter pipe than common thread. Customers producing more premium thread have been buying 10-roll straighteners rather than 6-roll straighteners, he said.

Brandt Engineered Products has found that the growing demand for API premium connections has sent some tremors upstream. “As recently as five or 10 years ago, just a few companies made the large-bore lathes needed for threading the largest diameters,” said David MacNeill, regional sales manager for the company. The growing demand has opened up this industry a bit, and now several manufacturers, including Brandt, offer threading machines. The latest machines offer more controlled axes and higher throughput than the machines offered years ago, he said.

Hydrostatic test equipment also has been changing over the years, Nidy said. The continued development of higher pipe grades has resulted in demand to test at higher test pressures, so today’s hydrotesters have substantially higher load capacities. In addition, today’s line throughput has increased, creating customer demand for dual-head and triple-head machines which can test two and three pipes simultaneously.

Figure 1

Miller Electric’s regulated metal deposition (RMD) process, an advanced gas metal arc welding process, provides the heat transfer and penetration necessary for pipe applications. The result is that pipe contractors have an alternative to the conventional pipe welding processes, shielded metal arc welding (SMAW) and gas tungsten arc welding (GTAW).

MacNeill said that the use of heat-treated products also has been driving the need for higher-pressure machines, while larger diameters are behind the growing demand for larger-sized machines.

Regardless of the specifics, energy industry customers are looking for more throughput, more flexibility, and often more automation, MacNeill said. Gravity-powered feeding systems have given way to drag-chain systems. The positive control provided by drag-chain systems helps to protect the product from damage (especially critical for the relatively expensive premium thread), reduce noise, and improve worker safety.

MacNeill, who used to work for a pipe manufacturer, is familiar with the challenges.

“Changing from a 9-in.-OD product to a 4-in.-OD product is one thing,” he said. “Maintaining a good profit margin is something else altogether. To do that, they need to nearly double the tonnage per hour.”

Pipe producers can use several testing processes to verify the pipe’s integrity: flux leakage, ultrasonic, and eddy current. They aren’t limited to just one test, of course; a test system often comprises two or three of these processes.

For example, Magnetic Analysis Corp. can combine its Rotoflux® flux leakage system and Echomac® ultrasonic system to detect OD and ID notches, both longitudinal and transverse, as well as lamination defects. The system also measures wall thickness variations after heat treatment and straightening. A combination of ultrasonic and eddy current unit, such as the Multimac®, expands the system’s capability, allowing the user to detect incomplete and mismatched welds, pinholes, leakers, and weepers in small-diameter umbilicals.

A complete system includes a magnetizer to prepare the pipe for the flux leakage test; demagnetizer to prepare it for the ultrasonic test; water system to provide the necessary coupling; marking system to indicate flaws; and a material handling system that handles both normal and upset ends.

Cutting Processes

Graebener-Reika’s Advantage series rotary-head cutting machines are intended for cutting oil country tubular goods, said President Rich Marando. The machine is optimized for cutting 3-in. to 8-in. pipe (3.5 in. to 8.625 in. OD). The rotary-head design provides accurate 90-degree cuts by rotating the cutting tools around a stationary pipe, Marando said.

“The basic model offers cutting and OD chamfering, and we offer ID chamfering as an upgrade,” he said. All models are equipped with a full-length, servo-controlled feeder for cut length accuracy (± 0.010 in.), and its control unit allows the user to create a cutting profile that reduces the likelihood of burrs.

The machine was designed for fast changeovers, using collet clamps and spacers to change workpiece diameter. Its design also facilitates common maintenance tasks.

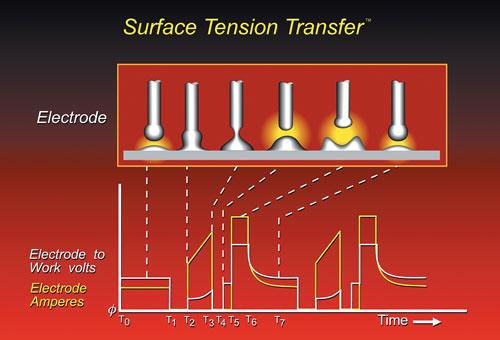

Figure 2

Lincoln Electric’s propriety Surface Tension Transfer process is a modified gas metal arc welding (GMAW) process that overcomes some of conventional GMAW limitations. The process uses a background current (from T0 to T1) until a ball forms on the end of the electrode. The current falls as the ball contacts the puddle (T1 to T2), then climbs until the ball is about to separate from the electrode (T2 to T3). It falls again as the ball separates to prevent spatter (T4). When the arc re-establishes, it switches to high current (T5 to T6), then drops to the background current level (T6 to T7). The result is more uniform heat input and better weld penetration, suitable for pipe applications.

Welding and cutting equipment manufacturer ESAB likewise has found that its cutting machines are useful in this industry. Gulf Island Fabrication, a company specializing in structural fabrication on a big scale, has been using ESAB equipment since the early 1990s to build offshore rigs. One of its projects was a floating rig it constructed for ATP Oil & Gas Corp., the ATP Titan. A deepwater drilling platform built for drilling and extracting in the Gulf of Mexico, the ATP Titan weighs 19,000 tons and measures 725 ft. from the base to the top of its derrick.

For its cutting and marking processes, the company uses 13 of ESAB’s CNC cutting systems, including AvengerTM and SabreTM systems. Heavy-duty gantry-style systems, their widths range from 10 to 40 ft. Processes include precision plasma cutting, oxyfuel cutting, plasma marking, zinc marking, and punch marking.

Pipe has to be cut to the right length in the field before it can be welded, and CS Unitec has saws cutting pipe nearly everywhere oil is extracted or processed —in refineries, for pipelines, and on offshore oil rigs. The company manufactures the largest portable band saws in the world, according to Tom Carroll, company president, which are available in both electric and pneumatic models. However, the power source isn’t the key feature.

“We make several models that are ATEX-classified,” he said, citing a European standard for operating in explosive atmospheres.

“October was our best month yet,” Carroll said. He’s expecting a good year in 2014.

Supplies and Consumables

Tube and pipe are the chief products used in oil and gas extraction, but they aren’t the only ones. Mill Masters Inc. has enjoyed brisk business in the last few years for mills used to make small-diameter stainless steel cable. The cables are used to connect downhole sensors that monitor operating conditions, such as temperature and pressure, to gauges in the rig’s control room.

“Usually two or three of these cables are bundled together inside a polypropylene jacket,” said Michael Fisch, product manager. “The process uses continuous welding, and as the cable feeds off the mill, it’s wound onto a coil. Each one holds about 5 miles of cable,” he said.

Hardfacing has taken on a more important role as wells have gotten deeper and as oil is extracted from hasher localities, notably oil sands.

Stoody, a manufacturer of welding consumables, has created several welding wires for hardfacing. Stoody® HB-62 and Stoody HB-56, which have hardnesses of 62 and 56 Rockwell C, respectively, are for hardfacing drill pipe. One customer using this application used to resurface after drilling two holes; it now drills six before resurfacing, a 300 percent improvement. Both wires earned Fearnley Procter NS accreditation, an approval program that supplements American Petroleum Institute standards. The accreditation also cites the company’s quality management and performance.

The company introduced two additional hardfacing alloys, Stoody 155FC and 160FC, in late 2013. Their composition includes tungsten carbides in nickel, silicon, boron matrices for weldability and abrasion resistance.

The more ductile of the two, 155FC, which has a hardness range of 35 to 45 HRC, was designed for multipass operations and offers greater resistance to spalling. The more wear-resistant of the two, 160FC has a hardness range of 40 to 50 HRC. The former is intended for use on components such as process screw flight edges, buildup on drill bits and stabilizers, and hardbanding; the latter was developed for use on drill bit holders, kicker pads, stabilizers, mud motors, and any other application that requires resistance to corrosion and fine particle corrosion. Each can be used by itself, or the 155FC can be used as a base for 160FC.

Consumables likewise play a big role in rig construction. ESAB learned just how big when Gulf Island Fabrication selected two of its consumables, Dual Shield II 70T-12 and Dual Shield II 70T-12H4 flux-cored wire, for use in the construction of the ATP Titan. Chosen for the particular needs of the offshore environment—the structure has to withstand the constant stresses of wave motion and exposure to seawater—these consumables were used on approximately 85 percent of the welds needed to construct the rig. Welding efficiency is a factor on a project of this scope and, according to ESAB, they provide an optimal combination of deep penetration, high deposition rate, ease of use, and minimal spatter. The project required 2.5 million pounds of wire.

Pipe Welding

The petroleum industry wouldn’t get much done without a lot of butt-welded pipe, and the processes for getting this done have been changing in recent years.

“Pipe welding traditionally has been gas tungsten arc welding [GTAW] and shielded metal arc welding [SMAW],” said Jim Byrne, sales and application manager for pipe welding for Miller Electric. “These days we are seeing increased interest in gas metal arc welding [GMAW],” he said. “In the past, using the short-circuit GMAW process on the root pass for pipe was dismissed for its lack of fusion and poor penetration,” he said. Some of the old hands have retired or left the industry, so some of the new up-and-comers in the industry have been giving advanced GMAW processes a fresh look because they have seen them in welding schools, Byrne said.

In Miller’s case, the advanced GMAW processes include regulated metal deposition (RMD®) for the root pass and pulsed welding for the fill and cap passes (see Figure 1). The company’s PipeWorx 400 welding system performs both of these processes and is designed for shop work.

RMD samples the arc characteristics up to 20,000 times per second and makes changes accordingly. The result is a smoother, cleaner weld with better penetration than conventional short-circuit GMAW and a faster deposition rate than GTAW. The weld also has a flatter profile and less spatter, reducing the amount of time needed to grind the weld before making the fill passes. The pulsed welding process uses the same wire-and-gas combination as the root pass, which is much faster than stopping to change the wire and gas when changing from one pass to the next.

“The drivers, as with nearly everything else, are to do the job cheaper, faster, and better,” Byrne said. “Contractors need to improve production speeds and maintain the quality level. For example, when welding a 2-in.-deep joint, a GMAW using a flux-core wire would require one-third the number of passes that GTAW would need,” he said. Qualified welders are in short supply, so this sort of productivity enhancement can help make up for the shortfall, he added.

Another system, Miller’s Pipeworx FieldPro™, incorporates several automatic features to reduce the number of decisions welders need to make, specifically when welding in the field. It can store four welding procedures for SMAW, DC GTAW, and GMAW. Switching from one process to another requires pressing a button, eliminating wire and gas changeover and the possibility of welding with wrong polarity. A remote control allows the operator to monitor the weld and make changes to the welding parameters from up to 200 ft. away from the welding power supply, eliminating trips back and forth to tweak the process. This system is also capable of operating RMD.

Carlos Richmond, product manager for mechanized automation for Arc Products, and Brian Butler, automation manager for Arc Products, had many similar observations.

Arc Products displayed a new orbital GMAW system in 2013, at FABTECH®, and one of the goals in its development was a focus on welding, not on spending weeks training someone to use it, Richmond said.

“The pendant control was designed to be easy to use,” he said. “It has two variable inputs and a steering knob that allow the operator to adjust the necessary welding controls on-the-fly,” Richmond said.

“To get started on a weld, you select the type of pipe and the type of gas, and that gets you in the ballpark,” Butler said. “Then you just make small adjustments to the amperage and other characteristics. It’s not quite foolproof, but it’s close.”

It also lets a supervisor check in on the welder from time to time.

“It incorporates Power Wave® technology, which has features like checkpoint production monitoring, so the welder’s supervisor can monitor that welder from anywhere,” Richmond said.

Butler acknowledged that some fabricators hesitate to use GMAW on pipe, especially on root passes, but this is changing. The unit uses an advanced GMAW process, Lincoln

Electric’s Surface Tension Transfer (STT®), which controls the current to adjust the heat regardless of the wire feed speed (see Figure 2). This improves fusion and reduces both fumes and spatter. It also takes into consideration different root gaps, so it’s a little more forgiving than conventional GMAW, and it’s considerably faster than GTAW, Butler said.

Petroleum, Today and Tomorrow

The world’s demand for oil has grown substantially for more than 30 years, increasing from 58 million barrels per day in 1982 to 90 million in 2012, an increase of 50 percent. More important, it has grown steadily and shows little sign of slowing down.

In North America production from 1982 to 2008 was essentially flat. Producers usually pumped between 15 million and 16 million barrels per day. Production shot up from 15 million barrels per day in 2008 to 17.9 million barrels per day in 2012, an increase of 18.6 percent in just four years. The price was the driver. The spot price for a barrel of West Texas Intermediate, which until 2002 had rarely exceeded $20, rose throughout the early part of the decade, and broke through $60 in late 2007. In 2012 it fluctuated between $80 and $110 per barrel, which is high enough to support continuing exploration and extraction activities, and it is expected to remain above $100 per barrel for the foreseeable future.

About the Author

Eric Lundin

2135 Point Blvd

Elgin, IL 60123

815-227-8262

Eric Lundin worked on The Tube & Pipe Journal from 2000 to 2022.

About the Publication

subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Team Industries names director of advanced technology and manufacturing

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Zekelman Industries to invest $120 million in Arkansas expansion

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI