Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Roll form and shine bright

Quick response helps roll former flourish in the solar business

- By Tim Heston

- October 9, 2013

- Article

- Roll Forming

Figure 1: Solar panel installations are relatively cheap to operate; the real costs come in when installing them, including the mounting structures that hold the panels in place. This is where innovative roll forming comes into play.

When Gary Schuster started his job as president and CEO at OMCO Inc., a roll former serving semitrailer and truck body manufacturers, the company had evolved to become a leading player in the field. Almost 90 percent of revenue came from trucking, and some of the parts coming off the roll form mills hadn’t changed significantly in 30 years. They may have gotten a few tweaks here and there, but that’s about it. After all, if the parts worked well, why change them? If it’s not broken, why fix it?

Then came the Great Recession. Revenue dropped a stunning 80 percent, and the business needed fixing.

OMCO has grown some 800 percent since its low point in 2009, and revenue is four times what it was during its previous peak year in 2006. How did the roll former survive such an unprecedented drop and bounce back so quickly? As Schuster explained, it’s partly because the company entered a new market at the right place and time. It’s also because of OMCO’s approach to roll forming, which hinges on cost reduction and, most important, rapid response.

Sunny Solar

Soon after Schuster started in 2006, when the trucking business already was starting to soften a bit, he set out to diversify revenue. He hired a new sales team to focus on growing the firm’s custom roll forming business, which at the time made up just 10 percent of company revenue. The new sales team wasn’t allowed to sell to more transportation companies.

In 2007 he moved his top salesperson to the Southwest to find new markets and, perhaps, a place for a new plant. After all, the company had a successful history when it came to geographic expansion. The original plant, in the Cleveland suburb of Wickliffe, opened in 1955, and the previous CEO had shepherded OMCO through two additional plant openings—one in Morgantown, Pa., in 1985, and the other in Pierceton, Ind., outside Fort Wayne, in 1988.

Shortly after his arrival, though, it became crystal clear where the opportunity was. “We started to focus 100 percent of our efforts on the solar business,” Schuster said. “It seemed to be blossoming at that point in time.” Managers were watching its core trucking business continue to decline. Meanwhile, roll forming the sheet metal mounting structures for solar panels, specifically for utility-scale installations, presented a real opportunity (see Figure 1).

The company experienced a frenzy of quoting activity in 2007 and 2008. Every prospect seemed to have a giant project in the works, but no one could pull the trigger and give OMCO a purchase order. Requests for quotes are nice and all, but they don’t make payroll.

By then OMCO had begun its quest to expand west, to be closer to what was becoming a hub of the solar industry, launching a new factory in Phoenix by the summer of 2009. This happened to be just when OMCO’s revenue situation was most dire.

Back in the Midwest, tensions mounted. Managers hadn’t expected the trucking business to fall as far and as long as it did. “The trucking business is cyclical, but this was absolutely unprecedented in both the trough of the down cycle as well as its length,” Schuster said. “Trailer builds declined dramatically, and to be honest, it was very difficult to keep the business together. I spent a lot of time working on bank relationships.”

The company had no choice at the beginning of 2009 but to shutter its Morgantown plant and consolidate those operations in the Indiana facility. It also had a lot of unused assets like rolling mills—something that’s bound to happen when sales drop by 80 percent. So these excess assets were shipped to the new Phoenix plant. “The company was financially struggling,” Schuster said. “So we started the Phoenix plant on a shoestring.”

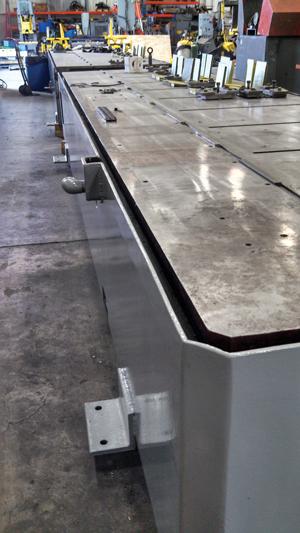

Figure 2: Some of the company’s stamping presses make components that are mounted to roll formed assemblies for solar panel installations. The assembly occurs in the factory, not on-site. It also stamps components for various customers outside the solar business.

Though solar was buzzing, no one was really moving forward with any significant projects. The potential was there, but orders weren’t. What started as a plan to diversify the business had transformed into a survival strategy. Would the solar business come to fruition once OMCO’s 65,000-square-foot plant opened?

Turns out, it did—big time. “Sales just exploded,” Schuster said. “As volumes took off and volumes rose, we added another [Phoenix] factory, so now we have 300,000 sq. ft. of factory space and about 600 employees in the Southwest.”

In 2009 the roll former’s first project was for a 10-megawatt solar plant. Projects grew larger in a very short time, and now OMCO’s Phoenix facilities are concurrently producing mounting components for two 550-MW projects, with a total installed base to date of 2,000 MW, all of which make 2009’s 10-MW project seem quaint. “Some of the largest solar plants in the world are being constructed now in the Southwest United States,” Schuster said. “It’s been fun, exciting—and crazy.”

Had the plant launched in 2007 or 2008, it may well have struggled or even failed. But by 2009 solar projects started moving forward, and OMCO’s mills started rolling. Also, if the company hadn’t rapidly deployed equipment to those plants as quickly as it did, the roll former would not have had the capacity it needed to meet the demand.

Rapid Deployment

From a market perspective, solar panel mounting structures are the polar opposite of truck trailer components. The basic design of OMCO’s roll formed components for semitrailers hadn’t changed in decades. But the solar business, in its infancy, has extremely short product life cycles. Everyone is on a quest to reduce installation costs.

According to Schuster, “Solar’s mission is to get to grid parity,” or the point at which the cost of alternative energy becomes equal or less than existing power from the grid. “Every project is a lesson learned, getting pennies out per kilowatt. We’re constantly getting the cost out of the installed mounting system.”

Like wind farms, solar installations are cheap to operate. The real costs are in installation and connecting those installations to the grid. For OMCO’s solar products, this means reducing on-site assembly time. Installing solar panels can be time-consuming work, often performed in the desert where it’s 115 degrees F in the shade. Productivity is low simply because of the nature of the construction site.

So OMCO attempts to make on-site installation simpler and shorter by shipping not just roll formed components, but subassemblies involving secondary fastening operations that connect subcomponents produced on progressive-die stamping lines (see Figure 2). These fastening operations occur in the plant, not on-site. Engineers try to limit joining in the field to methods that promote speedy and simple assembly, like self-locating tab-and-slot joints, usually formed with secondary operations integrated onto the rolling mill itself.

Rolling Mill Kanban

Still, the most challenging aspect—and according to Schuster, a key to the company’s success—was shortening the product launch process. Traditionally, it took between 20 and 26 weeks for OMCO to launch a new part program and purchase a new rolling mill for it. Between 2009 and 2010, the company shortened all this to between four and six weeks. It did it first by actually keeping an inventory of rolling mills on hand and at the ready.

“We do very little production here in Ohio,” Schuster said. “We have a fully craned factory here, and we normally keep four or five roll form lines active, ready to be deployed to the other factories. We always keep roll form lines in queue, ready for rapid deployment, which is an unusual strategy in this industry.

“[The Ohio facility is] our engineering center, where we build new lines and try out new shapes in roll forming. All this development work happens outside the production environment, so we don’t have the strains of trying to schedule a tryout in a production facility, where you have limited time. All of our tooling vendors are near us, and we can rapidly turn things around.”

In recent years the company bought dozens of used rolling mills and gutted them down to the roll stands, removing all the wiring and tearing down the gearboxes to the castings. When a customer project starts, the engineering team then goes into action. They use various strategies to shorten development times. In the prototyping phase, for instance, the company often uses soft rolls. These aren’t tool-hardened, but they take a lot of lead-time out when rapidly developing prototypes.

To prepare a roll forming mill, they install new controls and drives, and essentially rebuild it to like-new condition. As one mill is deployed to a factory, be it in Phoenix or Indiana, another rolling mill is purchased and inventoried at the Ohio facility. Call it kanban replenishment, only instead of parts or sheet stock, OMCO replenishes rolling mills (see Figures 3 and 4).

Since 2009 the Phoenix facilities have had an insatiable appetite for new roll form lines. By the middle of 2010, OMCO had shipped more than 20 mills to Phoenix and four more mills to Indiana, to handle additional solar projects in Canada. “Eventually, within a two-and-a-half-year period, we deployed more than 30 mills,” Schuster said.

Borrowing Best Practices

The trucking business, while healthy and steady, hasn’t returned to its 2006 peak. According to Schuster, fleets usually don’t expand until GDP grows more than 3 percent—and the economy hasn’t done that in years. Since the downturn, the roll former’s trucking business has been sustained by fleet owners replacing old equipment.

Still, the company’s trucking business has borrowed some aspects first implemented on the solar side. For at least one customer, the company now provides not just roll forming but also assembly, building the entire front wall of a trailer. “We’re constantly looking at where we can provide additional value and not just be a roll former,” Schuster said.

Managers consider quick turnaround as a long-term strategy, not just for solar but for other markets too. After a series of layoffs, OMCO had about 100 remaining employees in early summer 2009, just before the launch of the Phoenix plant. It now employs 800. But leaders know they may not be riding the solar wave forever, so what’s next? For this reason, OMCO has renewed its focus on custom roll forming as well as products for other market sectors.

Although Schuster said he couldn’t give further details, the company is looking at “expanding its geographic reach” both nationally and globally.

About Flexibility

The solar business has forced OMCO to be flexible. Certain products have a life cycle measured in months, not years. Some products may have the same roll form profile for several years, but engineers may add or change clips or other features, part of the industry’s continual quest to keep cost out of solar installations.

The typical scenario in solar goes something like this: The customer and OMCO agree to work together. Parts are designed, then redesigned, then tweaked some more—again, all in an effort to shorten and simplify expensive transportation and on-site installation time.

Finding ways for these mounting components to stack onto a truck is a science unto itself. OMCO can roll form a component and then connect it to a few stamped components, giving on-site workers fewer elements to install. But this won’t work if the subassemblies can’t stack efficiently.Part designs are finalized. Then they wait. And wait. Finally, OMCO is given the green light for production. No problem—except the customer wants these roll formed parts in six weeks. At that point, the staff in Ohio springs into action. Roll form lines in inventory are tested, and loaded onto a truck headed for Phoenix or Indiana.

The idea of rapid response isn’t unique to the solar business. In broader metal manufacturing, it’s not even that unusual. With short product life cycles permeating various sectors, it’s really becoming the new normal—especially in contract manufacturing. Schuster said it is OMCO’s plan to sell this core competency to a variety of markets for decades to come.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI