- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Tackling the costs of employer-provided health care

What manufacturers can do to help fix the system

|

Health care is one of the biggest concerns of today's manufacturers. Polls and surveys of National Association of Manufacturers (NAM) members have shown health care is as much of a concern as such major issues as litigation, regulation, and outsourcing.

One of the reasons for the concern is that, for more than 60 percent of the small and medium-sized manufacturers surveyed, health care costs are rising from 13 to 25 percent each year. For large manufacturers, that percentage is nearly doubled, with 40 percent annual increases in health care rates.

What's the Problem?

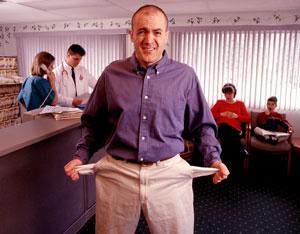

Employer-based health care is widespread and popular (see Figure 1). It's literally the backbone of the U.S. health care system. Most people get coverage through employer-based plans until they are eligible for Medicare.

|

| Figure 1 Most employees view health insurance as the most valued benefit offered by their employers. |

In theory, the system has worked very well for several reasons. It's a voluntary, fairly flexible, and tax-favored system (employees don't have to claim benefits as income, and employers can deduct the cost of coverage as a business expense).

So what are the problems?

- Administration. Health care is difficult to administer. With mandates created by legislation such as the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985, which temporarily extends the right to health care at group rates for unemployed individuals, and the Health Insurance Portability and Accountability Act (HIPAA) of 1996, which protects individuals from discriminatory practices and invasion of privacy, it's very complex.

- Dissatisfaction. Many workers aren't satisfied with the benefits they receive, and the complaints come back to the employer rather than the insurance company.

- Expense. Many manufacturers can no longer afford to offer coverage. A survey of NAM members showed that 71 percent predicted cost increases of more than 10 percent in 2004, while 81 percent predicted a range from 1 to 20 percent (see Figure 2).

Why the High Expense?

Rising costs in health care coverage can be attributed to several factors.

For one, the work force as a whole is getting older and living longer. When they become retirees, coverage lasts longer than it would have 30 or 40 years ago.

The rising prevalence of obesity in society is another problem. In fact, one research firm estimates the overall cost of obesity in society to be $13 billion per year. Obesity's connection to chronic health problems, such as diabetes and hypertension, compounds the problem. These conditions are of long duration and are very expensive to treat, usually requiring multiple medications, which has fueled the growth in pharmaceutical spending, another huge drain on employer-provided health care benefits.

|

| Figure 2 More than half of the companies surveyed expected to see double-digit increases for health insurance costs in 2004. |

Hospital spending is the single fastest-growing component of health care cost. Facing a huge labor shortage, hospitals must spend more to hire qualified workers. Also, as medical technology becomes more precise and advanced, costs go up.

Medical liability is a huge problem in the U.S. health care system. Every time a doctor or a hospital gets sued, the cost of that judgment flows down to the health care purchaser.

How to Fix It

NAM and other organizations are strong supporters of health savings accounts, health reimbursement arrangements, flexible spending account rollovers, and other methods to encourage consumerism in the current health care system. Employees need to understand that pills don't come in $10, $20, and $30 flavors; they might cost $250. The doctor's visit isn't a $15 co-pay; it's $300 to the company's health plan.

Other recommendations from NAM include:

- Protect the gains manufacturers received in Medicare reform. It will be vital to introduce private marketplace competition and disease management, and to help Medicare change to help prevent disease rather than pay for treatment of disease.

- Pass medical liability reform in the Senate. The House passed it twice in 2004, but the Senate balked on liability reform, whether it's product liability, medical liability, or class action reform. NAM believes that removing the litigation costs from health care is critical to controlling costs.

- Reduce medical error. Preventable medical errors, from surgical mistakes to botched prescriptions, kill nearly 200,000 Americans each year. Moving to electronic records and true peer review rather than litigation shelter will help to reduce the incidence of medical errors.

- Limit benefit mandates and liability expansions. While proposals for the patient's bill of rights, mental health parity, or colon rectal cancer screening sound good, mandates for additional coverage result in more health care costs for manufacturers. According to some health care industry observers, for each 1 percent that health coverage costs increase, 400,000 people lose their coverage.

- Encourage disease prevention and healthy habits. Behavioral issues account for at least half of all health care expenditures. In the future, manufacturers could look into varying insurance premiums by health status or health indicators. For example, people with lower body mass indices could receive discounts, as long as there is a provision for people who can't make a target but are working to improve their health status.

Where Is Health Care Going?

Interest is increasing for more employee involvement, with more emphasis on health savings accounts, and this trend is expected to grow.

There is great promise in consumerism and moving toward getting consumers more involved in their health care benefits. That way, manufacturers can maintain some level of employer involvement and still fix their costs to help end the veritable nightmare that health care benefits have been to employers in recent years.

National Association of Manufacturers, 1331 Pennsylvania Ave. N.W., Washington, DC 20004-1790, 202-637-3000, fax 202-637-3182, www.nam.org

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI