Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2016 capital spending forecast in metal fabrication: The growth continues

Survey reports gains in welding and bending equipment categories

- By Tim Heston

- November 30, 2015

- Article

- Shop Management

Visit an OEM these days and you’ll likely see kits of parts or a small batch of completed sheet metal subassemblies delivered just in time from a custom fabricator. Gone are the days of huge deliveries and massive batches. OEMs want to control the amount of inventory they have, and a good many of them have pushed those inventory requirements to their parts suppliers.

Custom fabricators don’t want to drown in inventory either. In fact, for fabricators having customers requiring them to hold finished-goods inventory, those inventory requirements aren’t as high as they once were. According to survey results published last month in The FABRICATOR, a little more than half (54 percent) of the respondents said they hold less finished-goods inventory today than they did three years ago.

At the same time, some fabricators deal with slow payments. More than a quarter of respondents to the “2015 Financial Ratios & Operational Benchmarking Survey,” put together by the Fabricators & Manufacturers Association International (FMA), said that on average they wait well more than a month for customer payments. Add finished-goods inventory requirements to slow payments, and you can run into a cash flow problem in a hurry. So what’s a custom fabricator to do?

The trick seems to be shortening the overall manufacturing time. Unlike payments and customer inventory requirements, the manufacturing cycle is directly under the fabricator’s control. Results from this year’s “2016 Capital Spending Forecast” from FMA, which tracks spending trends for metal fabricators in the U.S., imply that fabricators continue to shorten that cycle.

Big Gains in Bending

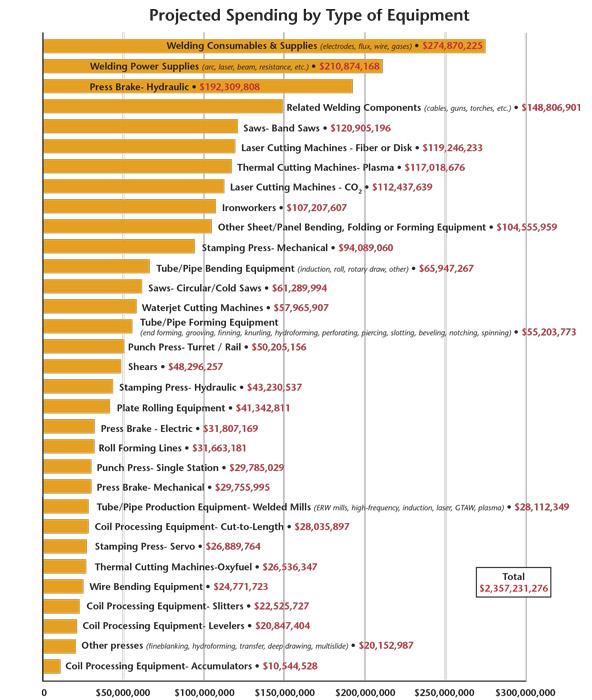

Projected numbers for total spending are up only a little over 2 percent over last year’s report—for a total of $2.3 billion. Overall, this shows that the metal fabrication manufacturing technology business has regained its losses from the Great Recession and then some (see Figure 1).

Among the spending category trends, one technology stands out: bending equipment. Total the projected spending for hydraulic and electric press brakes, as well as other bending equipment such as folding and panel bending, and you get well over $328 million. This surpasses the $231 million projected spending for both CO2 and solid-state (fiber or disk) laser cutting machines.

Planned spending on bending surpassed laser cutting for the first time in the 2015 forecast, and the trend seems to be continuing. True, total spending on all cutting processes (laser cutting, plasma cutting, punching, oxyfuel, and waterjet) together account for more than $500 million in total projected spending. All the same, the industry is now making bigger investments in the forming department.

When you consider the needs of the custom fabricator, this isn’t surprising. A fab shop needs to produce kits of parts as quickly as possible, with minimal setup time. For years shops have been able to nest kits of parts on the laser or punch press, but until recently press brake changeover was an issue. So fab shops increased batch sizes and nested identical parts on sheets to make life easier for the forming department.

Today advanced setup and quick-changeover technology—bending simulation, automatic tool change, the use of panel bending and folding when possible—is making the forming department as flexible as cutting. All this technology of course adds to bending investments, and the 2016 spending forecast certainly reflects that.

Gains in Welding

Welding power supply spending is up 10 percent, and welding consumables and supplies spending is up almost 40 percent from last year’s forecast. Spending on guns, cables, and other welding torches is up 32 percent.

Figure 1

Total planned spending increased a little more than 2 percent over the 2015 forecast, though certain categories, especially bending and welding, had significant gains.

Planned spending in all the welding-related equipment combined is more than $600 million. That’s the largest spending category by far, and the jump in consumables spending may be a harbinger of busier times ahead.

Shifts in Laser Spending

The initial cutting process remains the engine of the industry. Without reliable cutting, part flow halts. This year’s forecast shows a significant shift in spending. Projected spending on punching declined from last year, and for the first time, projected spending on fiber and disk lasers surpassed spending on CO2 machines.

True, the difference is less than $7 million—a tiny amount when measuring industrywide spending. And this survey doesn’t account for existing laser cutting machines, where CO2s still dominate, simply because the technology has been around for so many years. But it seems the popularity of fiber and disk laser cutting is stepping up rapidly.

Information and Software

When looking at the order-to-cash cycle, many now have their eye on front-office operations. As more custom fabricators are taking on more design work—beyond just design for manufacturability—engineering and estimating functions become more complex, especially as that work focuses on more subassemblies and full assemblies that call for multilevel bills of material and a multitude of sourced parts.

Some shops have reported that a job can spend more time in the front office than on the shop floor. So the industry is turning to better methods of communication, and they’re also turning to software: CAD/CAM, nesting systems, as well as enterprise resource planning (ERP). After all, no matter how good the shop floor gets, they can’t meet customer demand if they don’t get the right information at the right time.

So it’s no surprise that software spending is on the rise. This year more than 94 percent of respondents said software spending would either remain the same or increase. Only 6.7 percent said it would decrease.

Spending Geography

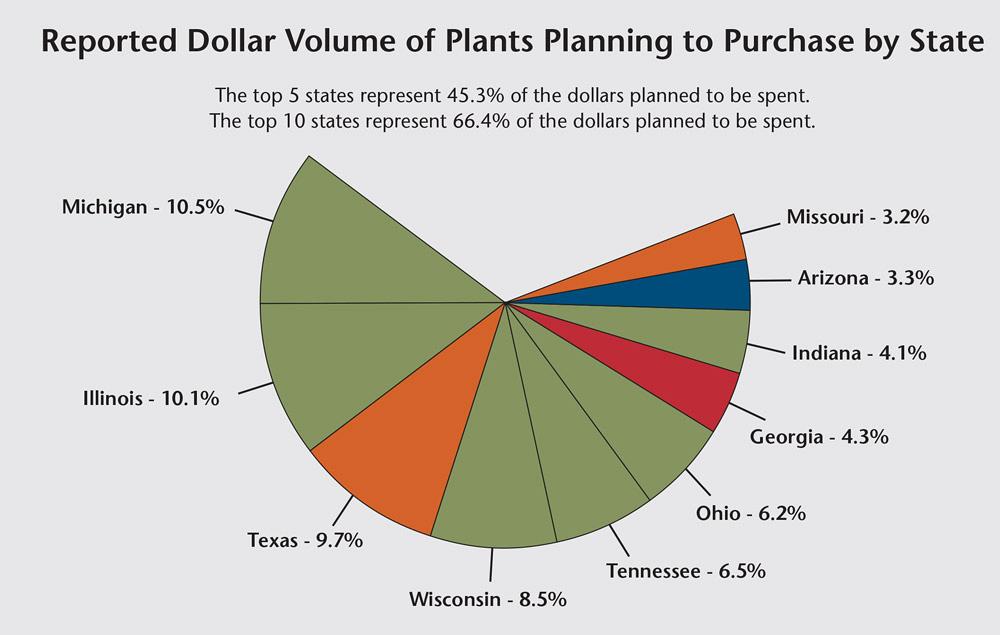

Reflecting the continued strength of the automotive sector, Michigan leads in projected capital spending this year, followed by Illinois and—surprisingly—Texas, despite the slowdown in oil and gas. This may reflect how custom fabricators are diversifying. The energy sector isn’t the only game in town.

When analyzing total dollars spent on equipment, the industry is geographically concentrated. More than 66 percent of total spending dollars will come out of just 10 states (Figure 2).

A Small-shop Foundation

Back in 2012, as the industry bounced back from the greatest downturn in a generation, total projected spending was at a little more than $1.5 billion. Projected spending between 2012 and today has jumped by nearly 50 percent.

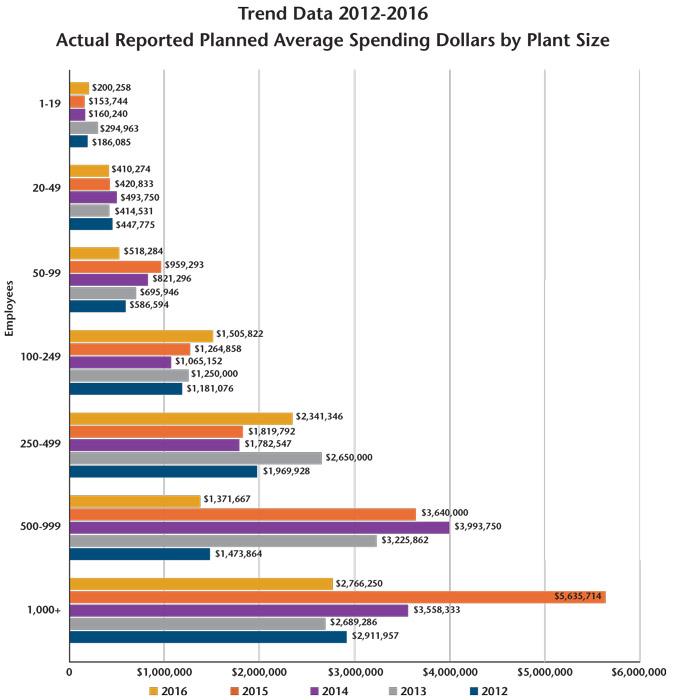

Individually, large companies obviously spend the most, though planned 2016 spending at companies with more than 1,000 employees took a tumble, dropping by more than 50 percent from last year’s forecast (see Figure 3). This may reflect the struggle for large manufacturers connected to mining, oil and gas, and agriculture.

Figure 2

Capital spending dollars remain geographically concentrated. More than 66 percent of all planned spending in metal fabrication comes from 10 states.

Individually, small shops obviously spend a small amount. But collectively, these shops—the very small shop, in fact, with fewer than 20 employees—drive technology spending in metal fabrication, mainly because there are just so many of them (see Figure 4).

In 2012 the industrywide small-shop spending was projected to be only $256 million. Back then, shops with 250 to 499 employees were planning to spend more than $441 million; that’s greater than the 2016 projection. That was great for them, but there simply aren’t that many medium-sized or large shops in the fabrication business. Hence, in 2012 the total level of capital equipment spending in metal fabrication was much lower.

Fast-forward to today. In 2016 small shops collectively plan to spend more than $977 million, a 35 percent increase over the 2015 forecast. To put this in perspective, over the past five years the planned spending at the small shop has nearly tripled. If anyone is looking at just how the manufacturing technology sector rebounded so significantly in metal fabrication since the Great Recession, they should thank the humble neighborhood job shop.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI