Editor-in-Chief

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Fabricating lessons that stand the test of time

The FABRICATOR’s 2017 Industry Award winner, AT&F learns that the guiding principles that helped to shape the company still apply during an aggressive expansion phase

- By Dan Davis

- January 25, 2017

- Article

- Shop Management

Ken Ripich (left) and Michael Forde Ripich stand in front of a 2,800-ton, 60-foot single ram press brake, which is representative of the heavy-duty equipment that AT&F is known for.

As he was interviewing for his current position as business unit leader of AT&F Wisconsin about two years ago, Joe Girard noticed a small saying at the bottom of a job description he was perusing: “The company is in its fourth generation of family leadership. While the values of the organization are similar to those found in family-run firms, the company is sophisticated and professional without being pretentious.”

He saw it as a good sign, and it turned out to be when AT&F, a 76-year-old fabricator of heavy and large parts, tapped him to run its newly acquired, 60,000-square-foot facility in Manitowoc, Wis. He knew he had joined a company that practiced what it printed.

“It’s a family-owned company that is run professionally and welcomes outsiders and their ideas,” he said. “You often don’t find all three of those.”

That combination has served the fabricator well over the years. It is now being led by the fourth generation of the family, and it is entering new business segments and geographic markets at a rapid pace. Guided by business principles that have been forged over the years, the family company has matured into a modern midsized manufacturer with an increasing fabricating knowledge base and an expanding manufacturing footprint. This growth and the efforts to maintain an entrepreneurial and family-first work environment are two of the main reasons that The FABRICATOR has named AT&F as the winner of its 2017 Industry Award.

What Is AT&F?

In the marketplace, AT&F’s reputation is shaped by expectations from customers in the heavy industrial, energy, defense, and marine markets, according to Ken Ripich, AT&F’s executive vice president of sales, marketing, and business development.

“Our OEM customers are the leaders in their respective industries. They demand a level of excellence from us that in some cases can even exceed what they would expect from their own internal departments. We strive to give them legendary service and consistent quality and the feeling that we are an extension of their facility,” said Ripich, who also represents the third generation of the family to lead AT&F.

“Our team is on 24-hour alert to offer whatever support is necessary, and generally we solve problems first and then ask questions later,” he added.

On paper, AT&F is a $70 million fabricating business with approximately 250 employees spread over multiple locations. This regional strategy melds well with the organization’s rapid-response culture.

The different facilities are:

- AT&F Metal Fabrication in Cleveland, which performs various plate processing activities on the campus it has called home since 1950. It has just over 425,000 sq. ft. of manufacturing space. (AT&F has U-stamp No. 14, which is the oldest U-stamp still in existence.)

- AT&F Advanced Metals, Orrville, Ohio, which designs, fabricates, and repairs processing equipment used in corrosive environments (see Figure 1). Such work involves stainless steel, titanium, zirconium, and other specialty alloys.

- AT&F Marine, North Charleston, S.C., consolidates the company’s shipbuilding expertise in one place.

- AT&F Nuclear, also located in Cleveland, holds key nuclear certifications to produce fabrications such as heat exchangers, pressure vessels, tanks, and other reactor components.

- AT&F Structures, Massillon, Ohio, fabricates lattice-type structures for the construction and energy markets.

- AT&F Wisconsin, Manitowoc, Wis., is the newest facility in the family. Having acquired a fabricator in financial distress, AT&F hopes to turn its 60,000-sq.-ft. facility into a provider of thick plate processing services to current and new customers in the area.

- AT&F India, Mumbai, India, has a new, 94,000-sq.-ft. production facility in Chakan, Maharashtra, which has many of the same large fabrication processing capabilities as facilities found in North America. AT&F India also operates a field projects division focused on large infrastructure jobs.

- AT&F Europe/Composhield in Denmark is a joint venture between the fabricator and this manufacturer of lightweight composite armor protection for military vehicles. (See AT&F in Europe sidebar.)

From the perspective of President Michael Forde Ripich, AT&F is defined by its ability to meet customers’ fabricating needs, which push the limits of scope, scale, and precision. “We Invest in Customer Success®” is the company motto that summarizes this spirit.

“Our company motto resulted from a strategy session about our customers’ difficult, unmet needs,” Ripich said. “Those needs require capital investment on behalf of our customers to the point that they aren’t able to justify the acquisition of such a large piece of equipment and use it only 10 percent of the time.”

Figure 1

This plastics, waste-to-fuel reactor was produced at AT&F Advanced Metals. It is a large and complex job involving specialty metals that is typical of the work done at the facility.

A perfect example of this is an investment in a plate roller capable of rolling up to 12-in.-thick plate. Ripich said a manufacturer would never purchase this size of plate roller to make just 20 or 50 cylinders a year, so this allows AT&F to make that investment to aggregate not only that one customer’s plate rolling work, but also others’ jobs. That justifies AT&F’s purchase of the roller and solidifies its service to its customer (see Figure 2).

This investment in a customer’s success is not limited to filling their fabricating technology gaps. Ripich said that also can be achieved with geographic locations and manufacturing expertise.

AT&F Wisconsin (see Figure 3) is a good example of being where customers are. AT&F decided to be closer to existing clients, while also establishing a beachhead in a robust regional manufacturing economy. In fact, the company has invested more than $1 million in equipment and building improvements in the Manitowoc facility.

AT&F Structures, in Massillon, Ohio, is an example of focusing on an area of expertise (see Figure 4). This is a dedicated facility, which opened in late 2015, that specializes in complex tubular welding for lattice boom sections seen on large tower and crawler cranes.

AT&F is an enterprise “because it’s aspirational in one sense, and operational in another,” Ripich said. “It speaks to the way we want to manage all of our operations. There isn’t necessarily one parent. There is a lot of knowledge out there, and there is a lot to learn from each other. Even though Cleveland is the most established, we look to leverage what our new operations can tell us about management and to integrate their unique manufacturing expertise across the enterprise.”

Meanwhile, the different branches of the AT&F enterprise can reach back to the Cleveland headquarters for guidance in metallurgy or business advice such as human resources, quality, engineering, and purchasing. The goal is to have a midsized company that can react quickly and intelligently, mimicking the service delivered by a much larger organization.

“You cannot grow without the right culture,” Girard said. “You might progress from $4 million to $8 million or from $8 million to $12 million, but you won’t be able to grow to a $70 million global enterprise by having one person own everything. It just isn’t possible.”

Ripich credits his father, Terry Ripich, with fostering the environment where team members all had a chance to contribute to the organization’s success. He was conscientious of the need to create a culture in which caring for the person working next to you and the customer in another state was just as important as compliance to modern manufacturing practices.

AT&F has taken on some new elements in recent years to boost its engineering expertise. The team now has more than 35 degreed engineers on staff, representing more than 10 percent of its overall workforce. Ripich said that this comes at a time when some customers are looking for more design contributions and engineering guidance from the supplier base.

“We now put engineers in operational roles,” Ripich said. “That provides us with systematic thinking and the expertise that is required in technical decision-making and operational design.”

Figure 2

AT&F’s Robert Ripich stands in front of a large plate roll, which can cold-roll 8.5-in.-thick material in widths up to 14 feet.

This engineering talent is not locked behind a large door in an ivory tower on the AT&F campus. For instance, Michael Puleo, AT&F’s vice president, heavy fabricating, said that welding engineers spend 80 percent of their time in the production facility, helping set up the latest automation systems and working to streamline production.

Puleo pointed to engineers’ contribution to AT&F’s robotic welding applications as an example of their expertise really making a difference for the company.

“A robot is only as precise as the engineers who prepare it,” Puleo noted. “We are fortunate to have very detail-oriented engineers working with the robotics, and it’s that attention to detail that brings out the potential of these powerful systems.”

To bolster its own fabricating expertise, AT&F has a 26-year-old program called Tank U, which focuses on the skills needed to produce large fabrications, and a 5-year-old AT&F Welding Institute, where new hires get their start and experienced welders expand their expertise.

“These skill development efforts now coincide with a formalized push to share knowledge with team members,” Ripich said. Human resources now tracks the number of hours that a person is engaged in either teaching or learning. The goal is for each individual to be involved in 40 hours of skills development per year.

“We have highly skilled people working with very repeatable and controlled processes so that fabricating is less reliant on art and more reliant on science,” Ripich said. “We are never going to replace the art, and that is part of the value that we provide. But we want to make the process more robust and repeatable to maximize our productivity.”

The Bigger, the Better

Many outside of the AT&F family, however, recognize the company for its ability to handle thick and long fabrication jobs. Ripich said that these capabilities are the hallmark of his grandfather, Larry Ripich; his brother John R. Ripich; and their generation.

“We began accumulating heavy equipment in the 1960s to satisfy the small chunks of unmet needs in different industries,” Ripich said. “We established a reputation of bigger and heavier.”

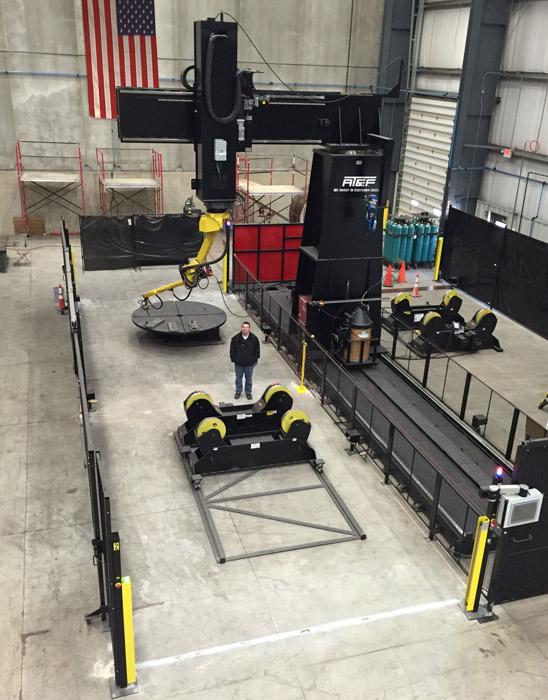

The Cleveland facility is a working testament to Larry and John’s vision. For instance, AT&F just installed a robotic welding cell that can weld lengths up to 40 ft. by 20 ft. high (see Figure 5). The welding robot has six axes of movement, which gives it enough range of motion to reach most spots on the large fabrications, and the cell has two sets of 30,000-lb.-capacity turning rolls and a 120,000-lb.-capacity turntable. The welding robot can reach speeds of 30 inches per minute.

The arm of the robot also has an optical laser system installed in it, which determines the position and the orientation of the workpiece and automatically adjusts the welding head for any variation.

The organization’s forming capabilities have long been calling cards for its business of big fabricating jobs. Of AT&F’s nine press brakes, the most impressive is its 2,800-ton, 60-ft. single ram press (as seen in the cover photo). “We are aware of no other machine of its size and sophistication anywhere in the world,” said Michael Ripich. “This machine is capable of forming the side of a passenger railcar in one hit.”

AT&F Cleveland also has six plate rolls that it has used to manufacture large and heavy cylindrical products for many years. Today it can handle plate rolling jobs that call for material as thick as 8.5 in. cold and with construction widths up to 14 ft.

Cleveland is also home to laser, high-definition plasma, oxyfuel, and waterjet cutting machines. Five-axis cutting can be done on all the cutting tables, providing AT&F with the option of offering beveled edges on materials being used in various applications.These large investments aren’t limited to Cleveland. In August 2016 AT&F Wisconsin installed a new plasma cutting system that can accommodate plates as large as 10 by 40 ft., which is similar to plasma cutting capabilities used in the Cleveland facility. The machine also has the ability to cut contour bevels, which eliminates a lot of the manual cutting that was done to prepare large fabrications for welding. The integrated controller allows offline and on-the-fly programming.

“We are a one-stop shop,” said Brian Spitz, AT&F’s vice president of finance. “The customers don’t have to know how to get parts from point A to point B and to point C and then back for final assembly. We can do it all for them.”

International Expansion

Would this organizational culture of serving customers’ unmet needs with the latest and largest metal fabricating technology work in an overseas market? That’s what the current generation of company leadership is exploring today.

The latest news about the opening of the new facility in Chakan, Maharashtra,

gives an indication that plans seem to be working out. Ripich cautions that this was no overnight success story.

“We had intentions of putting up a facility immediately, but in 2005 and 2006 our customers hadn’t arrived yet,” Ripich said, “and the Indian customers weren’t looking to set up a supply chain in the same fashion that we were accustomed to.”

So why choose India to enter the global fabrication community instead of Mexico, South America, or another outpost in Europe? It all started with a student meeting of the Finance Club of Case Western Reserve University in Cleveland in 2004.

At that time AT&F was looking for an international location where growth potential would be greater than the slow growth in the U.S. and where it might find a vibrant market for fabricated metal parts. It just so happened that the Finance Club had several international students, and they pitched their homelands as potential sites for AT&F’s future plans.

Figure 4

AT&F Structures, Massillon, Ohio, relies on its welder talent to fabricate lattice-type structures.

Upon hearing the presentations, the Ripich family felt that India made sense. English is widely spoken there. Property rights could be enforced. Finally, the country held great potential as its infrastructure required modernization.

Working with the Case Western Reserve graduates, AT&F established connections with India-based fabricating talent—a team of former shipbuilders and naval architects. Instead of establishing a brick-and-mortar fabrication facility right away, they looked to take over some commercial contractors that were struggling. They jumped into the familiar business of working with heavy structural beams, as long as 40 ft. and up to 3 in. thick, and into the not-so-familiar business of erecting those fabrications.

The core team of 15 people worked out of container offices, which were located at the job sites. It was not only cost-effective, but also gave the AT&F team a chance to remain engaged in the fabrication and erection activities at the site. It was a focus on quality that many of the customers were not accustomed to.

“We bootstrapped it from the beginning,” Ripich said. “We made a lot of mistakes, but we made them on a small scale and were able to recover quickly.”

Unlike in the U.S. where skilled labor might be a constraint, this region of India did not share that obstacle. The real issue for Indian companies looking to do business with AT&F was access to capital and raw material for the jobs. AT&F learned to respect this and help as much as it could, establishing itself as a trusted business partner, not just a supplier of parts.

This slow buildup helped AT&F India become part of large-scale power plant construction jobs and win a contract to build a floating platform port system that will act as ferry terminals in developing areas of the country. The latter job in particular was a milestone for AT&F’s operations in India.

“We were able to negotiate properly and manage quality and productivity effectively,” Ripich said. “We also established controls in reporting, so the enterprise could understand what was happening and support it well.”

Those construction firms soon wanted to engage in more projects with the AT&F team. Multinational manufacturing companies, some of which had not worked with AT&F in the past, reached out about possibly working together in India to provide parts for their new manufacturing operations in India. This gave the organization confidence in building the new facility and to pursue a more traditional metal fabricating business model there.

There are familiar sights in the plant, such as a 1,000-ton press brake with a bed reaching almost 20 ft. and a large high-definition plasma cutting table. The facility also has a modern five-stage finishing line for painting parts, something which really is nonexistent in the area. Also new for AT&F was the use of multiple, small hydraulic ironworkers imported from the U.S.

A visitor might notice more people in the shop than he or she might find in a similar-sized facility in the U.S. It represents a bias toward using abundant manual labor over automation. Ripich said that AT&F is challenging this practice with the addition of more automated equipment as well as the latest technology in metrology.

Figure 5

This new robotic welding cell in Cleveland obviously is capable of accommodating large weldments, but it also provides AT&F the ability to apply automation to complex applications where conventional welding methods might not be cost effective.

Ripich said that those early investments and experiences in India are starting to pay off now. The companies with operations in India and larger multinational operations looking to have an Indian source for fabricated parts now reach out to AT&F India with increasing frequency. Possible expansion into other regions in India is certainly a possibility, according to Ripich.

Coming Full Circle

In a way, the future success of AT&F in India and other markets that might be closer to its Cleveland home is related to a lesson company founder John J. Ripich, Michael Forde Ripich’s great-grandfather, learned when he first opened The American Tank & Fabricating Company for business.

Being a new business owner without a lot of customers, John J. Ripich was very aggressive in the bid to build an acid tank, which was used in the painting process, for Roadmaster Bicycle Co. The purchasing agent at the bikemaker recognized this low bid and actually lectured John J. Ripich about not charging enough for the work. The purchaser actually added another $1,000 to the order and told him to deliver the tank promptly. That moment taught John J. Ripich that the value a fabricator can provide is important to the customer and should go beyond price.

When AT&F first started working in India, all negotiations centered on price. The best deal always involved the cheapest price—at least in the beginning. But AT&F’s partners learned the value associated with high-quality work, on-time delivery, and supply chain support as it relates to accessing capital or raw material resources. As the parties continued to work with each other, the focus shifted from price to issues of quality, delivery, and safety. The Indian companies learned to value their relationships with AT&F, just as John J. Ripich would expect.

“Above all else, our customers want to feel taken care of,” Michael Ripich stated. “They want to know that you’ll do whatever it takes to give them the best quality—that you’ve got their best interest in mind.”

That’s why people want to do business with AT&F in India. They know that it’s not just price. They get value—quality parts delivered when they were promised and assistance before, during, and after the commercial transaction. It’s peace of mind that typically doesn’t come from the vendor promising the world but asking only for a pittance.That’s what you would expect to get from a family-run fabricator that’s professional and not pretentious.

AT&F, 216-252-1500, www.atfco.com

AT&F in Europe

Like many other fabricators in 2008-2009, AT&F was proud to dedicate capacity for providing armor kits to the U.S. armed forces for vehicles being used in Iraq and Afghanistan. The use of improvised explosive devices in these theaters of war spurred a tremendous push for these kits. AT&F worked around the clock for three years to meet the demand.

With the addition of these armor kits, however, the vehicles were becoming too heavy for their intended use, according to Ken Ripich, AT&F’s executive vice president of sales, marketing, and business development.

This led AT&F to Composhield, a Danish composite company that specialized in armor designs. In 2007 the two companies came together to form a joint venture in the U.S. called AMTANK Armor.

The Raven vehicle, a low-cost border-patrol vehicle from ATF Europe, will make its debut at the International Defence Exhibition (IDEX) and Conference, Feb. 19-23, in Abu Dhabi, United Arab Emirates.

Two years later, Ripich recommended establishing AT&F Europe and proceeded to purchase an equity position in Composhield.

“We have

huge potential for growth by supporting NATO-friendly countries around the globe with superior survivability technology,” Ripich said.

A big change for AT&F Europe/Composhield is its new dedication to designing entire vehicle systems. Rather than just adding composite armor to an existing vehicle, designers are creating customized armored shells, based on OEM customers’ CAD data, that can be placed on widely available chassis.

“Being involved earlier in the design decisions allows us to offer our customers a fully optimized solution that balances weight, price, and performance targets,” Ripich added.

This approach has resulted in the creation of a low-cost border-patrol vehicle that is built on a Ford F-350 or a Toyota Land Cruiser chassis.

“It’s the only vehicle that we are aware of that has this high level of protection that doesn’t require a special engine, suspension, or brakes,” Ripich said. “We are looking to sell the armor kit and instructions for the customer to build on the chassis of its choice.”

About the Author

Dan Davis

2135 Point Blvd.

Elgin, IL 60123

815-227-8281

Dan Davis is editor-in-chief of The Fabricator, the industry's most widely circulated metal fabricating magazine, and its sister publications, The Tube & Pipe Journal and The Welder. He has been with the publications since April 2002.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

Dynamic Metal blossoms with each passing year

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI