Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Fabricators anticipate growth in 2011

Fabricators improve what they can control to prepare for what they can't

- By Tim Heston

- December 2, 2010

- Article

- Shop Management

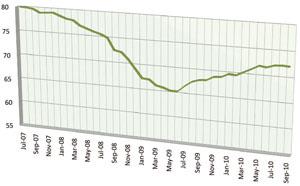

Figure 1: Manufacturing capacity plunged to historically low levels during the recession. Since mid-2009 manufacturers have gradually gained more work to fill that excess capacity. Source: Federal Reserve.

One October morning Dan Aronson opened Portland’s newspaper and learned that in 2011 Intel would start constructing a major manufacturing facility not far from his Clackamas, Ore., contract manufacturing shop, P&A Metal Fab. It’s a whopper of a project. Its construction will cost $4 billion and employ 15,000. Once finished, it will become the permanent workplace for 1,000 engineers and production personnel.

When I spoke to him just a few hours after he opened that newspaper, Aronson, company president, had yet to discuss the implications at length with anyone, but his mind was already racing. P&A used to fabricate components for local airflow equipment-makers that sold large systems for Intel facilities built in the 1990s. The work brought in large, healthy contracts for P&A. That October morning, Aronson thought those kinds of contacts could be coming again.

It’s obviously a fantastic opportunity for some real top-line growth, but it’s not long-term. Once construction is complete, that’s it. Will the work fit with his current customer mix? Will he be able to take on the additional volume without sacrificing service for his existing customers?

Metal fabrication managers may be giving more scrutiny to questions like these as they navigate their business into 2011. Survivors of the Great Recession focused on bottom-line growth. They increased margins by cutting costs, most obviously by downsizing but also by focusing on manufacturing efficiency.

With credit virtually frozen during the depth of the crisis in early 2009, company leaders realized just how valuable having cash on hand really was. Demand had dried up to the point where shop managers looked inward to shop efficiencies, then outward to spread that efficiency to other links in the supply chain. Vendor-managed inventory arrangements, replenishment systems, and the like spread the inventory burden to multiple companies, increasing efficiencies and freeing cash.

For the first time in many months metal fabrication managers are seeing significant opportunity for top-line growth. But growth since the recession’s trough has been inconsistent, and large orders are rarer than they once were. OEMs and other customers order what they need now, no more and no less, and they treat excess inventory like the plague.

Big things like that Intel plant in Oregon may be coming, but managers now look at such opportunities with jaded eyes. The uncertainty is daunting. Boomers are retiring, and health care will change somehow (though no one knows quite how yet). The federal government is still running record deficits, so the tax situation is sure to change in the future.

Transportation costs are yet another uncertainty. “Freight rates may go through the roof when the recovery starts to move ahead stronger,” said Chris Kuehl, economist for the Fabricators & Manufacturers Association International. The issue during this recovery, he said, is that the big companies “have locked up capacity in return for maintaining cash flow. So they’ve called trucking companies and have said: ‘We’ll keep you alive during the recession, but when the recovery comes, you keep the rates for us low, and you make sure we have the trucks when we need them.’ That means everybody else faces a shortage of trucks and much higher rates.”

What the future will look like is a complex picture, sources said. The short answer is that 2011 will have continual, gradual economic expansion with little chance of another dip into recession. But the specific path toward a company’s success remains shrouded by uncertainty.

So what’s a shop manager to do? In late fall The FABRICATOR called readers across the country to find out. Their answers could be summed up in a sentence: Continually improve what you can control—to prepare for what you can’t.

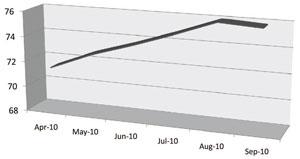

Figure 2: Similar to other sectors, capacity utilization for fabricated metal products increased earlier this year before slowing by summer. Source: Federal Reserve.

Talent and Unemployment

“We’ve acquired quite a bit of automation,” Aronson said. “We’re literally producing twice the amount of sales, if not more, than we did 15 years ago, with the same number of people.” He added that “up until 2009 we didn’t lay anybody off. We kept adding automation, but all that did was fuel revenue growth. We didn’t cut jobs because of it. We cut jobs because of the recession—and that was the only reason.”

Aronson’s comment reflects a common situation. Manufacturing capacity utilization grew steadily during this decade. As revenue grew, so did employment, but so did technology investment. Then in 2008 manufacturing capacity utilization began its plunge, and by the summer of 2009 it had sunk to historically low levels. By July 2009 the Fed put manufacturing’s overall capacity utilization at just more than 65 percent (see Figure 1).

At present many manufacturers have rehired, but not to prerecession levels. With so much output potential, it may take a lot of demand for capacity utilization to reach the historical average—79 percent during the past few decades, according to the Federal Reserve.

In September a Fed official with a hard-to-pronounce name made an intriguing statement. Narayana Kocherlakota, president of the Minneapolis Fed, estimated that this country’s current job opening rate is 2.3 percent. Filling all job openings would bring the country’s unemployment rate down significantly, from 9.6 percent to 6.5 percent.

This proves what many manufacturing managers know: Despite the economy, finding highly skilled, experienced workers remains challenging. This is why in 2011 the industry may see a significant uptick in the poaching of talent. To work with new technologies people need new skill sets along with a firm grasp of metal fabrication fundamentals. Such talent continues to be a rare find.

“Pay attention to the skilled workers you have now,” FMA’s Kuehl said, “because when job growth starts up again and way before the chronically unemployed are hired, companies start poaching. This is going to become a really significant problem during the next few months.”

Finding the Consumer

According to the Federal Reserve, the fabricated metal products industry enjoyed capacity utilization in the 75 percent range by the third quarter of 2010 (see Figure 2). But consumer demand isn’t back to prerecession levels either.

Capacity utilization recovered during the first half of this year as manufacturers rebuilt their inventory, but by summer the inventory rebuild softened. These days no one wants excess inventory, and OEMs aren’t about to increase orders until they see clear signs of improved consumer demand.

Where that consumer demand comes from is the big question, particularly with such an unprecedented unemployment situation. The recession left entire industries changed. This led to today’s structural unemployment problem. “Many people who lost their jobs, they really lost their careers,” Kuehl said. “It’s not, ‘I’m out of work temporarily until the economy recovers.’ It’s, ‘My job disappeared. The economy will recover, but it will recover without me. I need to pick up more training and perhaps move someplace else.’” Of course, thanks to the housing situation, many people can’t just pick up and move like they used to.

Kuehl added that it’s easy to blame globalization and emerging economies’ access to cheap labor for the industry’s woes, but the picture is a bit more complicated.

It’s true that emerging economies have access to cheap labor. But the cost of that labor is rising, and shop managers like Aronson are feeling the benefits. “We’re seeing a resurgence of work that had been taken overseas being taken back to domestic manufacturing,” Aronson said. “The overseas pricing has crept up.”

Besides, if labor is so much of an issue, how is it that Germany’s economy—one not only with high labor costs but also high taxes—is bouncing back? As Kuehl explained, it’s because they take trade very, very seriously. “The Germans are now the export masters of Europe and keep that position despite having the same disadvantages as the U.S. They have high wages, a generous system of benefits, high taxes, and strict environmental and safety laws.”

He added German consumers have been notoriously cautious; consumption makes up only 57 percent of Germany’s economy. “This has forced German companies to seek markets elsewhere—and they expanded into developed and developing companies alike,” he said. Conversely, U.S. corporations have thrived off the domestic consumer. After all, U.S. consumers made up 70 percent of action in the economy before the recession. “But that number is slipping,” Kuehl said, “and it may drop to 65 percent or even 60 percent by the end of the decade.”

The U.S. may not be able to count on the U.S. consumer as it has in the past, which means the economy may need to shift its focus toward consumers abroad.

Businesses Grow Margins and Revenue

“We look at our business much more rigorously and frequently,” said Stewart Cramer, president of LAI International, a large contract fabricator based in Scottsdale, Ariz. “We essentially look at our budget every week now, and we’re constantly checking to see if things are happening according to our original plans. We’re much more careful about spending, and we react more quickly than we ever did.” Such focus led to significant lead-time reductions. “Some of the kaizen events have helped us reduce lead-times on the order of 58 percent,” he said.

For LAI the recession has been all about increasing efficiency to improve profits. In 2009 revenue fell by about 13 percent, “but our margin as a percent of sales actually grew,” he said.

He added that in 2011 LAI will keep its focus on margins but may at last see some significant top-line growth, thanks in part to increased work expected in certain sectors, including commercial aerospace and power generation.

Cramer isn’t the only one expecting top-line growth next year. According to a survey of readers, 64 percent expect operating levels to increase in 2011—and perhaps most significant, only 7 percent expect any decrease (see Figure 3).

Companies like LAI continue their hunt for more work and revenue. Cramer said he expects that in 2011 LAI may see its first significant top-line growth since the downturn began. “But today we’re much more interested in the profitability of the work we take on. There may be a $5 million opportunity that drops 4 to 8 percent to the bottom line, but we’re going to recognize that’s not as attractive as a $3 million opportunity that drops 10 percent to the bottom line.”

The Rewards of Fiscal Conservatism

During the depth of the credit crisis, Cramer recalls leaving messages with the bank and waiting days for a return call. It turned out not to be a bad thing: Bankers were busy, and LAI was the least of their concerns. LAI, like so many metal manufacturers, was in good fiscal shape despite the downturn.

Tom Mackessy, president of Ometek Inc., based in Columbus, Ohio, was in a similar situation. “The reality is, if you have a good work force and very low debt level, there’s opportunity.” Earlier this year he called his bank, realizing he hadn’t heard from them in a while. “They told us they didn’t have to worry about us. We have that kind of relationship.”

Those that have available cash may be putting it to good use in the years ahead. According to Cramer, LAI may be looking toward more acquisitions in the future. “Multiples are lower than they’ve been,” he said, “and a lot of companies have been through some pretty good load testing over the past few years.” In other words, if a company has survived the Great Recession, it has probably done something right.

Next-generation Productivity

Every economic recovery reveals winners and losers. Despite uncertainties, the winners seem to be charging ahead and looking for opportunities.

“Pay attention to where the market openings are,” Kuehl said. “There are many customers out there who have lost their supplier.”

A.J. Rose Mfg. Co., an Avon, Ohio, metal stamping company, has done just this. Like others in the automotive supply chain, A.J. Rose experienced a dramatic drop in demand. Company revenues fell 40 percent in 2009 but jumped back 20 percent this year, with some of the work coming from competitors that had gone out of business. The company expects to continue growth in 2011, according to Terry Sweeney, vice president of sales and marketing. “We expect to gain another 10 percent next year,” he said. That’s not back to prerecession levels, he said, but it’s at least closer.

“You need these kinds of storms to knock the deadwood out of the trees,” he said. “We’ll see what the next generation of productivity brings.”

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI