Senior Vice President of Sales

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

How to maximize rebates on lighting upgrades

Getting you to your ROI more quickly

- By Josh Kurtz

- June 2, 2016

- Article

- Shop Management

If you are considering a lighting retrofit, chances are you’re already aware that tax incentives and rebates on lighting upgrades are available, and you’re counting on them to shorten your project’s payback and improve its return on investment (ROI). However, you may not know whether your project will qualify, how to identify which incentives are offered in your area, and how to obtain them.

Do you know about political and regulatory changes that are affecting incentive levels and availability? Are you aware of recent changes with DesignLights ConsortiumTM (DLC) Premium classification and other rankings that may impact your rebates on lighting ? If not, read on.

Hello, Utility

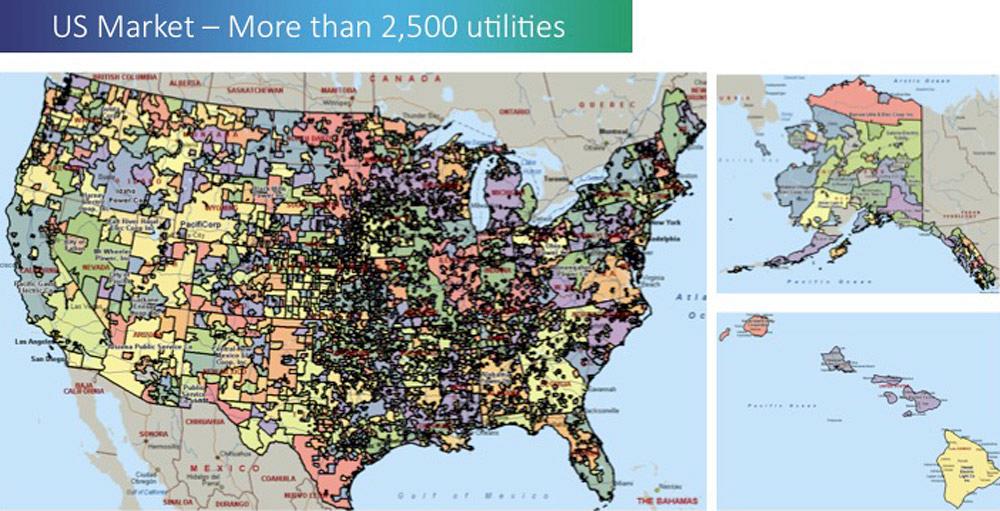

Incentives come from your utility; their availability varies from utility to utility (see Figure 1).

Getting to know the utility that provides your electricity is essential. Your utility determines your incentive opportunity—even if it is just determining if that utility participates in a state program. Not all companies in a region are served by the same utility, so while one company in your town may be eligible for an incentive, you might not be.

Identify the Rebate Opportunity

Once you have identified your utility, you can determine whether there is a rebate offered by:

Visiting the utility website. Most utilities that offer rebates have an “energy efficiency” or “rebate” keyword or pulldown window that you can search. Searching Google by your utility name and a keyword will get you to the right place on the utility’s website. From there you can navigate to the technology that you are pursuing (i.e., lighting) to see what your utility offers.

Searching the Database of State Incentives for Renewables & Efficiency® (DSIRE), which is operated by the N.C. Clean Energy Technology Center at N.C. State University and funded by the U.S. Department of Energy (DOE). The database allows you to search federal, state, local, and utility incentives for efficiency in your area. It allows you to narrow your search parameters by market, technology, utility, and incentive type.

8 Questions to Help You Understand the Program

Understanding the program your utility is offering is critical to maximizing your rebate. By finding answers to the following eight questions, you can yield the best results and avoid missing out on a rebate.

1. Is there an opt-out clause, and has your company opted out? If so, then typically you are not eligible for a rebate.

2. Is preapproval required before starting a project? If so, then it is critical to make sure that you have completed the program application process before starting the installation, including placing the order. Detroit’s DTE Energy is an example of this.

Figure 1

More than 2,500 utilities operate in the U.S., but not all offer rebates, and they vary from utility to utility.

3. Does the program require that you work with a program trade ally to get the incentive? If so, then it is critical to identify an installer or a manufacturer who is eligible to work in the program before proceeding. TVA requires that a trade ally perform the installation.

4. Does the lighting system you plan to install qualify for the utility’s incentive offering? Some do not. For example, many utilities require that a DLC-listed fixture, rather than a DLC-listed retrofit kit, be used to replace T12/T8 fluorescent office troffers to qualify for a rebate. Nevada’s state-run NVEnergy Sure Bet program requires a fixture rather than a retrofit kit be installed to qualify for its incentive.

5. Which type of program does your utility offer: prescriptive, custom, or performance contract? The program type determines the type of application you must use, how much work is required to redeem the rebate, and the rebate’s size.

Prescriptive programs typically require that you complete an application and install the project, and then you can receive the incentive. You may be required to obtain preapproval before starting the project. Again, rebate amounts vary from utility to utility. For example, Duke Energy customers can receive up to $188 for replacing their high-intensity discharge (HID) fixtures with an LED high-bay fixture.

Custom programs require preapproval, and incentives are based on the amount of energy saved.

With performance contracting, the utility pays for delivered energy savings. This type requires a very detailed application, site pre- and post-inspections, and measurement and verification of savings—and offers high incentives. For example, Oncor Energy users in Texas can get approximately $0.06 per kWh saved and $200 per kW saved on their projects.

6. Does the program have a cap on the amount? Most programs cap the amount of incentive a customer can receive. The cap may be a fixed amount, such as $100,000, or a percentage of project costs, such as 50 percent. In almost all cases, utilities will not pay more than the cost of the project (typically fixtures and external labor).

The cap is key because you’ll need to know the limit on the amount of incentive you can receive from your project when reviewing project proposals and calculating the best project return. Let’s say you are replacing an HID lamp with a high-performance LED, realizing a savings of 2,460 kWh per year. The Puget Sound Energy incentive of $0.20 per kWh saved would yield $528 per fixture. Its incentive cap is 50 percent of project cost, so if the fixture cost $750 to purchase and install, the incentive cap would be $375. So although the energy savings would dictate an incentive of more than $500, the actual incentive would be $375.

7. Why is funding availability changing so rapidly? Demand for incentives has increased as the number of companies seeking incentives is increasing.Utilities are re-evaluating and changing the incentive structures. They are seeking a more varied mix of projects and therefore often they are changing program requirements or reducing their lighting incentive levels. Many states’ program cycles are nearing expiration, such as California and New York.

Oversubscription is another reason. Incentive demand in a given year can prompt more companies to apply for incentives than the program budget can accommodate. This has led utilities to create a waitlist for projects. Sometimes utilities pull funds from future years’ budgets to meet current demands, thus cutting following years’ incentive budgets. Funding runs out again, and the cycle can continue. This occurred with utilities ComEd in Illinois, PPL Utilities in Pennsylvania, and Salt River Project in Arizona.

8. How do political and regulatory changes impact incentives? Many utility programs are political or regulatory constructs, having come into existence as part of legislation or regulatory settlements. As such, many of these programs are reaching their first evaluation points, and a number of points are leading to reconsideration of program effectiveness.

State governments are asking whether the programs help all customers or just the customers who capture incentives. They are scrutinizing whether savings are being measured accurately. They are looking at whether programs overly benefit business customers, rather than residential customers. They are asking whether utilities are profiting from the program payments for lost sales. And they are questioning whether programs are delivering energy at a lower cost than previous generations, as promised.

These questions have led some states to suspend political programs or to deny regulatory approval to others. Ohio-FirstEnergy programs were suspended until after 2016, pending legislative review of performance.

Changes to federal programs also may impact availability of incentives for projects, especially in states without other rebate options— e.g., PACE funding and EPAct tax benefits.

Impacts of Performance Standard Changes

When performance standards change, such as with the release of DLC Premium, utilities often react by changing their programs to require higher-performing fixtures be used to qualify for their highest incentives. An example of this is Pacific Gas and Electric’s revision of its incentives for troffer fixtures that required retrofit kits to meet the DLC Premium standard to qualify for its highest-value incentives.

Because these standard changes can be issued at any time, the changes in incentives may occur at any point in a utility program cycle. This means that waiting for fixtures to come down in price also may lower the rebate value and actually make the payback longer than if you purchase the lighting at the higher price/higher incentive rate. In addition, the standards changes may take the planned fixture out of incentive qualification.

Capitalizing on Incentives Is Worth the Effort

Whether your project is driven by improving light levels or reducing energy consumption, there’s a lot at stake—especially because the DOE estimates that legacy lighting can account for as much as 20 percent of your building’s energy usage.

High-performance LED high-bay fixtures are available on the market today that deliver 19,000 lumens per fixture and last more than 10 years. Replacing 400-W HID fixtures that consume 343,000 kWh for 7,500 hours per year at a rate of $0.08 per kWh with LED high-bay fixtures that consume only 79,500 kWh for that same time period at the same rate will save $21,120—a fast return and years of savings.

If you can capitalize on rebates and incentives, you can realize an even faster return and more savings—so much the better.

For more articles and information about implementing sustainability in your plant and operations, visit sustainablemfr.com and subscribe to the “Sustainable Manufacturer Network” e-zine.

About the Author

Josh Kurtz

2210 Woodland Drive

Manitowoc, WI 54220

800-660-9340

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI