Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabrication in 2016: Diversification proves its worth

Many predict continued, steady growth—but not everywhere

- By Tim Heston

- December 2, 2015

- Article

- Shop Management

Rob Grand-Lienard remembers a letter he received from a major oil and gas customer in early December 2014, promising good times ahead. That letter helped make the president of Special Products & Mfg. (SPM), a custom fabricator in Rockwell, Texas, rather bullish for 2015.

“Our customer was expecting to grow their business 20 to 25 percent per quarter,” Grand-Lienard said. “But just 45 days later, that was all snuffed out.”

Saudi Arabia hasn’t turned down the taps. We’ve got more oil and natural gas produced stateside than ever before, and global demand isn’t sky-high.

“To protect market share, none of the major producers have elected to cut back,” said Chris Kuehl, economic analyst for the Fabricators & Manufacturers Association International (FMA). “This may start to change, though,” he said, adding that per-barrel oil prices may rise next year. “But we’re a long way from another boom.”

Meanwhile, bumper crops have pushed down our grocery bills along with the sales of agriculture equipment. China’s voracious appetite for raw materials isn’t what it was. Construction has slid globally; and in the states, the OEMs built up a bit too much inventory, so their supplies overshot demand.

At the same time, cheap food and fuel have put more money in consumers’ pockets. Although consumption isn’t in high gear, it’s not pulling everything down either. As Kuehl wrote in November in FMA’s “Fabrinomics” e-newsletter, “The consumer is not engaged, at least not to the extent that would be preferred … Still, the consumer may be cutting back on a lot of things, but cars and trucks would not be in that list. The fact that gas has fallen in price has been a tonic to the industry.”

According to an August report from WardsAuto, North American light-vehicle production is set to exceed 20 million vehicles for the first time, and sales are forecast to continue their upward march. The publication predicts U.S. auto sales for 2016 at 17.3 million units, up from 17 million in 2015. Indeed, the growth in automotive and other sectors may be large enough to spur a modest increase in steel prices, according to the World Steel Association’s short-range outlook.

Moreover, some fabricators report that sales of recreational vehicles and all-terrain vehicles (ATVs) are up. Cheap food also has opened up opportunities in sectors like food processing.

Meanwhile, the National Association of Home Builders is projecting single-family home production to increase 27 percent in 2016, after an increase of 11 percent in 2015. With that increase comes a higher demand in home appliances. In third-quarter earnings calls, both Whirlpool Corp. and Electrolux AB reported some of their greatest profits were being made in the U.S.

At the same time, the rising dollar has been putting the pressure on exports. And in October the Institute for Supply Management’s PMI® fell to 50.1—just barely in positive territory, and the lowest reading in two years. As Lindsey Piegza, chief economist at Stifel Nicolaus & Co., told The Wall Street Journal, “Tepid overseas demand, a strong U.S. dollar, and a sizable inventory overhang have created the perfect storm for U.S. manufacturers.”

Still, the Credit Managers’ Index, published by the National Association of Credit Management, increased to nearly 54 in October. Kuehl, who puts together this index, said that the CMI tends to be a good predictor of where the PMI will be several months down the road. Judging by the October numbers, busier times may be ahead.

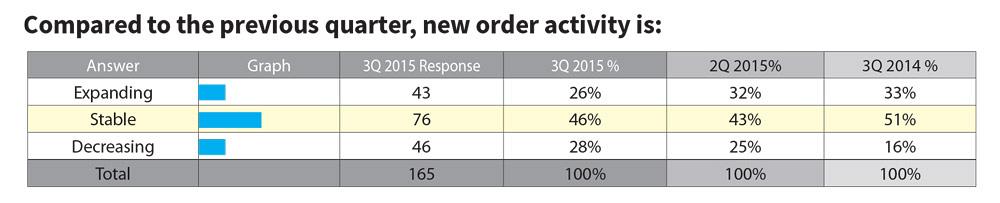

Figure 1

In FMA’s “Forming & Fabricating Job Shop Consumption Report” for the third quarter of 2015, about as many said new-order activity was expanding as was decreasing.

For those in custom metal fabrication, 2015 has proven the worth of customer diversification, especially because troubles in some areas have fueled opportunities in others. SPM, for instance, could have had a disastrous year, but its business related to telecommunications as well as commercial construction in the region is up, so the fabricator held on and is now poised for moderate growth in 2016.

“We’ve been pretty flat this year,” said Jared Lotzer, vice president of sales for BTD, a large contract fabricator based in Detroit Lakes, Minn. “And that’s a positive place to be, considering the state of the oil and gas and agriculture markets.” The fabricator is projecting between 5 and 10 percent growth next year, not because of growth in agriculture or oil and gas, but due to market share growth in other areas.

Considering all this, the 2016 economic forecast paints two very different pictures, one of commodities and another of everything else.

A Mixed Bag

These two pictures might explain some data about ordering activity and operating levels. Throughout 2015, fabricators have reported a mix of new-order-activity trends. In FMA’s “Forming & Fabricating Job Shop Consumption Report,” about as many said new-order activity was expanding as was decreasing (see Figure 1).

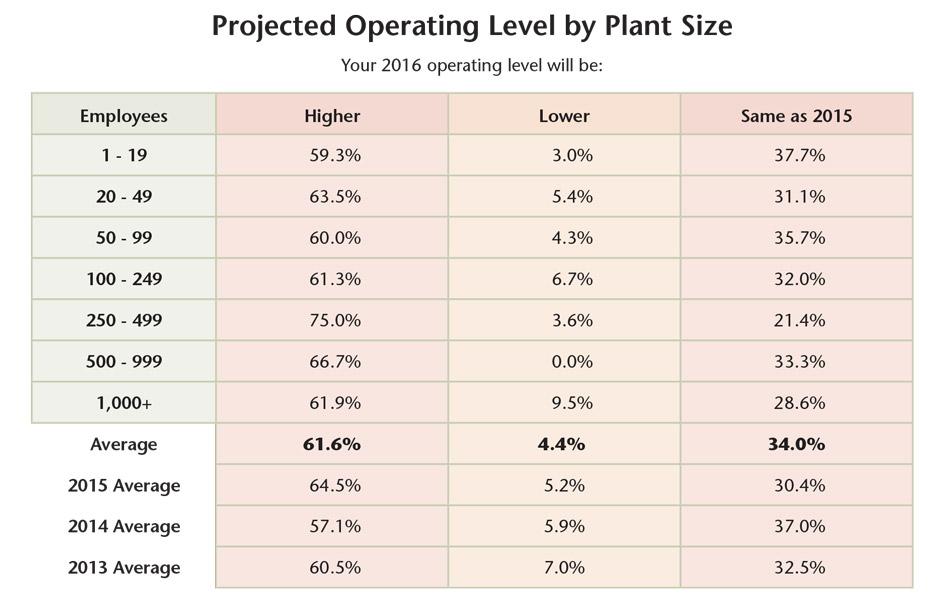

It’s a mixed bag that’s also reflected in the “2016 Capital Spending Forecast” from FMA. More than 61 percent of respondents said they predict their operating levels will be higher than they were in 2015; that’s down slightly from last year, when almost 65 percent predicted increased operating levels. Meanwhile, 4.4 percent said they expect operating levels to decline in 2016, the lowest percentage of decline reported since the recession (see Figure 2).

Commodity Crunch

The current plunge in metal prices is occurring in part because of lower demand globally, and in part because of mill consolidation. “The big consolidation [of the mills] we’ve seen recently has left just a few large players, and they don’t feel the price pressure that they might have 10 years ago,” Kuehl said. “A decade ago they wouldn’t be protecting market share at all costs.” Today, though, is different.

Through its annual “Financial Ratios & Operational Benchmarking Survey,” FMA tracks direct material costs as a percentage of sales. The costs vary widely, depending on the nature of the work in terms of size (from piece parts to large industrial projects) and volume. But on average, the direct material costs have remained at around 35 percent of sales for the past three years, despite the rapid decline in metal prices. This may indicate that fabricators in general aren’t benefiting from the drop in metal prices. It also may imply increased pricing pressure, with lower prices offsetting any gains from spending less on material.

Still, customers may not be demanding lower prices just because of lower metal prices. According to Ryan Raber, vice president of sales and marketing for Mayville Engineering Co. (MEC), a large contract fabricator in Mayville, Wis., pricing pressure is rising in certain markets simply because demand is lower. “When the market demand goes up, customers ask, ‘What’s your capacity?’ When the demand goes down, they ask, ‘Can you help me lower my costs?’”

BTD’s Lotzer said that his company predicted the decline in agricultural equipment spending several years ago. “We started to see the volume reductions during the late part of 2014 and going into 2015.” This year agriculture equipment work at BTD declined by 40 percent, and oil and gas work, which represented about 8 percent of its product mix, dropped to nothing.

“We have no [oil and gas] orders in sight,” he added. “That business went gangbusters and then down to nothing.” So the contract fabricator made plans to gain market share in other areas, including power generation and recreational vehicles. Gains in these and other sectors have offset losses elsewhere.

Figure 2

More than 61 percent of respondents of FMA’s “2016 Capital Spending Forecast” suggested that their operating levels would increase in 2016.

Global demand from mines and related industries is expected to be down for the foreseeable future, which has led to layoffs and some grim forecasts from construction industry giants. In a third-quarter earnings call, Caterpillar said it’s expecting 2016 to be its fourth consecutive down year for sales, the first time that’s happened in the company’s history.

These challenges have spurred some of the country’s largest contract fabricators to adapt. For instance, Raber said that MEC has experienced declines in some areas, but other sectors—including boating, recreation, and commercial trucking—have helped keep the fabricator healthy. “2015 has been a year where diversification has been a key strategic element in our business.”

Domestic Demand Strong

Some construction markets aren’t all gloom and doom, though. After all, if a machine has sufficient volume for a particular market, it’s usually assembled near that end market. And outside commercial construction in commodity-related industries, like mining and oil and gas, the U.S. construction market isn’t looking that bad for 2016.

“In our results, the Northeast has been one of the hottest spots [for structural fabrication],” said Mark Allphin, business manager for the steel segment at Atlanta-based Tekla, a construction software provider. “With a few exceptions, a lot of people have strong levels of business. They’re not quite to where they were in 2007 and 2008, but I think people might be OK with that.”

“The fastest-growing sector [in commercial construction] is assisted-living facilities,” Kuehl said, adding that other growth areas include hospitals and entertainment complexes. In short, strong construction correlates with the aging population and, again, the American consumer. On the other hand, “no one can fill office buildings,” he said.

According to the U.S. Commerce Department, construction spending increased every month in 2015. And according to Kuehl, the construction industry in the U.S. could see increased demand next year, especially if a large transportation spending bill passes (at this writing, before Thanksgiving, it hadn’t). The immediate problem for U.S. construction equipment has been an excessive inventory buildup, which led to a slump in demand late in the year.

MEC’s Raber added that machines like skid steers are made and sold in the U.S. “And that market is pretty positive, mainly because housing starts are positive. But some companies had a bit too much inventory in the pipeline.”

Ag Recovery

The agriculture equipment sector is also struggling, thanks to low food prices.

In a report, Joel Tiss, an analyst with RBC Capital Markets, said that he expects lackluster demand for tractors throughout 2016, and weakening volumes could continue to push down capacity utilization.

Still, this all may depend on harvests. “Next year may be a better year for farm machinery,” Kuehl said. It depends on the harvests elsewhere in the world. If they’re miserable, we’ll recover.” If the U.S. market does recover, farmers may pony up the funds to buy new machines, a purchase they’ve been delaying for a year or two.

Strong Outlooks

Wall Street hasn’t been kind to companies tied to commodities, but sometimes the view may be a bit skewed. Take the railroads. “People are freaking out about coal,” Kuehl said, yet not all railroads are utterly dependent on coal. Intermodal shipping—with a hub of rail and spokes of trucks—is still growing. And rail companies are still looking to save fuel costs in the long term, despite lower oil prices today. So trends toward lighter, stronger materials in rail will likely continue.

“Rail players have a far-out timeline,” Kuehl said. “They’re not reacting to the near-term oil price. They’re still into fuel efficiency and using lighter cars.”

Following the intermodal trend, the trucking sector has become more regional, again going by the hub-and-spoke model. Thanks in part to the rising dollar, the outbound activity to the ports is down, but the inbound activity is up.

Meanwhile, some in the aerospace business reported record deliveries of commercial aircraft in 2015. As of October, Boeing had announced it had a record 580 deliveries for the year.

It’s true that the pace of orders declined in the third quarter of 2015, according to durable goods data from the government.

But long term, the strong growth is expected to continue during the coming years. According to a report from Aviation Week Intelligence Network, the world’s in-service commercial fleet will increase from 31,700 aircraft in 2016 to almost 42,660 aircraft at the end of 2025.

Kuehl added that defense spending will probably continue strong into 2016, though the spending may shift to equipment for personnel, not large machinery investments seen in recent years.

When’s the Next Recession?

Kuehl said that most predict GDP growth for 2016 to be between 2.5 and 3 percent. The growth continues, steady, but nothing spectacular.

Still, economic news doesn’t lack for glass-half-empty outlooks. Some predict another downturn on the horizon. Allianz economist Mohamed El-Erian, for instance, predicts a downturn in 2017 of between 25 and 30 percent. In early November he told CNBC, “People forget how exposed we are to financial instability in the rest of the world.”

When you boil it all down, the rest of the world is really the concern. How long can the U.S. hold its own? But custom fabricators have one advantage. When one market tanks, they tackle another. Consider Springs Fabrication, an industrial fabricator in Colorado Springs, Colo. Until this year oil and gas represented its bread-and-butter work. Not anymore.

“We had about a week’s notice,” said CEO Tom Neppl. “When it fell apart, it fell apart almost instantly.”

So what happened? Springs Fabrication moved on. “We’re moving into other markets. We see some infrastructure spending in Colorado, and construction is booming, so we feel like there is opportunity there too.”

Some opportunities in metal fabrication come from markets that simply didn’t exist several years ago. For instance, walk into a fast-food (or their preferred name, “quick service”) restaurant during the next few years, and you’ll likely see a touchscreen where people place their order. All those touchscreens need a sheet metal enclosure.

“The food service sector is really perking back up again,” Kuehl said. “The sector is expecting big changes during the next few years, including the rollout of ‘robotized’ fast-food operations.”

Robotized fast-food operations need sheet metal, and so do countless other sectors. Serving a lot of them can reduce a fabricator’s exposure to the risk of downturns. In 2016 and beyond, having a diverse customer base will continue to be the name of the game.

BTD Mfg., 866-562-3986, www.btdmfg.com

Mayville Engineering Co., 920-387-4500, www.mecinc.com

Special Products & Mfg., 972-771-8851, www.spmfg.com

Springs Fabrication Inc., 800-466-5896, www.springsfab.com

Tekla Inc., 770-426-5105, www.tekla.com

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI