Contributing editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metals upsets, offsets, and onsets in 2007

What are the smart plays on price?

- By Kate Bachman

- January 9, 2007

- Article

- Shop Management

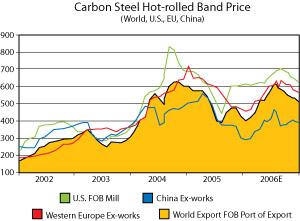

Figure 1U.S. hot-rolled band prices hovered around $600 per tonne in the first quarter of 2006, rising to nearly $700 per tonne midyear, then dropping as low as $622 per tonne. Prices are predicted to continue lowering in first-quarter 2007, then resume fourth-quarter 2006 prices in the second quarter. Source: World Steel Dynamics, Englewood Cliffs, N.J.

Metal fabricators should see price relief on U.S. carbon steel hot-rolled band prices going into the first quarter of 2007, with prices expected to bottom out at $500 to $540 per ton early in the first quarter, depending on the mill source. In February through April, prices should begin to rebound to highs of $570 to $620 per ton by late in the second quarter, as seasonal demand returns, inventory reductions revert, and mill production cuts take effect, predicts Patrick McCormick, World Steel Dynamics (WSD) managing partner (see Figure 1).

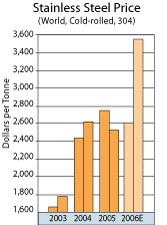

Stainless steel prices are likely to hover at current high or even slightly higher levels in 2007. World cold-rolled 304 priced at 1.78 per pound ($3,929 per tonne) in September 2006, according to MEPS (International) Ltd., nearly doubled the $1.00 per lb. ($2,217 per tonne) only nine months earlier in December 2005 (see Figure 2).

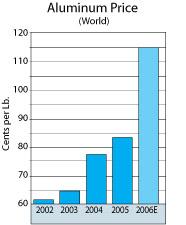

Global aluminum cash prices are forecast to decline from 2006 historical highs of $1.17 per lb. ($2,574 per tonne) to $1.05 per lb. ($2,310 per tonne) in 2007, and 0.95 per lb. ($2,090 per tonne) in 2008, according to an article in The Ringsider, a London Metal Exchange (LME) publication article. That lower price still would be dramatically higher than 2004 annual prices of 0.77 per lb. (1,694 per tonne) (see Figure 3).

However, Prudential Equity Group analysts increased their forecast from $1.05 per lb. to $1.20 per lb. ($2,640 per tonne) in 2007, a Nov. 29 Purchasingmagazine article stated. Platt's Metals Weekshows domestic aluminum prices peaked at $1.35 per lb. ($2,700 per ton, Midwest price) in April 2006.

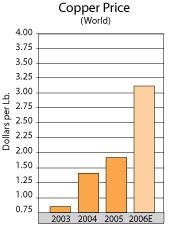

Copper prices were forecast to reach new annual highs in 2007, at an annual cash average of $3.26 per lb. ($7,165 per tonne) (see Figure 4), still below the all-time peak of $4 per lb. ($8,800 per tonne) seen in May 2006, another Ringsiderarticle forecast. 2006 prices averaged $3.10 per lb.

However, November's to-date average copper price slip on the LME to $3.22 per lb. ($7,084 per tonne) upset some analysts' 2007 price projections, prompting adjustments ranging from $2.50 per lb. ($5,500 per tonne) to $2.80 per lb. ($6,160 per tonne), a Purchasingmagazine article reported.

Demand, Supply

Carbon Steel. The domestic automotive industry's downturn is driving a temporary glut of carbon flat-rolled steel that likely will lead to a price reduction early in the first quarter of 2007.

Carbon flat-rolled steel inventories in the U.S. hit record highs of 10.2 million tonnes in September 2006, according to Michelle Applebaum, analyst, Steel Market Intelligence®.

"Right now there's an inventory bubble, low order rate, and second-tier mills showing hunger � and prices are coming down," WSD's McCormick said. "But the other thing that's happening concurrently is the slashing of production output by the Tier 1 mills, and by some Tier 2 mills," he added.

U.S. steel consumption in 2007 will be almost as high as consumption in 2006 at about 127 million tons, said Roy Platz, director, marketing and analysis, Mittal Steel North America, at a Metals Service Center Institute (MSCI) forecast conference in September.

Figure 2Record-high nickel prices, which account for a significant percentage of the cost of austenitic stainless steel, continued to push 2006 stainless prices beyond expectations. Sources: London Metal Exchange, Metal Bulletin Monthly, Purchasing magazine.

The construction and capital equipment sectors are expected to drive most of the growth activity next year — albeit at about half the growth seen in 2006, said Christopher Plummer, Metal Strategies managing director.

Although the residential housing market continues to decline, Plummer said that segment accounts for only a small percentage of steel usage and should have little effect on steel availability and prices. Growth in the nonresidential and public works end markets likely will offset the decline in the housing sector. Apparent domestic consumption for parallel flange sections, a major component in commercial building construction, is picking up in the U.S. , Gregory DePhillis, Arcelor Intl. America Inc., said.

The energy sector's growth as a market for steel products may offset some of the negative impact its high prices have had on material and operating costs. High energy costs have increased activity in the energy end market, increasing demand for plate steel for pipelines, refineries, and wind towers, said Patrick McFadden, sales manager, plate group, Nucor Steel, at the MSCI conference.

The strong demand for plate steel also comes from industrial equipment, heavy machinery, railcar, and barge end markets, according to McFadden.

Structural carbon steel inventories remain tight. In September Nucor's incoming orders at its structural mill were at the highest levels in seven years. Nucor-Yamato Steel Co. and Steel Dynamics Inc. (SDI) put customers on controlled order entry in the third and fourth quarters of 2006 (customers purchase steel based on past purchase quantities), according to a July press release issued by the American Institute of Steel Construction (AISC).

"What's different this year [2006] is that people want to book further and further out," said James Wroble, SDI's sales and marketing manager. "We were booked a month out, then five or six weeks, then 12 weeks."

MEPS has upgraded its previous estimate for global crude steel production in 2006 to be 1.2 billion tonnes and is forecast to increase by 6 percent in 2007 to 1.3 billion tonnes. Finished steel consumption is expected to be more than 1 billion tonnes.

According to MEPS, it is the desire for steelmaking self-sufficiency that is driving the onset of new plant and equipment capacity worldwide.

China continues to upset the equilibrium in global metal production and consumption, because it is now a net exporter, producing more than it is consuming; more than half of plate consumption growth is from Asia; and China is the largest consumer of carbon steel, aluminum, and copper and the largest producer of crude steel and aluminum. And, in yet another upset, in 2006 China became the largest stainless steel producer, according to Purchasingmagazine.

All eyes will be watching China to see if government attempts to curtail production and increase consolidation of its very fragmented steel industry are successful and if those changes offset the rising number of exports.

Figure 3World aluminum prices rose to a $1.15 per lb. average in 2006—far exceeding earlier predictions of $0.90 per lb. Price forecasts for 2007 range from $1.09 per lb. to $1.20 per lb. Source: London Metal Exchange, Metal Strategies.

So far production has not slowed significantly in China . According to a China Iron and Steel Association (CISA) report, China 's crude steel production was 356 million tons in 2005; 415 million tons in 2006, and is forecast to be 460 million tons in 2007.

As China 's demand growth rate slows, a glut in steel products has increased its exports. In early 2005, China was still a net importer, but in yet another upset, became a net exporterin 2006, according to WSD. "So net, net, they've had a massive supply change in China ," McCormick said.

Stainless Steel. Domestic stainless steel is in its tightest supply in more than 30 years, said James Stephens, vice president, stainless operation, ThyssenKrupp, Ken-Mac Metals Div. He asked why this is so when most end-use markets for stainless are flat or down and stainless flat-rolled production is up and is projected to stay strong through the first half of 2007.

New or reawakened dormant end markets for stainless are fueling the demand primarily, Stephens said, citing a resurgence of the tube and pipe industry and energy-related fields, including coal-fired plants, nuclear plants, oil and gas, chemical processing, and alternative energy generation. In addition, more stainless is being exported, he said. Other end markets for stainless that are experiencing a resurgence are aerospace and defense.

"This is where we see the end-user impact on stainless steel supplies," he said. "You are going to fight for certain types of stainless steels."

Although global stainless steel production was up in 2006 by an estimated 14.3 percent at 27.8 million tonnes, according to the International Stainless Steel Forum (ISSF), and is expected to remain strong in 2007, demand continues to outpace supply, with additional demand coming from new and resurrected markets.

Subject to raw material costs returning to historical levels, ISSF believes that the long-term growth trend for stainless steel of about 6 percent will be achieved.

Aluminum. The transportation sector has led the growth in U.S. demand over the past decade, at 4.4 percent, CRU reports show. It has become the second-largest aluminum consumer segment after packaging (primarily can stock). After dipping in '07 and '08, total vehicle production should increase in '09 and '10, CRU predicts.

The residential end market is predicted to hit a cyclical low in 2007, depressing sheet demand for aluminum doors, windows, awnings, siding, and extruded aluminum, but is expected to rebound to 2006 levels in 2008, the CRU data shows.

The truck-trailer market also faces a cyclical downturn in 2007, but legislation favorable to the industry should bring growth by 2009.

Figure 4Copper prices surged as high as $4.00 per lb. on the LME in May 2006, averaging $3.10 per lb. Annual average cash price predictions for 2007 vary widely, ranging from $2.50 per lb. to 3.30 per lb. Source: London Metal Exchange, Purchasing magazine.

Growth in the recovered aerospace sector has prompted aluminum capacity expansion from Alcoa, which plans to increase its capacity of aerospace heat-treated plate and sheet by 50 percent. Kaiser Aluminum and Alcan are expanding plate capacity as well, according to CRU.

Global flat-rolled production reached 15.6 million tonnes in 2005. Packaging (cans) and foil stock represent about half of the total aluminum consumption, while transportation and construction represent 13 percent each, CRU data shows.

In a Ringsiderarticle, analyst Adam Rowley, Macquarie Bank Ltd., estimated global total aluminum consumption was up in 2006 by 7.5 percent, to 34.3 million tonnes, while global production was up by only 6.3 percent, at 34 million tonnes. He projects 2007 consumption to be up again by 4.9 percent, to 36 million tonnes, and forecasts production to exceed demand by 6 percent, to 36 million tonnes.

Copper. A global refined copper deficit of 200,000 tonnes in 2006 — the fourth successive year of deficit — has ushered in the record-high prices. However, high prices may finally have dampened demand. China 's 2006 consumption flattened at 3.7 million tonnes, Purchasingmagazine reported. Real price relief should occur in 2008 if copper achieves a projected surplus of 200,000 tonnes.

Raw Materials Determine Prices Too

Carbon Steel. Marginally decreasing raw materials prices should have a direct downward effect on carbon steel prices, especially for consumers paying raw material surcharges, according to Metal Strategies' Plummer.

"We see pressures on raw materials easing in 2007 — nothing dramatic — we could be looking at across-the-board cuts in key steelmaking raw materials — iron ore, coal, and purchased coke — by 5 to 10 percent next year," he said. "We also see the price for scrap down an annual average of 5 to 10 percent. So that alone suggests we're looking at somewhat lower prices for 2007."

Stainless Steel. Adrian Gardner, metals market analyst, Brook Hunt & Associates Ltd., said a nickel shortage is partly to blame for skyrocketing austenitic stainless steel prices. Nickel, a defining component of austenitic stainless steels (200 and 300 series contain 8.5 percent to 25 percent nickel), is projected to decrease from record-high prices — as high as $15.80 per lb. on Aug. 24, 2006 — to an annual average price of $7.59 per lb. in 2007, reflecting primary nickel production growth of less than 5.5 percent, Gardner said. MBR forecasts global refined nickel production to exceed consumption in 2007, moving this 2006 deficit into a surplus, and forecasts an average LME cash price of $8.86 per lb. in 2007.

China will need an estimated 30 percent more nickel, or 50,000 tonnes, according to nickel mining giant Inco of Toronto.

In addition, insufficient stainless steel scrap supplies keep pressure on primary nickel price, albeit lower than 2006 highs, according to Gardner.

The price of stainless steel scrap (standard 18-8 grade 304) delivered to North American mills was about $1,550 per long ton, up at least $200 per ton since early December 2005, according to the online newsletter "Steel Business Briefing."

The high nickel price has driven stainless producers and fabricators to look at alternatives to offset high costs. The ISSF stated that the fastest- growing types of stainless steel are the ferritic grades (400 series), which do not contain corrosion-resistant-enhancing nickel. It added, "The continued high volatility of raw material prices will be a limiting factor for sustainable future growth."

Consolidation

Previous and continued consolidation in the carbon steel industry has had a stabilizing but heightening effect on prices, as larger mills are able to turn down capacity instead of lowering prices to offset decreased demand.

"Consolidation allows mills to play a more controlled price scheme," said McCormick. Consolidated producers now are so large that they're able to scale back capacity and still survive, he explained.

The biggest consolidation move in 2006 was Mittal Steel's buyout of Arcelor — itself formed from a three-way merger four years ago — only days after Arcelor bought Canada 's Dofasco in a hostile takeover bid. Arcelor Mittal now has three times the capacity of the next-largest steel producer, Japan 's Nippon Steel, The Ringsiderreported. Yet the top five steel producers account for only one-fifth of the world's output, making more consolidation among producers inevitable, the publication report said.

McCormick believes mill fragmentation in China will lead to the onset of consolidation. "In fact, the mills are more fragmented than they were three, four years ago, because you've got a lot of people adding capacity, trying to grow and grab the economic benefit of jobs in their communities."

He added, "If more of that steel gets stuck in China , the fragmented steel supply there will devour itself. It will be a horrible death before a consolidation occurs, just like we saw here [in the U.S. ]."

Aluminum. More consolidation is expected in the fragmented aluminum industry. With an estimated market value of $30 billion, Russian alumina and aluminum producer RUSAL — merging from the existing RUSAL and the SUAL Group, and the alumina assets of Glencore International — will be considered to be the largest aluminum producer, passing the current leaders Alcoa of the U.S. and Alcan of Canada. Although the new company may not be significant as a supplier to U.S. aluminum consumers, it is likely to influence global aluminum pricing.

Copper. Freeport-McMoRan Copper & Gold announced in November a plan to buy Phelps Dodge, which will create the largest copper supplier in North America , Purchasingreported.

Imports

The dollar is expected to weaken, economists say, driving U.S. prices even higher than they already are. U.S. carbon steel prices remain the highest of all regional markets, with European prices the next highest and China 's the lowest, WSD figures showed (see Figure 1).

"The pricing differential between China and North America, Brazil , and Europe remains very significant � surplus steel will go to wherever the highest-value market is, and if you look at regional pricing, even with the weak dollar, the higher-priced U.S. market will continue to attract imports," McCormick said.

"While China 's surplus is exported, most of it does not currently go to North America ," McCormick contends. "It goes to the rest of Asia, No. 1; Europe, No. 2; and then North America . The reason is simple: Asia is a lot closer, and the Chinese currency has lost value against the euro."

In November the American Iron and Steel Institute (AISI) reported that year-to-date finished steel imports are up 46 percent compared to the same period in 2005, at 36.8 million net tons. On an annualized basis, total and finished steel imports would set all-time records, surpassing the previous record set in 1998. "The rise � remains pronounced for countries with a history of unfair trading, especially in Asia . � In October, for the fourth month in a row, China , a nonmarket economy, was the single largest source of steel imports to the United States , 338 percent higher in October 2006 than in the same month last year," the report said.

Although it may sound like good news for metal fabricators to have access to lower-priced steel, McCormick believes steel imports will also come in the form of metal fabricated goods, rather than just as mill steel. "Metal-containing goods are increasing their flow from China ," he said. "The Chinese would much rather have the value-added jobs than just the steel-producing jobs."

Aluminum. Chinese alumina output surged in 2006, and aluminum production has increased, Greg Wittbecker, director of logistics and business development, Alcoa Materials Management, reported at the MSCI forecast summit. He asked the question that seems to be on the minds of all U.S. metals producers: "Will China's incremental primary output be consumed domestically or exported?"

Moderation, Balance

On the issue of imports, McCormick deals out advice for producers and fabricators alike. Considering the potential adverse impact on metal fabricators of steel-imports-as-metal-fabricated-goods, McCormick has warnings for U.S. steel mills. "If the pendulum swings too far — that is if U.S. mills drive the price of this market to too much of a premium — while the short term will feel good for the mills because of higher profits, the long-term consequences are they will potentially drive some of their customer base out of business or out of the country," McCormick said.

As well, McCormick warns fabricators not to rely on imports too much. "Astute buyers will balance the price opportunity for more imports with the supply risk. Here's your gamble with imports: Will you be able to count on them, year in and year out? Because if you have a short-supply domestic market, you need to have a historical supply position to secure your future demand with a mill."

McCormick also advises metal fabricators to avoid chasing price or lean their inventories too aggressively. "Since the market price will continue to be volatile, your company's ability — or lack of ability—to pass on steel price changes to your customers should determine the balance between fixed and variable price agreements in your buying portfolio. That is the smart play."Related Article

The FABRICATOR® acknowledges the following sources used in preparing this article:

Alcoa Materials Management, www.alcoa.com

American Iron and Steel Institute, www.steel.org

Brook Hunt, www.brookhunt.com

The Economist, www.economist.com

International Iron and Steel Institute, www.worldsteel.org

International Stainless Steel Forum, www.worldstainless.org

London Metal Exchange Ltd., www.lme.com

MEPS, www.meps.co.uk

Metals Market, www.metalsmarket.net/

Metal Strategies, www.metstrat.com

Metals Service Center Institute, www.msci.org

Mittal Steel USA, www.mittalsteel.com

Nucor, www.nucor.com

Prudential Equity

Purchasing, www.purchasing.com

Rio Tinto, www.riotinto.com

Steel Market Intelligence, www.michelleapplebaum.com

ThyssenKrupp, www.thyssenkrupp.com

World Steel Dynamics, www.worldsteeldynamics.com

About the Author

Kate Bachman

815-381-1302

Kate Bachman is a contributing editor for The FABRICATOR editor. Bachman has more than 20 years of experience as a writer and editor in the manufacturing and other industries.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI