Editor-in-Chief

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Spending time with capital equipment

The 2007 Capital Spending Survey indicates that manufacturing expenditures will grow this year

- By Dan Davis

- January 9, 2007

- Article

- Shop Management

Ask fabricators how they view business in 2007, and you'll likely get for a response, "Cautiously optimistic." In these days of potential terrorist attacks, war in Iraq and Afghanistan, tightening oil supplies, a shallow labor pool, and the constant threat of being replaced by an overseas supplier, fabricators should be looked upon as an optimistic bunch.

The results from the inaugural 2007 Capital Spending Surveyfrom FMA Communications Inc. reveals just that. Despite the fear that impending economic slowdown might be around the corner, most fabricators indicate a desire to invest in new equipment.

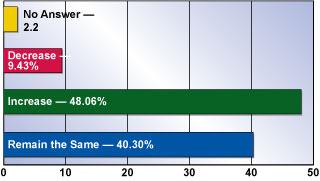

What did they say exactly? Figure 1reveals that more than 80 percent of fabricators surveyed said they planned in 2007 to increase or keep capital equipment and machinery spending the same as in 2006. Slightly less than 10 percent indicated a decrease in capital equipment spending.

When asked to break down capital expenditures for 2007 more specifically, respondents said they planned to set aside 64.54 percent for new equipment, 25.9 percent for used equipment, and 9.55 percent for rebuilt equipment.

What Else Was Learned?

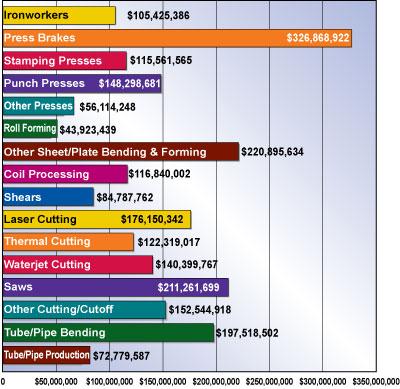

According to the 2007 Capital Spending Survey results, fabricators are keen on purchasing metal forming and bending equipment. Approximately $2.3 billion is projected to be spent on metal fabricating and forming equipment in 2007.

Almost $327 million is projected to be spent on press brakes alone. That's followed by almost $221 million for other sheet and plate bending and forming equipment, which includes machinery such as folders, panel benders, roll benders, and other, similar types of equipment not to be confused with press brakes.

But as a whole, more dollars are projected to be spent on cutting equipment than any other equipment sector. That's more than $885 million expected to be spent in this area.

More than $211 million is projected to be spent on saws, a staple in most fabricating operations. Interest in laser cutting machines continues to grow, as more than $176 million is expected to be spent in this area. Figure 2 offers a complete picture of projected expenditures by type of equipment.

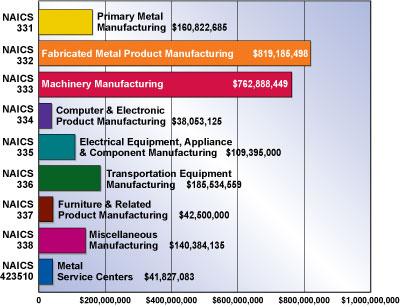

Figure 3provides a clearer picture of which industries are projected to spend the most on capital equipment. The different industry segments are broken out by North American Industry Classification System (NAICS) codes.

Fabricated Metal Product Manufacturing (NAICS 332) appears to be the most robust segment heading into 2007, with the industry projected to spend more than $819 million on capital equipment.

Following closely is Machinery Manufacturing (NAICS 333) at more than $762 million. The Transportation Equipment Manufacturing sector (NAICS 336) places third in this list with projected capital spending of more than $185 million.

A close look reveals that Computer and Electronic Product Manufacturing (NAICS 334) is projected to spend only $38 million on capital equipment in 2007. Obviously, this industry has seen many manufacturing endeavors move to the Far East over the last decade.

Interesting to note is that 61.2 percent of the actual dollars to be spent on capital equipment originates from plants in just 10 states:

- Pennsylvania(8.4 percent)

- Ohio(8.31 percent)

- Iowa(7.39 percent)

- Michigan(7.28 percent)

- North Carolina(6.53 percent)

- California(5.40 percent)

- Indiana(4.83 percent)

- New Jersey(4.67 percent)

- Texas(4.37 percent)

- Wisconsin(4.06 percent)

Figure 4provides a regional breakdown of actual dollar volume of plants planning to purchase capital equipment this year.

Machining Sector Continues Upswing

Taking into account the machining industry, which covers drilling and tapping, electrical discharge machining, gear cutting, grinding, machining center, milling and boring, and turning lathe equipment, U.S. manufacturers are expected to invest almost $18.5 billion in machinery and equipment in 2007. That's the result of Gardner Publications' 2007 Capital Spending Survey, the 39th edition of this survey.

The three previous surveys projected double-digit growth in capital equipment spending—averaging more than 20 percent per year—but 2007 is seen as a return to normalcy. Gardner Research projects a 4 percent increase in machine tool consumption for this year.

The automotive industry, driven by foreign carmakers that have established assembly plants and supply chains in the U.S., will be a big purchaser of machining equipment. Aerospace, medical, and energy sectors also will drive demand.

The 2007 Gardner Research Capital Spending Survey can be accessed at www.gardnerweb.com.

Further Explanation

In discussing survey results, the terms projected and actual are used quite frequently. Projected amounts are FMAC estimates of total amount of dollars to be spent in 2007. The estimates are based on survey returns. Actual amounts are actual summations from the surveys that were returned. They are not projections.

Figure 2 Metal fabricators and formers are projected to spend more than $2.3 billion on capital equipment in 2007.

The Winners Are �

The FABRICATOR®would like to congratulate these survey respondents who won $500 gift cards:

- David Phillips, Don de Cristo, Dover, Fla.

- Mi Samsun, San Sun Construction, Philadelpia, Pa.

- Craig Tedford, Precision Metal Products, Newburg, Ore.

The FMA Communications staff thanks them and others who took the time to fill out the 2007 Capital Spending Survey.

About the Author

Dan Davis

2135 Point Blvd.

Elgin, IL 60123

815-227-8281

Dan Davis is editor-in-chief of The Fabricator, the industry's most widely circulated metal fabricating magazine, and its sister publications, The Tube & Pipe Journal and The Welder. He has been with the publications since April 2002.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

Dynamic Metal blossoms with each passing year

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI