President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

How steel service center inventories affect steel prices

As inventory builds up, steel mills may have a hard time pushing price increases

- By John Packard

- August 23, 2017

If a steel service center has a lot of material on its racks, it isn't likely to order more steel. Such a situation could make recently announced price hikes hard to implement.

In mid-August U.S. steel mills advised their flat-rolled and steel plate customers that they would be increasing spot prices on hot-rolled, cold-rolled, galvanized, and Galvalume® steels, as well as plate. The flat-rolled mills announced $30/ton base price transactional increases. For plate, Nucor boosted prices by $30/ton, and SSAB advised its prices would rise by $40/ton.

Steel prices had been flat to trending lower leading up to these price increase announcements. The mills used the increase in commodity prices, especially scrap which rose $10/ to $30/gross ton for August delivery, as the justification for higher prices.

The steel mills also pointed at low inventory levels at their flat-rolled customers—especially service centers. The main distributor trade association is the Metals Service Center Institute (MSCI), which has been reporting low inventories for many months. MSCI estimates carbon flat-rolled service centers were carrying 2.3 months of supply as of the end of July. In May and June, MSCI was reporting distributor stocks at just 1.9 months of inventory on hand.

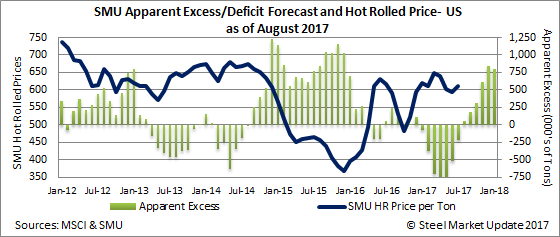

Steel Market Update (SMU) uses a proprietary model to analyze the MSCI numbers and identify whether distributors are overinventoried (excess) or underinventoried (deficit). For May and June, our model told us service centers were 800,000 tons and 525,000 tons short, respectively, of being in a balanced inventory situation.

One of the services that SMU offers its clients is to forecast where we see shipments and inventories and how that will affect the balance at the end of each month. Our forecast is based on historical rates of change from month to month.

SMU’s Service Center Inventories Apparent Excess/Deficit forecast in early July predicted the deficit in inventories held by flat-rolled distributors would decline significantly by the end of July. We have worked with the MSCI carbon flat-rolled shipment and inventory data just released for July, and our model indicates the deficit did indeed shrink and is very close to our original forecast of -232,000 tons.

MSCI reported carbon flat-rolled shipments of 1,991,000 tons. This is 20,000 tons more than our early July forecast of 1,971,000 tons.

Inventories at U.S. flat-rolled service centers ended the month of July at 4,646,000 tons, which was slightly higher than our forecast of 4,589,000 tons.Using our model, we show the distributors reducing the inventory deficit from -525,000 tons to -218,000 tons.

August Distributor Shipments/Inventories ForecastSMU forecasts flat-rolled shipments out of U.S. service centers for August will be 2,352,000 tons. Our forecast is based on the average monthly change for August over the past four years. In this case, the average change was +2.7 percent. We also forecast that flat-rolled steel distributors will hold 4,862,000 tons of inventory at the end of the month.

If the shipment and inventory forecasts are correct, service centers will have eliminated their inventory deficit for the first time in this calendar year and will be in a “balanced” position with +50,000 tons.

Figure 1. This graphic shows the link between inventory increases and subsequent drops in steel prices.

As we take our forecast out into the future using the same formula, we expect September through January to see a jump in inventories. As a result, the amount of excess steel on the distributors’ floors should increase every month through January.

If MSCI data is correct and our model is accurate, inventories at steel distributors will rise through the end of the year. As the inventories grow, the pressure will grow for steel prices to weaken (see Figure 1). As inventories decline, steel prices trend higher. When the green bars are indicating an excess (bars are above the zero line), prices tend to drop.

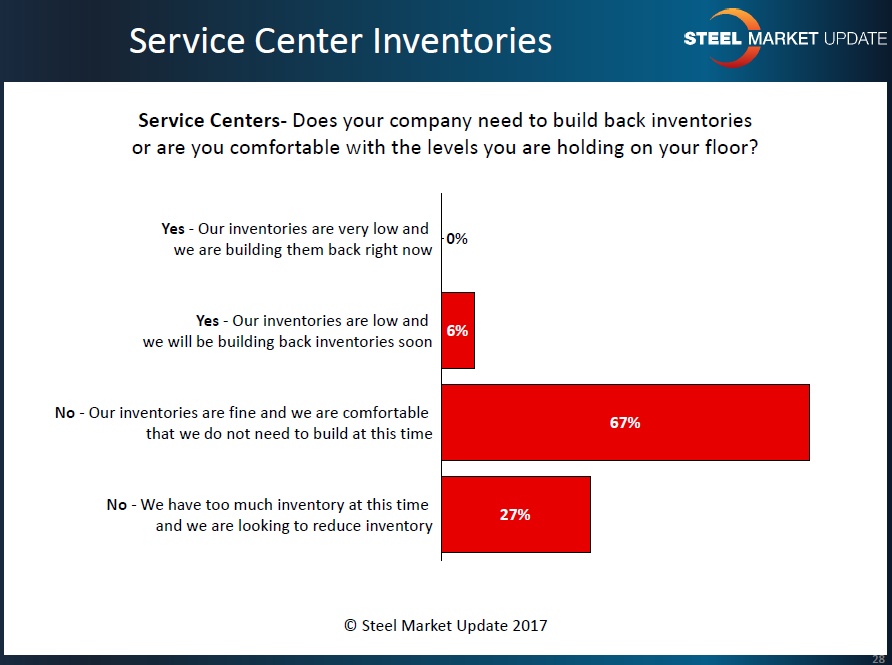

Complementing the data pulled from our MSCI analysis are the results we have gathered through the twice-monthly surveys we conduct throughout the year. One of the inquiries posed to service centers is if their inventories are balanced or if they need to either build or lower inventory levels.

In the survey conducted the week of Aug. 14, service centers reported inventories that were balanced or higher than what they considered comfortable. Only 6 percent of distributor respondents reported inventories too low and in need of replenishment (see Figure 2).

So SMU’s data suggests that the mills will be hard-pressed to collect the price increases announced in mid-August.

There is a possible black swan event that could change inventory flows dramatically and play with our model. That would be the flow of foreign steel. Due to threats of the Section 232 investigation, the amount of foreign steel being imported has increased as buyers look to beat any punitive action by the Trump administration.

It’s possible foreign steel flows could drop dramatically in September, October, and November of this year. During our survey process, trading companies were unanimous in their opinion that imports of cold-rolled, galvanized, and Galvalume steels will slow in the coming months.

Steel buyers need to remain vigilant to any changes in flows of steel, both domestically and internationally, as interruptions in the norm could have a dramatic impact on steel prices going forward.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI