Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Our Publications

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

How metal additive manufacturing has changed over a decade

Four metal 3D printing experts weigh in on material development

- By Gareth Sleger

- January 18, 2019

- Article

- Additive Manufacturing

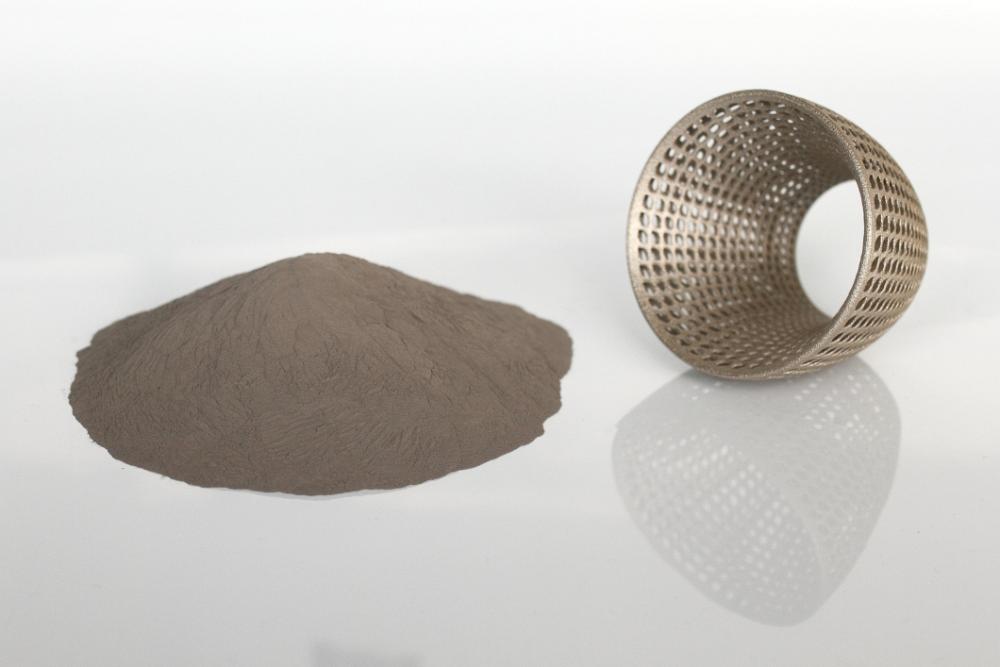

Here a 3D metal printer produces a steel part. Materials manufacturers are investing more in developing new metal additive materials. (Getty Images)

Now that additive manufacturing is gaining traction, materials manufacturers are investing more in developing new metal additive materials. That’s a big change from 10 years ago or even just five years ago when the market wasn’t big enough nor the technology advanced enough to justify such a venture. How far has metal additive come in the last decade, and what’s on the horizon for the rapidly growing technology?

The Additive Report reached out to four experts in the metal additive space for their insight:

Cheryl MacLeod, global head of 3D fusion science, 3D Printing at HP Inc.: When HP entered AM in 2015, the Silicon Valley computer giant wanted to take a new approach to metal material development. HP noticed at the time that the prototype devices market was lacking, so it started a Metal Jet production service in a partnership with British aerospace and automotive components company GKN. From that, HP now produces custom-made stainless steel powders for automotive, industrial, and medical customers, including Volkswagen, GKN, Wilo, and Parmatech. HP continues to develop new materials through its Open Materials Platform for both Metal Jet and Multi Jet Fusion.

Keith Murray, business development manager at Sandvik Osprey Ltd.: Osprey CE has been developing controlled-expansion alloys and metal powders with Sandvik for almost 20 years. The material program, based less than 10 miles from Swansea in South Wales, offers the full range of materials: iron-based alloys (stainless steel and maraging steel), nickel alloys, copper alloys, and cobalt alloys, as well as continued development in aluminum and titanium. Sandvik created its own gas atomized technology with capabilities ranging from supplying small-scale metal powder for prototype development to high-volume batches for large-scale production.

Jacob Nuechterlein, president and founder of Elementum 3D: The AM material, parameter, and research development company is on the forefront of producing new metal alloys and composites. Nuechterlein, with a background in metallurgy, started the Erie, Colo.-based company in 2014 to expand the alloy portfolio. Four years ago, only 12 commercial metal alloys were on the market compared to 60-plus aluminum materials. With a focus on laser powder bed, Elementum 3D has since developed numerous “ultramaterials” in aluminum alloy, refractory materials like tungsten and tantalum, steel- and nickel-based alloys, and copper.

Andy Shives, business manager of additive manufacturing at Praxair Surface Technologies: Industrial gas producer Praxair Inc. has been manufacturing metal powders for 50-plus years through the thermal spray coating markets. So, it’s only natural that its AM division, Praxair Surface Technologies (PST), has become one of the largest global manufacturers of additive metals over the last decade. PST now operates a 300,000-sq.-ft. facility in Indianapolis dedicated to production of metallic and ceramic powders. PST atomizes nickel-, cobalt-, iron-, titanium-, and copper-based alloys for almost every relevant market: aerospace, energy, and industrial, as well as an expanding reach in automotive and medical sectors.

The Additive Report: How does the pace of AM materials development compare to five to 10 years ago?

Shives: A lot of the big players now weren't even involved in additive, let alone metal additive, 10 years ago. But even today it's still the early stage. The number of applications or parts that are in production is still very small. Now, especially over the past five years, the knowledge has increased dramatically on what alloys are printable and what alloys you need to look at more for certain processes. For example, one alloy may work well for the laser powder bed process, but it won't work well for the electron beam process. And customers now really research which alloy works best for a specific application. And we've seen that increase significantly the past two to three years.

Murray: If we'd had this conversation in 2007, and you asked me where I see the technology going, I think anyone would find it difficult to really anticipate how far it's come. If you go back to then, there were maybe 100 machines installed around the world. It was a very niche application and technology. At first it was just an interesting complementary part of our business, but obviously that's changed quite a lot over the years. The scale of the industry, the level of innovation, the level of interest, and the level of demand for materials are unrecognizable from where they were 10 years ago.

Nuechterlein: Particularly, some of it has to do with the computing power and tools that we have available to us for materials development and for just printing in general. The flexibility of the equipment has opened quite a bit to let us to dive into knowing how it works and how we can make it better. People who are in the atomizing world now understand how to atomize material for AM and they see that there's a market for it. In the past there was a lot of variable quality. People have learned different tricks of the trade so that you can get a more consistent product. There's more places to source different materials from. Competition, I think, breeds a better product.

AR: Are manufacturers more openly adopting 3D printing as a real manufacturing option?

MacLeod: We are absolutely seeing manufacturers adopt 3D printing as a true production option, and going forward, we believe there will be explosive growth in materials development. More materials partners are interested in developing their ability to create AM powders, and as technologies become better suited for production, we’re seeing companies more willing to make investments in a broader range of high-performance materials. We are right at the inflection point where the technology is finally starting to get to a level of maturity that is really going to enable it to go beyond prototyping and low-volume production and move up the curve into full-scale production. The question isn’t if 3D printing will be the new platform for global mass production, it’s when.

Nuechterlein: Just the conversations that I have today versus when I started the company are completely different. It used to be that I was teaching people, even four years ago, what AM was. And now the conversation is more about teaching people how to use AM. And those are very different conversations.

Shives: Five years ago, a lot of companies were still exploring if they should get one machine or a couple machines – or they could have been working with outside contractors who had machines. Now a lot of these companies have at least one metal printer in-house doing their own studies. So, they've made that initial investment. It's got that important enough.

AR: What is influencing additive materials development right now?

Murray: It's still quite a diverse spectrum. There are different influencers for companies that are well into the additive journey within their own manufacturing process. They're getting closer to, if not already are using it as a serious production tool that drives development to refine materials and consistency not only for better reproducibility in terms of the process, but also the material characteristics. So it's really about understanding the minutia and refining specifications to give you a process that’s stable on an industrial basis.

MacLeod: Currently the biggest influence is the shift manufacturers are making from prototyping to production. This has a large impact on materials – moving from materials that are good at prototyping to materials that are more well-suited for production. For metals specifically, it’s all about production. We recognize that an open ecosystem of industry leaders is critical for greater innovation, breakthrough economics, and faster development of 3D printing materials and applications. When you look at vertical markets or anywhere you see serial production, most have a specific set of regulations, documentation, and processes that have become established norms in those verticals.

Shives: A lot of the alloys that many customers started using were pulled from specs from different markets, for example, casting and forging. They weren't written for the additive process. And what we're seeing now is customers becoming much more familiar with the additive machines, the various technologies, and creating custom parameter sets. And now designing specifications for AM. What has resulted from that are tweaks in alloy chemistry and particle size distribution. That's where you get into the custom alloys, which could be deviations from a well-known standard alloy. Or it could be a whole new alloy that was really designed and built for additive.

AR: What remain some of the obstacles to further pushing materials development?

MacLeod: Because 3D printing has been around for 30-plus years, a lot of engineers still think of the technology and materials in the silo of how they were first introduced – despite all the innovation in the space. For example, we are still learning what the powder bed AM process requires from a material standpoint and figuring out how to better match the core materials to the real profiles of each process. Injection molding has had a century to figure that out.

Materials manufacturers are investing more in developing new metal additive materials. (Getty Images)

Nuechterlein: Specifically, obstacles in materials development are competence and results. You want to be able to say that one lot will be the same as the next, and that if you get a great property, you're comfortable positioning that property on the plate. Customers want a lot of data. For each material that we release, we must generate a lot of data to make the customer comfortable before they move on large quantities. There's some flexibility and risk tolerance in a one-off here and there. But if you're talking about making an entire manufacturing run and you're going to be buying 20, 30 printers, you want to be very comfortable with how the material is going to perform in your part.

Murray: Standardization is a really big topic. You have different commissions like the American Society for Testing and Materials (ASTM) F42 group in the U.S. and the ISO/TC 261 committee, which is more European-based. But it’s also figuring out collaboration. Our materials company has a 150-year-plus heritage in processing material. We have a lot of inherent knowledge of the materials side – probably more so than some of the technology companies that build the machines. So, you have put together collaborations, drawing on relative strengths – materials and the process – to deliver the whole solution. The proliferation of the technology is happening so quickly. Trying to keep up and cover all your bases can be quite challenging.

AR: Do relationships between machine developers and OEMs still play a vital role in pushing the additive materials development envelope?

Shives: There are some equipment OEMs that work very closely with certain end customers to validate. We're seeing a lot of the OEMs that do proprietary parameter sets will do a lot of validation on their own. It's so secret and proprietary that they don't want the equipment company or other suppliers to know exactly what application or design they're working on.

MacLeod: We have a vision of extending our Open Materials Platform deeper into metals so that everyone can come and easily innovate on our platform. Progress comes from the collaboration that we have with our certified materials partners. There may be a point in additive when the science is so well understood that it’s been reduced to a set of predictive modeling and software tools that virtually anyone can use. At that point the deep relationship between the OEMs and materials companies will be less important, but this doesn’t yet exist for additive.

Nuechterlein: It's expanded even past that. There are a number of different options out now as to how you're going to make your part and why you're going to make that part again. Certainly, machine manufacturers are driving the largest portion of the industry, but not all of it. Now it's starting to pop up in individual applications that need figuring out. And AM is perfect for that, especially for small-run manufacturing companies. I would say a quarter of our business is with small companies looking to figure out how to do individual parts with functional prototypes.

AM: What’s one of the biggest things you see affecting additive material development in the near future?

Shives: One big shift might be the design for additive. The next generation of engineers in the industry are being trained differently to design new parts. There's been a lot of focus on that the past couple years. We're starting to see the early phases of that come out from the larger OEMs. So once these new designs for additive applications are confirmed and validated from the market, we will start to see production ramp up even more.

Murray: I'm not sure there is one next big thing, but it's a combination of improving performance and cost efficiency. Can you develop a material with a lower intrinsic metal cost to replace some of the existing ones? But it's about pushing the materials envelope. In iron-based materials, it's about improving durability and performance in things like tooling applications. And in high-temperature nickel-based superalloys, it's looking at the next generation of those materials and trying to optimize them for the process.

Nuechterlein: I think we're going to see a huge influx of different steels and being able to print steels. Steel today is really difficult to print. There are several reasons why, but it's a matter of figuring out how to weld these different materials properly. And not just weld them, but weld them with really, really high cooling rates to prevent cracking or other issues. Industries like automotive, tooling, and oil and gas have less use for aluminum-, titanium-, and nickel-based superalloys. They need high-performance steels. A lot of these printers are being used by mechanical engineers or a machinist who don't necessarily have a deep knowledge of how the material is being formed. You really have to have that knowledge that's really tied to metallurgy, heat treating, product forming, and forming different phases as you're printing.

About the Author

About the Publication

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI