Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabrication, automation, and the big picture

Chicago-area fabricator takes a holistic approach to manufacturing technology investment

- By Tim Heston

- September 8, 2015

- Article

- Automation and Robotics

Figure 1

Ludlow Manufacturing cut these rings on its 6-kW fiber laser. The parts go straight to packaging. However, about 80 percent of the job shop’s parts are formed and welded, which is something managers take into account when deciding what to automate on the floor.

Years ago Kevin O’Leary joined a job shop during a period of surging growth, so he knew all about the growing pains. The shop he used to work for hired people as it grew, but he recalled the typical challenges: not enough time in the day, not enough equipment to get the job done.

About two years ago O’Leary took a job at Ludlow Manufacturing Inc. (LMI) in Waukegan, Ill., a suburb north of Chicago. On his first day, he looked around and saw equipment everywhere—but where were the people?

He soon learned that this reflected the philosophy of the company founders, Todd and Jenny Ludlow, who launched LMI in 2005 (see Figures 1 and 2). Before launching the business, Todd Ludlow worked as an independent sales rep in stamping and metal fabrication. So why did he launch a fab shop of his own? “Like every person thinks, I thought I knew more than I did, and I could do a better job,” Ludlow said. “I have to admit, I don’t feel that way anymore.”

LMI started in 2,000 square feet with a used 1,000-W laser, one press brake, a compressor, and that’s about it. But the company grew quickly and today operates in 80,000 sq. ft. It wouldn’t be unusual to see a facility of that size employ 100 people or more. LMI, though, employs only about 45.

This goes back to Ludlow’s take on automation: He believes in it in a big way.

LMI’s Automation Philosophy

Instead of hiring people to grow, LMI acquired new equipment that helped simplify the act of cutting and bending sheet metal. Although Ludlow believes in automation, he looks at it holistically and pays attention to how technology can shorten not just a particular cutting, bending, or welding operation, but the entire order-to-ship cycle.

Lasers do have automated load/unload systems that hold enough material for unattended cutting at night (see Figure 3), but LMI doesn’t have any tower systems. About a year and a half ago, Ludlow had dreams of moving to an even larger facility and investing in a comprehensive material storage and retrieval system. “But I realized I was totally wrong about that,” he said.

Ludlow appreciated how such systems fit perfectly in other operations, but when he looked at his company’s job mix and resources, he found the investment wouldn’t make sense. The company doesn’t deal with a lot of remnants, so it couldn’t take advantage of a tower’s ability to automatically store and retrieve these remnants after cutting. With large towers, LMI’s lasers theoretically could cut unattended for days, but material handlers would still need to spend time shaking all those parts out of the cut nests. Ludlow added that investing in automated part-removal and stacker equipment didn’t make business sense either.

He emphasized that his thinking may change. But for now, material handling automation around the cutting centers isn’t a good fit. Looking at the big picture, he said that parts still need to be formed, welded, and inspected, so the order-to-ship time really wouldn’t change.

The time wouldn’t change much with a powder coat line, either. LMI is in a crowded metal fabrication market, which comes with its own challenges. Many shops chase the same work, so quite often LMI does business with companies outside Chicagoland, in Wisconsin, Indiana, even in the Southeast. But a crowded metal fabrication market also comes with benefits, and this includes custom powder coaters that serve LMI well.

Figure 2

Kevin O’Leary, vice president of operations and engineering (on left), joined LMI two years ago. He saw that the shop had plenty of machines yet few people, an unusual situation for a growing shop. The reason behind it was the company’s philosophy on automation espoused by co-founder and Vice President of Sales Todd Ludlow (on right).

Ludlow’s decision to buy or not to buy equipment and software isn’t based on conventional return-on-investment calculations. If he took a traditional ROI approach, LMI would employ many more people and have, if not less, certainly older equipment. His chief financial officer runs the ROI calculations, equipment depreciation, and other tenets of generally accepted accounting principles (GAAP). But Ludlow doesn’t run the business off those numbers.

“I run this business with a sales-based mentality rather than a traditional accounting-based philosophy,” he said. If a machine or software platform helps generate more sales than it costs, it’s a worthy investment. “And for most of our investments,” Ludlow said, “we’ve seen the benefits immediately.”

LMI employs few people relative to the sales it generates, so labor costs are low relative to revenue. Behind material, labor is a fabricator’s greatest expense, so employing relatively few individuals keeps LMI’s operating expenses low. Ludlow expects sales to exceed $13 million this year. Considering the number of full-time-equivalent employees (full-time plus part-time plus temps), this would make LMI’s sales per employee exceed $210,000. That’s much higher than the industry average of $158,000, as reported by the “2015 Financial Ratios & Operational Benchmarking Survey” from the Fabricators & Manufacturers Association International®.

O’Leary and Ludlow don’t view what they sell as simply “manufacturing capacity,” though. If it were that straightforward, they would be providing a commodity service, racing to the bottom, and dealing with razor-thin margins, an environment that makes growth difficult. They instead sell manufacturing expertise with smart engineering ideas that take advantage of the capabilities of LMI’s machines and software.

For example, why not unitize this design and combine several parts into one? Sure, the part may require 14 bends instead of four, but you eliminate welding. Besides, with offline bend programming and simulation on the shop’s new press brakes—which have touchscreen monitors that bring operators through the operation and lights that show tool placement and the bend sequence—14 bends aren’t a problem.

Of course, no matter how engineering-driven a fabricator becomes, employee engagement becomes difficult in an unsafe environment. At LMI every brake has an optical safeguard, every welding station has direct fume collection, and used compressor water is filtered for safe disposal.

You’ll rarely see an operator standing by a laser. For each shift, the company employs just one laser operator who manages the company’s five lasers. As vice president of operations and engineering, O’Leary also acts as LMI’s bending guru, working with engineers to program and run press brake simulations offline.

All of the brakes are networked. Recently one second-shift operator needed help setting up a part. The shop has overhead cameras that capture a view of most of the shop floor, so O’Leary can log on and actually see the operator standing at the machine. O’Leary asked for the part number, pulled it up online, and loaded the program onto the brake—all from his home office. The operator then asked which tools should go where.

As O’Leary recalled saying, “I told him, ‘Can you read the numbers on the tools? See the animation on the control?’” The control showed the operator where to put the tools, as did lights across the bed of the brake itself. The operator loaded the tools, performed the first bend, and told O’Leary that the angle was 2 degrees underbent. Still sitting in his home office, O’Leary input the correction in the bend program. The operator initiated the bend again, and the angle was spot on.

Bending operators need to know how to use a caliper, a height gauge, a protractor, and other basic measurement tools, but after learning these basics, they essentially can start bending good parts right off the bat. One of the company’s new Bystronic press brakes even has a table that lifts, so it’s level with the die opening. This encourages first-time operators to slide the blank parallel to the bottom die surface, not just jam the blank in at any angle (see Figure 4).

Processing Times

Looking at the big picture involves scrutinizing both value-added (processing) and non-value-added time. LMI has squeezed plenty out of its processing time with its investment in fiber lasers and electric and hybrid brakes. Most of its parts are small and less than 0.25 in. thick; why bend small parts on a massive machine? Moreover, the cycle time of these electric and hybrid systems can be extremely short. The result: An operator can make many more bends per minute (see Figure 5).

This makes LMI’s blanking-to-bending ratio low. The industry norm (at least for operations in which most parts are formed) is about three brakes to one blanking machine. LMI instead has only six brakes handling work from its five lasers. Considering roughly 80 percent of the shop’s parts are formed, and the fact that two lasers feeding parts to the brakes are high-powered fiber machines—one of which is 6 kW—that’s saying something.

O’Leary said that the company sends work through its robotic welding systems whenever possible. Several years ago LMI purchased a small machine shop, which opened the door for more welding and subassembly fabrication work that required milled or turned components. It also opened the door for in-house fixture development. Engineers build fixtures virtually in software, specifying machined as well as laser-cut components, then run the part through offline programming and weld simulation before the job hits the floor. Programs then can be downloaded to the company’s Genesis Systems welding cells.

“Sometimes it’s cost-prohibitive to develop a fixture [for robotic welding],” O’Leary said. “Usually we try to develop a fixture that’s load-and-go, with just one setup.” On occasion engineers may decide to tack a part manually but perform the weld with a robot. This means they need to make a holding fixture only for the robot, which is usually much less involved and less expensive than a complete welding fixture for both tacking and welding.

Tackling the Non-value-added Time

As any lean manufacturing guru will tell you, when you look at the entire manufacturing process chain, from order to shipping, value-added time takes up a small portion of it all. Non-value-added time dominates.

Some may debate what “value-added time” really is, but to keep things straightforward, LMI defines it as any time a tool touches a workpiece to make a good part: the laser cutting head, the press brake tools, the welding gun, and the portable CMM touch probe. All this helps produce a part that the customer is paying for. Everything else—quoting and estimating, scheduling, nesting, cutting assist gas and other consumables, entry of quality data, machine programming, maintenance activity, and more—may be necessary activities, but they don’t directly make or inspect what the customer is buying. Customers also, of course, are not buying bad parts, so any time spent making them, be it test parts for setup or errors made during production, is also non-value-added time.

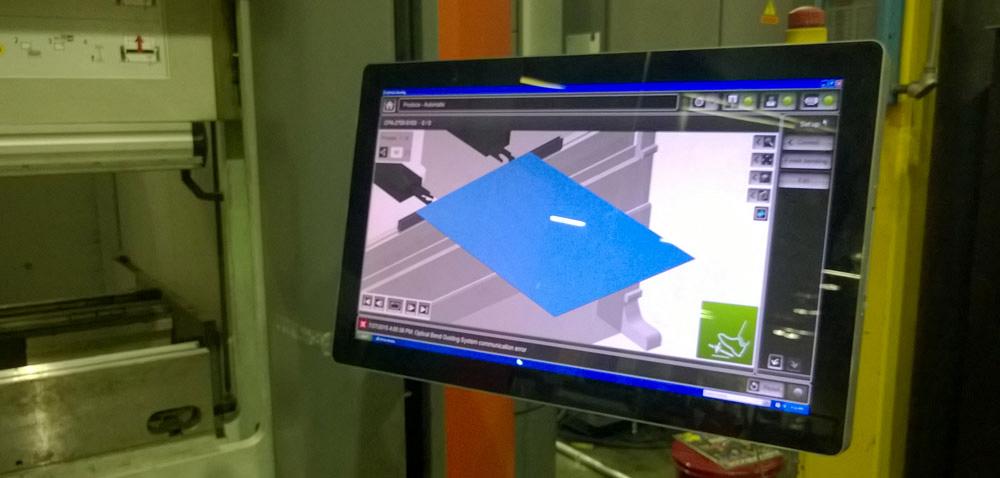

When managers were hunting for new press brakes, the short bending cycle impressed them, as did the integrated safety.ut what really caught their eye was the offline programming, simulation, and touchscreen controllers where operators can call up programs, view a simulation, and follow along during the bend sequence (see Figure 6). This helps shorten setup, improve communication, and avoid bending errors, such as bending a flange in the wrong direction. That’s all non-value-added time.

Similarly, when they purchased the new fiber laser systems, they loved the speed, especially with thinner stock. But they really took note of the software. The company now uses Bystronic Plant Manager software to automate the scheduling and nesting of every laser.

When Ludlow found a nitrogen-generation system (from Industrial Solutions LLC) that gave him the purity levels he needed for laser cutting, he bought one. Again, the customer is paying for parts, not the nitrogen to cut them, so LMI scrutinized the cost. “The quality of these [nitrogen-generation] systems have changed a lot in recent years. I’ve had a nitrogen generator here for four years, and I’m getting another one,” he said. “If I didn’t have it, my [nitrogen] bill would be about $6,000 a month. Now it’s only about $900, simply because I don’t have enough capacity in my generator to run to all the [laser] machines.”

Look up and you might think the shop has no air lines. Look closer, though, and you’ll see a 2-in.-square aluminum extrusion that runs the length of the facility. That’s for the shop air. To drop a new air line, a technician just needs to drill a new hole in the extrusion and drop an air hose. “Most shops our size run a 100-HP compressor with a 100-HP backup,” Ludlow said. “But we get only half a percent air loss [out of those aluminum extrusions], so we just run two 25-HP compressors with a 30-HP backup. We save so much money over a year by doing that.”

Figure 4

Ludlow moves a table so that it becomes parallel with the die surface, allowing the operator to simply slide the blank in against the backgauge.

This is yet another non-value-added expense LMI uncovered. Again, customers are paying for parts, not the electricity spent for compressors to pump shop air.

Quoting It Right

So many problems in fabrication begin at the very start of the process chain: quoting. As Ludlow explained, LMI quotes are based on data from past manufacturing jobs. The laser cutting data comes from XML files exported from Plant Manager, which has helped them build a library of exact processing times. If a part is complex, engineers may run the 3-D model through bend simulation to ensure tooling is available or needs to be purchased and to make sure the part can indeed be made without colliding with tools or the backgauge.

LMI also scrutinized data entry in quality assurance. Until recently a typical QA procedure at LMI went as follows: A worker delivered the part to quality for inspection. The QA person created the inspection file, performed the inspection, and then manually entered the data on the Excel sheet. When the QA tech typed in those numbers manually, the company’s portable CMM sat idle, not adding value.

So today LMI is working to eliminate all that data entry. Before a job is sent to the floor, an engineer in the front office exports the original CAD file to Faro’s CAM2 Measure software, which creates an inspection file that identifies all the part geometries that require inspection, “auto-ballooning” the drawing to identify all the inspection points. All this happens before the order hits the floor. Now when a part arrives in QA, the technician simply calls up the file and takes the measurements (see Figure 7).

“We’re taking the mundane data-entry portion of the quality role and building intelligence into the process upfront,” O’Leary said. “It does take a little more time upfront, but it cuts down the time in QA significantly, when we’re trying to get the part through production.”

Scheduling and Going Paperless

The company recently adopted OmegaCube Technologies’ enterprise resource planning (ERP) software and, at this writing, is moving toward a near-paperless environment, opting for 4- by 6-in. “move tickets” that accompany each work order. When a worker scans the ticket, the ERP platform brings up all the information about a job on the screen in front of him. This can include visual work instructions, videos, and the 3-D model (see Figure 8). A worker can print blueprints on a shared printer, if necessary. But for the most part, LMI is saying goodbye to the paper traveler.

“You can attach any file format to the job,” O’Leary said, “and you can view it, as long as the computer you’re working on has the application.”

The ERP works in concert with Plant Manager. The shop uses the ERP to schedule jobs based on the due date; then Plant Manager takes that schedule; looks out a specified number of days; and automatically nests parts based on available capacity, machine capability, grain direction requirements, and desired material utilization. Moreover, operators no longer need to manually log jobs into the ERP once they reach the laser. Once a program is executed, an XML file is sent back to the ERP to process all of the labor and material transactions.

Part revisions make up another issue that prolongs non-value-added time. Say a customer changes a material thickness requirement after a portion of the job has already been cut on the laser. If the customer says the parts are still usable, what then? The shop still could process the material, but it would need to make sure everything downstream can account for both the old and new material thickness. This includes available tooling at the press brake, fixtures at the welding cells, and inspection programs and data in QA. All this opens the door for more variation and a lot of confusion. Is it worth keeping the WIP, or to simplify things, should it just be scrapped?

Here, software has helped organize the situation. If a customer changes an order midstream, the ERP notes it and updates the work order to reflect the latest information. But if the customer says the already produced WIP is usable, then the software creates a separate work order that maintains all the previous job information at that particular revision level. This has helped reduce scrap rate and ensure LMI reprocesses only what is necessary for the job.

Down the road, LMI has plans to place monitors throughout the shop that show what jobs are where, as well as what’s on time and what’s behind schedule. If a job is behind schedule, it will become immediately apparent. “Managing the plant, I can see if someone is having a problem,” Ludlow said.

The Little Things

Perhaps nowhere is LMI’s focus on the big picture clearer than in the packaging area. After all, inefficient packaging mitigates all those efficiencies in processes upstream.

Here the company uses an automated shrink-wrap machine from Yellow Jacket for most batches of material—a big improvement over wrapping batches of product by hand. For materials shipped with strapping, the company no longer uses metal straps but instead applies heavy-duty plastic bands using a specialized hand tool from Orgapack (see Figure 9) that tightens the strapping and then ultrasonically welds the plastic ends together—no more spring-steel banding digging into the product or pinching fingers.

“It’s better, safer, faster, and cheaper,” O’Leary said.

Those four words pretty much sum up the goal of every modern fabricator.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI