Editor-in-Chief

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

10-kW fiber laser gets shop back on track

Scrambling to meet order demand, Progressive Metal Manufacturing Co. finds that its new laser gives them a needed boost

- By Dan Davis

- July 7, 2018

- Article

- Laser Cutting

The metal fabricating business is hard enough when growth is steady. When business explodes, the stress can be incredible.

Progressive Metal Manufacturing Co., which has two 55,000-sq.-ft. facilities, one in Ferndale and one in Warren, Mich., found itself in that predicament. It had experienced robust annual growth of 20 percent in the past, according to CEO Eric Borman, but it wasn’t prepared for a business push that resulted in almost 50 percent growth between the end of 2016 and now.

“It was pure reactive mode when business started to grow,” he said.

The company is now able to catch its breath as it works to become more efficient in its processes and tries to get a better handle on preparing for future business opportunities. The installation of a 10-kW fiber laser from Bystronic Inc. played a big part and helped the fabricator get back on track in 2018.

Keep on Trucking

Progressive Metal has developed strong working relationships with companies in the commercial trucking industry since its founding in 1962. It supplies parts to several of the major players that dominate the market.

Back in early 2016, Borman said that the commercial sector had entered a “mini-recession.” Most of the commercial truck manufacturers were waiting to see how the 2016 presidential election was going to shake out. No one apparently wanted to make any long-term commitments unless they knew a business-friendly presidential administration was going to assume occupancy of the White House.

In November 2016 the manufacturing community got its answer.

“Coming out of that, it just boomed,” Borman said.

A quick look at recent market data backs up the observation. According to transportation research firm FTR, orders for commercial trucks reached 37,200 in December 2017, a huge increase from about 21,000 ordered in December 2016. That was the third consecutive month of orders of 30,000 or more, which helped 2017 close out with a 77 percent increase in truck orders when compared to 2016 figures.

In addition to a general boost of economic optimism that came with President Donald Trump and his pro-manufacturing agenda, trucking companies were likely motivated to order new rigs to comply with a federal ruling requiring trucks to move from paper logs to electronic logs. That switch became law in mid-December.

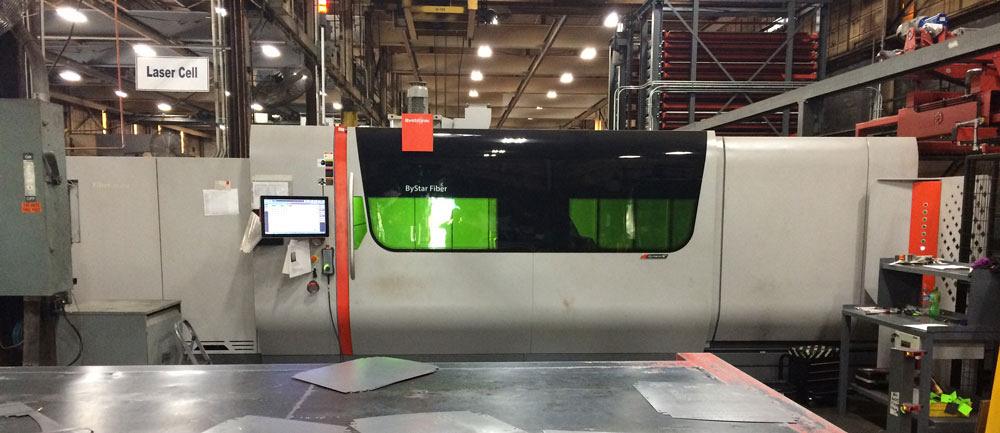

Figure 1

When in operation, the 10-kW fiber laser cutting takes place behind a Class 1 enclosure, which prevents the laser beam from escaping the cutting area. Photo courtesy of Rob Colman, Canadian Fabricating & Welding.

Borman said that by the time the company saw the huge wave of new orders coinciding with a resurgence in the industry, it was ill-prepared. The shop floor was soon overwhelmed. It outsourced all the laser cutting it could. Schedulers faced difficulty in keeping on top of all of the orders while at the same time managing expedited orders and engineering changes. Nathan Hendrix, Progressive Metal’s new president, is working to create processes so this type of situation doesn’t repeat itself.

“When you have this type of manual scheduling, things can become inefficient pretty quickly. Someone is constantly running out to communicate something, and they come back with the information,” Borman said. “It takes an hour to make a decision versus a minute.”

As Progressive Metal attempted to respond to the influx of work, material purchasers responded in the most basic way: They ordered a lot of metal. Hendrix said at one time the company had about 15 days’ worth of material on hand because everyone wanted to make sure they wouldn’t run out.

The latest fabricating technology could have helped, but rarely can a fabricator buy its desired laser cutting machine right from the show floor. In this instance, the order for the new laser had a lead time of nine months.

Progressive Metal started preparing for the arrival of the 10-kW ByStar Fiber laser (see Figure 1) in June. It needed to tear down a 40-shelf storage tower and sell two 3.5-kW CO2 laser cutting machines to make room for a new material handling and storage system and the new high-powered laser. Everything was unsettled until this January.

“It’s like living in a house as you’re remodeling your kitchen and your bedroom. It’s not fun,” Borman said.

Now Progressive has its new 10-kW fiber laser and its 6-kW fiber laser, which it purchased in 2015. Both are connected to a two-tower setup with 38 material shelves. The company’s first fiber laser, a 4-kW purchased in 2012, is now a “make-up” machine, according to Borman, handling any expedited or small runs that bypass the two main laser cutting devices. The 10-kW model in particular has done wonders to increase laser cutting capacity at Progressive Metal.

“I can say that those machines bailed us out. They helped out tremendously. It’s really remarkable,” Borman said. “Laser cutting is no longer a bottleneck for us.”

What the High-powered Laser Means

Although the debut of fiber laser technology back in 2008 had most of the industry thinking that it was simply a better way to cut sheet metal 1/8 in. and less, the high-power laser generators and accompanying tweaks to the machine and cutting head designs have changed that initial outlook greatly.

From the standpoint of greater wattages in the fiber laser, that is accomplished simply by adding active fiber modules, the place where the laser is generated. (The equivalent would be the large gas resonators that create the lasers in CO2 machines.) The modules can be added together to create a laser of a certain wattage, which is then delivered via a passive fiber-optic cable to the cutting head.

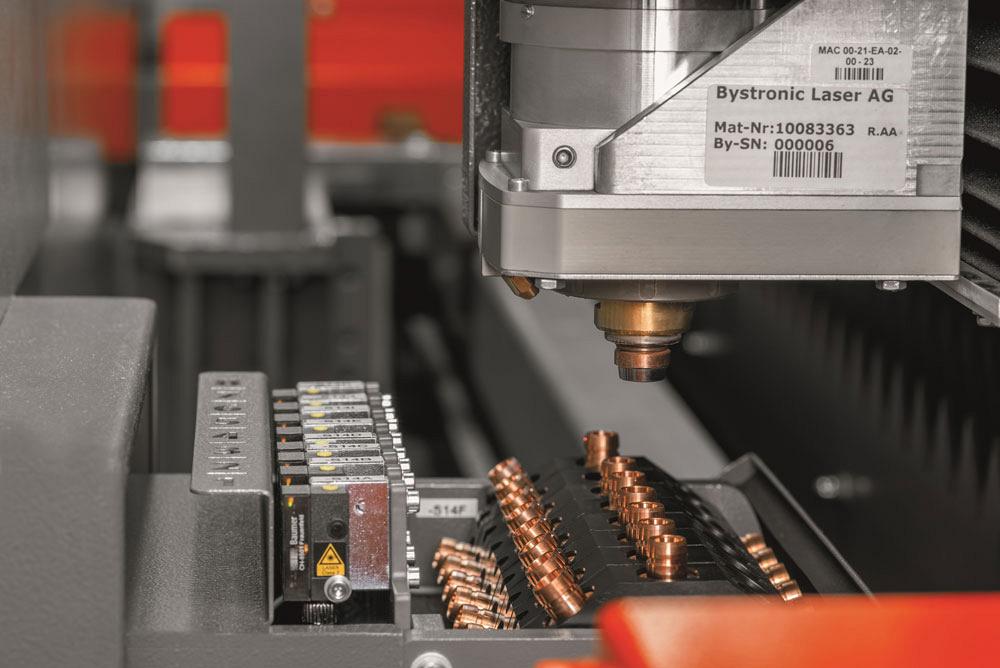

Figure 2

An automatic nozzle changer is one example of how fiber laser cutting machines have evolved to minimize setup downtime. Photo courtesy of Bystronic Inc.

In trying to explain the difference in just how much more cutting power a fiber laser can deliver, Frank Arteaga, Bystronic’s head of product marketing for North America, offered up a comparison of a 6-kW fiber laser and a similarly powered CO2 laser with comparable lens technology. If you were to measure the effective area of the focus point and then calculate the power density of the CO2, it would be 3 mW/cm2. The fiber laser, which has a much smaller focal point, has a power density of 20 mW/cm2 at the focus point.

“The power density is magnified a lot in the fiber laser,” Arteaga said. “It’s much more efficient too. The hourly cost of operation is about 50 percent less than a gas laser.”

Of course, the fiber laser has evolved in other ways as well over the past 10 years. Cutting head beam characteristics now change automatically, adjusting focal length as the machine moves between thin and thicker material. (Borman said that Progressive Metal primarily cuts material 1 in. or thinner on the fiber lasers.) Then you have the elimination of warmup times, beam alignments, and other tasks (see Figure 2) associated with CO2 lasers because of other advancements made in fiber laser cutting machines.

“Obviously, speed is speed, but it’s efficiency everyway. With something like automatic tip changers, that eliminates three minutes here and three minutes there. Over multiple shifts, that adds up,” Borman said. “There’s a lot less downtime.”

Even the mechanicals, such as linear motors, and the bridge design (which is triangular shaped on the ByStar, resulting in 25 percent less weight than a conventional bridge, but with 60 percent more rigidity) have contributed to achieving faster cutting speeds and acceleration during cutting, according to Arteaga.

“With that you’re able to achieve much higher accelerations and decelerations while you’re cutting, which is really what it’s all about now,” Arteaga said.

At 1/8 in., he added, you are looking at a 10-kW fiber being up to five times faster than an older 6-kW CO2 laser.

Borman pointed out that the 10-kW gives them new efficiencies in cutting material up to 0.5 in. It can cut that thicker material quickly and efficiently with nitrogen as the assist gas, which helps to prevent oxidized part edges. Typically fabricators that use oxygen as an assist gas when cutting steel have to clean that edge somehow to remove the oxide, which acts as an impediment to quality powder coat coverage.

Arteaga said that Bystronic engineers designed the latest-generation cutting head nozzle to concentrate the nitrogen directly into the channel. It doesn’t allow the gas to escape as much out of the sides (between the nozzle and the material) as it did with previous nozzle designs, reducing nitrogen consumption. That encapsulated gas flow kind of puts a seal around the cut area and keeps the heat in check as the high-powered laser rips through the metal, he said.

Parts sorting coming off the fiber lasers hasn’t been too much of an issue for Progressive Metal. Both lasers unload to a single stripping area where people “aggressively” separate the parts, he said.

Outside of having to learn how to operate the new complex machine tool once it got up and running, Progessive Metal leadership said its new laser cutting technology hasn’t presented any issues. It has, however, created new internal pressures.

“It’s putting the focus on sales now. We have new capacity, and we have to go sell it. It’s a good market to be in right now,” Borman said.

Getting on the Right Track

Progressive Metal isn’t focused on its laser cutting activities right now. The laser operation is running 24 hours during the week, and that newfound productivity has allowed it to close the gaps on some of its service issues. In mid-April Progressive Metal had 400 hours on the books associated with late products; in early June that had been reduced to 100 hours and it was falling.

The metal fabricator also is in the midst of installing Bystronic’s Plant Manager planning and production monitoring software and reviewing all of its processes. Currently the estimating process is being scrutinized.

The recently appointed Hendrix, who has experience with lean manufacturing initiatives in previous stops, is leading the charge to create an environment of continuous improvement. The first step is identifying and documenting processes, Hendrix said, and then regularly engaging the company’s manufacturing teams in an effort to open the lines of communication between them.

“We want to avoid the situation that we need a new laser and we’re nine months away from getting it,” Hendrix said. “We want to know six months ahead that we’re going to need capital equipment like that. Of course, you can’t always have great foresight, but we want to know as much as we can.”

Hendrix added that Progressive Metal’s shop floor likely won’t look the same as it does now. The plan is to reorganize the plant to improve flow of jobs between processes and follow that up with kaizen events, which could lead to more changes. Even more equipment investments are likely to be made, but not necessarily involving laser cutting, he added.

In the meantime, Borman said things are looking up for Progressive Metal.

“If you look at our customer scorecards, we’re doing very, very well right now in meeting all of their metrics,” he said. “We now can work on improving the business again.”

Progressive Metal Manufacturing Co., www.pmmco.com

Bystronic Inc., www.bystronicusa.com

About the Author

Dan Davis

2135 Point Blvd.

Elgin, IL 60123

815-227-8281

Dan Davis is editor-in-chief of The Fabricator, the industry's most widely circulated metal fabricating magazine, and its sister publications, The Tube & Pipe Journal and The Welder. He has been with the publications since April 2002.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI