Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

A square deal on continuous improvement in custom manufacturing

How Square Deal Machining has streamlined to compete

- By Tim Heston

- March 1, 2017

- Article

- Shop Management

Inventory for SDMI’s laser cutting, punching, and plasma cutting machines is stored at the point of use

A CPA in a previous life, Joe Morgan knows that numbers don’t lie. After purchasing Square Deal Machining Inc. (SDMI), a Marathon, N.Y., machine shop, in 1998—and growing the organization over the years from only seven employees to more than 300—he became intimately aware of a harsh reality in the job shop business: the unlevel playing field of labor costs.

Custom fabricators and machine shops generally don’t use proprietary equipment, and nothing stops competitors from improving their own processes, be it through lean manufacturing or any other technique. Those competitors could be down the street or anywhere in the world. Sure, analyzing total landed costs for a job, a buyer may not choose to send work to Asia, but what about Mexico? True, SDMI is far from the southern border, in upstate New York, but even there its customers may find that the numbers make sense for sourcing a job in Mexico, especially if the local supply base falls short of expectations.

At this writing, the Trump presidency was just beginning. His campaign rhetoric called the future of NAFTA into question, at least in its current form. No one knows what the future holds. Regardless, as Morgan explained, shop owners in Mexico have access to the same technology and, increasingly, top technical talent.

“It comes down to total landed costs,” Morgan said. “If the difference in shipping costs is $3,000 between working with us or a competitor in Mexico, and they can save $10,000 by moving parts to Mexico, we’re in trouble. That’s why we need to figure out how to reduce our labor costs and offer something better to our customer.”

Saving labor costs can’t include paying his people less. He must offer a competitive wage to attract talent. But what can reduce labor costs is giving people the tools they need to produce more—and SDMI made it happen. In recent years sales have grown 10 to 20 percent annually.

SDMI leaders and employees made this happen by focusing on three areas: improvement methods, technology, and, perhaps most important, the company culture.

The Method

Morgan grew up in a manufacturing family. His parents owned a metal finishing company, and after working three years as a CPA, he worked another two years in the family business. Then, two years after that, the opportunity arose to purchase SDMI, in 1998.

At the time SDMI was just a small machine shop, but in 2000 the company had the opportunity to pursue a large order that required both machining and fabrication. “At that point we purchased the assets of Royer Industries, a fabrication shop in Kingston, Pa.,” Morgan said. “We ran out of that plant for about a year before we consolidated everything at our location in New York.”

At the time the company ran like many job shops did. If machines weren’t running, it was thought, they weren’t making money. To reduce the number of machine setups and maximize uptime, operators ran big batches of everything—usually about six weeks’ worth of parts—regardless of whether or not parts were needed immediately. Quite often the shop’s cutting machines were processing sheet blanks for parts that would sit months in inventory, while other jobs that were needed immediately sat in queue, waiting their turn. Predictably (at least in retrospect), lead times grew and on-time delivery suffered.

In the mid-2000s SDMI began talks with a major customer about an improvement method—specifically, quick-response manufacturing, or QRM. Developed by Rajan Suri at the University of Wisconsin-Madison, QRM is a method for continuous improvement tailored for high-product-mix operations (see www.qrmcenter.org). In essence, QRM focuses on overall lead time, what Suri calls manufacturing critical-path time, or MCT. This entails everything from ordering materials, components, and outside services to processing orders in the front office and turning raw materials into finished goods and shipping them out the door. A faster laser may look great, but if the MCT isn’t shorter, will a customer care that a particular machine can cut at so many inches per minute? It’s not about how fast a cutting head or press brake ram moves, but how quickly a job moves from raw stock to the shipping dock.

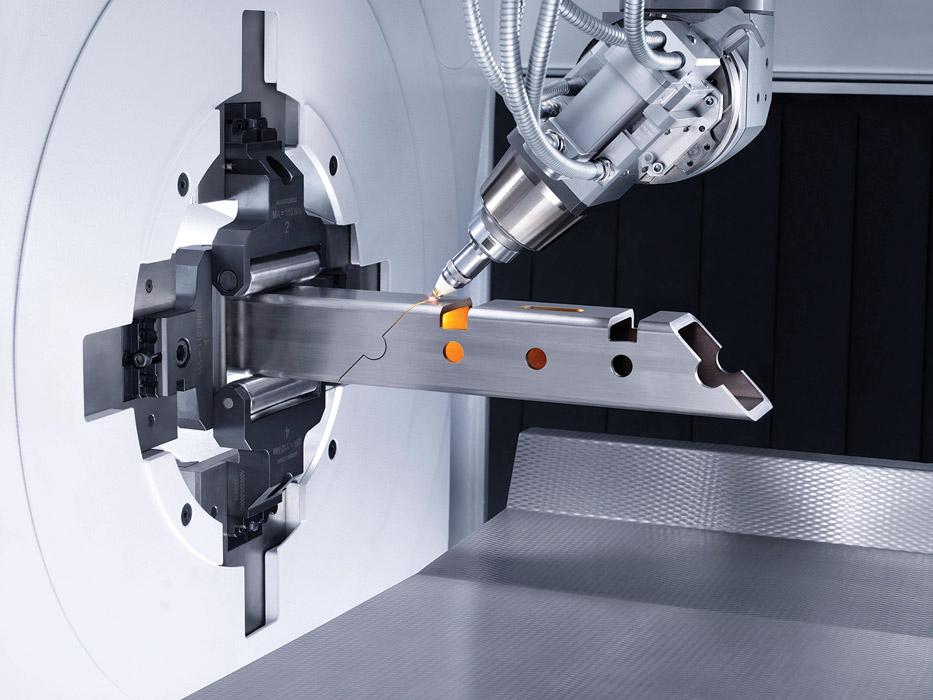

In early 2017 SDMI recently invested in its first tube laser, a machine that can process round tube, square tube up to 10 in. in diameter, and also structural beams and other open profiles. Image courtesy of TRUMPF Inc.

QRM requires everyone to look at every manufacturing step in this broader context, which, Morgan conceded, wasn’t easy at first. When two SDMI engineers returned from a monthlong training class at the QRM Center in Madison, Wis., they returned with knowledge that would require big changes.

If a shop wants to shorten lead time, it can’t run big batches of material. It instead needs to focus on small batches, quick changeover, and carefully managed capacity. No operation downstream should accept parts until it has the capacity to process them. It’s a classic pull-type manufacturing system; but because QRM is for high-product-mix situations, flow isn’t necessarily based on replenishing a specific product or product family, like a typical kanban in lean manufacturing. Instead, available capacity in downstream operations (assembly, welding) triggers order releases upstream in laser cutting and bending.

To make QRM work at SDMI, managers focused on a cornerstone of improvement for many job shops: shorter setup times. Robotic welding cells involve multiple tables, so products can be staged to ensure minimal downtime between jobs. Manual welding cells use hard fixturing when a job has sufficient volume; and if welders are producing a one-off or very low-volume order, they have a grid table and flexible fixturing components close at hand.

In bending, SDMI’s high-tonnage machines have adjustable V dies. So instead of changing out a heavy lower die, or even flipping a large four-way die, operators simply turn a screw to achieve the exact die opening they need. Press brake tooling is staged near or at the machine, when possible. Supervisors also analyze the product mix and, when practical, identify common brake tools, those that apply to a variety of jobs, to stay in certain machines.

One of the first areas managers scrutinized was one of the most critical: the cutting operation. Employees discovered a bottleneck in plasma and laser cutting—not a good place for a constraint, considering the machines feed parts to the rest of the shop. At first supervisors came up with the traditional solution: The shop just needed more laser machines.

“Then we did a time study to discover what was causing the issues,” Morgan recalled, “and we discovered it wasn’t the machines themselves; it was the crane getting the material to the machines. The lasers weren’t the bottleneck; it was the process of feeding raw material.”

At the time the shop kept both the band saws and the plasma, punches, and laser cutting machines in the same area, and too many relied on one crane to feed material. The solution was to move the band saws and invest in another crane system to load material into them.

“This greatly reduced the demand on the crane [by the laser machines], which increased our throughput greatly,” Morgan said.

Technology

Considering the time study and the material handling bottleneck, why is SDMI still relying on a crane to feed its cutting machines? Why not invest in a tower system and automated sheet handling? The cutting department has six lasers, after all. Why not have a tower system feed one or several of them at once?

As Morgan explained, it has to do with SDMI’s product mix. Although the company can cut thin sheet, about 90 percent of its work involves material between 3⁄16 and 1 in. thick. One laser, mainly dedicated to thinner stock, does have a dedicated, automated feeding system, but the remaining five do not, outside of a conventional shuttle table. At present operators can load stock onto the shuttle table before the previous job is finished—again, because of the longer cutting cycle time for cutting plate. And of course the operator still needs to take parts out of the nest. When doing so, he can spot-check cut blanks for quality.

SDMI’s robotic welding cells are set up for a high-product-mix operation, with quick-change fixture plates, trunnions, and other systems to ensure robots never stop welding.

“This really applies just because of our product mix,” Morgan said, adding that if the shop processed a lot of thin sheet, sheet handling automation would really make sense, simply because operators couldn’t load material fast enough to keep up with the machine.

This exemplifies how MCT now factors into SDMI’s equipment purchasing decisions. Managers constantly monitor capacity levels, as measured by how quickly jobs appear at the next downstream operation, be it bending, welding, or assembly. Raw stock is staged at the point of use, directly adjacent to each blanking machine, some of which have flat-part deburring machines a few steps away. If technology doesn’t help those blanks reach the subsequent operation faster, then it isn’t worth the investment.

That said, one big takeaway SDMI’s engineers had from their QRM training was capacity management. Before QRM the company followed typical industry practices: That is, when the shop had trouble making its deliveries, it bought equipment to meet customer demand.

“Now we look at it another way,” Morgan said. “We’re looking six months or a year down the road, and we ask, ‘Where could our capacity constraints be, and how do we solve them?’” This, he said, requires constant monitoring of capacity levels and continual communication with customers.

SDMI recently invested in its first tube laser, a machine that can process round tube, square tube up to 10 in. in diameter, and also structural beams and other open profiles. And for this system Morgan and his team followed conventional practices by identifying an underserved niche. They also analyzed existing cut-and-form jobs that can be completed in one step on the tube laser.

But when it comes to increasing capacity for existing processes, like flat sheet and plate cutting, SDMI scrutinizes its capacity levels. Improvement to uncover hidden capacity never stops. That said, SDMI strives to never go over 80 percent of a department’s theoretical capacity. Approaching 100 percent capacity is dangerous for a highly variable job shop. Just like a crowded highway can quickly become congested if someone taps on the brakes, a job shop working near its capacity limits can become clogged if even one job takes a little longer than expected.

If the cutting department crosses the 70 percent capacity threshold, planners go into action and start hunting for equipment. They communicate with customers, observe broader market conditions, and make the decision to purchase equipment to keep capacity levels ahead of expected demand.

“If we wait until we need it, it’s too late,” Morgan said, “and we have missed opportunity.”

The Culture

If you read up on QRM, including Suri’s book It’s About Time, you’ll notice a focus on multiprocess workcells. Companies identify what QRM calls focus target market segments. These can be actual end markets, or they can be groupings of product families (often from different customers in entirely different markets) that share similar processing steps. So a custom fabricator may group its operation by, say, material gauge, with a laser or punch surrounded by several press brakes, hardware insertion, and perhaps even a spot welder or two.

Early on in its QRM implementation, SDMI attempted this. Managers identified a product family that required both fabricating and machining, then placed a laser next to press brakes as well as milling and turning machines.

What managers discovered is that the workcell functioned only as well as the team did. The problem had to do in part with the different kinds of people working together. An operator that forms a heavy plate on a large press brake has a different way of working than a machinist making small precision parts.

“We abandoned the idea after two years and went to a more streamlined process,” Morgan said.

On the machining side, the company has grouped jobs together by tolerance and designed cells around them. Now SDMI has several cells dedicated to precision milling and turning, another cell dedicated to less precise machining of heavy weldments. Each cell has cross-trained people who, because they’re all focused on similar jobs, all tend to work together well.

Outside of that, the company’s 300,000-square-foot facility remains in a traditional departmental setup. But again, work flows not in large batches, but in a kind of pull system based on downstream capacity and customer demand.

Because SDMI serves many different industries, the nature of customer demand can vary significantly. For some jobs SDMI makes daily customer deliveries of small batches, an arrangement that suits QRM well. Other customers require larger batches delivered less frequently, or request a kanban replenishment program. And like many shops, SDMI has agreements to hold a certain amount of finished-goods inventory. Some of this is driven by the nature of the customer’s manufacturing operation; sometimes these delivery arrangements follow conventional practices for a particular industry sector.

Regardless, according to Morgan, whatever the nature of the demand, SDMI sets up its schedule to satisfy it. At the same time, the shop has reduced its batch sizes, cut its work-in-process and finished-goods inventory by half, shortened setup times, and shortened its typical lead time from six to eight weeks down to three.

To make this happen, the company had to give its workers the tools they needed to keep ahead of customer demand. They communicate with customers about forecasts, invest in technology at the right time (ahead of customer demand), ensure the shop never reaches peak capacity levels, and consider how people work with one another (in other words, the shop culture).

As Morgan explained, leave one element out, and it just wouldn’t have worked. And, of course, it all didn’t happen overnight.

“It was a gradual change,” he said, “and the initial culture shock did require us to do some convincing. But once people bought into the concept, it was just part of life. It’s something we don’t even think about anymore. It’s just how we work.”

It’s Morgan’s hope that this way of working will allow the shop to compete with any competitor in the U.S., Canada, or Mexico—despite vast differences in labor costs.

Except where noted, photos courtesy of Square Deal Machining Inc., 607-849-3502, www.squaredealinc.com.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI