Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabrication in Japan: Technology and data for a comfortable day

Strategies for a country with a shrinking population

- By Tim Heston

- November 8, 2018

- Article

- Shop Management

Figure 1

A little more than half of Makino Co.’s bending jobs flow through the company’s automatic-tool-change press brake. The yellow and blue returnable bins contain job travelers and work-in-process. Many jobs have a lot size of one.

The Japanese characters for sokujitsu bankin can be seen everywhere at Makino Co. Ltd., a 45-employee custom fabricator within the sprawling Tokyo metropolis. The phrase translates as “24-hour manufacturing.” When a customer submits an order, the sheet metal fabricator turns it around in a day.

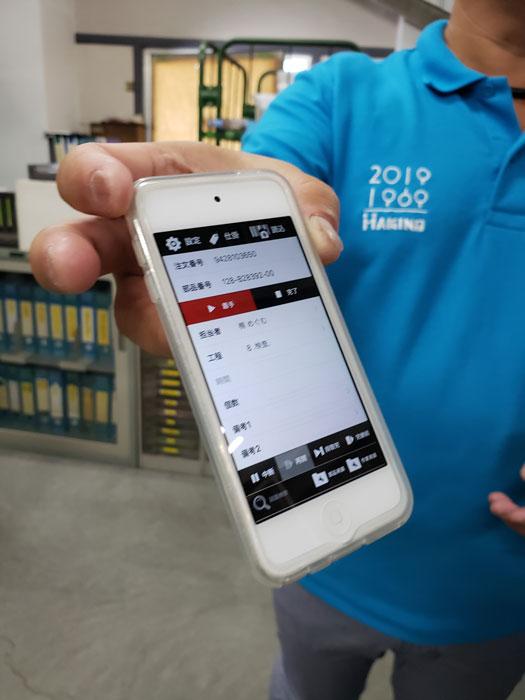

The shop is full of machines without an inch to spare, and surrounding many are colorful returnable bins, each with a bar code that’s read by an iPod given to every worker. The shop’s custom iPod touch app (designed to ensure secure transactions of customer information) allows employees to check for work instructions, message each other, and make sure everyone is on the same page. The goal: To ensure flow and high velocity without everyone bending over backward to get everything done.

Those at another Makino—Makino Milling Machine Co. Ltd., the milling machine builder most in U.S. manufacturing know—have the same goal, and to achieve it, they make full use of automation, software, and, not least, visual management. Tatsuaki Aiba, deputy production manager, gave me an odd look as I bent down to take a photo of the bright white tape on the floor. The tape outlined staging areas labeled clearly in English and Japanese on the gleaming factory floor in the heart of the company’s spindle manufacturing department.

“Why did you take that photo?” he asked in broken English (though much less broken than my nonexistent Japanese).

“Kanban,” I replied.

Aiba nodded, then smiled. The implication was clear. The tightly controlled work-in-process and clear visual cues can be easily taken for granted if it’s all you’ve ever known. Marry the visual cues with data from machines, and connect those machines to get a comprehensive, data-driven view of what’s really happening on the shop floor at every moment, and you have a recipe for “a comfortable working environment.”

So said Nobuyuki Kikuchi, corporate adviser, executive GM of the engineering division at Amada Co. Ltd. He and other executives hosted industry reporters during the company’s 2018 U.S. press tour in late September, held in and around Amada’s headquarters campus in Isehara, Kanagawa prefecture, a few hours southwest of downtown Tokyo.

Kikuchi wasn’t the only Amada executive to use the phrase “comfortable working environment.” It came up often when discussing automation and, especially, the internet of things and Amada’s approach to it. Now implemented at a few fabricators around Japan, Amada’s My V-Factory connects machines to an Amada-managed cloud database, collecting data for better predictive maintenance. Support personnel are at the ready to respond to problems.

A sense of pride in manufacturing abounds in Japan, and many are drawn to the country’s manufacturing powerhouses. Still, the country has a chronic labor shortage. The national unemployment rate is just 2.5 percent, its population is aging, and its working-age population is shrinking.

This means that workers must be more productive but without breaking their backs, mentally or physically. Combine the right equipment with the right automation, with sensors gathering the right data, and a fabricator can detect a breakdown before it happens and keep machines running. Not only does all this keep Japanese fabricators competitive, but it allows their workers to enjoy that all-important “comfortable working environment.”

Different Companies, Common Goal

On the surface the two Amada customers on the U.S press tour couldn’t be more different. Makino Milling Machine Co., the milling machine maker, has clean rooms and automatic doorways to ensure positive airflow from the inside out (never from the outside into the factory).

Its sheet metal department—which includes a fiber laser, a punch/laser combination machine, press brakes, deburring, and robotic fiber laser welding—produces various enclosures for most machine models. The mix of work isn’t homogenous, but it’s more consistent than the high-product-mix world of the job shop.

The other company, Makino Co. Ltd.—a Japanese job shop—is about as high-product-mix as you can get. It’s filled with cutting and bending automation, including an automatic storage and retrieval system, a punch/laser combo machine with sheet loading and part offload and stacking automation, bending with automatic tool changes (see Figure 1), and a diverse welding department that includes YAG laser welding alongside conventional arc welding processes. All this equipment is geared toward producing extremely small lot sizes, most of which fit into small returnable bins that can be seen throughout the shop.

Some of those bins have a dozen parts, perhaps two dozen, but a good many of them have just one piece. About half of the product flow is repeat work, the other half is new orders. And nearly all of it is turned around in less than 24 hours.

Still, both shops work toward optimal flow so everyone has, as Amada’s Kikucki put it, that “comfortable working environment.”

Work on the Move

Take the stairs up to the second floor of Makino Co. Ltd. (the job shop, not the milling machine maker), and you reach a hallway with a string of LED lights along the length of it. They’re usually moving, in holiday lights fashion, with a red section running from one end of the hallway to the other. It’s a sign that jobs are on the move (see Figure 2).

Enter the office and you see people on the move, too, including a team of estimators, each of whom produces several hundred quotes a day (see Figure 3). Each quote takes only a few minutes and is usually for a part or small subassembly. The shop’s quoting system is built on a library of standard processing times it’s built over the years.

Kenichiro Makino, president, showed the tour group a stack of typical orders; the prints all had parts that required complex cutting and (especially) forming, but all of them had a quantity of one. Just as Google has built a business model on making billions “one nickel at a time” whenever anyone clicks on a sponsored link, this job shop in Japan has built an $11 million (USD) enterprise by processing orders of one, five, perhaps a dozen—all extraordinarily quickly.

Even so, Makino said that the sales and quoting process remains a constraint. The company’s goal is to bring in at least two new customers a month to diversify its customer base. Makino’s father launched the business in 1969 and grew it in the 1970s working with just one major customer, NEC (the founder’s former employer). Today the company has more than 100 active customers.

Within the next three years Makino hopes to implement artificial intelligence into its quoting process. Specifically, it’s working with a local university on a phone app that would allow an estimator to take an image of a print. Working off of parameters set by the fabricator, the app could produce an estimate nearly instantaneously.

Among Japanese fabricators, 3-D CAD is common and drawings are converted to digital files once they reach the fabricator. But by and large, customers submit paper prints. “It’s in the Japanese culture,” said Makino. “A digital file may be missing something, so a paper drawing allows us all to double-check.”

Diversifying revenue even further, Makino sells its own line of patented press brake tools. This includes a tool that allows the forming of deep, 90-degree flanges taller than the press brake’s shut height. It does this with a narrow channel machined into a bearing that rotates during the forming cycle. The fabricator also designed what it calls the “Z forming” tool, which uses replaceable inserts to form a variety of offsets (see Figure 4).

The company runs one attended shift, mostly dedicated to rush jobs, some of which are turned around within hours. Overnight, blanking machines run unattended—not with high-volume work, but with nests full of disparate parts.

The first thing you see in the shop is a massive automated storage and retrieval system. The entire back wall is filled with active inventory that can be retrieved automatically at a moment’s notice.

“They have 216 different material grades on all those shelves,” said Gentaro Akaike, manager of the Americas Group, overseas business promotion, at Amada Holdings Co. “They do so many prototype jobs and other low-volume work, and they don’t know what’s going to come in the door.” With all that raw stock inventory, Makino is ready for anything. It could be cutting stainless, aluminum, carbon steel, even foil that’s a fraction of a millimeter thin.

Look at a sheet skeleton at Makino and you’ll notice material utilization isn’t high. This is because the company nests only what’s needed for shipping that day. The operation can’t pull in parts from several days out into the schedule just to fill a nest and achieve a little better material utilization. After all, with so many jobs having a one-day turnaround, Makino simply can’t schedule jobs several days out, because it doesn’t yet know what those jobs will be.

In the assembly area, several workers quickly glanced at what looked to be their phones, but they weren’t. They were iPod touches (an iPhone without the phone) that had a proprietary app designed for Makino. Workers check the schedule, see job notes from other employees, and pull up work instructions (see Figure 5).

If workers need to know what to work on next or have a quick question for their co-worker or manager, they turn to their iPods. This helps eliminate one of the most ubiquitous wastes in low-volume, high-product-mix fabrication: misinformation.

Speed and Precision at Makino Machine

At Makino Milling Machine, the milling machine maker, a large robot lifts and manipulates massive castings that are machined, cleaned, and transported to storage, all without a single fork truck driver or overhead crane operator. Material arrives in the milling department via automated guided vehicles, which follow magnetic tape on the floor.

A robotized milling cell processes more than 80 different motor mount bracket components. Parts are loaded, and thanks to vision technology, the robot can “see” the shape of the bracket, identify the part, pull up the program, and transport the piece to the appropriate work center. At a nearby machining center, every tool and toolholder has a QR code on it that, when scanned, reveals the tool’s entire history—when it was used, what components it was used on, and how.

Figure 4

On the left, a custom tool, built and patented by Makino Co. Ltd., has a narrow channel machined in a rotating insert. The arrangement allows for the forming of deep, 90-degree flanges taller than the press brake’s shut height. On the right, a “Z forming” tool uses replaceable inserts to form a variety of offsets.

The same happens in Makino Milling Machine’s soon-to-be-expanded sheet metal department, where an Amada punch/laser combination system automatically places punch tools (again, each with a QR code) from a 500-tool magazine into a “buffer turret” that feeds the tools into the production turret. Employees never manually load a tool into the magazine. Instead, they place it on a loader system that scans the QR code, after which a mechanized system places the tool in the magazine. Once the loader takes the tool, no operator needs to touch it again until the next sharpening. After cutting, the machine automatically removes pieces from the nest and stacks the blanks so that they’re sorted and ready for downstream operations (see Figure 6).

In 2013 Makino started bringing in-house a portion of its sheet metal enclosure work—in particular, the challenging, hard-to-ship, cosmetically critical workpieces (see Figure 7). Edges for the carbon steel sheets are pristine, and forming geometries are exact enough to be welded in a recently installed robotic fiber laser welding cell. If the product has sufficient volume, a fixture is built, and the robot is programmed.

Why laser weld? Speed is one reason, but not the only reason. The main reason could be seen after the fiber laser welding cell—or, more specifically, what couldn’t be seen. The sheet metal operation had a few employees grinding welds joined by standard arc welding, but most if not all the fiber laser welded joints required no postweld processing. The pieces flowed directly to coating and final assembly shortly thereafter.

Tatsuaki Aiba, our Makino Milling Machine tour guide, then pointed to some of the workers in final assembly. Some were students, many others were women, including mothers returning to work (a trend the Japanese government encourages to combat the chronic worker shortage). He then pointed to the air conditioning vents that directed airflow upward and then downward over the assembly cells. That, too, was installed to instill a comfortable workday.

The Importance of the U.S. Market

Despite trade tensions, machine tool makers are bullish on the U.S. metal fabrication market, and Amada is no exception. Coincidentally, during the press tour in late September, the U.S. and Japan announced the start of negotiations for a new free trade deal.

In a press conference during the tour, Amada Holdings Co. Chairman and CEO Mitsuo Okamoto described the company’s plans to boost North American sales 35 percent by 2021—to more than $684 million (78 billion yen). Within the past year Amada purchased Advanced Technology Sales and Service (ATS), a major distributor and service provider based in Greensboro, N.C., and broke ground on a new technical center and factory in High Point, N.C., slated to open in 2020.

“We are focused on timely delivery,” said Tsutomu Isobe, president of Amada Holdings Co. “We have a factory in Brea, but the U.S. is a big place. That is why we are opening a factory in High Point.”

Amada also purchased Marvel Mfg. Co., the band saw maker based in Oshkosh, Wis. Okamoto said that with this purchase, Amada will increase its North American band saw market share from 12 to 26 percent, selling machines under both the Amada and Marvel brand names. Amada now can sell Marvel’s machines through its overseas network; Marvel will sell Amada blades in North America; and Amada will be able to manufacture peripheral equipment at Marvel’s plant.

Thanks to the acquisition, Amada is expecting its North American band saw business to jump 139 percent by 2021. Over the same period it expects its sheet metal cutting and bending equipment sales to grow by 19 percent.

Japan: A Different Kind of Growth Market

All this activity has made North America one of Amada’s primary growth markets, but Japan isn’t far behind. Like in the U.S., small companies dominate Japan’s metal fabrication industry. Most shops have fewer than 50 employees. Amada executives said they expect sales to grow by 32 percent by 2021, at which point domestic sales for Amada Japan could exceed $1.5 billion (172 billion yen). That’s a significant number, considering the company’s already dominant market share in the country. Driving these sales, Okamoto said, are two factors.

Figure 5

Employees refer to a custom app to know what to work on next, read job notes from other employees, and pull up work instructions.

One is aging equipment. A lot of machines in Japan are ripe for a replacement. Second, because of Japan’s shrinking working-age population, companies are looking to automate more than ever before. “Our customers have increasing need for automation, and we are working to serve those needs,” Okamoto said.

This could be seen in Amada’s Isehara campus exhibition halls, including the company’s new 9-kW fiber laser with its beam shape-altering characteristics, able to shorten pierce times and adapt to both thin sheet and thick plate cutting.

This also includes automated sorting technology, growing more common with punch/laser combination systems. Yes, the machines seem to move slower than a team of operators could, manually shaking and breaking parts out of sheets. But the automated system never stops, and with the right program, it never makes a sorting and stacking mistake. Every sheet is presented downstream (to the press brake or elsewhere) the same way, in the same grain direction, and the same orientation.

In this environment, Amada Japan plans to expand its production capacity significantly within the next year. The sprawling Fujinomiya campus at the base of Mount Fuji is a busy place. For blanking, it has the capacity to produce up to 140 machines a month, and in September the plant was averaging a little more than 100 a month, or almost 1,300 machines a year (see Figure 8). To meet increasing demand, the company plans to expand its existing manufacturing space next year. That expansion is expected to increase production capacity by a third.

Still, as the company expands, it has plans to help make each worker more productive by, among other things, refining its data collection. Amada’s factory data is managed by a custom system it calls V-Post. Workers clock in and out of jobs so estimated times can be compared to actual production times.

But V-Post is a decade old, and it’s ready for an update. By sometime next year, managers hope to not only track job start and stop times, but also correlate those times with a worker’s skill level. Every worker in assembly is cross-trained on a variety of skills, but at present those skills aren’t correlated with actual assembly results. The new system aims to change this by correlating processing time and quality data with a worker’s training skill matrix, which maps specific levels of expertise for specific assembly skill sets, from wiring and hardware insertion to alignment and inspection. The goal is to better allocate resources and match each worker with his or her strengths.

About Flow

In 2016 Amada had its 70th anniversary, and to celebrate it the company built a museum dedicated to the company’s history. Located in the middle of the Isehara campus and opened earlier this year, the museum is not just a small hall with old machines and static plaques. Walk into the entrance hall and you’ll see a minimalist space, seemingly empty save for a few machines on display—until the lights go out and the projection cameras start the show.

A centerpiece of the exhibition is the LYLA-555 NC turret punch press released in 1971 with its bridge frame and triple-track turret design. Stand in the right spot and you trigger the projection camera that illuminates and outlines the entire system (see Figure 9).

The lights exude a subtle message. It’s not just about the machine specs and features; it’s about the machine’s history and, especially today, the story (data) a machine tells over its history.

That information is now being drawn out of machines and into the cloud. It’s then analyzed so shops can be more productive and profitable, and employees can go home happy after a comfortable workday. In Japan and, for that matter, everywhere else, nothing could be more important.

Figure 6

In Makino Milling Machine’s sheet metal department, blanks are sorted and stacked automatically.

Amada America, www.amada.com

Makino Milling Machine Co. Ltd., www.makino.co.jp

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI