CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Poor inventory management: The hidden profitability killer in manufacturing

How poor inventory management affects sales, customer service, and productivity

- By Bridget L. Lazlo

- October 10, 2016

- Article

- Shop Management

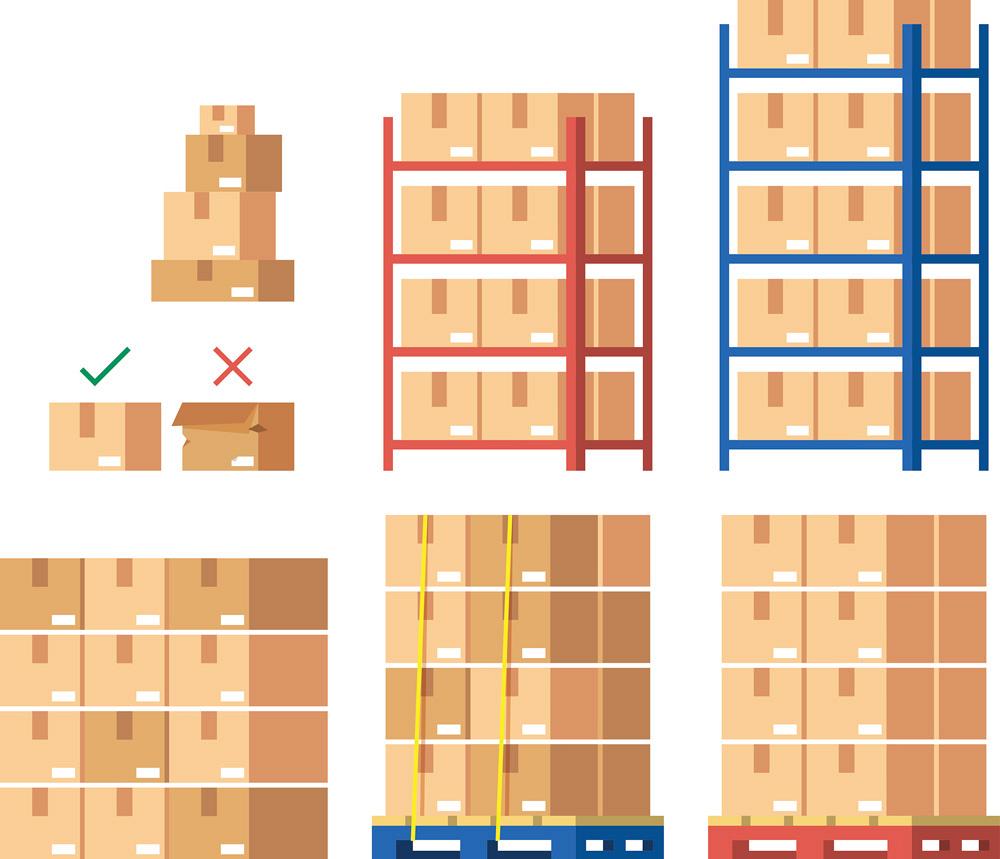

Inventory is typically one of the largest expenses a manufacturing company has, and an inaccurate inventory will have the biggest impact on a company’s profitability. For every dollar that the inventory is off, so is the profit.

How is this? If your inventory count is off by $50,000—that is, your books show it valued at $50,000 more than it really is—the accountants write it off to the profit and loss statement. This lowers profit by that $50,000. There goes your bonus.

Defining Inventory Accuracy

There are two types of “accuracy” when it comes to inventory counts: four-wall and part-level accuracy. Part-level accuracy deals with stock on hand, or the number of pieces you have in inventory. To calculate four-wall accuracy, you compare the total value of the inventory to the book value in the general ledger. This calculation can give managers a false sense of how well the company is managing the inventory.

For instance, you might have parts with similar costs that, when netted together, have a small effect on the books. To illustrate, let’s say our inventory rec-ords show we have one piece of Part A with a book value of $250. The records also indicate that we have one piece of Part B with a book value of $230.

When we do an inventory cycle count, we notice that we’re missing Part A, so we have a variance on the book value of -$250. We then notice that we have an extra Part B, giving us a book value variance of +$230 ($230CR). Combine those two variances and we get a total variance of $20—only a small percentage of the overall value. That may make the accountants happy, but in reality the inaccuracy of the on-hand stock makes our part accuracy 100 percent off on these two parts.

Productivity Effects

Inaccurate inventory kills not only profits, but also productivity. Imagine you now need Part A for production. You go to look for it. It isn’t there. You involve your supervisor and the warehouse supervisor, and you still can’t find it. You go to purchasing. They look and see they bought it, but you still can’t find it. You have just wasted three or four peoples’ time, and you still haven’t started production.

How much is that worth? This cost may not go right to the bottom line with the same force that the inventory write-off did, but it is just as impactful. The costs that account for these people looking for the parts, along with the lost production, are very real.

Indirect Costs

What about when a customer calls for a product you are showing in inventory? You promise them it will ship soon. The warehouse goes to pick the part from inventory and it isn’t there. What do you do? You call the customer back and they cancel their order. You just lost the sale and the profit associated with it.

If you are a job shop, a similar scenario applies. In this case, the customer may call and you trigger an order, thinking you have the raw stock in inventory. It turns out that you don’t have the material to make the part. The lead time to get it causes the customer to either cancel the order (if they can get the part elsewhere) or at least start looking for another supplier, especially if this starts to happen regularly.

Inventory is expensive to carry, and its cost isn’t just the price you paid. You pay purchasing personnel to buy material and parts, and inaccurate inventory makes these people less efficient, which increases costs.

Then you need to consider the indirect labor required to receive and move the material around as well as the warehouse space to store it, which comes along with property taxes, electricity, and heating and cooling. Fork trucks, including their operation and maintenance, cost money as well. And the longer your inventory sits, the greater chance it has to be damaged or stolen.

Other indirect costs are:

- Insurance to cover the cost of the inventory in the event of an accident.

- The cost of obsolescence and revision changes.

- Accounting personnel paying the bills.

- Systems to track the inventory, including computers and other hardware.

- Opportunity cost: Money tied up in inventory can’t be used for something else.

Cash Flow

The accuracy of your records plays a big part in smart inventory management. If the records show you don’t have something you do have, you end up ordering it again even though you don’t need it, and if it’s a rarely used item, it could sit for a long time. This affects the number of turns you will get on your inventory, and those inventory turns equate to cash that is invested and unavailable for other purposes.

Turns are calculated by dividing the cost of sales by the average inventory value. The higher the average inventory value, the lower the turns. For example, if you have cost of sales of $2 million and an average inventory of $500,000, your turns are 4. However, if you manage your inventory with a high level of accuracy, you reduce your average inventory to $400,000, and your turns are now 5. This frees up $100,000.

One effective way to improve inventory accuracy is to institute a cycle counting program. When done correctly, it will not only correct inventory errors, but also help uncover root causes for errors. After all, unless you solve those root causes, the problems described previously really don’t get any better.

Counting

To implement an effective inventory count, start with education. Every employee needs to understand the importance of inventory, the ways that inaccurate inventory kills profitability, and his or her role in making it more accurate.

Next, train a specialist who performs the counts and investigates the errors. The specialist should not just be any person who happens to have the time to count inventory. Instead, the person needs to be familiar with the materials and the processes around them. Inventory management should take up the main part of this person’s day.

You also need to develop a consistent, well-defined and -documented process, and everyone involved in inventory needs to know it. The process should include the following:

1. Set a time for the count when the least amount of activity is occuring.

2. Determine how many parts you should and can count in the time allocated. There are several ways to determine this. One is to use ABC codes and count the most valuable A items 12 times a year, the B items 4 times a year, and the least valuable C items once a year. You calculate an item’s value by multiplying its cost by the number used (the demand) over a year.

Another way is to use a control group. This is a group of items that you count over and over again. The group should represent all the different processes and types of items you carry (buy, make, or subcontract, for example). Once you attain 100 percent accuracy on your control group, you can change out some items and add others, then repeat the process.

3. Have a clean cutoff. All transactions surrounding the inventory must be processed before the count begins. Transactions entered after you’ve already begun to count inventory will cause discrepancies.

4. Make sure the inventory area isn’t touched during the count. Everyone should know when and where an inventory count is occurring. No one should remove or add inventory in this area during the count. If that isn’t possible, then have people use a tag identifying what inventory items have been removed and added (the “ins/outs”), so the count can be reconciled with this information.

5. Everyone should know the inventory’s unit of measure. Is the material counted in pounds, sheets, sets, or pieces?

6. Take the time you need to reconcile the counts. Never just change the system to match what was counted. If there is a discrepancy, first do a recount. Then scrutinize the recorded inventory transactions to see if something was missing or recorded incorrectly.

Reconciling

Reconciling is the most important step. Again, don’t simply change the inventory count in the system; uncover the root causes behind the discrepancy. There are many reasons for such errors. For instance, there could be a bill-of-material (BOM) error, in the case of backflushing—that is, waiting until production is complete before costing the items taken out of inventory. Those items may not match the items listed in the BOM. This process will take time, but it is absolutely necessary for good inventory control.Once you’ve found the root causes of the error, you can move forward with the reconciliation:

1. Make the adjustment in the system.

2. Record the reason for the error and the number of times it occurred.

3. Keep track of the errors. This includes the total number of parts counted, those with errors, and the cost of those errors. This helps you know what your accuracy level is and if it is improving.

4. Create a plan to solve the problems that cause the inventory errors, and work directly with the departments involved in that process. This could require training, new software, and process changes.

5. Monitor the plan to ensure problems do not happen again.

Your goal should be 100 percent accurate inventory records. This goal will improve your turns, which frees up cash. It will improve customer service, because you will know what you have available when a customer calls. It will increase production floor productivity because the material will be available when needed to make parts.Finally, it will increase company profitability. You won’t be writing off inventory that is not there. You’ll avoid having excess or obsolete inventory, and because you’ll be carrying inventory for less time, you will reduce the potential for damage and theft.

Cycle counting is a great way to start developing excellent inventory control, but only if it involves not just counting, but also root cause analysis and correction. This will help correct data and processing errors, and give your shop insight into ways to continually improve. Now, get started!

About the Author

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI