President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2018 steel year in review

How does what happened last year affect the fabricating business in 2019?

- By John Packard and Tim Triplett

- January 16, 2019

Most steel companies would call 2018 a good year. Some even a great year. But few look forward to 2019 with the same confidence they felt a year ago at this time.

One big reason is the price of steel. As the new year opened up on 2018, the average price for hot-rolled coil (HRC) was already a healthy $685/ton. With a boost from the Trump administration’s Section 232 tariffs that reduced competition from imports, the price jumped by 33 percent over the subsequent six months to a lofty $915/ton. Despite that price increase, distributors, fabricators, and OEMs continued to buy steel to meet the persistently strong demand for manufactured goods in the U.S. Mills and service centers reported record earnings in 2018.

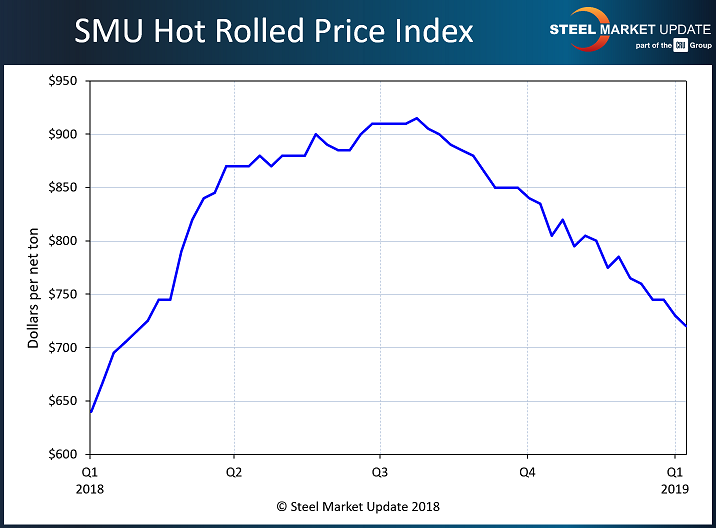

The new year might be a different story, however. Flat-rolled steel prices declined steadily in second-half 2018 and are now 10 to 20 percent lower than their peaks last summer. As of Jan. 7, Steel Market Update (SMU) data showed hot-rolled selling at around $720/ton, down from its 2018 high of $915 (see Figure 1). Cold-rolled was at $825, down from its 2018 high of $1,015. Galvanized slid to $820 from its high of $1,020. The price to start 2019 is still higher than it was at the beginning of 2018, but the downward trajectory has brought a negative perception to the market psychology—only exacerbated by the partisanship in Washington, the government shutdown, and Wall Street volatility.

Steel producers and distributors are hoping the market will find a bottom soon. Two out of three steel executives polled by SMU during the week of Jan. 7 believed the mills would announce an increase in flat-rolled prices by the end of January. But many of those service center and manufacturing executives were skeptical the mills would be able to collect. Whether such a price hike will “stick” depends on a number of market factors.

Ferrous scrap prices are one such factor. The cost of scrap that the mills remelt figures into how much they charge for their products. Lower scrap costs generally translate into lower steel prices. The benchmark price for shredded scrap is now around $330/ton, down from its April 2018 high of $380. Much of the decline in scrap is attributable to the weak export market as demand overseas has waned. Scrap that otherwise would have been loaded on a ship bound for China or Turkey is now finding its way onto a train for the trip from the East Coast to the Ohio Valley and Midwest. Combined with the mild winter weather in some parts of the country that has allowed material to flow unimpeded into dealers’ scrapyards, scrap supplies in the U.S. are outpacing demand, even with the domestic mills operating at over 80 percent of their capacity.

Obviously, the price of finished steel is ultimately a function of demand from steel users in the industrial sector. The surprisingly robust U.S. economy has sustained steel demand through various disasters, natural and political, for the past several years, leaving the market to wonder: How much longer can the good times last?

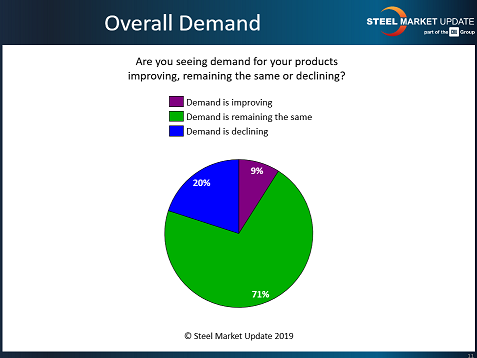

In fact, signs of a shift in market sentiment are starting to appear. About 71 percent of the respondents to SMU’s latest market trends questionnaire see little change in the demand picture as the new year begins. But among those who see a change in demand, twice as many view the trend as negative. For 20 percent, declining demand is a concern heading into 2019, compared with just 9 percent who feel steel demand is improving (see Figure 2).

“Demand is still soft starting the new year. No one is rushing to buy in a downward price market,” commented one executive.

“I would classify it as fence-sitting rather than demand-declining,” observed another.

Through all the volatility of 2018, the saving grace was steel demand that seemed almost too good to be true. Some of that was the result of the Trump tariffs, which cut imports by about 10 percent last year. With steel shipments up by 4 to 5 percent at the same time, domestic mills saw their market share increase. But most of their success can be attributed to the surprisingly resilient American economy.

Figure 1. The Steel Market Update’s Hot-Rolled Price Index shows the declining price trend that has been in effect since early in the third quarter of 2018.

What are the prospects for the economy in 2019? Corporate purchasing executives surveyed by the Institute for Supply Management are optimistic about business conditions this year. They expect revenues to increase in 17 manufacturing industries. Strong construction spending in 2018 holds promise for further steel demand in 2019, but the sector is challenged by the high cost of raw materials, along with labor shortages and rising interest rates. Automotive production is expected to dip below 17 million vehicles in 2019, but to remain at high levels. Steel demand from the energy sector is at the mercy of fluctuating oil and gas prices. Oil trading at $50/barrel or less offers little incentive for new drilling. So the outlook appears mixed.

On the trade front, all eyes are on the new U.S.-Mexico-Canada Trade Agreement, which has been signed by the three nations but must still be ratified by their legislatures. A major stumbling block to final passage of this so-called “free trade” agreement is the tariff the Trump administration maintains on imports of steel and aluminum from Canada and Mexico. Without some form of compromise, the whole agreement could collapse, with negative consequences for commerce in North America, warn some experts. Withdrawal of the tariffs, or even their replacement with some sort of quota, promises to open the borders and increase the steel supply in the U.S., which would likely add to the downward pressure on prices.

The Department of Commerce continues to grapple with the thousands of exclusion requests filed over the steel tariffs by companies that claim there is no domestic source for the particular steel they require. After much confusion over the exclusion process and the criteria being used to assess claims, the government reportedly has granted about 75 percent of the exclusion requests so far, removing the tariffs on roughly 16 percent of the finished steel entering the U.S. But the ongoing process has proven disruptive and costly to many U.S. manufacturers.

The U.S. could see more Section 232 tariffs on imports of autos and auto parts in 2019. The Commerce Department is due to issue a report on the national security implications of automotive imports by Feb. 17.

The American Institute for International Steel and two of its member companies that are importers of steel have challenged the constitutionality of Trump’s Section 232 tariffs. The Court of International Trade is expected to rule on the case this spring.

In other notable 2018 headlines, General Motors angered the administration when it revealed its plan to shutter five North American assembly plants by the end of 2019, impacting 6,300 jobs. GM cited slowing sales and the tariffs on aluminum and steel as challenges facing the auto industry. GM estimates the tariffs raised its material costs by $1 billion in 2018.

Several leading steel producers have announced plans to reinvest last year’s profits in new plants and equipment over the next few years. To cite a few examples:

- JSW USA made a splash with its billion-dollar commitment to the U.S. market. The India-based company just completed a successful restart of the long-idled Mingo Junction mill in Ohio and has broken ground on a new electric arc furnace mill adjacent to its pipe plant in Baytown, Texas.

- Nucor has several projects in the works. It is currently scouting for a suitable location in the Midwest to build a $1.35 billion EAF mill with 1.2 million tons of steel plate capacity. It plans to invest $650 million to expand the production capability of its Ghent, Ky., strip mill, the former Gallatin Steel plant. And Nucor plans to add a new, $240 million galvanizing line at its Arkansas sheet mill.

- Steel Dynamics plans to construct a new, $1.8 billion EAF flat-roll mill somewhere in the Southwest. The company says the mill will have an annual production capacity of 3 million tons with the capability to produce the latest generation of advanced high-strength steels.

- U.S. Steel restarted the second of two blast furnaces at its Granite City Works in Illinois.

The service center sector continued to consolidate in 2018. How much is difficult to measure because transactions between privately held companies often go unreported. But a few high-profile mergers suggest the trend still has some legs. Two venerable Chicago-based metals distributors joined forces when Ryerson agreed to acquire Central Steel & Wire Co., and Nebraska’s Norfolk Iron & Metal strengthened its foothold in the west with its acquisition of O’Neal Flat Rolled Metals, to cite two of the biggest deals.

Like few other periods in history, politics and the presidential administration’s trade policies are altering the normal steel business cycle. Steel prices are still at relatively healthy levels compared with historical averages, but their staying power depends in large part on whether the U.S. economy can continue its surprising run in 2019.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI