President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Market psychology split on steel prices

Half of service centers expect a steel mill price increase

- By John Packard and Tim Triplett

- July 10, 2019

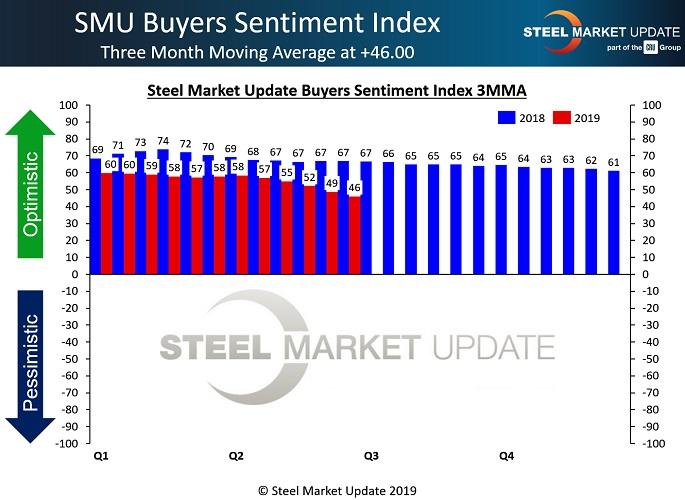

Steel market psychology is split into two distinct camps: those who believe steel prices are fast approaching a bottom and will rebound in the second half and those who believe the lingering trade tensions and uncertain demand will keep pressure on prices—and buyers on the sidelines— for some time to come.

Cautious buying by service centers, manufacturers, and fabricators, along with widespread inventory destocking, has put a serious dent in steel demand. Combined with weak scrap prices and what is arguably overproduction by domestic steelmakers, the resulting downtrend in steel prices is no surprise.

SMU Steel Price Data

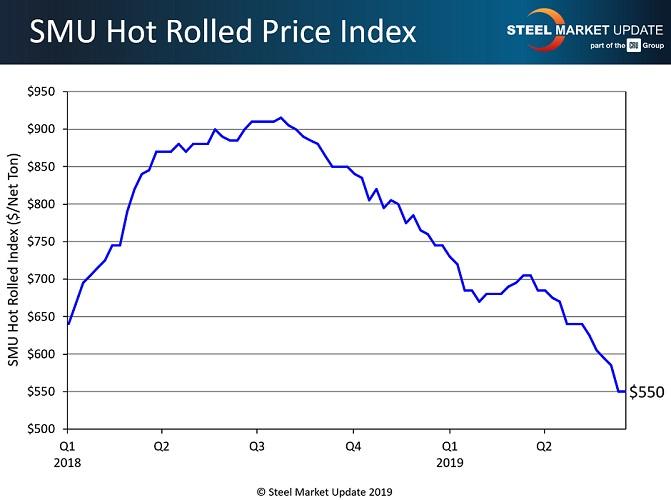

Steel Market Update (SMU) gathers real-time pricing data from steel buyers every week. As of mid-June, SMU’s Price Momentum Indicator was pointing “lower” on all steel products, as it has been for most of the year. According to SMU data, the benchmark price for hot-rolled steel (FOB the mill, east of the Rockies) was averaging $550/ton ($27.50/cwt), with lead times of two to five weeks. That’s a 40 percent decline from the $910 peak in July 2018. Cold-rolled dropped to $700/ton ($35.00/cwt), with lead times as short as five weeks during the same time frame. Cold-rolled prices peaked at $1,015/ton last summer.

The story is the same for galvanized steel, which had a base price dip from $1,014 in May 2018 to an average of $710 ($35.50/cwt) per ton in June. Galvanized 0.060-inch G90 averaged $788/ton. Galvanized lead times ranged from four to eight weeks. The price of steel plate declined by a similar percentage to $840/ton ($42.00/cwt) from highs of more than $1,000 last year. Plate lead times were down to four to six weeks as of last month.

As is always the case in a declining price environment, buyers are reluctant to place an order today when they believe they can secure a better price tomorrow. Those with inventory are anxious to liquidate their higher-priced material sooner rather than later to minimize the loss as their stocks lose value. SMU data puts service center flat-rolled inventories at a tight 2.5 months of supply as of the end of May. Most are only buying on an as-needed basis until they see signs that prices are beginning to rebound. But for the time being, with lead times as short as one week on hot-rolled and four weeks on coated steels, there’s no need to build inventories.

Declining ferrous scrap prices continue to contribute to the feeble finished steel prices. Prices of prime and obsolete scrap declined almost every month in the first half of the year as supplies outpaced demand from the mills. Weakness overseas has limited demand for scrap exports as well. SMU sources expect the pressure on scrap prices to persist into July and August, and possibly beyond. As one executive explained, for scrap prices to stabilize and rebound, either steel demand has to pick up or scrap flows have to slow down.

“Steel orders are down, and the mills have bought too much scrap. On the supply side, there is too much scrap being produced and recycled,” the executive said. “The U.S. scrap industry has become extremely efficient over the last 30 years and now it’s working against them.”

Many in the market believe the crisis in prices is somewhat self-inflicted. Inspired by the Trump administration tariffs, which have nearly eliminated competition from foreign imports, domestic mills cranked up production to more than 80 percent of their capacity this year, despite the questionable steel demand. Steelmakers have denied oversupplying the market, but recent actions speak louder than words.

U.S. Steel Corp. announced June 18 that it planned to idle three blast furnaces in response to lower steel prices and softening demand. “We are idling two blast furnaces in the United States and one blast furnace in Europe to better align our global production with our order book,” the company said in a statement. U.S. Steel will idle one blast furnace at its Gary Works facility in Indiana and a second at its Great Lakes Works facility in Michigan, reducing production by about 200,000 tons/month.

"We will resume blast furnace production at one or both idled blast furnaces when market conditions improve," the company added. Obviously, the market will be watching closely to see if other mills follow suit in trying to match domestic production to consumption.

Hot-rolled steel prices have been on a steady decline since the third quarter of 2018. Steel producers and distributors are feeling the squeeze and hoping for a turnaround in the second half.

What’s the Market Sentiment?

Service center executives canvassed by SMU have mixed opinions on whether the market is close to a bottom, which will eventually require a successful price increase by the mills. Responding to SMU’s query, half said they expect the mills to announce a price increase in the next 30 days. The other half believe it would be futile, given all the factors currently weighing on steel prices.

"With current CRU prices below pre-tariff numbers, why wouldn’t they try for an increase?” asked one respondent. "Lead times need to extend, and scrap has to stop going down for a price increase to be announced,” countered another.

Even if the mills do announce an increase, two out of three buyers say they won’t support it.

“Until they can stabilize this downward trend and get scrap up, there is no justification,” commented one executive. “It would have to be supported by something other than wishful thinking, like increased scrap costs or a demand surge,” added another.

Will the first signs of an uptick release an explosion of pent-up demand and trigger a surge of orders as service centers and other buyers rush to replenish their stocks? Or might it turn out to be a “false bottom,” as one CEO warned, in which prices see a brief bump only to fall back again as demand proves insufficient to sustain a real turnaround? Time will tell.

Upcoming Events

More than 1,000 industry executives are expected to show up for the steel industry’s premier educational and networking event, the 2019 SMU Steel Summit Conference, set for Aug. 26-28 in Atlanta. For more information on the program, speakers, costs, and how to register, visit the Steel Summit website.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI