President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel mills lose pricing momentum

A softening market could lead to further price declines

- By John Packard and Tim Triplett

- September 19, 2019

The market for steel looks to be soft in the coming weeks as some industry segments slow and service centers work through their inventories.

Domestic steelmakers managed to reverse the year’s long downtrend in steel prices for a few weeks in July and August, but the turnaround was short-lived. As of mid-September, Steel Market Update’s Price Momentum Indicator is pointing firmly lower for hot-rolled, cold-rolled and coated steel prices, as well as for steel plate, as the market heads into a fourth quarter in which uncertain demand is keeping many buyers on the sidelines.

The upward momentum the mills saw from the three $40/ton price increases they announced earlier this summer has apparently run its course. For mills to successfully collect a price increase, they need a commitment from distributors. Service centers are not cooperating, as they are no longer supporting higher prices, according to findings from SMU’s Sept. 9 market trends questionnaire.

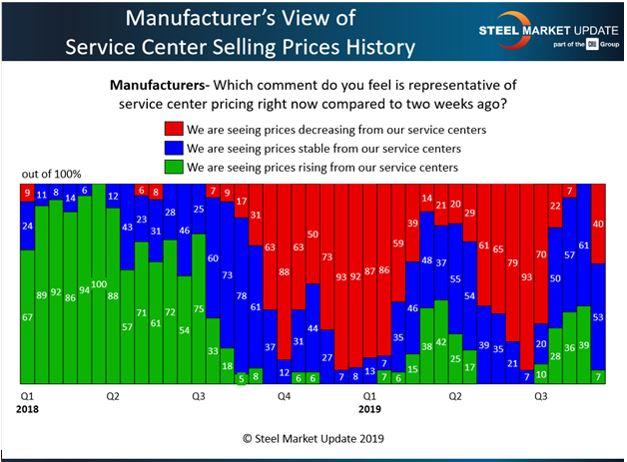

As seen in Figure 1, none of the service center executives responding to SMU’s poll said they were still raising prices. Roughly two out of three said they were holding the line, but nearly one-third admitted they were reducing prices to close the sales.

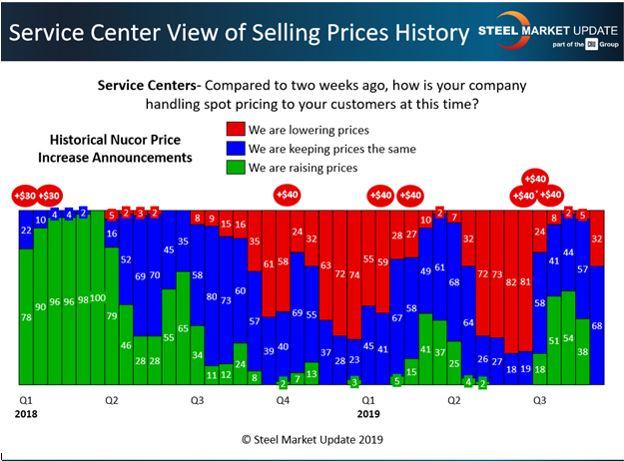

Corroborating the trend, only 7 percent of the manufacturers responding to SMU’s questionnaire reported they were still seeing higher prices from their service center suppliers (see Figure 2). Forty percent said steel offers from service centers were lower—a major shift from just a few weeks prior.

SMU Steel Prices

SMU data shows the benchmark price for hot-rolled steel dropped from about $700/ton at the beginning of the year to around $550/ton by the end of June when the mills increased prices. In the weeks that followed, the hot-rolled price saw a brief bump to an average of nearly $585 per ton, but it failed to sustain any traction.

Flat-rolled and plate steel prices have since reversed course as buyer sentiment has become somewhat negative. As of Sept. 16, SMU data showed the average delivered price for hot-rolled steel at $560/ton, with mill lead times of three to six weeks. The price of cold-rolled coil averaged $740/ton, with a lead time of four to eight weeks. The benchmark price for 0.060-inch G90 galvanized coil averaged $813/ton, with lead times for spot orders averaging four to nine weeks. Lead times for steel plate were as short as three to five weeks as the price dipped to an average of $730/ton. Based on the latest feedback from service centers and their customers, it appears likely spot prices will trend further downward in the coming weeks.

SMU Service Center Inventories Report

Another key indicator—service center inventories—also suggests that steel prices are unlikely to get much support from the distribution channel anytime soon. SMU’s new Service Center Inventories Report shows industry inventories that are balanced to slightly high considering the market is entering a slow period of the year when companies traditionally pare back their buying. As of the end of August, flat-rolled inventories average 55.8 days of supply and plate inventories 52.1 days, according to SMU data.

SMU surveys key data providers each month to gather the latest information on steel sheet and plate inventories. The results are summarized in the Service Center Inventories Report, which is distributed to SMU’s Premium subscribers around the tenth business day of each month. Companies that volunteer to (confidentially) share inventory data each month receive additional benefits, including a Flash Report with preliminary data about a week before other subscribers.SMU’s Service Center Inventories Report includes:

- Total inventory levels from the data providers.

- Total monthly shipments by the data providers.

- Shipping days of supply.

- Months of supply on hand.

SMU Inventories Report Analysis, which includes expert commentary on the month-to-month changes in flat-rolled and plate inventories, with forecasts based on industry pricing trends and other market factors.Data providers also qualify to receive information on the average daily shipping rate, tons on order, shipping days of supply on order, percentage of inventory on order, and the percentage of inventory committed to contracts as compared to the percentage available to the spot market. (Contact Paige Mayhair at 724-720-1012 or paige@steelmarketupdate.com for information on how to subscribe to SMU’s Service Center Inventories Report.)

What the Market Says

Service centers and manufacturers are reporting softening demand, shortening lead times, and mill prices that are very negotiable. One service center executive pointed to layoffs at farm equipment makers and record low crop prices in the agriculture sector. Farmers have very little cash to invest in grain bins, tractors, or other steel-intensive products, he said. The president of another service center put it this way: “Is there more of a problem on the demand side than we have been willing to acknowledge?” He reported sluggish shipments in August and September that are well off projections in sectors including agriculture, energy, and heavy equipment. “No one expected the market to turn so quickly,” said another source, commenting on the downturn in steel prices. At this point, he anticipated no new sales activity until the first or second quarter of 2020.

Figure 1. The steel price increase looks to be over as a little more than two-thirds of service centers surveyed indicated that they are keeping prices the same and the rest responded that they are reducing prices.

Executives also pointed to lower ferrous scrap prices and the expectation for scrap to move even lower in October as more proof of the pressure on prices. Add in widespread concerns about the strike at General Motors, and many people feel the lows of the year will be tested in the coming weeks.

As the general manager of one large service center told SMU in mid-September: “This particular downturn has been expected given the market dynamics evolving over the last couple of months. We very well could see a repeat of what occurred in the summer, with a drop-off in price by mid to late fall, followed by a period of heavy orders at very low prices, then lather, rinse, repeat.”

Upcoming Events

On Jan. 7-8, Steel Market Update will conduct a Steel 101: Introduction to Steel Making & Market Fundamentals workshop in Fontana, Calif. The workshop will include a tour of the California Steel Industries mill.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI