President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices under pressure

Demand in automotive, construction appears to be slowing

- By John Packard and Tim Triplett

- April 19, 2019

Looking back at a first-quarter 2019 that started out with so much promise, many in the steel sector would describe it as “good but not great,” especially compared to the boom times of the first quarter of 2018, when the market was feeling the effects of Trump’s tax cuts and tariffs. But the lingering uncertainties on the political and trade fronts appear to be weighing on market sentiment as well as steel demand and pricing.

The U.S. steel industry produced approximately 24 million tons of steel in the first quarter, a 6.7 percent increase from the same period last year. The mills are cranking out raw steel at more than 82 percent of their capacity, even higher for flat-rolled products. Yet construction demand has yet to take off after a rough winter, and automotive sales are forecast to decline by 1 percent to 4 percent in 2019, to point to steel’s two largest markets.

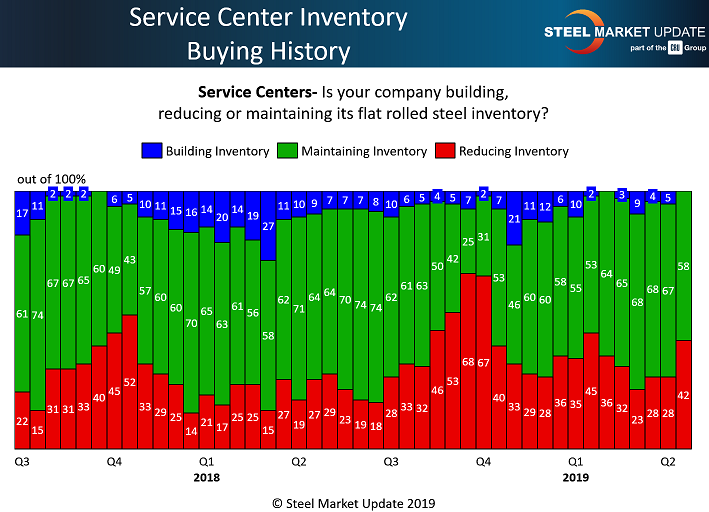

Distributors and OEMs are buying cautiously and keeping inventories lean. About 42 percent of service centers polled by Steel Market Update (SMU) are reducing their flat-rolled inventories, and the rest are standing pat. As a result, the lack of inventory build is contributing to lackluster demand.

Despite the mills’ best efforts, steel prices have been unable to gain much traction so far in 2019. Price increase announcements of $40/ton in January and February yielded partial and apparently temporary gains for steelmakers. The prices of all flat-rolled steel products are now well below where they were at the beginning of the year, which may be good news for fabricators and other steel users, but is not-so-good news for steel producers and distributors that have seen their margins and the value of their inventories erode.

SMU tracks steel prices each week and publishes its SMU Price Momentum Indicator, which signals whether steel prices are more likely to move up, down, or sideways in the coming 30 days. Currently, SMU’s market momentum is lower for hot-rolled and plate products and neutral for cold-rolled and galvanized.

As of April 16 (all prices below are FOB the mill, east of the Rockies), the price of hot-rolled steel averaged $670/ton ($33.50/cwt), with lead times of three to six weeks, down from a January peak of $730. Cold-rolled was selling for $825/ton at the beginning of the year; today’s average price is $805/ton ($40.25/cwt), with lead times of five to eight weeks. Galvanized had relatively strong demand in the first quarter, moving up from $820/ton in early January to $850/ton in late March, before backing off to the current $815/ton ($40.75/cwt). Lead times for galvanized now range from four to 12 weeks. Even the price of steel plate, which was on allocation for most of 2018, weakened. The current average plate price is $975/ton ($48.75/cwt) FOB delivered to the customer’s facility, down from $1,005/ton when the year began.

Mill price increases cannot succeed without the cooperation of distributors. They are on the front lines in the spot market, and it’s their day-to-day decisions about whether to deal or hold the line that ultimately translate into price changes. SMU’s latest survey data suggests that support for higher prices is waning among service centers. About 90 percent of service center executives responding to SMU’s latest poll said they are having difficulty passing along higher prices to their customers.

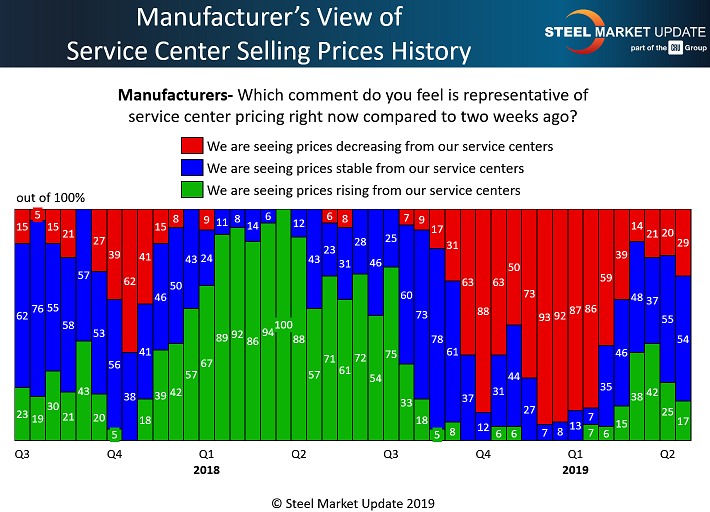

In its twice-monthly survey, SMU asks manufacturers if they are seeing higher prices from service centers. In mid-March, around 40 percent of respondents said their service center suppliers were seeking higher prices. In the latest data, that figure had declined to 17 percent.

To confirm the trend, SMU asks service centers twice each month if they are raising spot prices to their customers. Less than 5 percent of the respondents to SMU’s April 15 questionnaire said they are collecting higher prices, down from 40 percent a month ago.

The majority (52 percent) of service center and OEM executives responding to the latest poll expect flat-rolled prices to move sideways from here, while 37 percent expect them to move lower. Only 11 percent anticipate higher prices in the current environment.

If no distributors are building their flat-rolled steel inventory, that contributes to the lack of demand in the market. That means steel mills announced price increases aren’t likely to stick.

This is feedback from some of the steel buyers surveyed:

- “Demand is slow, and pricing is weak.”

- “The market is flat, and sentiment is weak. Section 232 tariffs have made imports too costly. I don’t see them going away anytime soon. Bad for the consumer as they are paying a premium and struggling.”

- “The market appears stable, but the specter of oversupply keeps many buyers from being very aggressive, and it looks like this will continue.”

- “Trying to secure contractual business is about as difficult as we have ever experienced.”

- “I see the situation getting worse for imports in the future with more potential trade action.”

- “Order input has picked up, but pricing is very competitive.”

- “Imports of finished goods are becoming a major factor.”

- “It’s so hard to get a feel for demand. Obviously automotive is weakening. Construction is a key, and I feel very uncertain about an uptick in construction demand.”

- “I have offers from suppliers to roll Q2 pricing into Q3. I am hoping that Q3 pricing will actually be a little better.”

- “All flat-rolled products are considerably weaker. If the long-anticipated decline in imports does not materialize, the mills are in for a disappointing year.”

Is “Steelmageddon” Coming?

Looking more long term, analysts foresee an overcapacity that could be devastating for steel prices. Domestic steelmakers have announced dozens of capital investments estimated to add 20 million to 24 million tons, or about 20 percent more steel capacity to the U.S. market, over the next few years. Without a corresponding increase in demand, which is highly unlikely, the market could be flooded with steel looking for buyers at almost any price.

Timna Tanners, metals and mining analyst for Bank of America Merrill Lynch, has dubbed the phenomenon “Steelmageddon,” commenting, “There’s going to be a glut that will shake up the industry.”

In the worst-case scenario for Steelmageddon, weak demand and removal of the Trump administration trade protections, along with a major oversupply of the market, could drive steel prices down near $500 to $550/ton by 2022, Tanners predicted. (Tanners will be a featured speaker at the 2019 SMU Steel Summit Conference, Aug. 26-28, in Atlanta.)

Of course, the steel mills dismiss this theory and contend the boom in investment will lead to a stronger, more modern, more competitive domestic steel industry in the future. Let’s hope they are right. The U.S. economy needs a healthy steel industry.

Upcoming Events

It’s also time to register for SMU’s Steel Summit Conference set for Aug. 26-28 in Atlanta. More than 1,000 industry executives are expected to show up for the educational and networking event. You can find our program, speakers, costs, and registration information here.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI