President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Trump tweets make steel pricing difficult to predict

Singling out Turkish steel and aluminum latest example of tumultuous trade policy

- By John Packard and Tim Triplett

- August 16, 2018

Steel pricing is the product of a complex interplay between supply and demand, along with other factors such as ferrous scrap prices and foreign steel import levels. Factor in the unpredictable nature of President Donald Trump’s trade actions, and steel prices have become increasingly difficult to predict.

The Trump administration restricted imports by imposing Section 232 tariffs of 25 percent on steel and 10 percent on aluminum effective June 1. Quota agreements were reached with Argentina, Brazil, and Korea. The goal is to safeguard the nation’s security by ensuring that essential industries such aluminum- and steel-making are not threatened by unfairly traded imports. Less competition from foreign mills and healthy demand from a strong U.S. economy have allowed domestic steelmakers to keep prices unusually high. One steel company after another announced record profits in the second quarter.

Trump threw the market another curve in the early morning hours of Aug. 10 when he doubled the tariffs on Turkey. He declared via Twitter: “I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar! Aluminum will now be 20% and Steel 50%. Our relations with Turkey are not good at this time.” The new tariffs became effective Aug. 13.

The Turkish steel industry is a major buyer of ferrous scrap from North America and was the eighth largest exporter of steel products, including rebar, cold-rolled coil, galvanized coil, oil country tubular goods, standard pipe, and hot-rolled coil, to the U.S. over the past year. The 50 percent Section 232 tariff, on top of antidumping and countervailing duties already in place, render Turkish imports uncompetitive and effectively eliminate them from the U.S. market.

It is difficult to gauge the impact of this decision on the U.S. steel market. At least in the short term, it could put downward pressure on ferrous scrap prices, and thus steel prices, assuming Turkey purchases less scrap from the U.S. On the other hand, less competition from Turkish imports of finished steel products stands to support higher prices from domestic mills that move in to fill the gap.

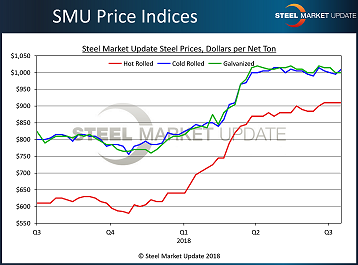

Steel Market Update (SMU) is beginning to see signs that steel prices have peaked and are more likely to decrease than increase in the coming months (see Figure 1). SMU’s surveys indicate that lead times on steel orders are shortening, which suggests the mills are not quite as busy. Buyers tell SMU that the mills are more active and willing to discuss price during negotiations.

One of the major mills, ArcelorMittal USA, announced a $30/ton price increase on cold-rolled and coated products on Aug. 14. This is not necessarily a sign of strength. Rather, the mill is hoping to improve profitability by increasing the currently narrow spread between hot-rolled and cold-rolled/coated products to more normal levels.

Pricing on galvanized steel may be poised for a dip as the coating extra for zinc comes into play. The price of zinc, which is used to give galvanized its corrosion-resistant coating, has declined precipitously in the last few months, from more than $1.60/pound to as low as $1.05/pound in recent trading. If the low price shows some staying power, the mills are likely to adjust their extra charge for zinc.

SMU’s Price Momentum Indicator has been at neutral since July 10, meaning steel prices are in transition and could move in either direction over the next 30 to 60 days. But if not for the Turkey tariff situation still playing out, SMU would have adjusted its Price Momentum Indicator to Lower for flat-rolled in mid-August.

The following were SMU’s benchmark steel prices, FOB the mill east of the Rockies, as of Aug. 15:

- SMU’s price range on hot-rolled coil was $870/ton to $910/ton ($43.50/cwt to $45.50/cwt) with an average of $890/ton ($44.50/cwt), with lead times of three to seven weeks.

- SMU’s price range on cold-rolled was $970/ton to $1,010/ton ($48.50/cwt to $50.50/cwt) with an average of $990/ton ($49.50/cwt), with lead times of five to nine weeks.

- SMU’s base price range on galvanized was $960/ton to $1,030/ton ($48.00/cwt to $51.50/cwt) with an average of $995/ton ($49.75/cwt). The galvanized 0.060-inch G90 benchmark price ranged from $1,046/net ton to $1,116/net ton with an average of $1,081/ton, with lead times of four to 10 weeks.

- Steel plate products are in shorter supply, and plate prices were expected to increase once the mills opened their November order books. As of mid-August, SMU’s price range on plate was $960/ton to $1,000/ton ($48.00/cwt to $50.00/cwt) with an average of $980/ton ($49.00/cwt) FOB the customer's facility. Plate lead times were six to nine weeks, with mills on controlled order entry.

SMU regularly canvasses the market to measure what steel buyers are thinking. The most recent poll in early August showed:

- Early fears that the Trump tariffs would so severely restrict imports that the U.S. would face a shortage of steel later this year now appear overblown. Only a very small percentage of respondents fear steel will be in short supply. The vast majority were evenly split on whether supplies will tighten.

- Three out of four respondents saw demand holding steady, while another 9 percent saw demand improving. Only about 16 percent reported demand declining.

- Roughly half of the steel executives who responded believed steel prices would decrease. The other half expected prices to remain about the same for the near term.

What seems to be concerning steel buyers the most these days is not demand or supply, but the seemingly capricious nature of Trump administration trade policies. As one executive commented, “The Turkish situation will definitely cause some headaches for many and introduces new uncertainty into the market. Anyone looking to import has to ask: Which country might be next?” Said another: “It demonstrates the power vested in one man to impact global markets with the stroke of a pen, or perhaps a tweet.”

SMU conducts various steel training workshops around the country in conjunction with a domestic steel mill. Our first “Steel 201: Introduction to Advanced High Strength & Other New Steels” workshop will be held on Sept. 11-12 in Middletown, Ohio. Attendees will tour the AK Steel Research and Innovation Center as well as the fully integrated Middletown steel mill.

On Dec. 11-12 SMU will conduct another one of our “Steel 101: Introduction to Steel Making & Market Fundamentals” workshops in Toledo, Ohio. Attendees will tour North Star BlueScope’s electric-arc furnace and rolling mills.

Information about any of these workshops can be found at www.steelmarketupdate.com/events.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI