President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Unpredictable steel prices to remain so

Recent price increases seem to be sticking, but the future of the Section 232 tariffs clouds any ability to forecast a trend

- By John Packard and Tim Triplett

- March 15, 2019

Where will steel prices be heading in the coming weeks? No one really has any confidence in answering that question.

Are steel prices witnessing a dead-cat bounce or the beginning of a bullish reversal? The market appears split on the feline versus bovine analogy. In other words, a huge divergence of thought exists on what is going to happen to steel prices over the next three or four months.

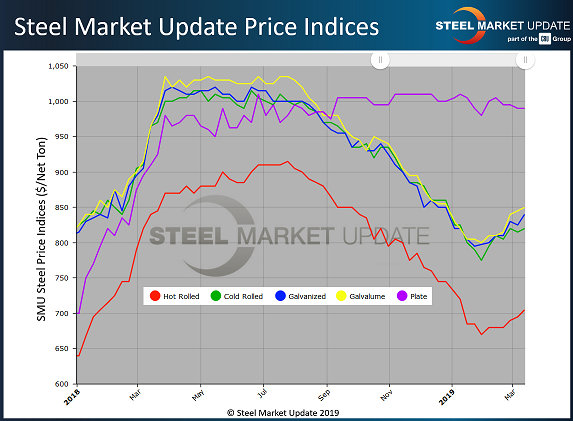

The benchmark price of hot-rolled coiled (HRC) steel peaked at around $915/ton last summer, according to the Steel Market Update HRC Index. HRC then began a steady descent that took it down to $670/ton by late January—a 27 percent decline. Since then the price has recovered, moving to over $700/ton. Will this be a soft bounce, or is it the beginning of a bull run?

Some bullish analysts forecast that the price of hot-rolled steel could run back up as high as $900/ton. With an assist from the Trump administration’s Section 232 national security tariff, which puts a 25 percent duty on foreign steel, domestic steel mills are operating nearly at full capacity. With less competition from imports and pent-up demand from the harsh winter, the mills are hoping to collect two $40/ton price increases announced in January and February, with more likely to follow if those prove successful.

In the dead-cat camp are analysts who are concerned about the staying power of Section 232 tariffs, which are being challenged in Congress, in the courts, and in various trade negotiations. It appears increasingly likely that the Trump administration will have to rescind the tariffs on steel imports from Canada and Mexico to secure passage of the U.S.-Mexico-Canada trade agreement sometime this year. Opening the U.S. border to steel from the north and south could cause a surge in supply and drive prices back down to $600/ton, making the recent uptick in prices just a short-term bounce.

Current Steel Prices

As of March 12, Steel Market Update’s Price Momentum Indicator was set at “higher” on flat-rolled steel, as lead times have begun to extend and prices have begun to move up following the mills’ two announcements (see Figure 1). (All prices are FOB the mill, east of the Rockies.) The price of hot-rolled steel averaged $705/ton ($35.25/cwt), with lead times of three to six weeks. Cold-rolled steel was selling at an average price of $820/ton ($41.00/cwt), with lead times of five to eight weeks. The benchmark price for galvanized 0.060-inch G90 coil averaged $918/ton (45.90/cwt), with a lead time of five to eight weeks. For Galvalume 0.0142-in. AZ50, Grade 80, the average price was $1,141/ton (57.05/cwt), with a lead time of six to nine weeks.

For steel plate, the SMU average was $990/ton ($49.50/cwt) FOB delivered to the customer’s facility. SMU’s Price Momentum Indicator on plate was “neutral,” meaning prices were expected to remain steady over the following 30 to 60 days. This shift occurred because SSAB made a $40 price increase announcement a few days prior to this article being written, and it is SMU’s policy not to influence the market when announcements are made. Plate lead times were six to nine weeks.

Distributors Supporting Mill Increases

Steel Market Update canvasses the flat-rolled and plate steel markets twice a month through the use of a questionnaire to end users, service centers, steel mills, and trading companies. One of the key indicators SMU tracks is whether service centers are raising prices or continuing to offer discounts. The latest survey results show that flat-rolled service centers are beginning to support the concept of higher steel prices. Distributors are raising spot pricing on their end-user customers, which is helping to support the price increases announced by the domestic mills.

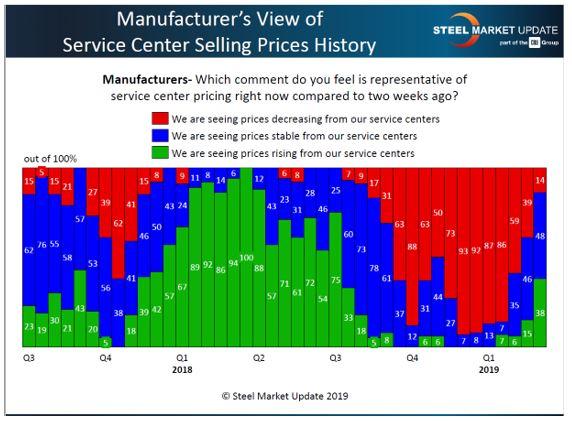

In the first week of March, 38 percent of the manufacturing companies responding to SMU’s questionnaire reported that their service center suppliers were raising spot prices—twice the percentage reported two weeks prior. At the same time, the percentage of manufacturers who reported falling spot prices declined from 39 percent to 14 percent (see Figure 2).

Service centers, responding independently from the manufacturing companies, reported similar results. Forty-one percent said they were increasing pricing to their spot customers. Only 10 percent admitted they continued to offer discounts to customers to secure the sale. Figure 3 shows the service center results.

What Steel Executives Are Saying

What does the future hold? There is no clear consensus. Here’s what steel executives polled by SMU are saying about mill lead times and the current pricing environment:

Figure 1. With steel price increases looking like they might not erode anytime soon, will the steel mills feel confident enough to continue the trend, or will changes in the Section 232 tariffs situation end any momentum for further price hikes?

- “We are starting to see mill lead times for HRC moving out to ship dates in the second and third week of April. We have paid about half of the total $80/ton mill increase. Based on our communications with multiple sources, it appears the market may move mostly sideway. Steel mills are still willing to negotiate.”

- “We are not seeing an extension in lead times yet. Some mills are basically sold out for Q2, and others still have April production. It is really kind of a mixed bag.”

- “Lead times seem to be all over the place. There’s not the usual mix where integrated mills are notably longer than EAF mills. Bottom line, while lead times are slightly longer than a few weeks ago, there’s not a widespread momentum of extending lead times like we normally see when markets gain pricing strength. I think hot-rolled prices may get into the low $700s, then hold. There’s a greater chance we’ll see prices ease back again in the late spring and summer to the $670 range.”

- “Weather has not had any impact. Demand was very strong to start the year, but now seems to be settling back into the expected range of 0 to 5 percent growth. There’s more chatter lately about demand concerns popping up in multiple sectors, and automotive in particular is making many folks nervous.”

- “Pricing is increasing and will continue to increase for a while. I do not expect all of the $80/ton increase to stick, but half to three-quarters will. Moderate firming of prices will continue unless the tariffs collapse.”

- “Mill lead times are moving out, especially in the South for hot-rolled. With import pricing on a par with domestic now, I’m very concerned there will be little to no imports arriving in the summer. With the domestic mills already operating at a high capacity utilization, this could create a short-supply issue. We have paid about $40/ton of the increases, which look to have stabilized the bottom.”

- “We have seen the mill lead times start to creep out and we have paid a little more than half of the $80 increase. We have booked a couple offshore orders at numbers not much less than current domestic prices, but we feel confident the current numbers will look great by the time the steel arrives. It’s hard to believe this market will not continue an upward trend, especially if there are not many import tons arriving.”

- “I’m not overbuying at current levels, as I think pricing will go up a little over the next month or so. But I don’t believe that will last. I see pricing coming back down from mid second quarter into the third quarter. If and when the tariffs come off of Canada and Mexico, along with some imports coming in May/June/July, and we get some kind of trade agreement with China, we’ll see some softness again.”

Based on executives’ comments and survey results, Steel Market Update believes spot steel prices will continue to rise gradually over the next 30 to 60 days, at least as long as the tariffs remain in place. If Trump rescinds Section 232 tariffs on some countries or replaces tariffs with quotas, all bets are off on how the market will react.

Upcoming Events

Registration is open for Steel Market Update’s next Steel 101: Introduction to Steel Making & Market Fundamentals workshop, which will be held in Davenport, Iowa, May 14-15. The workshop will include a tour of the SSAB Montpelier, Iowa, plate mill. For details, visit www.steelmarketupdate.com/events/steel101.

It’s also time to register for Steel Market Update’s Steel Summit Conference, Aug. 26-28, in Atlanta. More than 1,000 industry executives are expected to show up for the educational and networking event. You can find the program, speakers, costs, and registration instructions at www.steelmarketupdate.com/events/steel-summit.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI