Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Solving low rates of machine utilization in the metal fabrication shop

How machine monitoring and understanding data can help shops get more out of what they have

- By Tim Heston

- April 26, 2022

- Article

- Manufacturing Software

Anyone who’s worked on the fab shop floor for years probably has memories of the boss bursting in after the punch presses stop. Why is it so quiet? To managers, the cha-chunk of presses in the fab shop is equivalent to the cha-ching of cash registers. If machines aren’t producing, the thinking goes, the fab shop isn’t making money.

Conversely, if a machine is running, everyone assumes all is well with the world. But is it really? Is the machine producing good parts? Is the machine in a healthy, well-maintained state, or will things go awry sooner rather than later? Is the machine producing the right parts for the right job at the right quantities, and how well is it producing them? Is the operation running as efficiently as it could be?

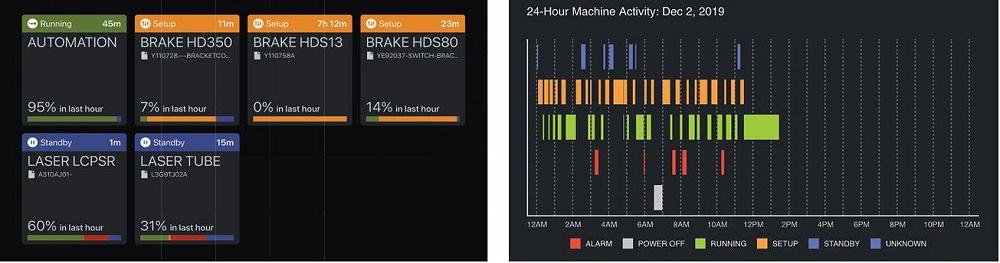

In recent years, machine vendors and third-party players have introduced monitoring systems that aim to make the shop floor much more transparent. They offer, among other things, dashboards showing actual machine uptimes and idle times. Such platforms connect directly to the machine and don’t require manual input.

Historically, machine uptime has been looked upon in a binary way—it’s either running or it isn’t—and again, a lot of that information is based off simple assumptions. I can hear and see the machines running, so everything must be OK. But the shop floor isn’t that simple—a reality that continues to reveal itself in the increasingly connected shop.

The Monitoring Continuum

Today’s machine and third-party vendors offer a variety of software that can track actual machine utilization, an act that itself can help fabricators identify previously hidden problems, boosting utilization and efficiency right off the bat. Depending on the product and level of service, software also can relate that utilization data to specific jobs and other machines in the value stream or job routing. Then comes condition monitoring, which delves into machine-level data to determine the machine’s health and identify issues before they snowball into larger problems.

The level of integration and sensing intelligence depends on the software used and the age and brand of the machine. On some modern machines, a fabricator might be able to track specific alarm codes or the condition of specific components. Still, even the simplest sensors on ancient machines can reveal a lot about an operation’s efficiency.

Machine utilization measurement, job tracking, and machine condition monitoring are often viewed in separate sandboxes. That said, the lines between software functionalities may blur in the coming years. Specific shop floor problems have many causes that can’t be pigeonholed into one category. For instance, poor utilization on a press brake might have to do with not just the condition of the machine (leaking hydraulic oil, for instance) but also the sequence and nature of jobs the machine processes throughout the shift (job tracking and scheduling).

Fabricators who think broadly, connect the dots, and identify patterns of events might find they get more out of the machines they run and the people they employ. Such a feat will become only more important as the labor shortage persists.

The Subtleties Behind Measuring Productivity

Broad measurements of uptime data reveal a metal manufacturing industry full of underutilized assets. In January MachineMetrics, Northampton, Mass., released a report showing average machine uptimes throughout its customer base, which incudes machine shops as well as various sheet metal and plate fabrication operations. Machines like automated laser cutting centers experience much higher uptimes than their manual counterparts. Still, the uptime average in 2021 remained stubbornly low at only 28%.

Low utilization rates “was really the spark that led us to start this company,” said Eric Fogg, MachineMetrics’ co-founder and chief customer officer. “You can ask the owners of a lot of companies, ‘How much are your machines running? What’s the utilization rate?’ It’s a simple question that not a lot of people can answer.”

Truth, the saying goes, resides on the shop floor, and today’s software can track various activity (not just uptime) as reported automatically by the machines themselves. AMADA AMERICA

Fogg added that many in manufacturing think a machine with unplanned downtime happens “because of the limitations of the machine, machine maintenance issues, or perhaps difficulties with the job. And yes, those things are huge, and there’s a lot of work to be done in those areas. But a lot of it has to do with planning and organization. Do we have the labor and machines to complete this work? Do we have jobs organized in such a way that will ensure jobs will run efficiently in succession to each other?”

The reasons for unplanned downtime MachineMetrics collected throughout 2021 reveal familiar problems in metal manufacturing, including the labor shortage. More than 52% of the time, machines were down because operators simply weren’t available. More than 22% of the time, machines lacked jobs or material—no surprise in a year of wild demand swings and supply chain challenges.

“Our data shows that there’s a tremendous amount of low-hanging fruit in this industry,” Fogg said, adding that often unnoticed minor stoppages can add up to serious downtime. “Everyone remembers the big crashes, but not all the little fender benders. All the same, we also find that machines actually have material and they’re ready to run. What the machine needs is an operator.”

Such data reveals just how acute the industry’s labor shortage is. One minor unexpected event—an operator calling in sick, a setup that takes a little longer, an expedited order—can send ripples through production, and shops don’t have the resources immediately available to absorb them. One more thing: Customers don’t pay for the disruptions those ripples cause.

“We did a study where we compared indirect processes with actual processing time,” said Tobias Mauz, head of sales, software and IoT solutions at TRUMPF Inc., during an Industry 4.0 virtual conference hosted by the Fabricators & Manufacturers Association in November. The study found indirect processes represent about 80% of production time, while direct processes represent just 20%. “Cutting, bending, and welding is value-adding. Then there are the indirect processes. No customer pays us to move material from one workplace to the other, for quoting, for scheduling an order, or printing the paperwork. Some of these processes might be indirect, but they are not value-adding, so therefore we also don’t get paid for it.”

Digging Deeper

If a machine was down because an operator was unavailable, why was that operator unavailable? Yes, the staff is probably stretched too thin, but what happened in this specific instance? Did the operator not show up to work? Were they freeing a bottleneck elsewhere in the plant, and if so, what caused that bottleneck? If a machine lacked a job or material, was it due to external supply chain problems? Or was it an internal problem; that is, was the operator waiting for a fork truck driver to deliver material? Or did the machine simply not have anything to run because of a dip in demand?

“‘Why?’ isn’t a very interesting question to me, because everyone can give you a different ‘why,’ and it often doesn’t get to the core of the issue. I want to know what, how, when, and who.”

So said Casey Greer, the Chicago-based lead IIoT professional service consultant for AMADA AMERICA. Greer (who also presented at FMA’s Industry 4.0 conference in November) works with the company’s Influent platform, which connects to and analyzes the data from multiple machines and machine brands. It also integrates with a shop’s enterprise resource planning (ERP) platform.

“When you see an underperforming machine, you’ll have some immediate questions,” he said. “What is it running? Who is running it, and when?” Dashboards that the platform provides can help a shop answer those questions immediately. “Let’s now look at the part. Is it a difficult one to set up? What does the operator have to do to set it up? All that information will help you make better decisions.”

As Greer explained, shops can start with the most objective measurement of all, when. It’s difficult to assess and solve a problem if shops don’t know exactly when their machines are running. And really knowing “when” involves far more granular information than listening for the punch machine’s cha-chunk from the office.

Greer described a situation in which several welding robots weren’t producing as expected. The problem originated in how the operation sequenced the job. The situation involved welding robots with dual weld tables; one part on one table had a 15-second weld time while another part had a one-minute weld time. Obviously, the one-minute weld time set the pace, which unfortunately was slower than managers wanted it to be. To solve the issue, the company ended up scheduling different parts with like run times, effectively helping to level-load (at least to some degree) a product family with highly disparate processing times.

“The company basically combined and sequenced parts with like run times in such a way as to maintain throughput of both parts [the one-minute and 15-minute part] through the weld cell,” Greer said, adding that this situation exemplifies the nature of modern machine monitoring and the application of the Industrial Internet of Things in general. “It’s not about having a software product with a set of features. It’s about learning about a problem from the [fabricator’s] perspective and working together to solve it.”

How Long Did the Job Take, Really?

One challenge is the disconnect between when a machine is cycling and the labor transactions that operators record. ERP and manufacturing execution system (MES) software usually track the time between when an operator clocks in and out of a job, but they often lack a direct connection to the machine itself. An operator might clock in an already-setup press brake job at 10:15 a.m. and then clock out at 10:30 a.m. That information alone shows that the job took the operator 15 minutes, but that’s about it. Measure the actual bending cycle time, and the story becomes more complete. That new information might reveal that the press brake spent only five minutes cycling the ram and actually bending parts.

Does the operation take three times longer than it actually should? Probably not. After all, the operator needs to manipulate the material and perform in-process inspection and other tasks. But there might be efficiencies to be gained, and by having both the machine uptime and labor transaction data, operators and supervisors can work together toward improvement. Would staging material in a certain way help? Is there an issue with the material, such as grain direction or thickness variation, that requires the operator to tweak the setup? Is the blank size incorrect for the tooling being used? Are there any gauging issues, such as an undeburred tab rocking against a backgauge or sidegauge?

The difference between clocked time and actual machine cycle time could stem from legacy practices. Working from the labor transaction data from the MES, the operator sees that the shop has assigned 15 minutes for the job, and so he makes sure to clock the job in for 15 minutes. Sure, he might be taking advantage of operational dysfunction, but he also might just be following instructions, working a certain way because, well, that’s the way it’s always been done.

Again, to follow Greer’s point, the why isn’t very interesting. The answer can change depending on a person’s perspective, which in turn leads to the blame game. Time spent finger-pointing is a waste unto itself. Working from information gleaned from the what, how, and when can give shop personnel the information they need to start improving.

Getting Predictive with Data

In a typical fab shop, nearly all machines—no matter their age or brand—can tell machine monitoring software whether it’s on or off. Modern machines, of course, can tell monitoring software a lot more.

“There are so many elements to monitor,” Greer explained, adding that the level of monitoring depends on the machine brand and age. “And when data is collected, we can see everything that happened on a machine, including when programs started, what alarms happened, and how far into the run they happened.”

Such data can be extremely valuable for maintenance departments looking to decipher the state of a machine before it was unexpectedly taken out of service. The data also can be fed to analytics systems, either off-site or cloud-based (depending on the software setup and vendor), that can help refine a predictive maintenance program. Instead of simply inspecting and maintaining items on a set schedule (as with preventive maintenance), a fabricator can inspect and maintain machine components based on actual usage, which in turn can extend the machine’s life and reduce overall operating costs. Now, monitoring services, either through machine vendors or third parties, can notify a fabricator about an issue before it becomes a problem.

“With modern condition monitoring, we can be much more proactive,” said Christine Benz, head of TruServices and Smart Services at TRUMPF Inc. “With fully automated analysis of data, we are able to predict when problems might occur. And we can help fabricators resolve issues before they’re even aware of it.” For instance, in the past an operator might observe poor kerf quality, which would in turn spur reactive troubleshooting. Now, the operator or technician can make changes to prevent the problem in the first place.

Sensors might detect changes in water levels in a laser cutting machine’s cooling system or in hydraulic fluid levels in a press brake, sending data that can trigger a fabricator to act “before there’s any effect on shop production,” Benz said. “Our goal with condition monitoring is to achieve zero unplanned downtime.”

“In certain cases, we’re now analyzing cut quality of some parts and optimize the tech tables,” said Mathias Staiger, R&D manager, connectivity, at TRUMPF. “And for one machine type, we can update those tech tables automatically so that the machine can achieve better results.” He added that in this and other cases, cloud-based data analytics deals only with machine-level data, not parts-level data.

In some cases, machines can read the results of those analytics and self-correct. Such machine learning scenarios aren’t pervasive through sheet metal fabrication, but they do exist. A prime example is with automated denesting and part sorting technologies that are just starting to emerge. The suction cups on the end effector (combined with specialized push-pin lifters underneath) can attempt to lift a part out of a nest, detect when it fails, then try again using another strategy.

“If the first attempt doesn’t work, the machine automatically changes to engage a different suction cup pattern [on the end effector removing the blanks] to separate the part from the skeleton,” Benz said, adding that the machine factors in where the part is on the nest and how it’s oriented. A part oriented horizontally in the corner might lift differently from a piece in the center of the sheet. “In this way, the machine learns.”

Benz added that a fabricator can use data gleaned from condition monitoring in conjunction with other software that can automate planning and material movement. In some applications, for instance, sensors on machines as well as in material storage and work-in-process locations can trigger orders and material movement. She clarified that TRUMPF’s condition monitoring and production planning software are separate platforms, but fabricators can draw data from both to identify correlations.

“Digitization and automation in the machine tool industry will become more and more important,” Benz said. “There’s a push for the sheet metal industry to digitize the entire process, from order to cash. Considering the amazing trend we see with reshoring, bringing manufacturing back into the U.S., the two major goals that the industry has are to set the standard for high quality parts and be as efficient as possible. Manufacturers will need to do both.”

Root Causes of Unplanned Downtime

Every fabricator is different, so it’s impossible to pinpoint the root causes of every problem, but many can be traced to several general areas. One has to do with instituting a sheet metal design discipline that considers how things are made. If engineers design bends with k-factors, bend allowances, and bend deductions without knowing which tools the brake operator will use, there might be a problem. The same thinking goes when nesting, determining the lead-ins, microtab locations, and blank position relative to the table slats and other blanks on a nest.

Another root cause has to do with organizational, training, and resource issues. It could be a lack of communication, such as between first and second shift, or the fact that a certain programmer was never instructed how and when to move job travelers to the shop floor. It could stem from inconsistent, because-we’ve-always-done-it-this-way tribal knowledge. This itself incorporates problem with sheet metal design (like assigning k-factors but not knowing the tooling that will be used), as well as poor maintenance practices.

The consequences compound as machinery becomes faster and more automated. An automated blanking system might be down for hours or even days—not because of some subtle electrical drive issue or problems in the cutting head optics, but because of dirty slats. Molten metal from the kerf welds to the built-up slag on the slats, so when the automated forks slide in and lift the cut sheet, they lift the entire table with it. Still, beware of jumping to conclusions. Was it only the condition of the slats, or was there something awry in the cutting conditions? Perhaps the slat positions relative to how parts were nested contributed to the problem, or perhaps the position of a microtab (or lack thereof) played a role?

All sources agreed that this is why starting with machine data can be so valuable, both from a production and condition monitoring standpoint. As sensors and software evolve, both will give shops deeper operational insights. Such technology ultimately will help fabricators identify what’s really happening, providing a shared reality that serves as a starting point for smarter improvement.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI