President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices defy predictions of a peak

Demand rises as steel mills keep supply tight, expected to continue into 2021

- By John Packard and Tim Triplett

- December 1, 2020

- Article

- Metals/Materials

With steel prices not receding as expected, fabricators might want to buy steel now instead of waiting for a decline that may not occur until after the first quarter of 2021. Getty Images.

Steel prices continued to move higher through the fourth quarter, surprising many steel buyers who were predicting a peak as new capacity and seasonal factors were expected to bring the uptrend to an end. But steel supplies remain tight relative to demand, and buyers tell Steel Market Update (SMU) that negotiations with the mills have become quite contentious as steelmakers hold the line on spot and are less willing to compromise on contract tons.

In comments to SMU last month, buyers complained about the unusually aggressive nature of the pricing offers from the mills. Some are looking for alternative sources, both domestic and foreign.

“I’m not used to such a combative relationship. The darn mills are taking an odd stance. They are telling us to take it or leave it. There are other places to purchase steel. The mills never learn their lesson,” said one manufacturing executive.

Others reported some flexibility in contract negotiations with certain mills, mostly involving relief from add-ons such as coating extras and freight. But for the most part, the mills are narrowing the window on the volume of tons that must be ordered before they will consider discounts.

As the year winds down, a major event will take place that will impact the flat-rolled steel markets. Cleveland-Cliffs, owner of AK Steel, will finalize its purchase of most ArcelorMittal USA assets (except for its Calvert, Ala., joint venture mill). In comments to SMU last month President/CEO Lourenco Goncalves said his guiding philosophy regarding mill production is creating value. (Goncalves: “I have said time and time again that I am for value, not for volume.”) SMU interprets this to mean the mills controlled by Cleveland-Cliffs would prefer to see the market stay tight and prices high.

As of mid-November, steel supply was limited, and steel spot buyers were having to pay higher prices on almost a weekly basis. With problems at Stelco (computer system hack), NLMK USA (Farrell, Pa., steel mill on strike), and on-time delivery issues with multiple mills keeping supplies tight, the expectation is for flat-rolled steel prices to remain strong through the balance of 2020 and into 2021.

The vast majority (86%) of the steel buyers responding to SMU’s poll in November said they were expecting another round of price increases from the mills soon, and many were not happy about it:

- “I think another round of increases is inevitable, whether it’s a formal announcement or not, but there is still blood in the water.”

- “They haven’t really needed to announce increases; they are able to get them by default.”

- “The mills have raised prices for January absent price increase letters.”

- “Hopefully they will give the market a breather. Have they forgotten about 2018? Binge and purge mentality at the mill level.”

SMU’s survey of service center and OEM executives on Nov. 9-11 revealed an average benchmark price for hot-rolled steel of $710/ton, surpassing the $700/ton level where many had expected it to top out. That’s up 60% from a low of $440/ton in mid-August as the economy struggled with the coronavirus, and it exceeds the $580/ton in mid-March pre-COVID 19.

In summary, the upward slope of the steel prices is as much about the tight supplies as it is about the growing demand as the economy rebounds from the pandemic shutdowns. Mills idled significant capacity in the second quarter and have taken their time about bringing production back. Lead times for delivery of spot tons from the mills have nearly doubled since early in the year as the mills scramble to keep up with orders. As of November, most mills were filling their order books for January already as buyers hurried to secure their share of the limited tons available.

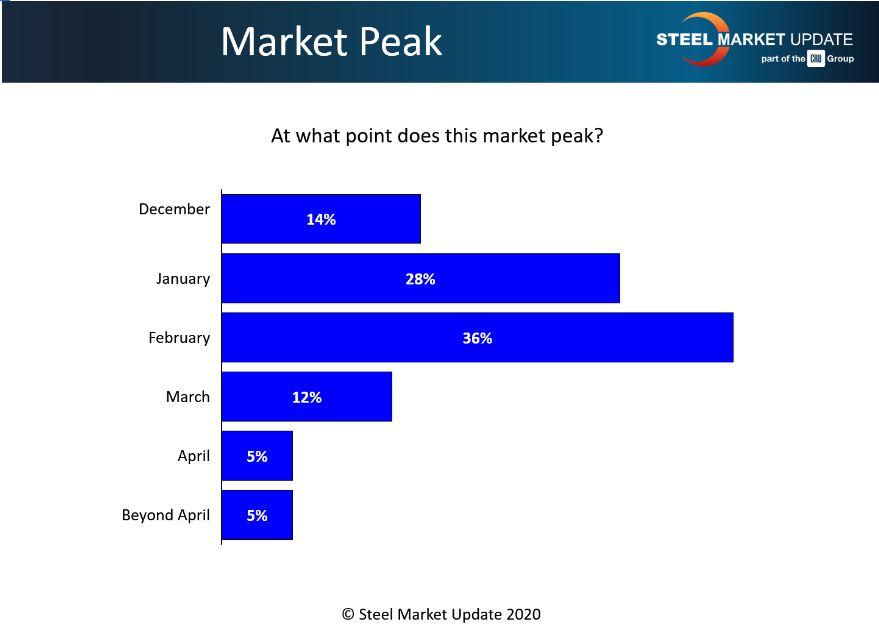

How long will steel prices continue to rise? Forecasts are mixed as there is little consensus on the question. But the majority of buyers polled by SMU in November see prices continuing to rise well into first-quarter 2021 (see Figure 1).

Figure 1. Industry observers who suggested that steel mills couldn’t hold the line on announced price increases have been proven to be wrong. A majority of steel buyers reveal to Steel Market Update that they see steel prices possibly peaking in the first quarter of 2021.

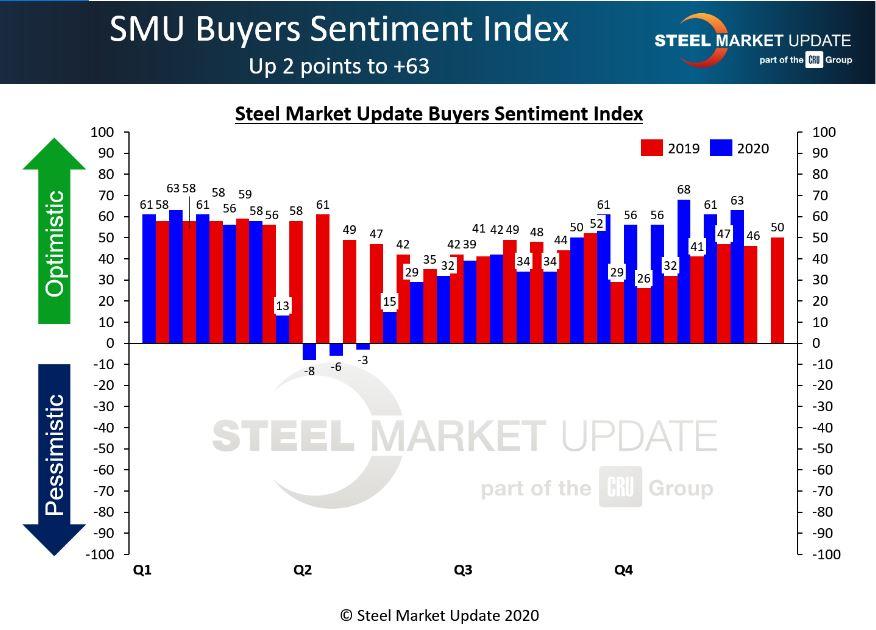

Current and Future Sentiment

Last month’s election had little effect on steel industry sentiment, primarily because steel buyers were already so upbeat. Every two weeks SMU asks steel buyers how they view their company’s chances for success in the current environment and three to six months in the future. SMU’s Current Sentiment Index registered +63 in the week after the contentious presidential contest (see Figure 2), little changed from the +68 in the weeks prior. The Future Sentiment Index was comparable at +62 (see Figure 3). To put that in perspective, current sentiment plummeted to -8 and future sentiment to +10 shortly after the pandemic hit.

That steel executives’ attitudes have recovered so dramatically so quickly is surprising given the ongoing political acrimony and threat from COVID-19. One can only surmise that this bullishness reflects the healthy steel demand and profitable steel prices the market is experiencing as 2020 comes to an end.

Steel Market Update Events

SMU is working in partnership with Port Tampa Bay to host the 32nd annual Tampa Steel Conference on Tuesday, Feb. 2. The 2021 event will be on a virtual platform similar to the SMU Steel Summit Conference produced earlier this year. The daylong program will include a variety of topical speakers as well as a speed networking session. Cost of the conference is $150 per person for those who do not qualify for a discount. Those who have attended the Tampa Steel Conference in the past will get a 50% discount for registrations made by Dec. 31. SMU and CRU member companies qualify for a $25 discount. Visit www.tampasteelconference.com for more details and to register.

SMU also will be hosting a number of steel training workshops in 2021. We will be conducting the popular Steel 101: Introduction to Steel Making & Market Fundamentals Workshop in February 2021. SMU also will be rolling out three new hedging steel price risk workshops. We will have an introductory (Hedging 101) workshop; an advanced workshop, focused on strategy and execution of trades; and a workshop dedicated to hedging galvanized steel. More information about SMU training workshops is available at www.steelmarketupdate.com.

Not a Steel Market Update Subscriber?

SMU provides real-time pricing, news, and analysis of market trends affecting North American flat-rolled steel, plate, scrap, and related markets. To sign up for your free three-week premium trial, email paige@steelmarketupdate.com, or call 724-720-1012.

About the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI