Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2019 forecast: Where do metal fabricators stand for the upcoming year?

A strong 2018 market will continue in the new year as the industry continues to boom behind advanced technology despite Trump’s tariffs and labor shortfalls

- By Gareth Sleger

- December 18, 2018

- Article

- Shop Management

Life has been good for companies in the metal processing, forming, and fabricating industries. Markets across the board have experienced a boom not seen since long before the 2008 recession.

This past year has been a prime example of the flourishing manufacturing sectors. But at some point, there is concern over when the bubble is going to burst. And while the 2019 forecast doesn’t project any major downturns, the overall feeling of many in metal fabrication is to remain cautiously optimistic.

“There’s no reason to be pessimistic or to think that it’s all going to come to a screeching halt,” said Chris Kuehl, co-founder and managing director of Armada Corporate Intelligence and economic analyst for the Fabricators & Manufacturers Association Intl. “But there are little warning signs of concerns on the horizon.”

Riding the Economic Tailwinds

Even with inflation, the ongoing skills gap, and the growing trade war surrounding President Donald Trump’s imposed steel and aluminum tariffs, 2019 U.S. GDP is poised to increase steadily. Kuehl estimated that growth in metal fabrication should keep pace at the national level, between 2.7 and 3.4 percent.

Kuehl pointed to a dozen economic index numbers that show a healthy economy going into 2019, albeit with a few significant headwinds. For instance, the new orders reading in the October Purchasing Managers’ Index (PMI) from the Institute for Supply Management was trending downward.

“It’s important to note that even with these declines,” Kuehl said, “the overall status of these [index] readings remains higher than it has been in several years.”

Regardless, positive trends abound. For instance, automobile sales indices are in positive territory. “Consumers still want their new vehicle, and nothing seems to dissuade them,” Kuehl said.

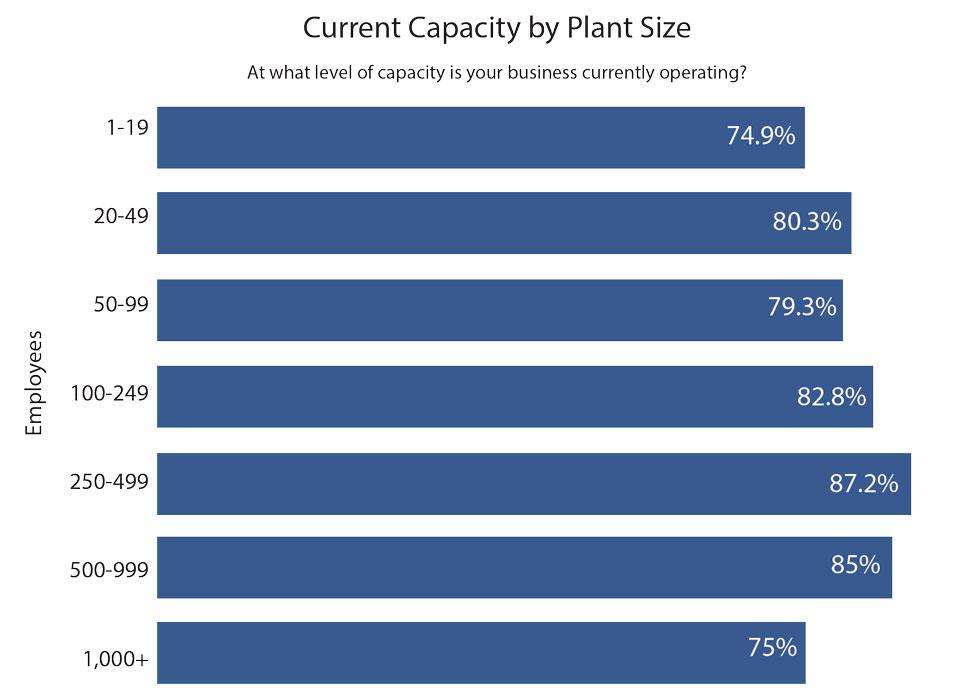

Moreover, surveys measuring capacity utilization numbers are trending around 80 percent, a solid number—not too high, not too low. One from FMA, as reported by its just released “2019 Capital Spending Forecast,” pegs the metal fabrication industry average at 78.9 percent (see Figure 1).

“As far as the industry is concerned, the numbers are always fairly close to the national numbers,” Kuehl added. But that also depends on the sector. For example, companies working within the oil market are poised for a big year, while those in the agriculture business might not see as much growth.

Kuehl also noted that some of the other sectors within the industry that will emerge strongly are energy, aerospace, automotive/transportation, and health care. “We’re seeing a lot more activity in energy than we’ve seen in a while,” Kuehl said. “But the growth in health care has been staggering. So, anybody who’s in that business, whether it’s building medical machines or even providing construction of medical facilities, will continue to do well.”

Figure 1

According to FMA’s 2019 Capital Spending Forecast, capacity at metal fabricating companies is close to 80 percent across shops of all sizes. In the past, Chris Kuehl, FMA’s economic analyst, has called the capacity range of 80 to 85 percent the “sweet spot” --high enough to be busy, but allowing for some slack for new work.

Fabricators Report Robust Forecasts

Cupples’ J&J Co., a Tennessee fabricator with locations in Jackson and Dyersburg, is one company approaching 2019 cautiously optimistic. Jeff Cupples, vice president of engineering and estimating, said the 330-employee company is rest assured for long-term growth but always takes short-term growth with a grain of salt.

“That’s how bubbles go—they can pop any minute,” Cupples said. “I’m a realist: I look for the best, but I’m also keeping an eye out for the worst. We always have an A-B-C plan. My plans always have a backup. If A works, that’s great. But then you have B and C if you can’t do A.”

That plan in 2018 has worked well for Cupples’ J&J, which signed on Caterpillar Inc., Cub Cadet, and Kubota as customers this past year while adding 80 new employees. “They’re all growing heavily with us,” said Cupples. “Midway through third quarter we saw a 28 percent increase.”

And heading into the first quarter of 2019, Cupples’ J&J anticipates purchasing its 25th robotic welding cell along with another laser, two more robots, a few more press brakes, and a horizontal machining center.

The company also has its first two quarters mapped out. “We’ve got the ability to use our customers’ forecast schedules,” Cupples said. “When we can plan ahead like that, we’re pretty safe. So, now we have materials locked in for the first six months of the year.”

Small to medium-sized metal fabrication companies are often at the mercy of a larger company’s influence on the supply chain since they are often so far removed from the ultimate consumer.

“Smaller businesses just can’t use the gauges that bigger companies can,” Kuehl said. “There are just too many steps between them and the ultimate buyer. All they can really do is keep their ear to the ground and be ready for that phone call if it looks like things are not trending the right way.”

One of those companies that expects the market to keep trending the right way in 2019 is EVS Metal, a sheet metal fabricator with headquarters in Riverdale, N.J., and other shops in Texas, New Hampshire, and Pennsylvania.

“Everything that we’re seeing is positive,” said Joseph Amico, EVS Metal’s executive vice president and director of sales. “Positive business performance, positive from our customers’ perspective, positive from our competitors, and positive from our vendors with machinery. We are seeing increases across the board in all of the components that we use to build our metal products. I haven’t seen that in a while.”

With that, Amico is forecasting a big increase in revenue for EVS Metal next year. Heading into 2019, EVS has seen a month-over-month profit growth that’s among the highest level in the history of the nearly 25-year-old company. “It’s been a build over the last few years,” Amico said. “And at the very least, it just shows that people are confident in their business and growth strategies.”

Because of such a profitable 2018, Amico said EVS can afford to still play it fairly conservative in the upcoming year. That includes some small capital investments for the first quarter of 2019.

“We’re not forecasting big expenditures and equipment for the beginning of next year since we’ve already had some pretty big ones leading up through these past couple quarters,” Amico said. “That’s what helped us get through the year and be able to better satisfy our customer base.”

Tariffs and Trade

And satisfying customers in the metal fabrication market became tricky when Trump announced his intention to implement tariffs in March. The ruling placed a 25 percent tariff on steel and a 10 percent tariff on aluminum imports from China that eventually expanded to Canada, Mexico, and the EU in May. In turn, each country retaliated by implementing their own tariffs again the U.S.

“It created a supply and demand issue when the foreign stuff wasn’t coming in,” Cupples said. “But it was a bit of a shock. When it came full bear in the middle of the third and fourth quarter, it slowed us down a little bit.”

But, ultimately, growth in the industry was so strong that the tariffs and the trade war that followed didn’t put much of a dent on the bottom line for many companies.

“I’m pleasantly surprised that all the tariffs didn’t have that big of an impact on our EVS customer base,” Amico said. “I was a little bit nervous when they started announcing them, but most people have understood that there was going to be increases as those came about. And it’s been fairly painless to pass those increases along, as long as we have the supporting information.”

Helping soften the blow of the tariff hit was strength of the U.S. dollar, said Kuehl. And with the dollar at an 18-month high heading into 2019 and showing no indication of weakening, companies should expect the trend to coast through much of the new year.

“We’re the only central bank that’s raising rates,” Kuehl said. “And if the dollar is strong, the U.S. will import more regardless of what you do with tariffs and trade wars. But the frustration is that the deficit keeps getting bigger as the Fed continues to raise rates.”

Achieving the Technological Edge

Another growing frustration for fab shops that doesn’t seem to have an immediate solution is the ever-expanding skills gap. If there’s one downside to the industry’s current surge, it’s that there aren’t enough qualified, experienced, or even willing workers to fill the need.

To make up for that, robotics, automation, and even additive manufacturing will continue to be pumped into businesses to make up for the labor shortage as much as possible. And with robust attendance numbers at this November’s FABTECH® show in Atlanta and September’s IMTS in Chicago, the appetite for advanced manufacturing technology will only intensify in 2019.

“If you’re on the top edge of technology, even when the market starts to head down, you can usually fight the battle a little easier,” Cupples said. “But we’re all having the same problem finding skilled laborers. You can automate as much as possible, but you still need some base labor. We could hire another 30 or 40 people right now if we could find them.”

About the Author

Related Companies

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI