Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

2020 metal fabrication forecast: The big rethink

Fabricators and manufacturers expected to continue to reinvest in a softening economy

- By Tim Heston

- December 9, 2019

- Article

- Shop Management

Fabricators will rethink their technology purchases in the face of a retirement wave and the tightest labor market seen in decades. OEMs will rethink their supply chains in the face of an uncertain trade war. And many will rethink their material purchasing strategies in the face of volatile material pricing. Considering all this, you could call 2020 'the big rethink.' Getty Images

If you were to chart growth projections among metal fabricators, you’d draw a blurry scatterplot. Fabricators serving certain markets expect record revenue next year. Consider FabCorp Inc. in Houston. The company’s telecommunications work, including heavy fabrications connected with the infrastructure needs behind the 5G push, has a rosy outlook for 2020.

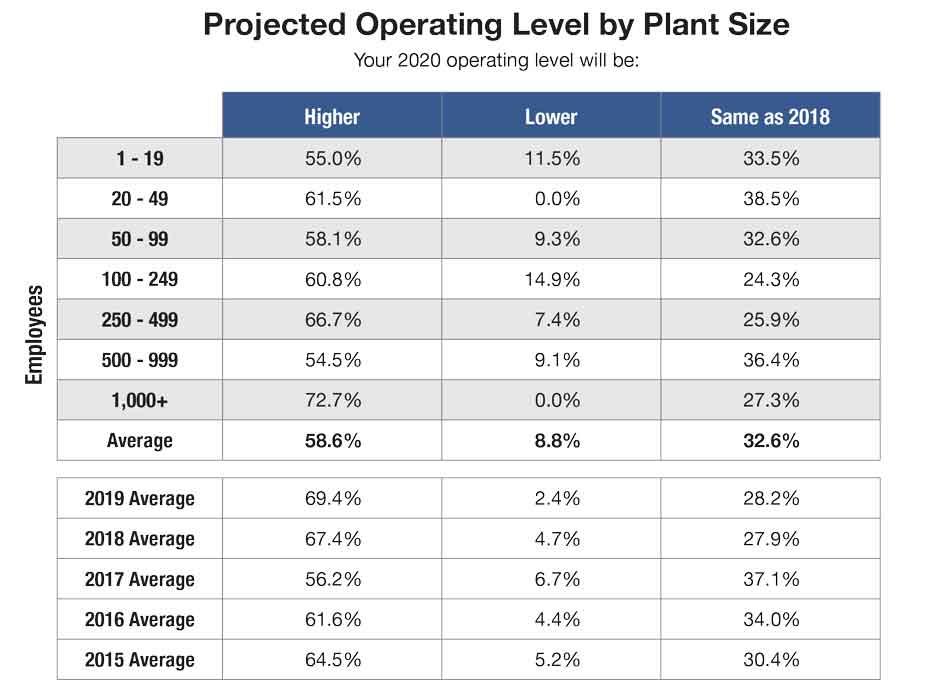

Almost 60 percent of respondents to the “2020 Capital Spending Forecast,” published by the Fabricators & Manufacturers Association (FMA) and released last month at FABTECH®, expect higher operating levels next year. Other fabricators, including large ones that serve OEMs that sell on a global scale, have seen the effects of the global slowdown. They expect 2020 to be somewhat flat.

“Of course, manufacturing has never been a unified business,” said Chris Kuehl, economic analyst for FMA and managing director at Kansas City, Mo.-based Armada Corporate Intelligence. “It depends on what you’re manufacturing. We have sectors that are booming. And we have sectors that are in decline, and ones that are in the middle. The declining ones are those sectors that are most connected to the global economy.”

Some large OEMs, in the face of an unpredictable trade war, are rethinking their supply chain strategies. And the material price fluctuations over the past two years are forcing some to rethink their inventory strategies.

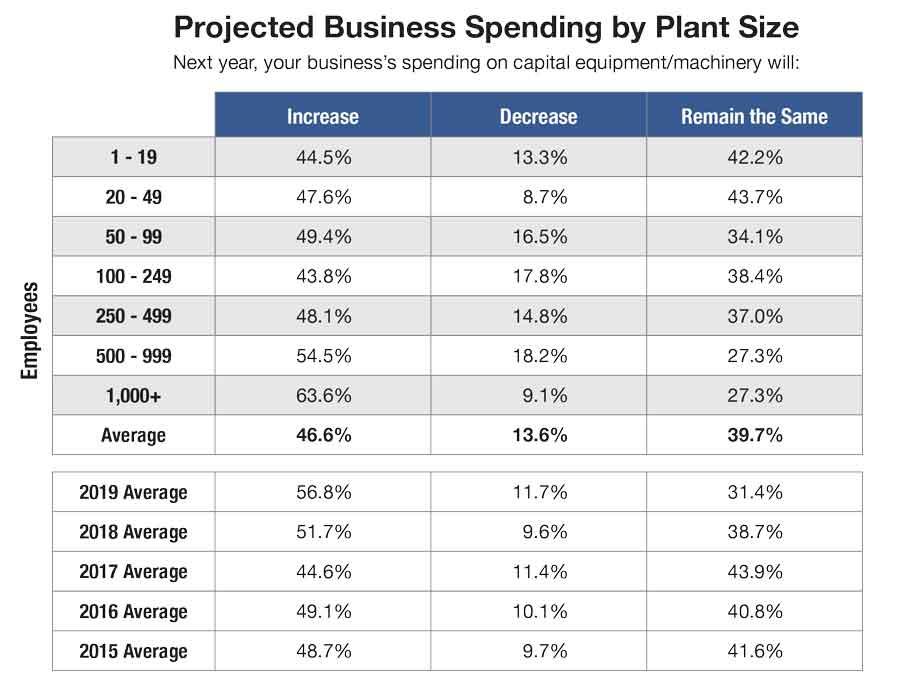

Even so, capital equipment spending projections in the metal fabrication space remain healthy, beating broader capex trends. According to the “2020 Capital Spending Forecast,” equipment spending is holding steady—not a bad outlook, taking into account the record-high spending projections during the past few years. Considering the labor shortage along with big shifts in equipment and software productivity (like the virtually industrywide shift from CO2 to fiber laser cutting), fabricators are thinking twice before slashing capex budgets.

Many expect the election to play its usual role as a kind of economic pause button—not for all on the fabrication market “scatterplot” but certainly for some. But pushing pause won’t mean pure idleness. Fabricators will rethink their technology purchases in the face of a retirement wave and the tightest labor market seen in decades. OEMs will rethink their supply chains in the face of an uncertain trade war. And many will rethink their material purchasing strategies in the face of volatile material pricing. Considering all this, you could call 2020 “the big rethink.”

Strong Fundamentals

“The greatest threat of a recession comes from the global slowdown,” Kuehl said. “For many countries the slowdown would be a huge issue, but the U.S. depends on exports for only about 15 percent of its GDP.” He added that overall GDP is expected to continue to grow in 2020, just at a slower pace—somewhere between 1.7 and 2 percent.

That said, the U.S. economy remains the envy of many around the world. “The fundamentals of the U.S. economy remain very strong. In particular, the fundamentals of the U.S. consumer are the best we’ve seen in decades.” So said George Mokrzan, Columbus, Ohio-based senior economist for Huntington National Bank, who presented at FABTECH last month at FMA’s economic forecast breakfast.

All this provides context when looking at recent reports, be they capacity or production numbers from the Commerce Department or the Purchasing Managers’ Index from the Institute for Supply Management. The latter has reported manufacturing in contraction territory for the past several months. The October PMI®, the latest available at press time, came in at 48.3 percent.

One comment in the ISM report from a fabricated metal products supplier gives a good snapshot. “I’ve been hearing from lots of my suppliers that their business is down, and they are looking for more work ...[but] we remain very busy.”

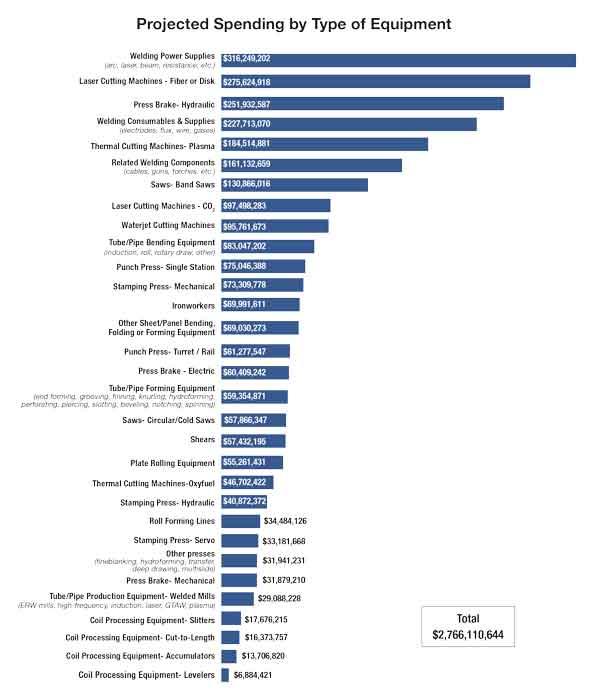

Total 2020 spending projections are virtually unchanged from 2019, but some equipment categories, like fiber lasers and press brakes, show significant gains.

Rethinking Capital Spending

In November the Commerce Department reported a capital spending decline of about 4 percent—nothing worth ringing alarm bells over, but a sign that the boom over the past two years is ending.

But spending in metal fabrication looks a little rosier. FMA’s forecast projected equipment spending to be $2.76 billion in 2020, just a hair stronger than last year’s $2.75 billion projection. And a few equipment categories are seeing truly massive gains.

Fiber laser cutting machine spending is expected to hit $275.6 million in 2020 and will continue its market domination, leaping more than 40 percent higher than 2019 projections. 2020 spending projections for CO2 laser cutting systems fell to $97 million, a 36 percent drop.

Meanwhile, press brake spending is reaching record highs, with 2020 projections jumping a full 50 percent, to $252 million—most likely a reflection of the industry’s push into high-end press brakes and automation to handle the increased throughput from the fiber laser.

Some equipment categories—shears, ironworkers, certain types of stamping presses—show declining spending levels, hence the flat growth projection for next year. But overall, the spending levels remain strong.

Even if a slowdown or recession were to occur in the next year or two, few expect it to be a repeat of the credit crisis and ensuing financial fallout of a decade ago, which means the financing for manufacturing technology investment will still be there.

Moreover, a decade ago an equipment upgrade didn’t give shops quite the productivity boost as it does today. A case in point is, of course, the fiber laser. Minnesota-based BTD, one of the country’s largest contract metal fabricators, has replaced all but a handful of its CO2 lasers across all its locations with fiber lasers. According to Jared Lotzer, vice president of sales and quality, one fiber laser at BTD has about twice the throughput of its older CO2 lasers.

“And we’ve also put a renewed focus on automation in our bending and forming,” he said, adding that the company has invested in robotic press brakes as well as robotic feed mechanisms (including some collaborative robotic systems) for its stamping operations.

And, as Lotzer explained, the spending continues unabated, despite a less-than-stellar 2019.

“Many of our customers peaked during the first quarter of 2019,” he said. “So during the first half of 2019 we saw strong demand; then we saw volume declines during the second half. So by the end of the year, it looks like 2019 is going to end flat with a lot of the markets we serve.”

A majority of respondents to the “2020 Capital Equipment Forecast” expect operating levels to be higher.

He added that recreational vehicle markets remained strong, reflecting still-strong consumer sentiment across the economy. “The biggest downtick we’ve seen is in the oil and gas sector and in construction.”

He said that agriculture equipment is also soft, but not as soft as oil and gas, thanks in large part to less demand for oil service products and lower returns on new fracking projects.

Through it all, there have been wild swings in material pricing and, hence, inventory values. “We’ve had to maintain really transparent communication with our customers,” Lotzer said, “so you’re not stuck with inventory values that you can’t move through the supply chain.”

Rethinking Supply Chains

Donald Bly knows all about moving product through the supply chain. He’s a management consultant and partner at New York-based Applied Value, a consulting and investing firm that works with large OEMs across manufacturing, from automotive and appliance and construction to off-road vehicles and industrial equipment. Its investment firm owns a structural and architectural fabricator that’s heavy into warehouse construction, and judging by the growth of e-commerce, its positive outlook for 2020 is no surprise. But Bly also sees significant challenges ahead.

“We’ve seen a downtick across a lot of industries,” he said, “particularly automotive, which has been well-publicized. But a lot of other companies among our client base have started to react and hunker down from a cost standpoint.” This includes the commercial truck segment, where some OEMs predict significantly lower production in 2020.

Bly has worked with a variety of OEMs on adapting a supply chain strategy that can adapt to larger economic trends. In 2009 it was about right-sizing supply chains and consolidating the supply base, a practice that has helped some of the world’s largest and most successful contract fabricators grow even larger, improve their profitability, and develop strategic partnerships.

“Over the past two years, though, OEMs have been scrambling to find new suppliers that are going to be able to meet increased demand and give them capacity,” Bly said. “So over the past year or two especially, we’ve seen more steel service centers attempting to increase their fabrication services.”

With supply chain management comes risk management, especially when it comes to fluctuating material pricing. Material prices have skyrocketed and then plummeted within the past year. OEMs can deal with consistent material prices; but when prices fluctuate wildly, it becomes difficult to plan product development, especially when material is the greatest cost component.

“Companies are getting more into risk management,” Bly explained. “They’re asking, ‘How do we procure the material and components that we need [white managing] the risk of the price fluctuations up and down?’”

Companies now are utilizing financial instruments like hedging to reduce exposure to price volatility. But they’re also re-evaluating the supply chain and the geography of their manufacturing footprint.

A majority of “2020 Capital Spending Forecast” respondents said their spending levels will either increase or stay the same.

“Several of our clients buy steel from steel suppliers in the U.S., ship it to Canada to form a component, ship it to Mexico for assembly, then ship the final product to the U.S. and elsewhere globally,” Bly said. “Given everything that’s gone on with the tariffs, they’ve asked, ‘What do we do in complex situations where tariffs in each country can compound the complexity?’”

Nowhere has risk management been more acute than the automotive supply chain. The Ann Arbor, Mich.-based Center for Automotive Research (CAR) has two distinct forecasts for 2020—one if nothing changes on the tariff front, another if certain tariffs go into effect for imported vehicles and parts.

If nothing changes, CAR’s 2020 forecast is for 16.4 million units sold, followed by 16.2 million units in 2021, after which sales numbers should recover.

“But if these tariffs do hit at 25 percent, they would have substantial negative impacts on the industry,” said Bernard Swiecki, CAR’s assistant director of research. Even if the tariffs go into effect, that 25 percent is still “a theorized amount,” Swiecki said, adding that the powers that be might decide to impose different tariffs. Or they might delay them altogether—which, according to early November comments from Commerce Secretary Wilbur Ross, might be the case.

So what effects would those tariffs have? “The average U.S.-built vehicle would be about $2,000 more expensive and the average import about $3,700 more expensive,” Swiecki said. “We believe this would reduce sales by 1.2 million units and take about 368,000 jobs out of the economy.”

Is Protectionism the New Normal?

The big “supply chain rethink” occurs with the rise of protectionism, not just with the current administration but across the political spectrum. According to Kuehl at Armada Corporate Intelligence, it’s one reason behind the steel mills’ push toward equipment upgrades and overall modernization.

In the short term it looks as if they’re increasing production capacity just as material prices swoon. But a longer-term strategy is at work. Aging U.S. infrastructure means demand for steel will eventually improve. “And I also think [the mills] recognize that they’re likely to have more protection than less in the years to come,” Kuehl said. If political powers change in 2020, more trade concessions might be on the table, especially between Canada and Mexico. “But I don’t know if either Democrats or Republicans will completely open up the market to foreign competitors.”

During his FABTECH presentation, Mokrzan showed a chart that gave a macro-perspective on tariffs and the effects of protectionism in the U.S. It showed inflation rates of goods, education, medical expenses, and real estate. Education and health care prices have skyrocketed since the turn of the millennium. But the same can’t be said for durable goods, which—again, on a macro level—has experienced near-zero inflation over the past 20 years. Food has followed a similar trend (though inflation has been higher than goods).

“And the tariffs have affected food and goods,” Mokrzan said, adding that this has mitigated the tariffs’ negative consequences in the U.S. He conceded that, yes, many manufacturers are feeling short-term pain. “But time will heal many of these wounds.”

Rethinking the Importance of Partnerships

“I expect the first half of the year to be slow, but based on what we’re hearing, both from our customers and from general economic indicators, we feel the second half [of 2020] will be very strong.”

Most metal fabricators and manufacturers expect softening growth in 2020, but business reinvestment continues unabated. Getty Images

So said Eric Miller, president of Miller Fabrication Solutions in Brookville, Pa., a large contract fabricator serving the construction and transportation markets, among many others. And he conceded that the trade war and, especially, material price variability have affected the company’s bottom line.

That said, the company is deep into lean manufacturing. It has a dedicated continuous improvement manager and plans to expand its staff dedicated to process improvement—that is, people who concentrate not on what shipped and when (as production management does), but the actual processes that went into shipping those products. Rock-solid processes build delivery reliability, which in turn builds that “customer stickiness” that so many fabricators strive for.

“Yes, when we see steep changes in material pricing, that’s generally not good,” Miller continued. “But pricing has stabilized, hopefully for a while.” Regardless, recent volatility “really shows how important having strong partners is, both on the customer side and the supplier side. If we have a good working relationship with suppliers and customers, we can all work together and approach problems with an open mind. Moving forward, we’re all going to see just how much good partnerships really matter.”

The complete “2020 Capital Spending Forecast” is available at the FMA store.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI