Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Metal fabricator’s shift toward dynamic markets pays off

Tenere focuses on speed, flexibility, and scalability in high-demand sectors through pandemic

- By Tim Heston

- November 9, 2020

- Article

- Shop Management

Engineers at Tenere Inc. have seen a lot of highway during the pandemic, driving between the company’s U.S. locations in Wisconsin and Colorado. Like many organizations, Tenere has implemented strict policies to curtail COVID-19’s spread, including masks, social distancing, and no commercial air travel without a two-week quarantine or testing. Often it was just easier for engineers to just hit the highway.

Tenere’s road warriors aren’t driving thousands of miles for meetings that could be done over video chat. They’re installing sheet metal assembly and hardware insertion lines designed to be both automated and flexible. It’s part of the company’s overall expansion strategy to meet ever-changing demands from customers.

Engineers aren’t simply completing capex projects launched during the good times, before business fell off a cliff. In fact, Tenere’s business hasn’t seen any cliff at all. According to Brian Steel, CEO, the 700-employee contract manufacturer—which specializes in sheet metal, machining, and plastics—could grow by as much as 20% in 2020. The company has accomplished such growth by seemingly defying conventional wisdom. By some measures its revenue mix is less diverse than it was four years ago, and it’s never been busier.

Refining the Revenue Mix

Six years ago, experiencing record revenue from customers in just a handful of sectors would have thrown up red flags during board meetings. High revenue concentration is custom metal fabrication’s Achilles heel: A shop grows off the back of a handful of customers in a specific industry, which after a boom period experiences a crash; the fabricator suffers and then rebuilds with diversification as a top priority. It’s a common story, but it isn’t Tenere’s story.

Not long ago the fabricator served customers in the renewable energy space, information and communication technology (ICT), lawn and garden, ag equipment, and more, operating through sheet metal and machining plants in Dresser, Somerset, and Osceola, Wis.; machining and plastics manufacturing in Westminster, Colo.; as well as additional capabilities in Monterrey, Mexico. It seemed to be a safe strategy. If one market declined, another market would pick up the slack, and all would be well, right?

Not necessarily. After Steel joined Tenere four years ago, he and the leadership team took a hard look at the business. “It was true that we were following the traditional thinking,” he said. “For a sustainable business, you needed to operate across a broad range of markets, so that when one’s down, another is up. But after some deep analysis, we discovered that in some markets we were losing on efficiency, profitability, and the ability to delight our customers.

“It was costing us extra money to serve such a broad range of markets, and even with that expanded effort and energy, we weren’t best in class in many of those markets. We just dabbled across them all. So we sat back and asked, What are we really good at? Just as important, What are customers willing to pay for?

“What we found is we’re really good at fabricating thin sheet metal to tight tolerances and integrating plastics and metal. Overall, we’re really good at speed, scalability, and flexibility.”

Determining a fabricator’s core competency is the easy part; actually using that insight to drive the business isn’t so easy, especially when it involves exiting large contracts—in Tenere’s case, very large contracts. Steel described exiting a contract worth more than $4 million annually.

These relationships weren’t bad; some had given Tenere awards for quality and reliability, in fact. Even so, the work itself didn’t take advantage of the company’s strengths. Customers had lengthy forecasts and products didn’t change regularly in significant ways. Tenere had invested in flexible manufacturing technology and engineering expertise, yet some customers simply didn’t need that.

A new Prima Power automated panel bender has reduced the bending cycle time for some of Tenere’s products significantly, by more than 90% in some cases.

“Some customers didn’t need what we were really good at, where our energies were,” Steel said. “So we instead looked at top dynamic markets like ICT and renewable energy, areas where the technology is changing very rapidly. We sought to start working with more innovators in those markets. Our whole goal was to find companies at which technologies change significantly every 18 to 36 months.”

These markets have their own challenges, of course. For one, demand can vary dramatically, not just from rapid product development cycles, but also from global supply chain constraints. For instance, even before the pandemic, demand from the ICT sector varied significantly with supply chain constraints for memory and other electronics. “There’s nothing we can do about it, and there’s nothing our customers can do about it,” Steel said. “All of a sudden, demand drops for five or six weeks as we wait for the smart stuff [the electronics] to show up again as we wrap our custom sheet metal around it.”

The ICT space has many subsectors, from hyperscale computing in data centers to fiber deployments by the communication carriers, and each has its own demand variabilities. At certain points business for those who supply data centers might be sky-high, yet sheet metal work supporting fiber deployments becomes nearly nonexistent. “Now we’re seeing the fiber work grow again as governments are passing legislation to get fiber to rural communities,” Steel said.

Tenere focuses on custom enclosures, not commodity items, which brings up another challenge of dynamic markets: Commoditization happens in a hurry. For Tenere, that means focusing on the next generation of products and ramping up the current generation quickly.

The company stays away from commodity products in renewable energy, too, especially the commercial side of the business. “That’s why we play only in the consumer side of renewables,” Steel said, be it part of residential roof systems or enclosures around battery storage units. “The real shift is in the storage of renewable power and the distribution of that power at the consumer level. Battery technologies are changing constantly, and so the custom mechanicals that wrap around them need to change with them.”

Long term, ICT will become like any other utility, and the pace of innovation will slow, but a lot of innovation will happen between now and then. Much of the change now involves designing data centers with increased density (more compute power in less space) and lower energy consumption. “And that’s driving the market toward custom mechanicals and away from standard racks and chassis,” Steel said, “And that will certainly help us.

“If we see hyperscale data centers slow—and I don’t know when they will because the pandemic has pushed up demand significantly—around the corner is 5G and compute-at-the-edge,” Steel continued. “That’s going to drive even more customization.”

Flexible Fabrication and Automation

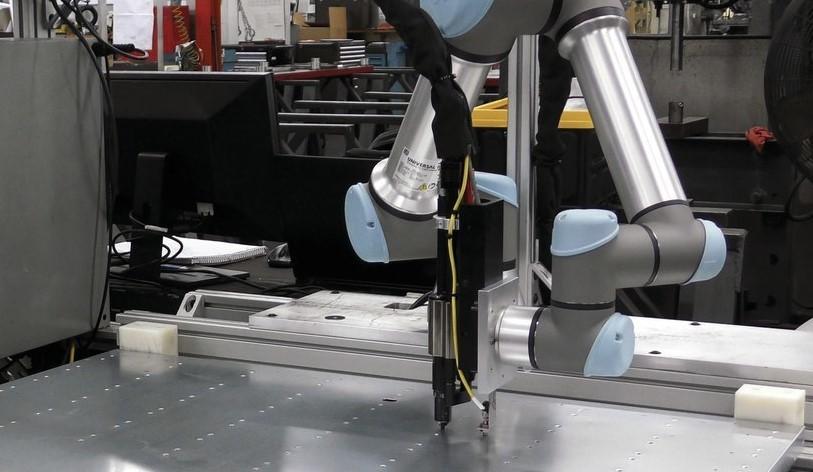

Dynamic markets require dynamic manufacturing technologies with either universal tooling or tools requiring little to no changeover: laser cutting, punching, press brakes with automatic tool changes, panel bending. Tenere’s marrying dynamic manufacturing with flexible automation, including the robotized hardware insertion and riveting lines those road-warrior engineers have been integrating in recent months. That line is being designed with custom fixturing tables.

“We’re making them portable so we can move them into a position where they can take on a specific function within the line,” Steel said. “When the product run stops in two or three months, the fixturing table can be moved to another area of the line, and the robots can be reprogrammed.”

Some robots are dedicated to one hardware machine and some interact with multiple hardware machines, depending on the size and shape of the workpiece. Some hardware or riveting lines are designed to handle laser-cut blanks before passing the parts on to the press brake. Others take formed parts from the press brake and manipulate them to insert hardware.

Design for manufacturability also comes into play. If, say, a part needs a few features to be eliminated, redesigned, or repositioned so it can lie flat for panel bending, Tenere works with the customer to make it happen. The fact that many customers in the ICT and renewable sectors are open to part design changes, especially if they drive down cost through automation, was a big reason Tenere shifted its focus toward dynamic markets.

The Role of Stamping

It’s a common strategy, especially for large players in custom sheet metal manufacturing, to manufacture a product through its life cycle curve. In Tenere’s niche, the curve is steep, signifying a rapid ramp-up to significant volumes, hence the importance of flexible automation in cutting, bending, and welding. Even so, the product life cycle is too short, and the part design is too mutable to justify a hard tool—right?

As Steel explained, this depends on the kind of stamping a company does. What if tooling engineers attempt to put as many cutting and forming operations as possible into a single progressive die in a high-tonnage press? Tool development and implementation take time, but once perfected, stamping’s productivity just can’t be beat. That said, a part needs to have significant volume to amortize the tool. Considering Tenere’s shift toward dynamic markets, where does that leave stamping—especially considering the nearshoring and reshoring trends in ICT?

As Steel explained, “We see outsized growth potential in stamping, which has not been our core business. We do have stamping equipment in Wisconsin and Monterrey, but most of our revenue still comes from soft tool fabrication [such as laser cutting, punching, and bending with press brakes and panel benders]. But with shifts in supply chains from China, we’re seeing significant demand for higher-volume stamping, especially in the ICT space, so we’re preparing for that as we move forward.”

That said, Tenere won’t limit itself to progressive die applications. Steel said that the company sees increasing potential in transfer press applications with simpler tooling to produce the higher-volume common-building-block parts that integrate with various customized sheet metal assemblies.

Instead of spending 10 to 14 weeks developing a complex prog die, engineers, both stateside and at a partner in Asia, will spend six to eight weeks developing simpler tooling and getting a transfer press line up and running. With this strategy, a part design change might require new tooling for only a few stations on the transfer line.

About Scaling Up

Steel doesn’t hide the fact that Tenere has been lucky when it comes to the short-term effects of the pandemic. The company’s focus has been on dynamic markets, and it just so happens that many of them have benefited greatly from the new world brought about by COVID-19.

Also, just because Tenere is serving high-demand markets in 2020 doesn’t make it exempt from logistical challenges COVID has introduced: spreading out operators as necessary, policies for visitors and truck drivers in shipping and receiving, acquiring the necessary PPE, and so on. Early on hand sanitizer was so scarce that the company made its own with alcohol purchased from a nearby Wisconsin distillery. And because most workers in the Monterrey plant take public transportation, which increases risk of infection, the company now offers private busing for all employees at that plant.

Like many fabricators, Tenere has been dealing with constrained supply chains. PPE aside, Tenere hasn’t experienced supply chain disruptions, but its customers have, so the fabricator has had to adapt.

Then there’s the travel constraints. Along with the road warriors driving between Colorado and Wisconsin, Tenere has had to develop strategies to implement planned equipment and facility expansions in Monterrey.

“Expanding the Monterrey operations is our biggest challenge now,” Steel said. “We simply can’t get a team down there on a regular basis to open the facility and install equipment. So we’re hiring resources in Mexico to support us.”

Over the short term, Steel said that Tenere will likely benefit from being countercyclical, hiring when others are furloughing and laying off, especially in Wisconsin. “Some fabricators, through no fault of their own, are just in the wrong industries right now. That has made some great talent available, and we think we might have a one-time opportunity over the next year or so to add talent that we couldn’t’ otherwise bring to the organization.”

Some of that talent will be brought on to progress Tenere’s automation efforts. In fact, despite a labor market that’s starkly different from what it was just eight months ago, the company hasn’t abandoned its flexible automation investments. There’s simply no other sustainable way to execute Tenere’s quick-to-scale-up strategy.

“The most difficult thing to scale in a shop is labor,” Steel said, “so our investment in automation continues.”

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Steel industry reacts to Nucor’s new weekly published HRC price

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

Are two heads better than one in fiber laser cutting?

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI