Western U.S. Regional Sales Manager

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

The business case for abrasive waterjet cutting

This waterjet system should impact production by driving down per-part costs

- By Geoffrey Ericson

- August 3, 2020

- Article

- Waterjet Cutting

An abrasive waterjet system should lower production costs and, for job shops, make capacity easier to sell. The per-part cost is central to this equation. Getty Images

“How can they possibly be making money on this job?” It’s a question people across metal fabrication continue to ask, usually after learning about a seemingly below-cost bid from a competitor. Many assume it’s just a low-ball offer to get the customer in the door; the competitor won’t be able to deliver at that price for long, and within a few weeks or months the prospect will be back requesting another quote.

This happens, of course. That said, big economic downturns—be it the dot-com bust, the Great Recession, or the great economic paralysis of 2020—tend to weed out those shops that don’t have a good handle on their costs. That leaves high-performing operations that manage costs very well, and when they do underbid the competition to win work, they tend to keep it and, even better, maintain or increase their profitability.

How exactly do they do this? They focus on operational excellence and scrutinize the entire quote-to-cash cycle. As part of this, they focus on their cost per part. As they continue to make strategic technology investments, their per-part cost continues to drop. This happens, however, only if a fabricator considers the big picture and weighs all the costs associated with buying and operating a certain technology.

Abrasive waterjet cutting is a prime example. Understanding all the costs associated with the abrasive waterjet process—and especially how these costs apply to the intended application—isn’t as straightforward as it might seem.

Abrasive Waterjet Basics

The abrasive is waterjet’s cutting edge. A science unto itself, selecting the right garnet abrasive hinges on your waterjet system setup, what you’re cutting, and the edge quality you need. But the abrasive is only half the equation; the other half involves how those sharp-edged abrasive particles propel through the kerf.

It starts at either a direct-drive or intensifier pump that generates high-pressure water, which flows through a jewel orifice and becomes high-velocity water. The water and abrasive mix in the mixing chamber where the abrasive particles accelerate to speeds close to that of the water stream. They are then refocused into a cohesive cutting stream through the mixing, or focusing, tube. The focusing tube’s inside diameter is usually recommended to be three times the diameter of the jewel orifice. For example, a 0.010-in.-ID orifice would be coupled with a 0.030-in.-ID mixing tube.

The idea is to optimize an abrasive waterjet stream’s velocity and power density for the application. Give the right velocity and power to the abrasive particles cutting through the workpiece, and you make the cutting action more effective.

Since 1971 waterjet cutting systems have been in operation around the world at fabrication shops. There have been many technology advances in the last 49 years. In 2008 waterjet manufacturers introduced 90,000-PSI waterjet pumps to improve production capabilities.

Over the years many have dissected the waterjet cutting process, describing the merits of different pumps, pressures, cutting head setups, and tables. These are all just pieces of the puzzle, though. What really matters are the results. The business owner needs to put together the pieces in the right way to meet or exceed quality requirements while providing the lowest cost per part for the majority of the job mix.

Dissecting the Cutting Costs

A pump’s operating cost varies directly with its horsepower (see Figure 1). Pumps with greater HP can drive more water and abrasive through wider orifices. The maximum orifice size for a 60-HP, 90,000-PSI pump might be 0.011 in., while a 125-HP, 90,000-PSI pump can drive a larger stream at high velocity through a 0.016-in. orifice.

Yes, operate a 30-HP pump next to a 125-HP pump over an eight-hour shift and the 125-HP will rack up more operating costs. But this doesn’t reveal the true cost per part. In fact, buying a waterjet based purely on its high horsepower is a bit like buying a large pickup truck, parking it in the driveway, and then looking for something to haul. For business owners who use their truck as a tool, what they purchase depends on what they need to haul. Similarly, fabricators buy equipment, including a waterjet system, based on the mix and volume of jobs they have now and would like to have in the future.

The cost per part will vary with the job, but the variables are largely the same. To illustrate, let’s start with a specific job—a 1-in.-thick aluminum square with 50 in. of cutting area and a quantity of 250 parts—tested with different waterjet pumps from one manufacturer (KMT Waterjet) with different horsepower and pressures.

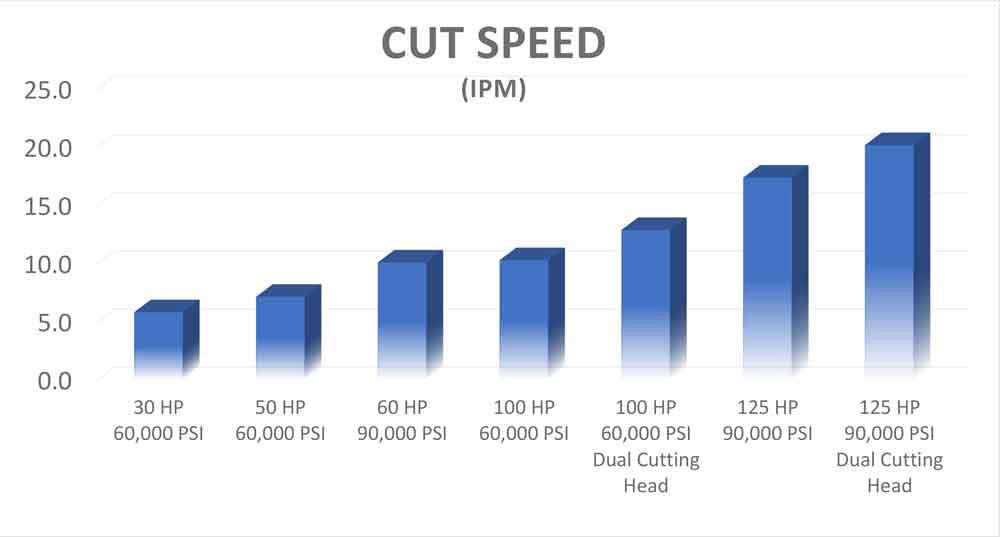

The test results in Figure 2 show that cutting speed generally varies directly with horsepower too. For this aluminum-cutting job, the more horsepower the pump has, the higher the velocity of the waterjet stream, resulting in a faster cut. Considering this, it’s no surprise that overall capacity increases with horsepower as well (see Figure 3). Running machines with greater capacity, operators can cut more parts per day and multitask.

But even all this doesn’t tell the whole story because it glosses over one of the greatest costs: abrasive use. Depending on the pump, the specific abrasive used, the amount, and the number of cutting heads, abrasive utilization makes up between 50% and 75% of total operating costs.

Figure 4 shows the aluminum job’s abrasive use. Abrasive use varies with PSI, and this again has to do with the power and speed behind the individual abrasive particles. With the combination of more horsepower and increasing operating pressure from 60,000 to 90,000 PSI, the velocity of the waterjet stream mixed with garnet means that a system will use significantly less abrasive to cut parts faster. For this job, the pumps with higher PSI used far less abrasive than pumps with lower PSI.

Using less abrasive has significant implications. Typical operating cost calculations incorporate only usage—that is, the amount of abrasive that flows through the kerf and into the tank. But the hidden costs abound, especially in abrasive handling. This comprises the initial out-of-pocket cost of purchasing more abrasive, more storage space, transporting the abrasive around the facility, unloading it into the machine hopper, removing it from the tank, and disposing it. Ten hours a week transporting abrasive around the shop, with an hourly labor rate of $40, can add up to about $20,000 a year.

Business Case for Ultrahigh-pressure Waterjet

Driving down the cost per part involves more than choosing a setup that gives you the most inches per minute. Again, IPM is just one part of the equation. Higher pressure, reduced abrasive use, and increased cutting speed work together to drive the per-part cost down, leading to the per-part costs shown in Figure 5.

Say you need to choose between a 100-HP pump at 60,000 PSI, a 60-HP pump at 90,000 PSI, and a 50-HP pump at 60,000 PSI. Figure 1 shows that the operating costs for the 100-HP pump are of course higher. Figures 2 and 3 show that both the 60-HP and 100-HP systems cut these 1-in. aluminum parts to a smooth edge at basically the same speed. The 50-HP system cuts a little slower, though not dramatically so.

But again, this isn’t the end of the story. As shown in Figure 4, that 90,000-PSI system used much less abrasive. That’s why this ultrahigh-pressure 60-HP system can cut this job at almost $1 less per part than the higher-HP system and almost $3 less per part than the lower-HP system.

At the high and low end of the pump spectrum on the graph, the differences become even more stark. A 125-HP pump can cut this job at less than half the per-part cost as a 30-HP pump.

Figure 1

Operating costs rise with horsepower, but this isn’t the whole story. (Operating costs in this chart include abrasive usage, $0.30 per pound; utilities; and consumable and wear parts.)

By weighing this cost per part against the return on investment (ROI), you can tackle new waterjet technology with eyes wide open to the complete picture. A lower-HP system of course will have a shorter ROI than a higher-HP system. But the higher-HP system’s ROI can be variable, especially if the average per-part cost is significantly lower. That lower cost might push the volume of waterjet cutting work skyward and, hence, shorten the ROI.

The Effects of Technology

Every waterjet operation has its niche, its desired ROI, and unique market situation, which is why such a variety of waterjet systems are available. Success hinges on an operation’s ability to sell its capacity, and the idea is to make selling that capacity easier.

Determining the cost per part effectively translates a waterjet system’s specs, like HP and PSI, into a variable that can fit into a job shop’s “selling waterjet cutting capacity” equation. For sure, cost per part isn’t the only factor. Market dynamics play a role too, as do other manufacturing steps in a shop’s job routing. A “cut only” job is very different from a waterjet-cut part that’s just one piece of a complicated job routing with a multilevel bill of materials.

Even so, the cost-per-part calculation remains critical. In many cases it’s the key ingredient that allows a fabricator to gain more share in existing markets and introduce waterjet cutting to entirely new markets.

Say a prospect wants to replace an expensive machining process with waterjet cutting. He calls around to various shops and receives a range of prices, all lower than the current machining operation. But there’s the engineering approval process to consider, perhaps a few design changes to optimize it for abrasive waterjet. Is it worth it?

Then the prospect calls another shop that quotes a price far lower than everyone else, and the prospect decides to take the leap. How can this shop possibly make money? It isn’t low-balling blindly. Instead, the shop invests in technology, knows its per-part costs and ROI target, prices accordingly, wins the work, and still ends up being one of the most profitable operations in the area.

About the Author

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI