Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

How does the expanded steel and aluminum tariffs impact metal fabricators?

Industry analysts weigh in on evolving U.S.-China trade war and economic impacts of COVID-19

- By Gareth Sleger

- UPDATED March 3, 2020

- February 29, 2020

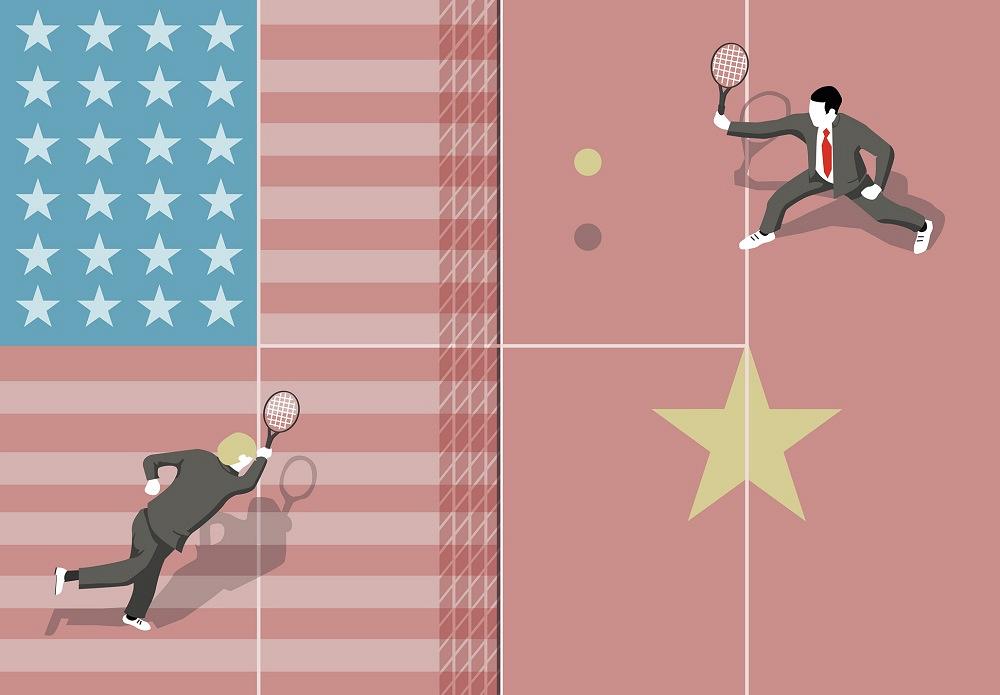

It’s been a busy month on the trade and tariff fronts. The Trump administration expanded Section 232 tariffs on various steel and aluminum products, while China has cut back its tariffs in the face of the Phase 1 trade deal and spreading coronavirus. What does it mean for metal fabricators? Getty Images

It’s been a busy month on the trade and tariff fronts.

The past several weeks have seen the U.S. and China sign a “Phase 1” deal to relax trade war tension; the Trump administration expand tariffs on steel and aluminum products; China reduce tariffs on many American products; bipartisan support to move forward with USMCA; and, of course, the continued economic side effects of the COVID-19 virus.

So, what does all this mean for metal fabricators?

As far as the expanded steel and aluminum tariffs that went into effect Feb. 8 go, there should be minimal impact – at least for now, said Chris Kuehl, managing director at Armada Corporate Intelligence and economic analyst for FMA.

“So far what's being discussed is pretty minor,” Kuehl said.

The tariff expansion is meant to protect against imports of steel and aluminum products like nails, tacks, as well as stamped car and tractor parts. And the impact of these tariffs really depends on where exactly metal fabricators and manufacturers fall in the supply chain.

If the material that fabricators are using will be affected by the tariff expansion, it’s going to add an obvious cost. That means shops will have to source elsewhere, eat the cost, or pass costs on.

“I think most of their reactions will be to source from somewhere else,” Kuehl said. “Most of the fabricators that I know don't import as much from Asia as they do from closer sources like Canada and Mexico. So, they won't really be affected. Even if they can't source from somewhere else, then their next most common response would be just to pass the cost on to the ultimate consumer if it's not too much.”

There’s also the fact that the exemptions surrounding the Section 232 tariffs are still fairly broad. Argentina, Australia, Brazil, Canada, Mexico, and South Korea are exempt from additional tariffs on steel products, while Argentina, Australia, Canada, and Mexico are exempt from tariffed aluminum goods.

Since the expansion announcement, several importers and distributors of steel and aluminum products have either filed for exemption or sued the Trump administration. PrimeSource Building Products, for example, was one of the first major importers to successfully appeal the imposed expansion. Others like Huttig Building Products and Omani nail company Oman Fasteners LLC recently followed suit.

Kuehl added that the steel and aluminum industries are both dealing with a lack of demand. “A lot of the steel industry wants this administration to knock it off with this and just figure out a way to increase demand – not that it's that easy, but what we need right now are more cars, more trucks, more repaired bridges and roads.”

Like many manufacturing economic analysts, Kuehl wasn’t surprised that steel and aluminum tariffs were expanded to products.

“As many were pointing out, even two years ago, the way to get around the tariffs is just to sell the product made from steel and aluminum,” Kuehl said. “But there are so many ways to get around this restriction as well. All these products have to do is originate from some other country. So, I don't know that it's going to have a big impact on anyone.”

One metal fabricator that sees the expanded tariffs as a positive is Jeff Cupples, vice president of estimating and engineering at Cupples’ J&J in Jackson, Tenn. When the original steel and aluminum tariffs were implemented in May 2018, Cupples said his shop hired around 100 people.

“It’s been good for us,” Cupples said. “Part of our hiring explosion was because people were excited about the boom we were going to have here. Companies stopped ordering quite so much overseas and things ramped up here because of President Trump and the things he was doing. There was a bit of a slump when material prices shot up. But it’s all stabilized for us now.”

Phase 1 trade deal and China tariffs cutback

In mid-January Trump and China Vice Premier Liu He met in Beijing to sign the Phase 1 deal to get the ball rolling on reducing tariffs and years of trade tension.

According to the agreement, China has committed to $77.7 billion in additional manufacturing purchases from the U.S. over two years, a $32.9 billion increase in 2020 and a $44.8 billion increase in 2021.

Then on Feb. 6 China announced a 50% reduction in tariffs on about $75 billion worth of U.S.-origin products.

Nelson Dong, a senior partner at the international law firm Dorsey & Whitney and a member of the board of directors of the National Committee on U.S.-China Relations (NCUSCR), said China’s tariff reduction can be looked at a few different ways.

“First is a sensible and practical move if China is to meet its very ambitious Phase 1 purchasing commitments,” Dong said. “However, even with these tariff reductions, there are still many skeptics who believe China will have significant difficulty reaching those Phase 1 goals."

Then there’s the economic fallout from the COVID-19 epidemic sweeping from China, which has resulted in an unprecedented lockdown and quarantine of 60 million or more Chinese citizens and workers. Dong said the Chinese government is working to project a sense that the country can carry on business as usual in the face of a health emergency.

“The coronavirus problem is already widely expected to hurt China’s domestic economy,” Dong said. “Their lost hours of work will be significant in the aggregate and will clearly lower national productivity in 2020 and thus lower corporate revenues and earnings.”

With the losses added up from affected Chinese companies and manufacturers, there is expected to be continued less purchasing of more expensive imported goods. In fact, China’s National Bureau of Statistics recently announced that the country's February manufacturing purchasing managers’ index fell to an all-time low at 35.7, down from 50 in January. It's the first released major economic indicator ins the COVID-19 outbreak.

One of the largest stamping companies out of Northern California, Scandic Springs, Inc., has already seen a shift in its supply chain. And owner Hale Foote believes it's directly related to the impact of adjusted tariffs and COVID-19.

"Our larger customers starting surveying us to find whether we saw any supply chain issues," Foote said. "So far, we have not had shortages. And last week, two separate customers sent us new drawings that listed a Chinese company as the existing supplier, and asked us to quote ASAP. Presumably, our customers could not get parts from China."

That supply chain shift is only expected to keep pivoting.

“If China hopes to have any chance of meeting its Phase 1 agreement import commitments,” Dong added, “it has to adjust for those economic headwinds, and so these tariff reductions are probably calculated to reinforce the government’s recent injection of more liquidity into the Chinese financial system."

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Related Companies

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI