President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

A brief history lesson on steel prices during crises

The demand for steel is not great, but not as bad as it was in the Great Recession

- By John Packard and Tim Triplett

- April 17, 2020

Steel Market Update (SMU) has been asked: How does the COVID-19 pandemic compare to the Great Recession in terms of its impact on the steel market? The full effect of the coronavirus crisis on the U.S. economy and steel demand is still to play out, of course, but some comparisons can be made. Generally speaking, steel production and steel prices have declined more sharply in the past few months, but to a lesser degree than during the 2008-2009 recession.

SMU surveys steel buyers twice each month to track market sentiment. Buyers’ optimism or pessimism offers some insight into their likely decision-making. SMU’s Buyers Sentiment Index offers a sharp contrast between current attitudes and the way folks were feeling during the Great Recession. As of mid-April, the index had a reading of -4—down dramatically from +58 just the month before—but still considerably more optimistic than the all-time-low reading of -85 hit in March 2009.

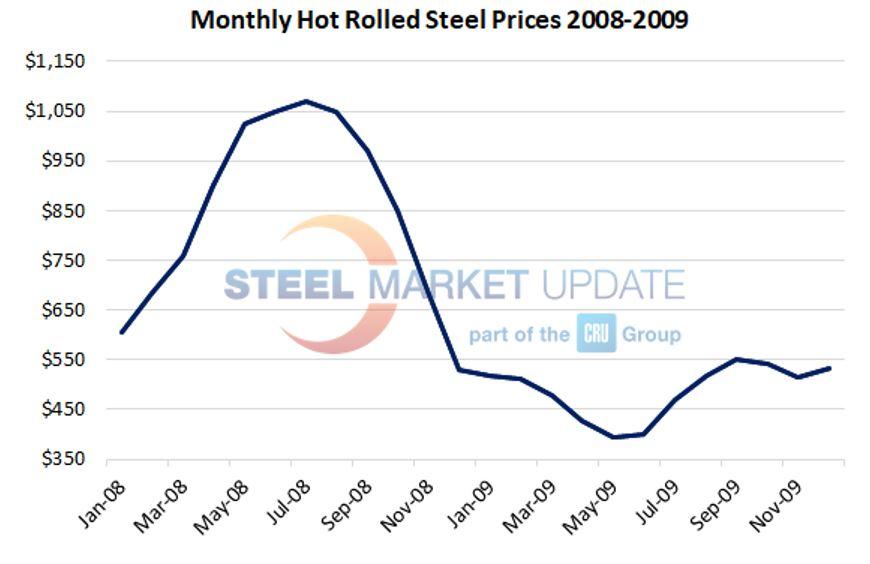

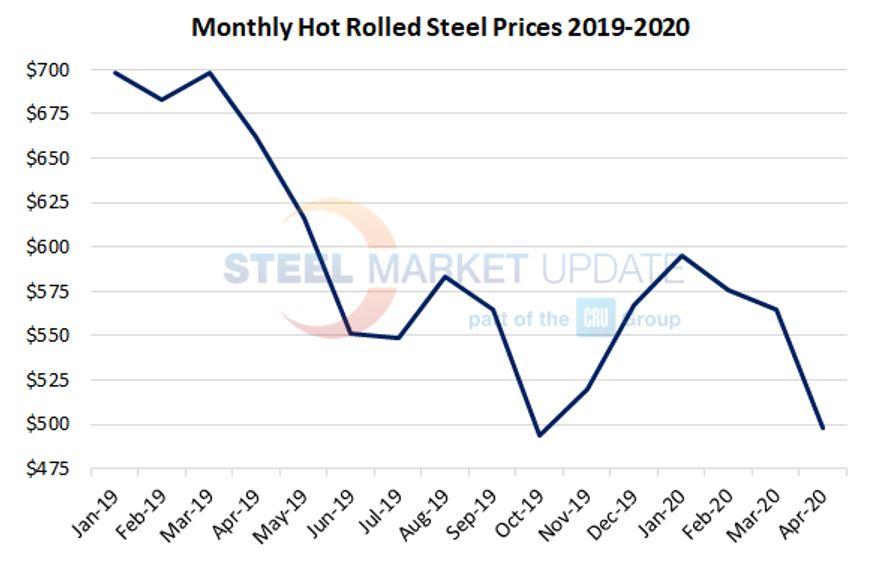

Both economic collapses were severe and unexpected, and both took a serious toll on steel demand and prices. Looking at the mill utilization data from the American Iron and Steel Institute for March and April 2020, capacity utilization declined from more than 80% to around 56% in less than a month. During that period, the benchmark hot-rolled price declined by roughly 15%, from $580/ton to $495/ton (see Figure 1).

In comparison, in the summer of 2008, U.S. mills were cranking out steel at 90% of their capacity to capitalize on inflated hot-rolled market prices in excess of $1,000/ton. When the real estate bubble burst, sending the economy into a tailspin, the price of steel lost half of its value, to around $500/ton, in a period of about five months. In the same 19-week period, mill capacity utilization plunged from 90% to 33% as the recession slashed steel demand.

Steel prices did not immediately recover once the capacity utilization hit bottom at the end of August 2009. Prices continued to languish for another five months, hitting bottom in early June 2009 at $380/ton (see Figure 2). The subsequent recovery was prolonged and slow due to excessive inventories having been accumulated throughout the supply chain.

Being more proactive this time around, the domestic mills have acted quickly to idle some 10 million tons of their annual capacity in an effort to match supply with the declining demand and put a floor under steel prices.

Whether steel prices continue to decline or level out in the coming weeks or months depends on several factors. Before the government was forced to shut down commerce and enforce social distancing back in March, the economic fundamentals were strong, arguably much stronger than the economy of 12 years ago that was propped up by an inflated housing market. So, recovery from the pandemic could be more V-shaped, according to experts.

Ferrous scrap prices are an indicator of finished steel prices. Unlike in 2008, scrap collection is an issue today as dealers must avoid COVID-19 infection. Less prime scrap is available from auto plants and other manufacturers that have been forced to suspend production. Thus, scrap prices are likely to firm up as supplies tighten.

Service centers have been doing a much better job of managing inventories compared to the Great Recession. SMU proprietary service center inventories data put flat-rolled inventories at 2.5 months’ supply (based on March shipping rates), which would be considered “balanced” in a reasonable market. These inventories will become inflated over the next couple of months, but buyers are making adjustments to accommodate anticipated lower volumes.

Steel demand remains the big question. How much of the business will come back once the virus is behind us, and how much will be lost for good? Negative forecasts for automotive sales and oil prices don’t bode well for steel in the near term, but sources tell SMU that activity is still fairly strong in some sectors of the economy, such as construction and agriculture, and in some regions of the country.

Figure 1. The coronavirus crisis has resulted in a sharp decline in steel demand, and prices have dropped as a result.

Distributors have put purchasing on hold, but will be quick to come off the sidelines at the first signs of a turnaround. Steel could get tight if the recovery of demand outpaces the mills’ ability to restart production. It will be critical for steel buyers to keep a close eye on the market to make sure their company does not get caught short. This year steel purchasing agents will be juggling supply and demand as never before. Everything is one big question mark.

What Steel Executives Are Saying

Comments from service center and manufacturing executives responding to SMU’s April 13 survey reflect the weight of their worry over the coronavirus crisis:

- “New York City-area customers are more likely to be closed than open.”

- “Business is steady, but there is a lot of uncertainty on the national economic level.”

- “Declining a little more each week.”

- “COVID-19 restrictions are different in each state in regard to construction.”

- “Demand appears to be a moving target as OEMs struggle with keeping plants running and understanding what their order intake will be.”

- “When the majority of your customer base is closed due to government mandates, you cannot be successful.”

- “We will hold our own, but we are experiencing some stiff headwinds.”

- “State government has us shut down due to COVID-19.”

- “April shipments are expected to be about 45% below what was forecast at the start of the year.”

- “Prices are dropping. Inventory values are dropping. It will be difficult to recover with limited demand for our products.”

- “The outlook looks very negative as most economists are calling for recession and reduced demand. It depends on how long this lockdown lasts and how quickly we can recover. But this year does not look very promising.”

- “Once the economy opens back up, and consumer confidence returns, there should be some pent-up demand for our products.”

- “When the virus-related situation returns to some facsimile of normal, there will be a lot of pent-up demand and business levels will ramp up quickly. But I don't think that will happen in the next three months, and may only be beginning six months from now.”

- “We’re doing fair compared to competitors. No matter what, we all have a rough row to hoe.”

- “A lot of jobs have been shelved for at least three to six months, so I do not see demand coming back until August or September.”

- “Once the government finally opens the economy back up, it will take several months to recover.”

- “Maybe this is false hope, but I think the U.S. government, among other major economies, has provided enough liquidity/incentives to kick-start demand within the next four to six months.”

- “April and May will be extremely difficult. After that it’s really hard to estimate, but we think the recovery will be gradual and uneven.”

Upcoming Events

Steel Market Update is hosting a free weekly Steel Community Chat every Wednesday at 11 a.m. ET. The webinar includes guests such as analysts, economists, and industry executives. The webinar is at no cost and open to all. You do not have to be an SMU subscriber. You can register for the next event here.

Our Steel 101: Introduction to Steel Making & Market Fundamentals Workshops have been postponed pending the reopening of business and when companies feel comfortable allowing employees to travel. We do not anticipate an “in-person” Steel 101 until September, when we are scheduled to conduct a workshop in Hamilton, Ont., Canada, and tour the ArcelorMittal Dofasco fully integrated steel mill.

SMU conducts the largest flat-rolled and plate steel conference in North America. The SMU Steel Summit Conference is still scheduled for Aug. 24-26 in Atlanta. We are carefully monitoring government instructions and the medical community to see if an end-of-August conference will be safe for attendees. We anticipate making a final decision as to whether the conference will be canceled in mid to late May.

SMU also is looking at taking its training workshops and conference “virtual,” if it makes sense. We will have more information about our online plans soon.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Supporting the metal fabricating industry through FMA

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI