President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Are steel prices trending up?

Steel buyers wait to see if market demand will allow for further increases

- By John Packard and Tim Triplett

- December 16, 2019

Recently announced price hikes from mills resulted in an increase in steel prices toward the close of 2019. Some buyers, however, wonder if market economics will support those increases. Getty Images

After declining for much of 2019, steel prices moved up substantially in the last two months of the year. What will be the trend heading into early 2020?

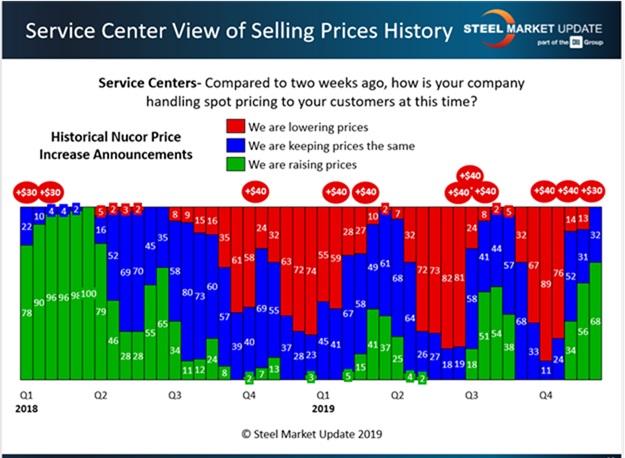

Flat-rolled steel producers raised prices three times during October and November for a total of $110/ton. Likewise, plate producers also announced three increases, raising prices by a total of $130/ton. The announcement of higher prices, however, does not mean the mills will be able to collect them. That depends on what the market will bear and how much support they get from distributors (see Figure 1). But without doubt, the increases have moved the market.

Steel prices increased by approximately 20% from late October to mid-December. Steel Market Update (SMU) survey data as of Dec. 10 showed that the benchmark price for hot-rolled steel rose by nearly $100 to an average of $570/ton ($28.50/cwt) FOB mill, east of the Rockies. Cold-rolled and galvanized steels averaged $760/ton ($38.00/cwt), with Galvalume® at $770/ton ($38.50/cwt). The price of steel plate was up to an average of $690/ton ($34.50/cwt), from $640/ton at the beginning of November.

Steel buyers surveyed by SMU in early December were almost evenly split on the staying power of the recent price hikes. A slight majority (52%) said they expected to see prices stall and begin to move lower in the coming six to 10 weeks.

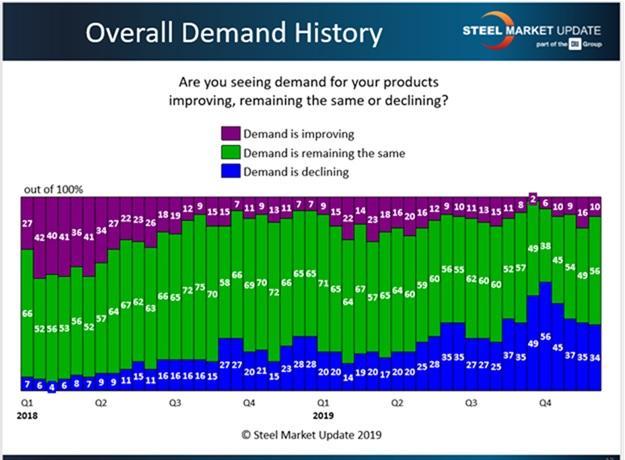

Ultimately, mills can collect higher prices over the long term only if there is sufficient demand (see Figure 2). Most buyers (56%) were reporting flat or stable demand last month. Another 34% saw demand declining. Only 10% said demand from their customers was improving, which may not bode well for those hoping for higher steel prices in the first quarter.

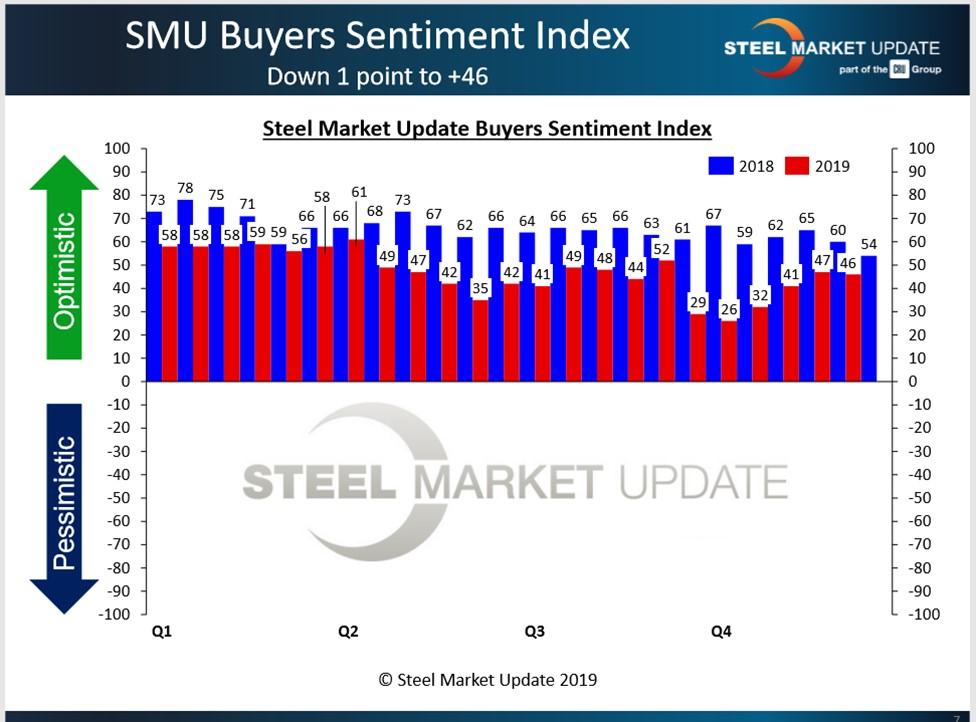

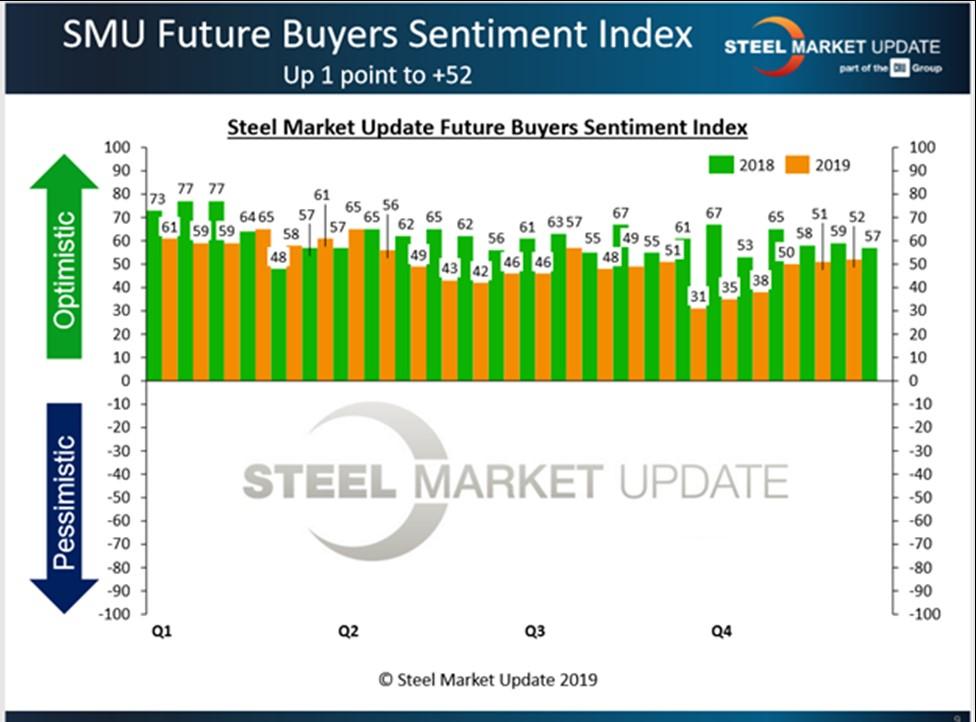

Steel buyers, including service centers and manufacturers, remained relatively upbeat, however, as the year came to a close. SMU’s Steel Buyers Sentiment Index trended up right along with steel prices in the last two months of the year (see Figure 3). The goal of the index is to measure how buyers and sellers of steel feel about their company's ability to be successful today and three to six months into the future. The Current Sentiment reading of +46 in early December was a 20-point improvement from early October. The Future Sentiment reading showed buyers even a bit more optimistic about the next few months with a reading of +52 (see Figure 4). Although improved, these sentiment readings are still well below levels at this time last year.

In Other News

Scrap prices climb. Ferrous scrap prices increased by $45/ton to $60/ton in November and December. There are a few reasons for that.

Demand remained solid as the mills continued to crank out steel at around 80% of capacity. Scrap supplies tightened as winter weather began to impede scrap flows into dealers’ yards. And a pickup in foreign demand for U.S. scrap boosted exports to countries such as Turkey, further tightening supplies here at home.

Higher costs for scrap and other raw materials help the mills justify higher finished steel prices. Experts anticipate even higher scrap prices in the first quarter.

“There is little doubt the U.S. scrap markets will rise again in January,” one executive told SMU. “January has nowhere to go but up, whether it’s from demand/supply, bad weather, or an export-driven scenario. It’s going to go up!”

Cleveland-Cliffs acquires AK Steel. Steel industry consolidation saw a new twist last month when iron ore producer Cleveland-Cliffs acquired integrated steel producer AK Steel. In the past, steel mills have purchased mining operations to guarantee themselves captive supplies of raw materials. In this case, the roles are reversed, with the raw material supplier acquiring a captive customer for its products.

Early reviews of the transaction were mixed.

“The Cliffs deal to merge with AK Steel was one of the best-kept secrets ever in our industry,” observed one SMU source. “From the standpoint of vertical integration, sometimes it works in your favor and sometimes it doesn’t.”

Tariffs make the news again. President Donald Trump stunned the market on Dec. 2 when he tweeted his intent to place a 25% tariff on steel and a 10% tariff on aluminum from Brazil and Argentina, accusing them of currency manipulation. Both nations had negotiated quotas as an alternative to tariffs.

Argentina is a relatively small exporter to the U.S., but Brazil is a major supplier of steel slabs. Without access to affordable Brazilian slabs, several mills in the U.S. are in jeopardy, and the market may find itself in short supply. As of this writing, Trump had not followed through on his threat with a proclamation that would make the tariffs official, nor had he clarified what would happen to the quotas, leaving trade between the U.S. and Brazil in a sort of limbo.

What Steel Buyers Are Saying

With news like that and the industry watching to see if steel prices will continue to climb, everyone has a different take on what’s happening in the market:

Trading company: “Costs for steel and aluminum are being artificially raised by trade tariffs applied at the whim of a tweet, creating nonuniform costs for some producers like slab converters and their customers. The environment is very challenging.”

Manufacturer: “Demand has been lackluster this fall compared to normal years. Customers continue to scale back inventory and run much leaner.”

Trading company: “There’s too much uncertainty driven by the current U.S. government trade action—or lack of action in the case of U.S.-China.”

Service center: “I would not be surprised to see a fourth price increase announcement, but I expect pricing will begin to soften at some point in Q1.”

Service center: “We like the business we have booked and the quotes in our system. Barring any weather issues, we should expect to see a strong Q1.”

Service center: “I expect at least $100 of the $120 [price hike] announced to stick. We expect strong, stable business conditions in 2020, in line with 2019 plus a little.”

Manufacturer: “With scrap moving higher and hot-rolled lead times moving out, we expect pricing to go up. We are expecting just a small increase in business for Q1. We will enter the year very cautiously. Living in a steel world where a tweet changes the market day to day has forced our company to run lean and put off expansion.”

Service center: “We expect pricing to hit a ceiling in 1Q 2020 and top out in maybe February or early March. We think 2020 will look like 2019 in terms of demand. Pretty flat expectations.”

Service center: “We are not expecting prices to move higher through the first quarter. We just don’t see the demand out there to warrant price escalation. With heavy truck and agriculture down, we are expecting a just-so market for our products. Decent, but not strong.”

Service center/Wholesaler: “Seasonal factors and inventory levels should give this upturn some staying power.”

Manufacturer/OEM: “Now with AK sold to Cleveland-Cliffs, blast furnaces out at USS, the effect of the Brazil tariffs on NLMK and AM Calvert, it will be Chicken Little the sky is falling. Mills will scare everyone into buying steel. They will raise prices and watch it all disappear before their eyes in February. There is no true demand.”

Service center/Wholesaler: “With imports continuing to decline and domestic production beginning to slip, we think pricing will remain stable well into Q1, depending on demand.”

Service center/Wholesaler: “Margins and net profits, or lack thereof, in the mill and service center sectors should support some sustained level of price increase. If the mills get too aggressive with significant and continual price increases, end users will view it as a ‘will they never learn’ event and wait it out. Frankly, I agree with the end users. This binge-and-purge pricing approach hasn't worked in the past and won't work in the future.”

Service center/Wholesaler: “The mills are greedy and poor judges of the market.”

Manufacturer/OEM: “I’m not convinced the economy is that strong. Inflation is too low, real wages aren’t going up, low interest rates are not stimulating the economy as much as they should, and manufacturing is slowing. Demand and supply will take over; prices will go down.”

Manufacturer/OEM: “Who the heck knows? Nothing makes sense anymore. We can only control what we can control.”

Upcoming Events

It’s not too early to mark Aug. 24-26 on your calendar for the 2020 Steel Market Update Steel Summit in Atlanta.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

Related Companies

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI