Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel mills feel confident with early 2023 economic rally

The new target for the steel industry: $900/ton for hot-rolled coil

- By Michael Cowden

- February 16, 2023

Steel mills are in a good position as 2023 opens. Demand for their products looks good, and service centers appear to be supportive of recent price hikes. mbz-photodesign/iStock/Getty Images Plus

The wave of domestic mill price increase announcements that began shortly after Thanksgiving has continued well into the first quarter.

Mills were seeking at least $900/ton ($45/cwt) for hot-rolled coil (HRC) when this article was filed in mid-February. If they achieved that, it would mean prices were up nearly $300/ton from a 2022 low of $615/ton recorded in November. The latest gains came after mills announced a combined $100/ton in price increases in less than two weeks in early/mid-February alone.

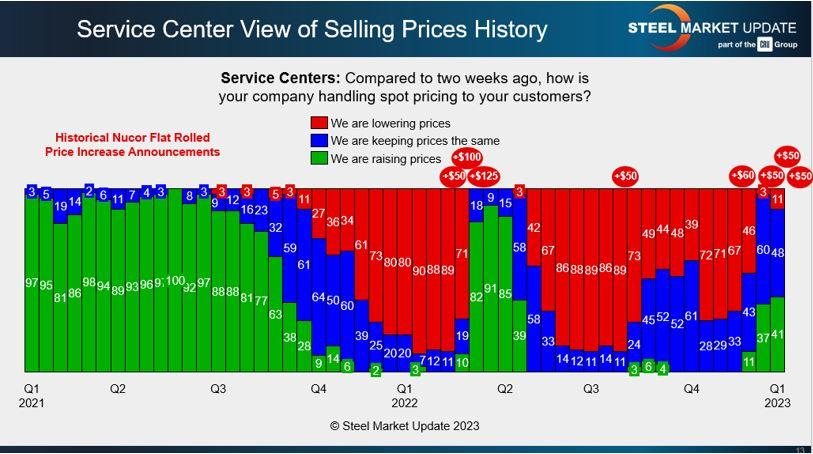

In fact, we had trouble squeezing the raft of late increases in late Q4 2022 and early Q1 2023 into Figure 1. As you can see, more service centers continue to raise prices in tandem with mills. In other words, despite some macro concerns, such as inflation, higher interest rates, recession fears, or the debt ceiling debate, manufacturing companies are seeing a stronger-than-expected start to 2023.

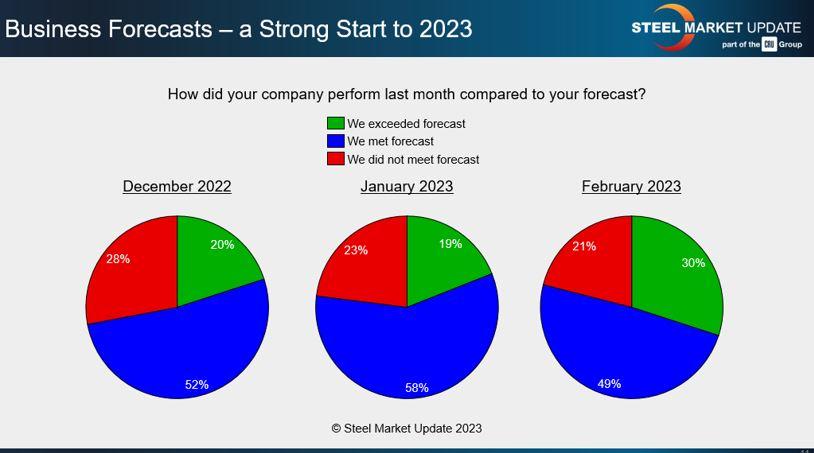

For example, about half of respondents to our survey report that they are meeting forecasts (see Figure 2). Another 30% are exceeding it, and only about 20% are missing it.

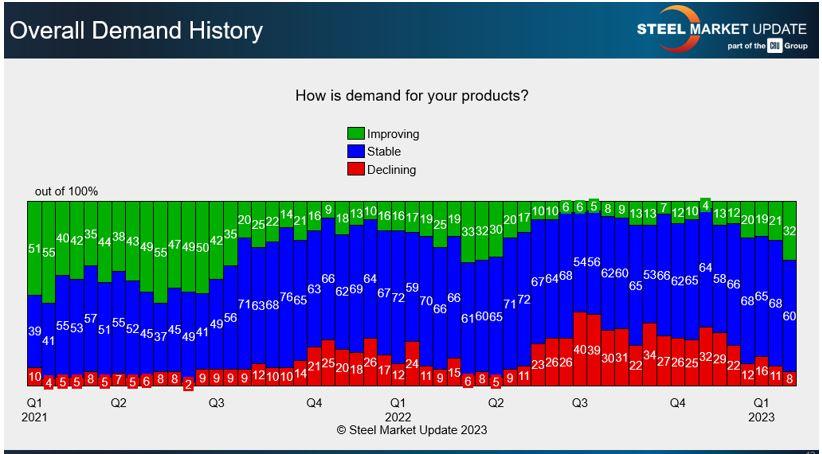

You can see in Figure 3 that we’ve seen modest month-over-month improvement in overall demand. If you go back to November, the results are even more pronounced. We’re also seeing some of the strongest demand readings we’ve seen since the market shock following the invasion of Ukraine last year.

One question I have: Is this strong demand from end users, or is it mostly momentum-driven? Service centers, for example, could be pulling forward demand as they buy to get ahead of the next anticipated round of mill price increases.

Opinions are mixed. Some steel buyer sources tell us that solid demand, combined with new capacity struggling to ramp up, has created a supply squeeze in certain regions. Others say they’re not able to pass along higher steel costs at the rate that mills have been raising prices, and that demand is starting to falter.

Despite such mixed outlooks, we’ve seen a steady increase in where people think prices will be in two months (see Figure 4).

Expectations of higher prices coincide with the rapid-fire mill price increases we’ve seen. Most people don’t think prices will get above $900/ton. But that probably has more to do with the lag time between when price hikes are announced and when the impact of those hikes is reflected in our surveys.

That said, there are some flies in the ointment. A significant minority of survey respondents think prices won’t peak until late spring or early summer. But most continue to predict that prices will peak before Q1 is over (see Figure 5).

Figure 1. In recent weeks, more service centers are reporting an intention to increase steel prices.

That’s something to watch. Why such divergent outlooks? Why might one camp say that prices will peak soon while another says that won’t happen until this summer?

Want another reason for caution? Yes, lead times have clearly improved since November, when HRC lead times dipped below four weeks. And, yes, five weeks on average is a healthy lead time. But it’s not typically one associated with prices rising nearly $300/ton in fewer than three months.

Lead times might kick out again in response to the latest round of mill price increases. But if they don’t extend along with prices, that could be cause for concern given that the two typically trend together.

Also, we’ve seen a bit of an unusual shift in how companies are managing inventories (see Figure 6). Most steel consumers are maintaining inventories. Some service centers continue to build them. But a growing minority of end users are looking to reduce inventories. Why might that be? Will we see, as we saw following the Russia’s invasion of Ukraine last year, a rapid increase in prices followed by a steep decline once markets recalibrate?

It’s worth noting here that some analysts think the lag between when interest rate hikes are announced and when they are felt means that construction, a key end market for steel, could slow down significantly in the second half of the year. They also believe that infrastructure spending won’t be enough to offset that trend.

That said, I think it’s also safe to say that we’re still trying to figure out what the new normal for steel prices is following the shocks of the pandemic, the war in Ukraine, and the increased regionalism we’re seeing today when it comes to both the steel trade and supply chains, more broadly speaking.

Consider that $615/ton low we saw in November 2022. It used to be that prices above $600/ton were good news for steel mills. Prior to the pandemic—think late 2015, for example—we saw HRC prices fall below $400/ton, lower than even the darkest days of the initial Covid-19 outbreak.

What if $600/ton is the new $400/ton? If that is the new floor for the market, then what’s the new ceiling? Are we near it already? Do we still have room to rise? I’d be curious to hear what you think.

Steel Market Update Events

Consider registering for our next Steel 101 Workshop. We’ll be holding the event live in Cleveland on April 11-12. It’s a great overview of the steelmaking process for both newbies and industry veterans.

Steel 101 is unique in that what you learn in class is immediately reinforced by a mill tour. This time we’ll tour Cleveland-Cliffs’ Cleveland Works. It’s the first time we’ve toured an integrated mill in a while, and we’re looking forward to it! You can learn more about Steel 101 at events.crugroup.com/steel101/about-steel-101.

Figure 2. Manufacturing companies indicate that their economic fortunes are improving as they entered February.

Also, don’t forget to register for Steel Summit, our flagship event and the largest flat-rolled steel conference in North America. You can learn more and register by visiting events.crugroup.com/smusteelsummit.

The event, scheduled for Aug. 21-23 at the Georgia International Convention Center in Atlanta, is just a free tram ride away from Hartsfield-Jackson Airport. We had nearly 1,300 people attend the event last year.

Keynote speakers this year will include Cleveland-Cliffs Chairman/President/CEO Lourenco Goncalves; ITR Economics President Alan Beaulieu; and Gene Marks, president of The Marks Group PC. We’ll be announcing additional speakers in the weeks ahead.

Subscriptions and Surveys

If you like what you saw in this column, please consider subscribing to the Steel Market Update. Contact Lindsey Fox at lindsey@steelmarketupdate.com to learn more.

Also, please consider participating in our market surveys. Make sure our data reflects your company’s experience! Contact info@steelmarketupdate.com to sign up.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

Dynamic Metal blossoms with each passing year

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI