Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices are back on a downward trend

Lead times and steel mill negotiations point to lower prices

- By Michael Cowden

- May 19, 2022

How will steel buyers react with the knowledge that prices could be headed down for the next several weeks? Hulldude30/iStock/Getty Images Plus

I wrote last month that steel prices had stalled and that a bevy of indicators were suggesting that a fall might be around the corner.

I was cautious then not to make too much of a couple of weeks of SMU survey data. There is no reason to be cautious any longer. The warning signals we saw in April are now entrenched trends.

Pick your indicator: steel prices, lead times, or mill negotiations. All point to lower prices in the weeks ahead.

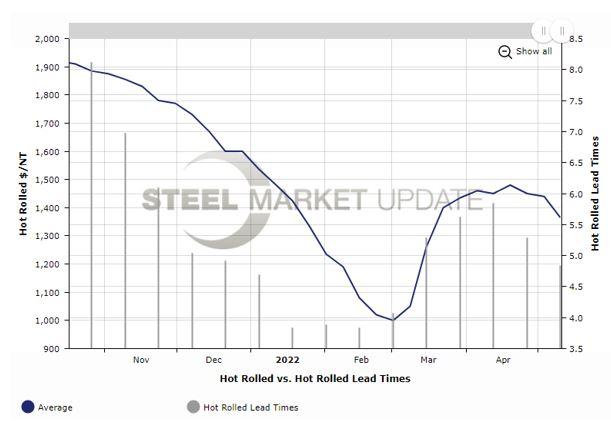

Let’s start with lead times and prices (see Figure 1). The big news recently is that hot-rolled coil (HRC) prices fell significantly below $1,400/ton ($70/cwt). Our average HRC price dropped to $1,365/ton in early and mid-May, down $115/ton (7.8%) from a post-Russia-invasion-of-Ukraine peak of $1,480/ton in mid to late April. (You can chart pricing information yourself using Steel Market Update’s interactive pricing tool, which can be found here.)

Included in that decline was a $75/ton week-over-week decline on May 10—the biggest drop we’ve seen since a $90/ton plunge in early February. Recall that prices in February were in freefall before the invasion of Ukraine sent them sharply upward again.

You’ll notice a theme across the indicators we track. Prices were plunging at the start of the year. HRC prices fell from $1,600/ton on Jan. 1 to $1,000/ton on March 1—a decline of $600/ton, or 37.5%. They then shot up to $1,480/ton after Russia’s invasion.

In other words, Russia’s military incursion into Ukraine more or less reset the market to where it was on Jan. 1. The problem now? Lead times are moving back to their normal ranges: about four to five weeks for hot-rolled, and about six to eight weeks for cold-rolled and coated. But prices remain well above their usual levels.

If you were already paying attention to lead times, the big drop in prices we’ve seen in recent weeks shouldn’t have come as a huge shock. HRC lead times were at 3.84 weeks in mid-February. Russian forces invaded Ukraine on Feb. 24, and HRC lead times subsequently extended 52% to a mid-April peak of 5.84 weeks. HRC lead times have since fallen 17% to 4.84 weeks. (Other products have followed roughly the same trend.)

If lead times continue to move lower, further price declines are in store. If you don’t believe me, keep reading.

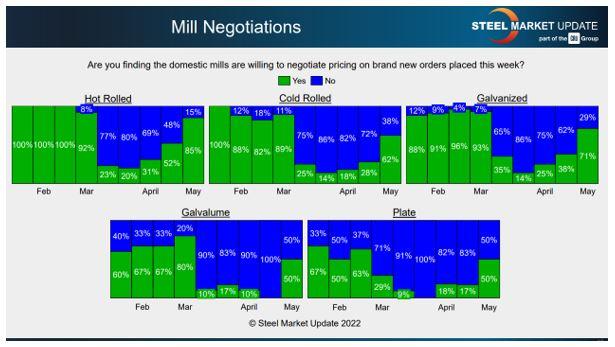

Let’s start with mill negotiations (see Figure 2). It was a buyer’s market until the outbreak of war in Ukraine. The war sparked a seller’s market through March and most of April, and now we’re back to a buyer’s market again.

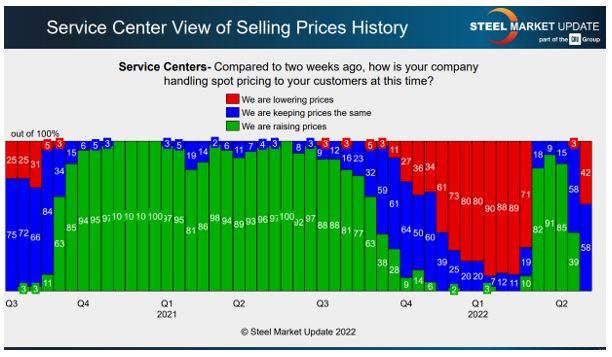

It’s not just mills that are lowering prices; so, too, are most service centers (see Figure 3). I mentioned last month that falling resale prices were something to keep an eye on. That’s because those, like lead times, are a leading indicator of FOB mill price trends.

So how fast and how far will prices fall? If you remember, that’s the same question we were asking ourselves at the beginning of the year.

We learned in Q1 that prices could fall fast, but we didn’t establish quite how far. That depends on costs, and a lot is in flux now, in large part because of the Russian invasion of Ukraine. If current trends hold, we might find the answer to that question soon enough.

But falling U.S. steel prices aren’t necessarily a bad thing. From a mill perspective, it can make buyers think twice about buying imports. Also, it can help make U.S. manufacturers more competitive abroad.

Yes, U.S. HRC prices are still well above those in the rest of the world, but not by quite as much. Case in point: The delivered price of Italian HRC was approximately $1,218/ton when this article was filed. U.S. HRC is theoretically $147/ton more expensive than imported Italian HRC, which is a lot, but it’s less than the $179/ton premium U.S. HRC carried a week earlier.

That’s maybe not much of a silver lining, and there is a lot of gloom and doom in steel (and aluminum too) lately. You can see why in the price, lead time, and mill negotiation data. I’ve even heard some rumblings that this is the summer of 2008 (or the fall of 2014) all over again.

I’m not in that bear camp, but it’s always good to be on the lookout for bear traps.

My main concern is a contrarian one: The herd mentality that tends to characterize the steel market is doing no one any favors.

This is a story that I’ve seen over and over in the steel industry. Everyone gets spooked and moves to the sidelines. Then demand comes back or supply gets squeezed because of the next black swan event, whether abroad, such as a pandemic or war, or at home, such as a strike or unplanned outages. At that point, everyone is short on inventory and scrambling for material, which sends prices rocketing back up.

Black swans are nearly impossible to predict. But I think a short squeeze is a lot more likely than a repeat of 2008.

Figure 2. The green bars represent mills willing to negotiate lower prices. The blue bars represent mills refusing to negotiate on prices. Mills are now back to the point of being open about negotiating steel prices.

Or, as one service center executive told me recently, “I don’t think people are buying quite as much because the price is starting to come down, so they are holding off whenever they can.”

That’s not a bad because mill pricing was “too damn high” and so a correction was overdue, he said.

But he also added that he wasn’t concerned about demand. “For us, we’re still busy, we’re putting out as much volume as our structure allows.”

Let’s hope that remains the case.

Steel Market Update Events

Summer is just around the corner, which means SMU’s Steel Summit is getting closer. The Steel Summit, the biggest annual steel gathering of its kind in North America, is set for Aug. 22-24 in Atlanta at the Georgia International Convention Center.

The event is a convenient one. For those flying in, you can take a tram directly from the airport to the conference center and the hotels around it.

We anticipate about 1,200 decision-makers to attend the networking and information gathering event. If you’re on the fence about going, think about it this way: You could plan a half dozen trips to see customers, or you could see them—and steel’s leading executives and thought leaders—all at once in Atlanta.

You can find out more about the event here.

For more information about SMU or to sign up for a free trial subscription, email info@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

Tips for creating sheet metal tubes with perforations

Are two heads better than one in fiber laser cutting?

Hypertherm Associates implements Rapyuta Robotics AMRs in warehouse

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI