Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices coming back to normal?

Cost of steel could be headed to pre-pandemic pricing levels

- By Michael Cowden

- November 16, 2022

Can metal fabricators expect to pay for steel what they were paying for it two years ago? The decline in steel prices isn't quite there, but people are beginning to wonder if they might get there eventually. Vladimir Zapletin/iStock/Getty Images Plus

The thing that strikes me most about the current steel market is that $600/ton ($30/cwt) for hot-rolled coil (HRC) sure looks like the “new” $600/ton.

That’s a joke of course. I make it in remembrance of all that talk in 2021 and following the invasion of Ukraine this year about how the new normal for HRC would be higher than the old normal.

I recall predictions that the new normal for HRC would be anywhere from around $800/ton to as high as nearly $1,000/ton. That doesn’t seem likely now, to put it mildly.

Recall we hit a post-war peak of $1,480/ton in late April. We’re now at $655/ton, or nearly 56% lower, according to SMU’s interactive pricing tool.

And our most recent market survey indicates that many steel industry participants expect prices to fall further still (see Figure 1).

Forty-two percent of respondents think that HRC prices will start 2023 below $650/ton. That’s not unexpected. Prices tend to bottom out at year-end as the market slows down ahead of the holidays.

What I find interesting is that 7% of survey respondents say that HRC prices could fall into the $500/ton range. That wouldn’t have been a surprising result pre-pandemic, when pricing dipped into the $500s. Even the $400/ton range was not uncommon back then.

But it has been almost taboo to float the idea of $500/ton steel over the last two years. Recall we had a period of approximately 18 months (January 2021 to June 2022) when prices moved between $1,000/per ton and $2,000/ton, a sharp departure from the pre-pandemic norm of around $500/ton to $700/ton.

It’s hard to see anything close to $1,000/ton in the cards now. Scrap prices were down yet again in November, and expectations are that reduced steel output will continue to keep scrap prices subdued. In other words, there is nothing equivalent to the cost push we saw following the invasion of Ukraine to drive prices higher.

It doesn’t help that big deals cut earlier this year with certain domestic mills could continue to cast a shadow over the market into 2023. Those deals effectively pulled forward months of buying from some bigger service centers and distributors.

Figure1. The amount of steel buyers who believe that prices for hot-rolled coil will fall below $649/ton keeps increasing from one Steel Market Update survey to the next.

Also, the United Steelworkers (USW) union and U.S. Steel have tentatively agreed to a new four-year labor agreement. The terms are generous, and I’d be surprised if the contract isn’t ratified

That’s bad news if you’re a competing mill or service center that had been hoping for labor strife to drive business your way or to reverse the relentless downdrift we’ve seen in sheet prices since late April.

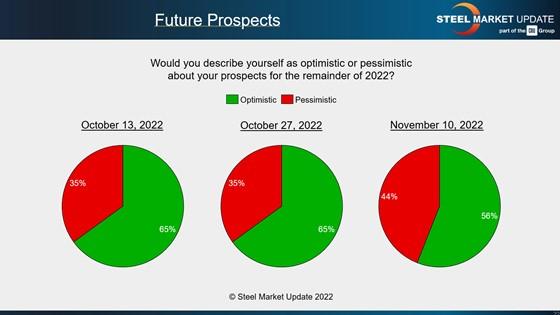

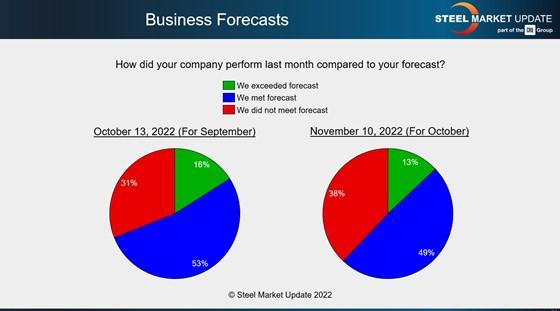

And it’s not just the price data that we track that has turned bearish. Other indicators that we follow are softening. (Figures 2 and 3 are a sampling from the full survey results that premium Steel Market Update membeYour text to link...rs receive.)

More people are reporting that their companies are not meeting forecast. Additionally, more are pessimistic about their prospects for the remainder of 2022.

And more than 70% of service center respondents to our surveys say that they continue to lower spot prices to their customers (see Figure 4).

As for imports, we’ve seen interest in them decline along with falling domestic prices. There are two ways to look at that. Mills might celebrate lower import volumes, but they might want to watch what they are wishing for. Another interpretation is that domestic prices are falling so fast that buyers don’t want to take the risks associated with offshore buys. Namely, that a good import price secured now won’t be so attractive once that material finally arrives at port.

Speaking of imports, it’s worth thinking about what the result of increasingly strict trade restrictions on Russia might be. Russia losing market-economy status in antidumping cases has paved the way for higher duties not just in steel but in everything from uranium to fertilizers.

That said, Russia has only a shadow of the presence it once commanded in the domestic steel market. So the impact of Russia losing market-economy status on steel prices probably will be muted. Case in point: Russia shipped more than 2.14 million metric tons of steel to the U.S. in 2017. That figure had fallen nearly 40% to 1.29 million metric tons in 2021, and it stands to fall even more sharply in 2022, according to U.S. Department of Commerce figures.

Also, let’s not cry too much about falling prices. They might not be good for steel mills and service centers. They could, however, provide a welcome respite to manufacturers. Skilled workers might still be hard to come by. Affordable steel is not.

Likewise, the USW-U.S. Steel negotiations are a good outcome for steel consumers exhausted by supply chain problems. They might even be an OK outcome for producers. Businesses don’t like uncertainty, and perhaps we’ll see buying activity pick up at least a bit because companies now know that labor issues (at least in steel) won’t disrupt the market.

Figure 2. The amount of companies that didn’t meet forecasts is growing, according to Steel Market Update surveys of steel buyers.

Note, too, that lead times, while still low, are falling as we get closer to 2023. Activity typically improves in Q1. And there are precedents—2020, 2016, 2011, and 2010—for a December price squeeze.

Finally, just when everyone throws in the towel on steel is usually when things start coming back. On that note, thanks to so many of you for coming back to Steel Market Update year after year, in good markets and in bad ones too. We appreciate your business.

Steel Market Update Events

Mark your calendar for Feb. 5-7, the dates for the Tampa Steel Conference. Steel Market Update hosts the event along with the Port of Tampa Bay. The event is in person in Florida. Enjoy networking outdoors in the warm weather and learn what the big issues will be next year from senior executives and thought leaders across steel, energy, and politics. You can register here.

If you like what you see here, consider subscribing to Steel Market Update or signing up for a trial subscription. Contact Lindsey Fox at lindsey@steelmarketupdate.com to learn more.

If you want to participate in our survey, please contact Steel Market Update production manager and steel industry analyst Brett Linton at brett@steelmarketupdate.com. Don’t just read the data; see your company’s experience reflected in it!

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI