Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices stall as demand from manufacturers begins to soften again

As shock of hostilities in Ukraine wears off, steel mills come to grips with demand concerns

- By Michael Cowden

- April 18, 2022

I wrote a month ago that steel prices were shooting back up again—and did they ever.

Steel Market Update (SMU) recorded two consecutive weeks of triple-digit price gains in March. SMU also recorded the highest week-over-week gain we’ve ever seen in hot-rolled coil (HRC)—$210/ton.

Russia’s invasion of Ukraine—and subsequent shocks to raw material costs and supply chains—drove prices higher. Prices shot higher not only for steel, ferrous scrap, and pig iron, but also for ferroalloys and energy. It was the same story on both sides of the Atlantic.

The sharp week-over-week gains have since moderated. We saw HRC prices dip in mid-April for the first time since the outset of the war. The decline was modest, but we saw flat or modestly lower prices across several of the products we track. We don’t think that trend is an outlier.

What happened?

Let’s start with the big picture. Russia’s invasion of Ukraine sent prices in the West soaring. But prices in Asia didn’t go up nearly as much, probably because of a severe COVID-19 outbreak in China and equally severe lockdown measures. (Also, while the West put various sanctions on Russian goods, including steel, China did not.)

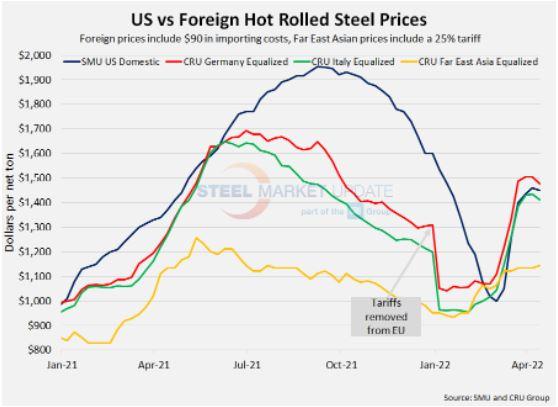

Beijing might provide stimulus to offset the impact of those lockdowns, as it has done in the past, but for now there is a huge gap between HRC prices in the West and those in Asia. That’s unusual. In normal times—and we realize these are not normal times—prices in the East would rise or prices in the West would fall. It looks like prices in the West are inflecting downward (see Figure 1).

Increasing Lead Times

The data SMU collects also provides some reason for caution. The trend I mentioned in prices is also playing out when it comes to lead times.

SMU’s HRC price bottomed out at the beginning of March at $1,000/ton ($50/cwt). Now, our HRC price is at $1,450/ton—a 45% increase.

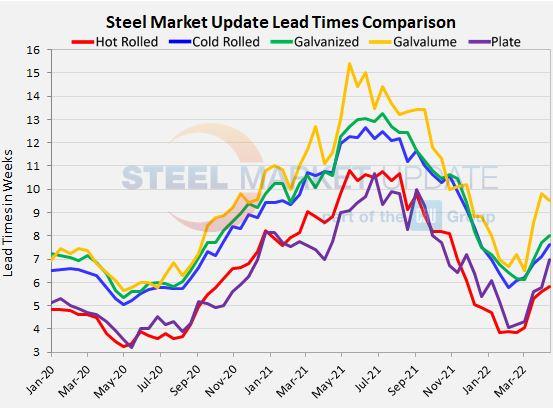

Take a look at lead times (see Figure 2).

FIGURE 1. Typically HRC prices across the world follow similar pricing trends. In these not-so-typical times, steel prices in the Far East have not increased like they have elsewhere.

Lead times for HRC bottomed out in mid-February at 3.84 weeks and are now at 5.84 weeks, a 52% increase. In other words, prices and lead times are stretching out roughly in tandem, which is usually the case and why we keep such a close eye on lead times.

Let’s look back to late April 2021, the last time prices were in the mid-$1,400s/ton. Lead times were 9.81 weeks then, or about four weeks longer than they are now. And they didn’t top out until nearly 11 weeks.

Now, in contrast, we’re already seeing lead times extending more slowly. And we see the same trends in other products as well, another indicator that prices might be at or near a peak.

We also keep an eye on mill negotiations. We’re seeing some evidence of mills being more willing to negotiate lower prices again. To be clear, this is not like late last year or January and February of this year. Recall that you could almost name your price at the time. Then the war flipped the script and mills refused to discount.

There is some wiggle room on the margins now. On average, 25% of steel buyers tell us mills are willing to negotiate lower prices. That’s not much, but it is a noticeable shift from late March when only 16% said mills were willing to cut a deal.

On HRC, which tends to move up and down before other sheet products, the trend is even more pronounced. Thirty-one percent of buyers said mills are willing to negotiate lower prices, up from 20% in late March.Another thing to take note of is service center resale prices. We don’t track those in absolute terms, but we do keep tabs on general trends.

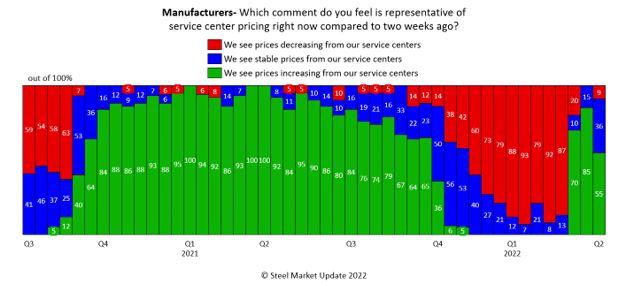

What’s interesting to note here is the far right-hand side of Figure 3. Most manufacturers (55%) report that service centers are continuing to raise prices. But a significant minority report that service centers are keeping prices unchanged (36%) or are reducing them (9%).

I try not to call trends based on just one survey, but it’s worth noting that this week’s outlier can be next week’s or next month’s trend. I’d flag, too, that this particular data series is a good advance indicator of pricing moves at the mill level.

You can see that in Q2 2021 manufacturers began reporting that service centers were lowering resale prices, or at least not raising them. That’s notable because mills at the time were still raising prices aggressively. Remember that prices didn’t peak until late Q3 (September, to be precise), and the market didn’t entirely come to a consensus that prices were falling until Q4.

Why had service centers stopped raising prices in tandem with mills? In other words, why not pass along higher prices to downstream customers? Probably because they could use reduced prices to attract or maintain new business, and because they were no longer certain that next month’s price would be higher than this month’s price.

FIGURE 2. Lead times for HRC has extended out to 5.84 weeks, but that trend is slowing. It might be an indicator that prices are ready to decrease.

Again, one survey does not make a trend, but I’d take notice if we continue to see decreasing and stable service center pricing in surveys in the weeks ahead.

Why am I tempted to call this a trend? The macroeconomic data supports it.Automotive sales are down. And nonresidential construction continues to be stymied by a shortage of skilled workers and high costs for steel, aluminum, and wood.

Oil and energy-related tube products (a key end market for sheet) are hot sectors, especially with oil at more than $100/barrel and gasoline at more than $4/gallon; but that comes at a cost. Specifically, inflation at the pump—not to mention at the grocery checkout as well—could hurt demand for durable goods. You can’t eat steel or aluminum, for that matter.

Steel Market Update Events

Enjoy the company of your steel industry colleagues at SMU’s Steel Summit Conference. The largest annual steel gathering of its kind in North America is set for Aug. 22-24 at the Georgia International Convention Center in Atlanta.

About 1,200 decision-makers are expected to attend this important networking and informative event. You can find out more about the event by visiting here.

For more information about SMU or to sign up for a free trial subscription, emailinfo@steelmarketupdate.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI