President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices strong entering the fourth quarter

Is the demand real, or are steel mills trying to see if the price increases stick?

- By John Packard and Tim Triplett

- September 28, 2020

Steel prices were on an upward trajectory entering the fourth quarter of the year. How high they will go, and for how long, is open to debate.

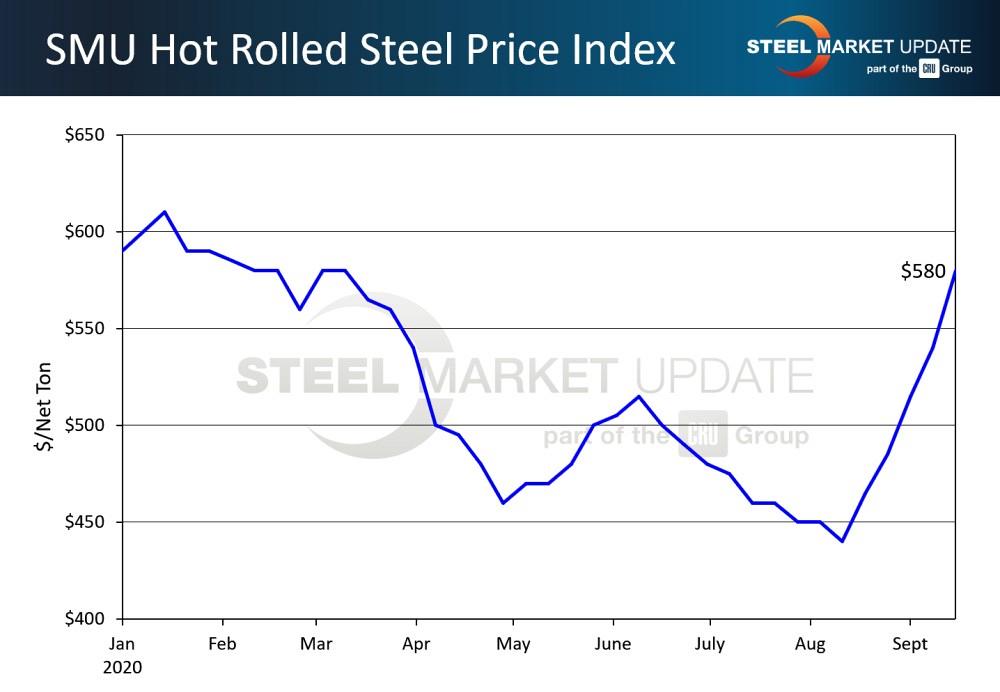

Steel Market Update’s survey of the market on Sept. 14-15 put the benchmark price for hot-rolled steel at $580/ton—back to the level it was in early March before the COVID-19 pandemic (see Figure 1). That’s up about $140 from the low of $440/ton reported by SMU in the second week of August. In mid-September, the same week as SMU’s survey, a few mills announced further price increases of $50/ton to $60/ton. Buyers were telling SMU that the mills were holding the line in price negotiations with $600/ton as the target for hot-roll.

Will they be able to collect it? There are two schools of thought, captured well by contrasting quotes from two SMU sources:

- "The recent price announcement has lots of traction; inventories got too low and buyers got flat-footed. It will stick. There is no negotiation on HR [hot-rolled] and galvanized right now, with $30/cwt ($600/ton) firm for HR and $40/cwt ($800/ton) firm for galv.”

- “Interesting moves by the mills, reminiscent of the old days. Pile on increases, move out lead times ... then ride that horse till it dies. We don’t see this exuberance lasting beyond November, even with all the so-called outages. Q4 is typically lower demand for all. COVID in winter is still an unknown. The election will be a spectacle undecided for weeks, etc. Contract negotiations for 2021 may still be undetermined by December. Smart buyers will station themselves on the sidelines and wait for an opportunity.”

Bank of America Analyst Timna Tanners raised her second-half steel forecast to reflect the better-than-expected demand behind the price increases, but her outlook was cautious.

“U.S. hot-rolled coil prices are heading for $600/ton near term, with Monday's price hike supported by higher scrap costs for mini-mills and strong auto demand tying up their integrated mill peers. We expect near-term strength that can last into November, as recent greater protection from imports and strong Chinese demand keep global alternatives expensive.”

She pointed to mill outages that tightened supplies, including planned downtime at Stelco's Hamilton mill, reduced volumes at NLMK's Farrell, Pa., mill due to a strike, and unplanned outages at U.S. Steel's Mon Valley and ArcelorMittal's Burns Harbor. “However, we expect disrupted mills to resume output and seasonal weakness in Q4 to dampen prices ahead,” she said.

Back in the spring, when the government shut down much of the economy to stem the spread of COVID-19, numerous mills idled furnaces and cut production to sync with the curtailed demand. Much of that capacity is back online, but not all. Additionally, some outages still are planned for the fourth quarter. Some experts believe the escalating steel prices are as much about the tight steel supplies as about growing demand.

“Demand is improving for sure at the margin, but this is really a supply-side squeeze and those tend to be short-lived,” said KeyBanc Analyst Phil Gibbs.

Steel Industry Sentiment

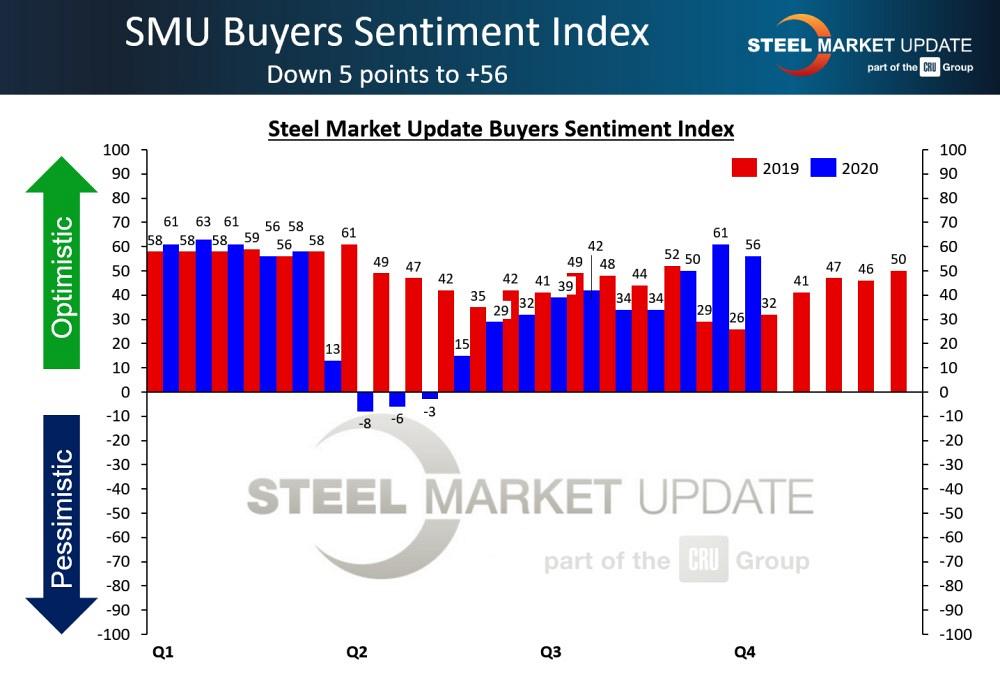

While the economy and the steel market have a long way to go to recover from the ongoing pandemic, the steel industry sees reason for optimism. Steel industry sentiment has rebounded to levels even better than this time last year. SMU’s Steel Buyers Sentiment Indexes have been improving in fits and starts since hitting bottom in early April. That optimism sends a message about the potential staying power of higher steel prices in Q4.

Every two weeks SMU asks steel buyers how they view their company’s chances for success in the current environment and three to six months in the future. The current sentiment reading in the survey taken the week of Sept. 14 was +56, up from a weak +26 at this time last year and a substantial rebound from the low of -8 in the first week of April, its lowest reading since November 2010 (see Figure 2).

Figure 1. Hot-rolled steel prices are creeping back to where they were just before the coronavirus crisis hit the U.S.

SMU’s Future Sentiment Index had a reading of +53, an improvement from the +35 in September 2019, when the hot-rolled steel price was under $500/ton (see Figure 3). Future Sentiment hit a recent low of just +10 in early April shortly after the pandemic took hold.

Upbeat About Fourth Quarter?

SMU also asked readers in mid-September: Looking ahead, do you feel upbeat about your company’s prospects in the fourth quarter? More than 75% said they are looking forward to a strong finish to the year. Here are some of their comments:

- “The fourth quarter looks to be shaping up well now. My main concern is when it will top out. I am thinking it won’t be until the first quarter now.”

- “It looks like a strong market for the next 60 days.”

- “Demand is remaining stable.”

- “We haven’t seen the hole in our backlog that we expected, but still feel it will happen.”

- “Fourth should be our strongest quarter this year, for sure. The third quarter was very strong, so that says a lot.”

- “We have inventory right now and our competitors don’t, so we are booking orders and futures for the fourth quarter.”

- “We’re hiring new labor for our production line.”

Buyers still have some concerns. These comments help to describe some of the main points of worry:

- “Concerted mill outages, coupled with the lack of imports, is causing a spot market vacuum in certain areas.”

- “Mills are likely going to be ‘feeling their oats’ when it comes to negotiating 2021 contracts.”

- “While Q4 looks good, there is always concern about the drop-off. When things rise dramatically, they fall equally dramatically.”

- “Automotive demand will fall once a sufficient number of 2021 model year cars are shipped to dealer lots.”

- “A second wave of COVID could force more economic shutdowns.”

- “Election year politics!”

Not a Steel Market Update Subscriber?

SMU provides real-time pricing, news, and analysis of market trends affecting North American flat-rolled steel, plate, scrap, and related markets. To sign up for your free three-week premium trial, email paige@steelmarketupdate.com, or call 724-720-1012.

John Packard, president/CEO of Steel Market Update, can be reached at john@steelmarketupdate.com. Tim Triplett, executive editor for Steel Market Update, can be reached at tim@steelmarketupdate.com.

Steel Market Update’s mission with its newsletters, website, conferences, and educational programs is to inform, educate, and motivate those in the flat-rolled steel industry.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

How to set a press brake backgauge manually

Capturing, recording equipment inspection data for FMEA

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI