Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices tumbling back to levels before the war in Ukraine

Steel buyers recognize that they need to be more cognizant of just how far prices might fall

- By Michael Cowden

- June 15, 2022

Steel prices look to be falling after a huge price spike in March following Russia’s invasion of Ukraine. betoon/iStock/Getty Images

Very quickly the steel market has reverted back to where it was before the war in Ukraine. The big question now is not whether prices fall, but how fast and where the bottom might be.

Chatter in the market suggests some wonder if prices will fall back to or below $1,000/ton, roughly where they were just after Russian forces launched their full-scale invasion.

“My bigger concern is where does it stop? I didn’t think it was going to stop until—Abracadabra!—there was a war. Now I can’t think of a single thing that would stop it from sliding besides the mills saying, ‘Ok, we’re going to throttle back,’” one service center executive said.

A second service center executive agreed. “I hate talking about lower prices because I have inventory, and I want prices to be higher,” he said. “But I think we are fast returning to the path we were on prior to Mr. Putin’s invasion.”

A Brief History of Steel Prices

The prospect of hot-rolled coil (HRC) at $1,000/ton seemed remote in mid-April, when prices nearly hit $1,500/ton, according to our pricing tool. Also, remember it was only in September 2021 when prices reached nearly $1,955/ton, but the climb to last September’s record high was a long slog compared to the unprecedented price spike we saw in March 2022, when HRC rose $435/per ton over 31 days.

I’ve been writing about steel and metals since 2007. SMU’s numbers go back to 2007. There is analogue to what we saw in March. It was the biggest price jump steel has seen in the last 15 years—perhaps ever.

But HRC pricing at or below $1,000/ton is not hard to imagine now. New capacity is ramping up. Scrap prices have fallen in recent months. Now concerns are mounting that inflation—and the higher interest rates deployed to combat it—could tip the broader economy into recession.

Knowing why these gyrations happened is cold comfort if you’re bringing in material now that was ordered a month ago, when spot prices were significantly higher.

“We were making a slim margin on hot-rolled and a decent margin on cold-rolled and coated. Now we’re losing money on hot-rolled and making a slim margin on cold-rolled and coated,” a service center executive recently told Steel Market Update.

How many others are in the same boat?

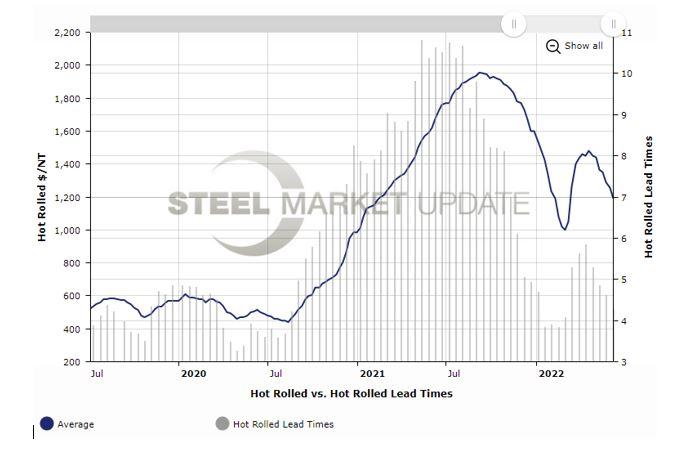

Figure 1. The short lead times for sheet metal have put the mills in a position where they are open to negotiating lower prices. (HRC prices are the blue bars, and lead times are the gray bars.)

Our Latest Survey Results

Given such comments, it’s maybe not surprising that SMU’s latest survey results are the most bearish we’ve seen since the beginning of the war. HRC lead times are down (see Figure 1). (You can create this chart, and others like it, with our interactive pricing tool. You must be an SMU member. Log in and visit: www.steelmarketupdate.com/dynamic-pricing-graph/interactive-pricing-tool-members.)

A roughly four-week lead time for HRC is relatively standard by most historical comparisons. But while lead times are back to normal, prices still are very elevated compared to past norms. If you look back to August 2019 for example, before the pandemic distorted markets, lead times were roughly where they are now, but HRC prices were $585/ton.

With lead times short, more mills are willing to negotiate lower prices. Survey respondents tell us nearly 90% of domestic mills are willing to consider cutting HRC prices to attract new orders. That’s a sharp turn of events from March, when almost all mills were insisting on higher prices (see Figure 2).

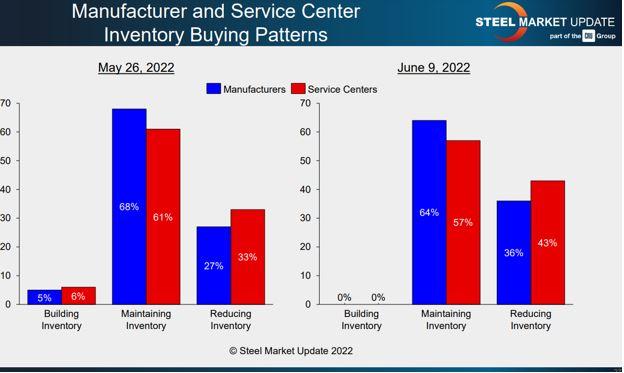

This isn’t happening in a vacuum. More and more service centers and manufacturers tell us they are looking to cut inventories—and that trend has accelerated in recent weeks (see Figure 3).

And it’s not just mills that are lowering prices. So too are service centers. That’s another sharp reversal of the trends we saw in March and April, when service centers, like mills, were aggressively raising prices.

Similar reports are evident elsewhere. More people report that they are on the sidelines. There’s an increase in the number of people pessimistic about their future prospects. But you get the picture.

We’re no longer in the seller’s market that characterized March and much of April. Instead, we’re back to the buyer’s market that we had at the beginning of the year, before the war temporarily sparked concerns about the availability of key raw materials such as pig iron.

Where Do We Go From Here?

The results of our latest survey indicate that people continue to expect prices to go down, at least in the short term (see Figure 4). Will they recover in the fourth quarter?

First the bear case: I don’t like to talk about the summer of 2008. I don’t think comparisons to that period should be made as lightly as they sometimes are. But I’d be remiss if I didn’t acknowledge that some market participants fear that there are too many parallels for comfort between June 2008 and June 2022.

Some recall mills insisting then that everything was fine. That demand was good, and that backlogs from the various markets they served was good—right up until those backlogs vanished almost overnight. And they hear echoes in public comments from steel industry executives that are eerily familiar to what was being said in 2008.

Figure 2. In March steel mills insisted on higher steel prices. As of June, they are a bit more flexible in steel price discussions.

I’m still not ready to go all in on the ’08 parallels. Prices in Asia appear to be stabilizing, and import offers for HRC aren’t very competitive given how fast domestic prices are falling. The discrepancies between import and domestic cold-rolled and coated prices are larger. But there, too, our understanding is that the gap is closing quickly.

“If you’re a buyer, you’re like, ‘Wait a minute, why am I going to buy import (HRC) right now? The domestic price is heading to $50/cwt. I’m not sure it’s going to stop when it gets to $50. So what is a good import price right now?’” one mill executive told me.

Recall too that the U.S. tends to both overshoot and undershoot the global market. We dropped below Asian HRC prices in the summer of 2020. Remember $440/ton, anyone? And then it was nowhere but up for the next two years.

I also think back to what a veteran steel industry analyst once told me: “Whenever everyone throws in the towel on the steel industry is usually when it comes roaring back.”

Steel Market Update Events

SMU’s Steel Summit, the biggest annual steel gathering of its kind in North America, is happening Aug. 22-24 in Atlanta at the Georgia International Convention Center. I’ll be there. We anticipate roughly 1,200 decision-makers from the sheet and plate industries to attend as well. Some nearby hotels already are selling out.

If you register, you’ll have access to our discounted room blocks. You can do that here.

As I said last month, if you’re on the fence about going, think about it this way: You could plan a half-dozen trips to see customers, or you could see them all at once in Atlanta. The logistics are hard to beat. You can take a tram from the airport to the conference and the hotels around it. You can be in and out without having to worry about renting a car or navigating traffic.

For more information about SMU in general or to sign up for a free trial subscription, email info@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/09/2024

- Running Time:

- 63:55

In this podcast episode, Brian Steel, CEO of Cadrex Manufacturing, discusses the challenges of acquiring, merging, and integrating...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI