President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

What to look for besides the climbing steel price

Lead times might be an early indicator of when steel prices will recede

- By John Packard and Michael Cowden

- June 18, 2021

If you look beyond the rising prices for hot-rolled coil, you might begin to get a better idea of when steel prices might retreat from historic highs. Hint: Keep an eye on lead times from the mills. Getty Images

No one could have predicted a year ago that the steel market would be where it is today. And it remains difficult to predict how long steel prices will stay in nosebleed territory.

Steel Market Update’s average hot-rolled coil (HRC) price was at $1,720/ton ($86/cwt) as of June 15, up nearly 75% from $985/ton at the beginning of the year and a roughly fourfold increase from the 2020 low of $440/ton.

It would have sounded insane a year ago to suggest that steel prices would smash through the $1,000/ton ceiling, let alone $1,700/ton. Suddenly even $1,800/ton is not unimaginable.

People now are talking seriously about $2,000/ton HRC. That sounds more like a stainless or aluminum price. But we’re already near that level for coated products like galvanized and Galvalume.

Here’s another fact to give the current market some context: Prices for prime scrap are now approximately $645/gross ton, or about $576/short ton. Historically, HRC typically has stayed in a relatively narrow bandwidth of $500/ton to $700/ton. It never has gone too far below $500/ton because mills started losing money. And it never has gone too far above $700 or else imports would flood in and send prices lower.

None of us has seen a market like this before. And that $500/ton for HRC might more accurately describe prime scrap prices these days.

It’s not SMU’s job to forecast steel prices. But what we can do is suggest some indicators to watch closely if you think prices are nearing a peak—namely sentiment and lead times, both of which SMU tracks closely.

Steel Buyers Remain Optimistic

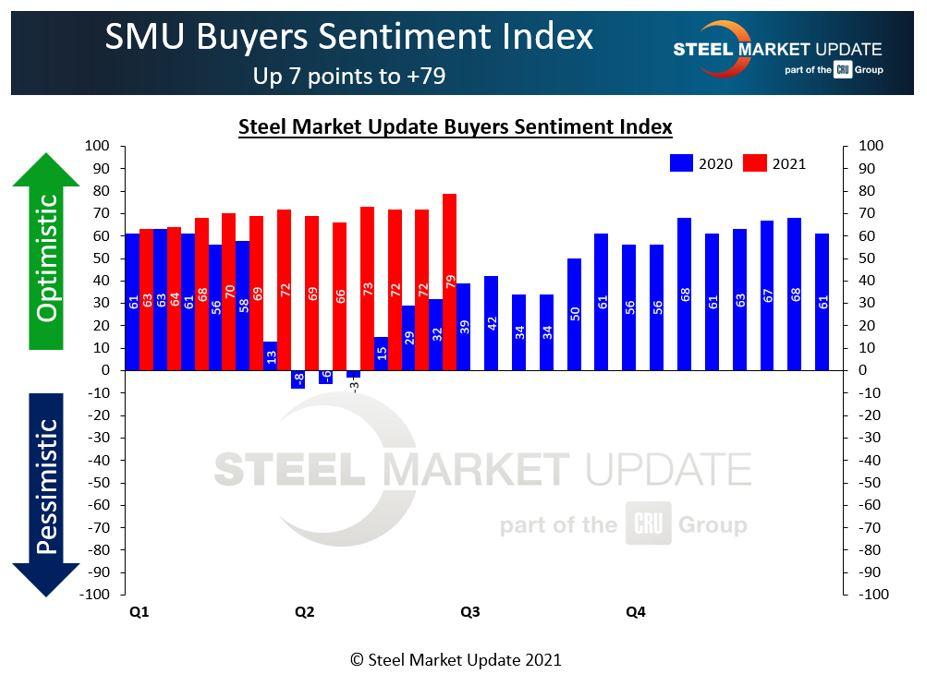

Let’s start with sentiment. You would think with prices as high as they are—and fears about a correction running rampant in some corners of the market—that sentiment might be lower. And yet, to date, there is simply no evidence of any real pessimism. Our sentiment index is at +79, its highest reading ever and up sharply from the negative readings we saw following the outbreak of the COVID-19 pandemic in the U.S. in the first half of 2020 (see Figure 1).

That’s a bit surprising given that steel and scrap prices have been a little wobbly in Asia. Keep in mind that the U.S. typically follows Asia, on a lag. And, given steel’s notorious volatility, any pricing correction has the potential to be sharp and violent rather than gradual. But the point of SMU surveys is not to tell people what to think. It’s about listening to what the market is telling us.

To date, for each survey respondent reporting concerns about inflation, a correction, or demand destruction, approximately three report that demand is so strong that price remains a secondary concern. For most, the tight availability of steel is the primary issue. And the bullishness in our surveys has been borne out in market prices more so than the pessimism baked into some forecasts.

Figure 1. Steel buyers’ sentiment, as measured by Steel Market Update, is at an all-time high, as are steel prices. Buyers remain highly optimistic about their prospects, despite the possibility of a price correction in the coming months.

That said, the steel community is optimistic by nature. Is it too optimistic?

Here’s another way to look at it. Prices nosedived along with sentiment in April and May of last year. But last August, when prices were even lower than in the spring, sentiment remained in solidly positive territory—which turned out to be a good advance indicator of the rally that was coming. And sentiment continued to lead prices higher through much of the first half of 2021.

So it does appear that buoyant sentiment is a good indicator of higher prices—at least on the way up. What’s a little worrisome—if you’re looking for reasons to worry—is that sentiment seems to follow prices on the way down. Take March and April 2020, for example. Sentiment was probably too positive in the early days of the pandemic. It didn’t drop into negative territory until after prices had already corrected sharply lower.

Taking a Look at Lead Times

Another indicator to watch closely: SMU’s lead times.

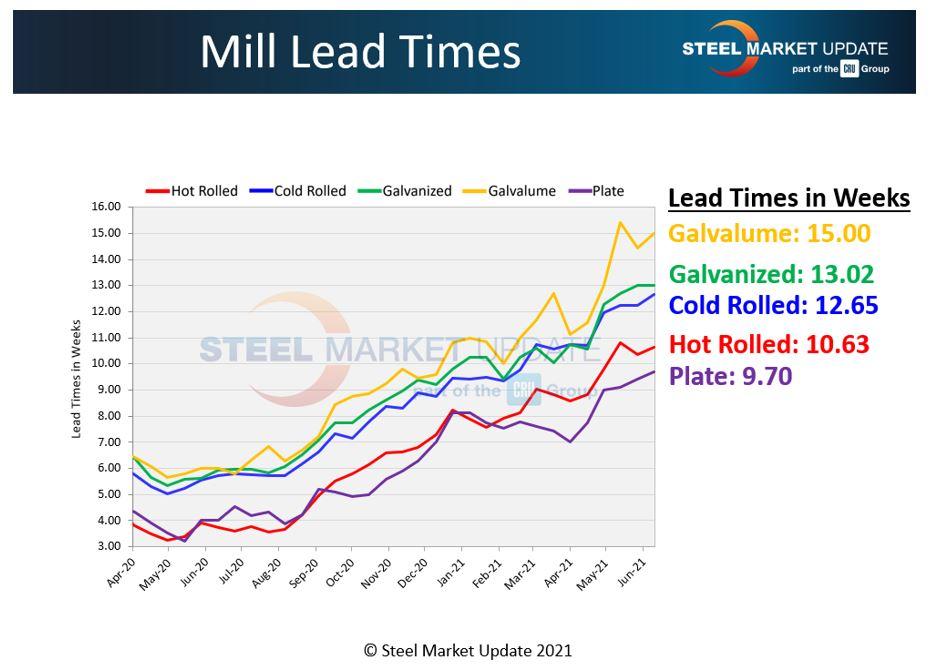

When lead times are stretching out, it usually means prices are going to keep moving up. And when lead times are moving in, it’s typically a sign that prices are falling or will soon. As you can see in Figure 2, lead times have been marching steadily upward since last August, when prices bottomed and this historic upcycle started.

Deliveries for spot orders of HRC now average 10 to 11 weeks, which means any steel ordered in June might not arrive until late August or early September. Some industry veterans are now raising the question if a year-long price upswing is possible. In fact, some people believe the market might not correct until the first half of 2022.

Lead times have been a little choppy lately, but it’s hard to read anything into deliveries bouncing around between 10 and 11 weeks, which is more than double what they would be in a normal market. But keep an eye out for HRC lead times flattening out—as they appear to have done already in galvanized—and then for any sustained declines. Because if lead times slip, it means steel is more readily available (see Figure 3). And more supply typically means lower prices.

What Steel Buyers Are Saying

To give you an idea of what people think about the current steel-buying market, we provide you some of their recent feedback:

- “We are in uncharted territory. I would never have dreamed it would ever get this high.”

- “We're hearing more rumors of spot tons, but they are so few it isn't moving the needle.”

- “Prices are already too high, but it seems to have a little further to go.”

- “Prices will come off in July. Total imports have been tracking higher since January.”

- “We don't expect imports to come flooding the market, nor do we expect domestic mills to bring back idled capacity. The strength will continue to run heading into the holiday season. Ho! Ho! Ho! Here's some $2,000/ton HRC in your stocking.”

Steel Market Update Events

SMU’s Steel Summit Conference in Atlanta Aug. 23-25 will be a live, in-person event. There will be an option to attend the event virtually for those unable travel. Click here for more information and to register: www.events.crugroup.com/smusteelsummit/home.

For more information about how to become an SMU subscriber and to sign up for a free trial, contact Paige Mayhair at paige@steelmarketupdate.com or by phone at 724-720-1012.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Michael Cowden

Senior Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI