Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

What’s next after the early 2023 steel price hike?

Steel buyers suggest that a decline could be coming by early summer

- By Michael Cowden

- March 17, 2023

As steel prices climb, imported steel looks more affordable to domestic steel buyers. onlyyouqj/iStock/Getty Images Plus

Monday mornings are for sheet mill price hike announcements—or so it seems lately.

Cleveland-Cliffs, as I was writing this article in mid-March, announced it was up $100/ton ($5/cwt) on sheet prices in general and targeting a $1,200/ton base price for hot-rolled coil (HRC) in particular.

I would not be surprised if more increases are announced by the time you read this text. But let’s assume for a moment that the rapid-fire increases that the Cleveland-based steelmaker, and its competitors, have announced since mid-January stopped.

I’m using Cliffs as an example, but the same pricing trends, broadly speaking, apply to other domestic flat-rolled steelmakers.

The company has announced six increases totaling $450/ton since the beginning of the year. The first three were $50/ton each, and the second three $100/ton each, according to SMU's price increase calendar.

Recall, too, that Cliffs rolled out its first increase of the year on Jan. 17, up $50 and targeting $800/ton. That implied Cliffs’ HRC price at the time was $750/ton. If the company achieves $1,200/ton, it would represent a 60% gain in less than three months.

A Brief History of Hot Band Price Spikes

We’ve seen price spikes like that before. HRC prices last year rose from about $1,000/ton from late February/early March to nearly $1,500/ton by mid-to-late April—only to fall back to about $1,000/ton in late June. (You can chart that out for yourself using our pricing tool at www.steelmarketupdate.com/dynamic-pricing-graph/interactive-pricing-tool-public.)

What we haven’t seen is a price spike like this that didn’t coincide with a major external catalyst.

The spike from $1,000/ton to $1,500/ton HRC last year stemmed from a panic about raw materials prices following Russia’s invasion of Ukraine in late February. We also saw a sharp price rally in the first half of 2021 on the snapback in demand following the initial outbreak of the pandemic in 2020.

And if you want to zoom out even further, we saw something similar in 2018 with the surprise rollout of Section 232 tariffs of 25% on foreign steel. Then the even bigger surprise of those tariffs being applied to Canada and Mexico followed.

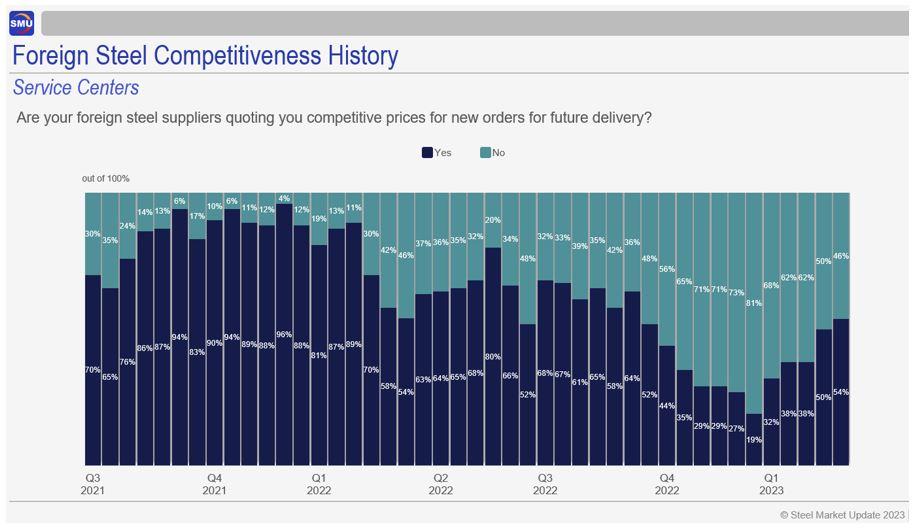

Figure 1. Foreign steel is a lot more attractive for domestic steel buyers than it was in late 2022.

No black swan events occurred this time. Instead, there were a lot of “mini swans,” as one market contact told me. Among those massively disruptive events were spring maintenance outages, new capacity ramping up more slowly than expected, production issues at a major Mexican steelmaker, and low import volumes.

I know some of you think the sharp gains stem from mill greed. But let’s also consider the case for mill need, which might explain why there was such a concerted rush to increase in the first quarter.

CRU-linked contracts, as most of you know, are often based on a discount to the prior month’s spot price. The average CRU spot price for January, which determined February contract numbers, was $716/ton. And the average CRU spot price for February, which determines March contract prices, was $803/ton. Let’s assume a 5% discount and you get to $680/ton and $763/ton, respectively.

Given how rapidly scrap prices shot up in the first quarter, some mills might have been operating at skinnier profits on contract tons than you might think, even as producers were targeting $1,000-plus/ton on the spot market.

It’s also worth noting here that mill capacity utilization has been low. It’s been hovering around 75% for most of this year, according to figures from the American Iron and Steel Institute (AISI). It’s been that way even as HRC prices have soared into four-digit territory. That’s a departure from past upcycles.

Case in point: Capacity utilization, per AISI figures, was at 81.9% last April as HRC prices approached $1,500/ton. It was at nearly 85% in August 2021, when market participants were speculating that HRC might hit $2,000/ton.

When Consensus Is Wrong

That’s the bookkeeping aspect of it. There has been a very emotional aspect to it too, judging from some of the calls, emails, and text messages SMU has received.

We’ve had mills incensed that anyone might question whether HRC could soar well above $1,000/ton. We’ve had buyers insist that price gains of this magnitude can’t be real. Heck, in my last article for The FABRICATOR, I noted that only 5% of respondents to our survey thought prices would rise above $900/ton.

Let’s set aside the acrimony and accusations for a moment. I think we might be able to agree that it stems in large part from consensus about 2023 not matching reality to date.

Prices fell to nearly $600/ton in November, and our low end—which typically represents large buyers—dropped into the $500s/ton. There were fears that we’d start the year with a mild recession spawned by higher interest rates.

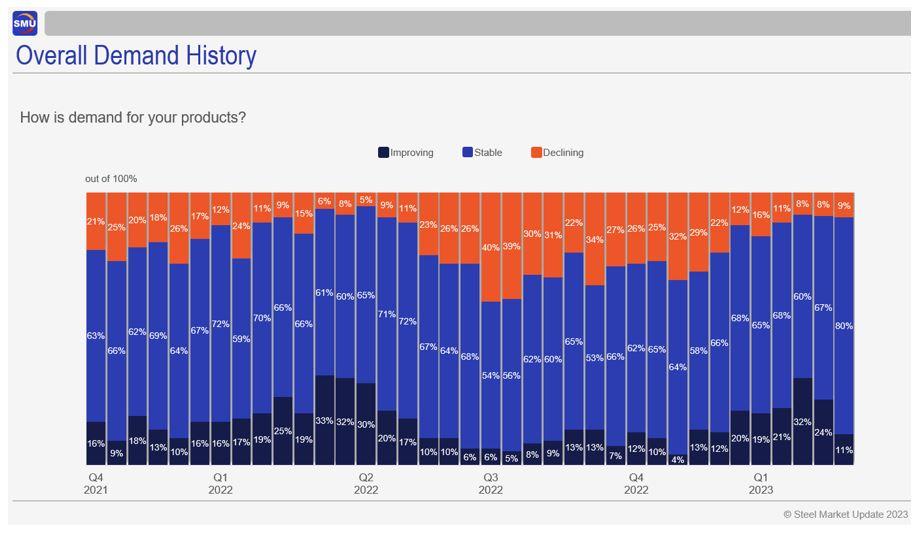

Figure 2. The number of respondents reporting improving demand for their steel products has declined over the past couple of months.

Instead, demand surprised to the upside. Is it stellar? Not necessarily. But in general, it’s better than expected.

Industry observers also agreed that the higher prices we saw in late 2022 and early 2023 were mostly momentum-driven, based on certain contract dynamics or on steel consumers buying ahead of the next anticipated price hike. The generally accepted notion was that prices would, as a result, peak in Q1 and come back to earth after that.

So what happened? You could make a case that fears of a recession functioned almost like fears of domestic prices correcting downward when it comes to import buys. We’re more familiar with the contours of the latter. Fears of domestic prices correcting can prevent people from buying imports, which functions to extend domestic price rallies.

Could fears of a recession have kept people from buying as much as they ordinarily would have? And could that, in turn, have contributed to the surge in prices we’re seeing now? It’s worth considering.

Second-half Blues?

What happens in late Q2 and in the early half of this year? Recall that late Q2 is when Nucor has said the Gallatin expansion would ramp up. It’s also when some of you said long U.S. lead times now might prove costly, because they reduce the risk of ordering imports, which could be arriving in greater volumes around then. See Figure 1, for example.

Fifty-four percent of service center respondents say import pricing is competitive with domestic offerings now, up from only 19% late last year. Any material ordered now might not arrive until this summer. But what happens when it does arrive?

Also, while demand is by no means bad, we’ve seen some moderation over the last month or so (see Figure 2).

Only 9% report declining demand. That’s a good result and on par with numbers we’ve seen since the beginning of the year. But the number of people reporting improving demand has fallen from 32% in February to 11% in March.

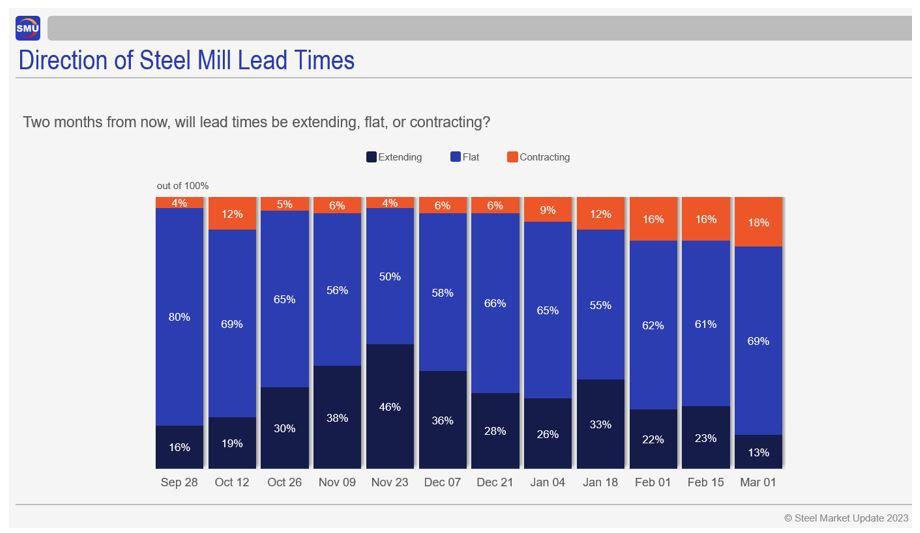

Finally, look where our readers expect lead times to be two months from now (see Figure 3).

I like this question: “Two months from now, will lead times be extending, flat, or contracting?” You could make the case that it was one of the early indications of the current price rally. There was a sharp rise in November in the number of people (46%) predicting that lead times would be extending in two months.

Figure 3. Survey respondents might be offering an educated guess about where steel mill lead times are heading: flat or contracting by May/June.

That number has since fallen to only 13%. Don’t get me wrong. Lead times are extended now, and I wouldn’t be surprised to see them continue to extend over the short term. But if our survey respondents are correct, we should expect lead times to be flat or contracting in May/June.

Could that be a sign that this will be a first-half rally that runs out of steam in the second? It looks that way to me. That said, I've been wrong before, so I’m happy to hear any ideas from you on where things might go from here.

SMU Events

Consider registering for our Steel Hedging 101. We’ll be holding the event live in Chicago on April 26 and live in Pittsburgh on June 20. It’s a great overview of the hedging tools that can help you navigate today’s more volatile steel markets. You can learn more about Steel Hedging and register here.

Also, don’t forget to register for the Steel Summit, our flagship event and the largest flat-rolled steel conference in North America. The Steel Summit is scheduled for Aug. 21-23 at the Georgia International Convention Center in Atlanta. You can learn more and register here.

Keynote speakers this year will include Cleveland-Cliffs Chairman/President/CEO Lourenco Goncalves; ITR Economics President Alan Beaulieu; Gene Marks, president of The Marks Group PC; and Barry Zekelman, executive chairman and CEO of Zekelman Industries. We’ll be announcing additional speakers in the weeks ahead.

SMU Subscriptions and Surveys

If you find this column informative, please consider subscribing to Steel Market Update. To do so, contact Lindsey Fox at lindsey@steelmarketupdate.com.

Also, please consider participating in our market surveys. Your voice allows us to get a snapshot of the market as it is, even if that’s not always where it was forecast to be. Contact info@steelmarketupdate.com to sign up.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI