Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Will announced steel price hikes stick?

Even with optimism in the metalworking industry and strong demand for products, no one is sure

- By Michael Cowden

- August 16, 2022

U.S. prices for hot-rolled steel coil have fallen nearly 45% from their peak of $1,480/ton following the outbreak of war in Ukraine to approximately $820/ton more recently. simon2579/iStock/Getty Images Plus

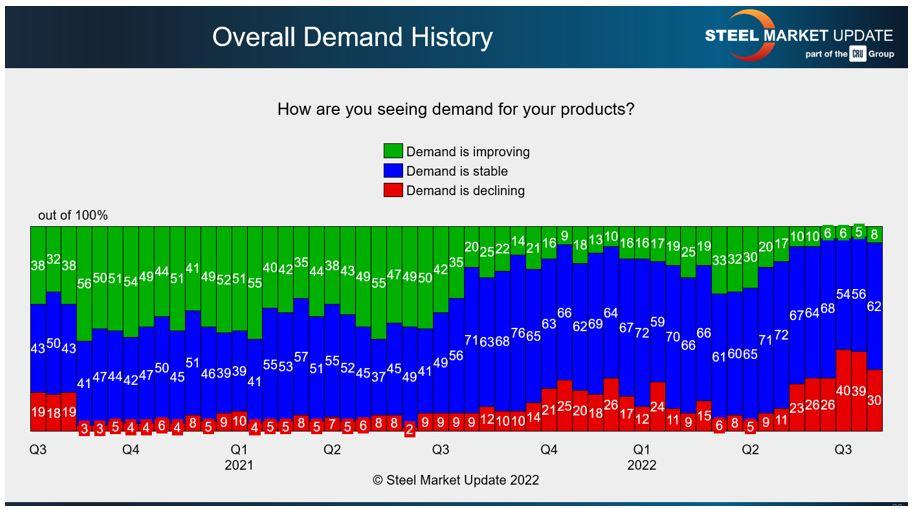

I started out my column last month on a very bearish note. More people responding to our surveys were reporting declining demand than at any time since the early days of the pandemic. I feared that trend would continue.

Fortunately, it didn’t. Don’t get me wrong, our more recent survey data is hardly bullish. But it’s less bearish than it was over the summer.

So did we bottom out and start to rebound toward the end the summer? Or was it the infamous dead-cat bounce?

A (Modestly) Rosier Outlook

First, some context. Fewer people responding to our surveys are reporting declining demand (see Figure 1). Approximately 30% compared to around 40% in July.

Roughly a third of people reporting lower demand is by no means a good thing. But it’s a relief to see the trend of declining demand is not getting any worse.

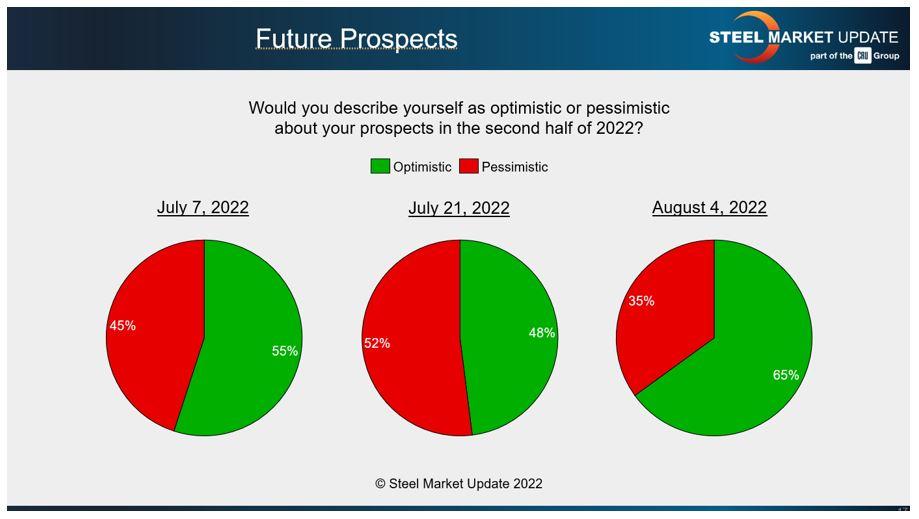

Also, more people are optimistic about the second half of this year than was the case in July (see Figure 2), when that market seemed to have hit what I’ll call peak pessimism.

Almost all survey respondents report that domestic mills still are willing to negotiate lower sheet prices. We also have seen a big change in manufacturer buying patterns (see Figure 3). Fewer—actually the fewest since at least Q3 2020—say they are buying imports to meet future requirements.

That shouldn’t come as a surprise to those of you who have been following our coverage of the rapidly declining spread between U.S. hot-rolled coil (HRC) prices and the landed price of imported HRC.

Also, U.S. prices have fallen nearly 45% from their peak of $1,480/ton following the outbreak of war in Ukraine to approximately $820/ton more recently. Big declines like that in a short period of time often make buyers think twice about buying imports, especially given the longer lead times associated with offshore purchases.

The trend is not true across the board. Most trader respondents to our surveys report back that they are not able to offer competitive HRC prices to U.S. buyers. But when it comes to foreign galvanized and Galvalume products, most say they are still able to offer attractive pricing.

Figure 1. A survey of steel buyers revealed that an increase in people reporting “stable” demand for their products.

Why? U.S. HRC prices have fallen more quickly than prices for coated products. The result: Base prices for coated products such as hot-dipped galvanized carry a much higher premium to HRC than in the past. That has made domestic coated product more vulnerable to imports. But with new capacity in the U.S. continuing to ramp up, I wouldn’t be surprised to see domestic coated price fall fast too, making imports less competitive in future months.

Will Price Hikes Stick?

On the news side, we saw mills in the U.S. and Canada in August announce price hikes for the first time since March. Recall March marked the start of the war in Ukraine, which temporarily sent raw materials and steel prices sharply higher.

When this article was filed in mid-August, the question was whether those increases would stick. Would they serve to set a floor for the market at or around $800/ton for HRC, or would they fail and only underscore underlying weak demand?

I’d think of price increases like trying to start a car. The price hike is turning the key. Demand is the gas. If there is no gas in the tank, the engine won’t start no matter how many times you turn the key.

Looking back at recent price hikes from Nucor, the steelmaker probably used price hikes to change the psychology of the market twice over the last two years—once as demand snapped back in 2020 following the initial outbreak of the pandemic and again this year following the war in Ukraine.

The fundamentals supported higher prices in the back half of 2020, and no one needed a reminder of which way prices were going for the first eight months of 2021. But as pricing trends following the war indicate, the jolt provided by price hikes can only be sustained if supply-and-demand fundamentals support the upward move. The fundamentals did not support higher prices for long earlier this year, despite a combined $275/ton in price hikes.

A similar pattern of price hikes not sticking for long repeated throughout much of 2019 too. Price hikes were not enough, for example, to offset the impact of Section 232 being lifted from Canada and Mexico in 2019, and so their impact was fleeting.

So will mill price hikes change service center psychology this time around, or will they fall on deaf ears? The jury is still out on that. You can find data points to support either position.

Labor Negotiations

Another big thing to consider is contract negotiations between U.S. and Canadian mills and the United Steelworkers (USW) union. Futures markets have been watching those developments closely.

In Canada, prior contracts with Stelco and the USW expired at the end of June. Those between production workers at Algoma and the union expired at the end of July. Neither mill had agreed to new terms with the USW at the time this article was filed.

Figure 2. Despite a lot of concern about an economic slowdown, a majority of survey respondents are optimistic about their business prospects in the second half of 2022.

Workers at both mills were legally authorized to strike in mid- to late August. A disruption at either mill, both of which are important suppliers to the upper Midwest and the Great Lakes, could create waves in the U.S. market.

The even bigger question is whether the USW agrees to new labor contracts with U.S. Steel and Cleveland-Cliffs. Current labor contracts between the union and the two U.S. steelmakers expire on Sept. 1.

Labor accords would roughly preserve the status quo. A strike or lockout at a major U.S. mill has the potential to send prices temporarily higher, perhaps similar to what we saw earlier this year with the war in Ukraine. Remember that Algoma and Stelco operate one integrated mill each. U.S. Steel and Cleveland-Cliffs are much larger companies, have more mills, and together account for much of the flat-rolled steel produced domestically.

Steel Market Update Events

The next Steel 101 workshop will be held in on Oct. 19-20 in Corpus Christi, Texas. The highlight of the event will be a tour of Steel Dynamics Inc.’s new steel mill in Sinton, Texas, the newest electric arc furnace sheet mill in North America.

Steel 101 is a great way for people new to the industry to learn the basics of how steel is made and what the key end markets are. The mill tour provides people a chance to see the processes they’ve just learned about in action.You can learn more here.

If you want to participate in our survey, please contact SMU production manager and steel industry analyst Brett Linton at brett@steelmarketupdate.com.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

Michael Cowden

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Steel industry reacts to Nucor’s new weekly published HRC price

Dynamic Metal blossoms with each passing year

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI