President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Will COVID-19's economic impact weaken steel prices?

Coronavirus has the potential to continue its affect on U.S. manufacturers in a major way

- By John Packard and Tim Triplett

- March 18, 2020

COVID-19 has wrecked the economies of many countries already, but will it do the same to the U.S.? Manufacturers are waiting to see, and as a result, steel prices remain stable—for the time being. Getty Images

Steel prices are as unpredictable as the spread of a rogue virus. But one thing we do know about steel prices is that they are likely to fall in the wake of the COVID-19 scare.

As of March 11, the price of flat-rolled steel products had yet to see much effect from the global panic over the coronavirus. Steel Market Update’s canvass of the market showed an average spot price for hot-rolled coil of $580/ton ($29/cwt), FOB the mill east of the Rockies. Cold-rolled and galvanized were around $770/ton ($38.50/cwt). These numbers moved up and down within a small range in the first two and a half months of the year and had only a small uptick from the price hike announced by the mills in late February. The average price of steel plate delivered to the customer's facility was $650/ton ($32.50/cwt), down from $700/ton ($35.00/cwt) at the beginning of the year. SMU’s Flat-rolled Price Momentum Indicator (excluding plate) remained at “neutral” as the market struggled to establish a clear direction amid all the turmoil caused by the spread of COVID-19.

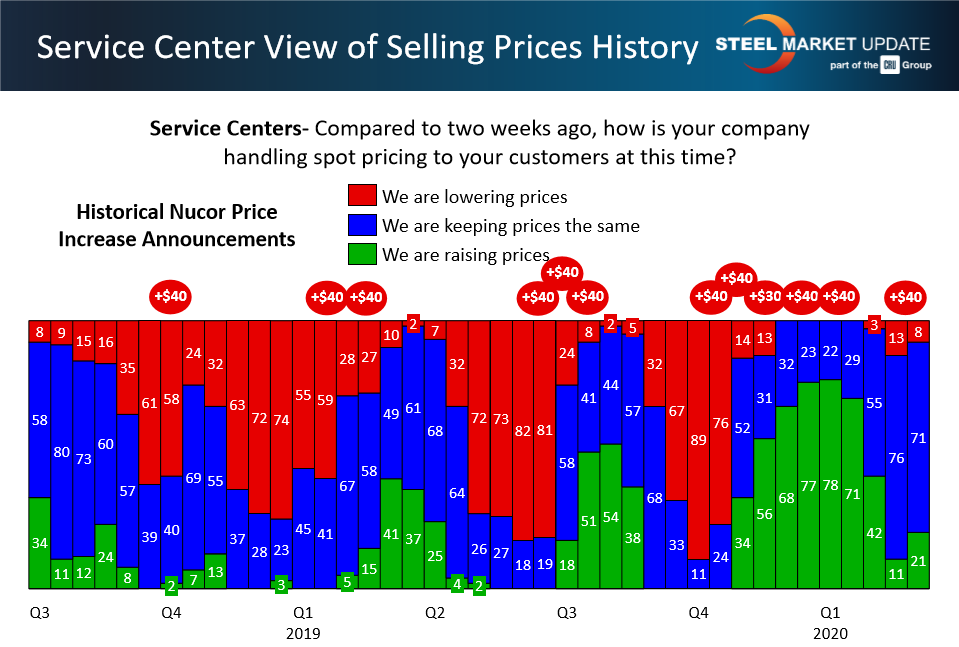

The last price hike by the mills received limited support from the service centers, as shown in Figure 1. Only 21% of those responding to SMU’s poll said they were raising prices to their customers. The vast majority were holding the line or even reducing prices given the uncertain market conditions.

Analysts at SMU’s sister company CRU were predicting the virus would deliver a serious blow to global industrial production and economic growth. Their forecast called for a GDP decline of at least 0.2%, and possibly as high as 1%, which would take world growth into recessionary territory.

Even as China closed factories and quarantined millions of its citizens to stop the spread of the virus, its mills continued to produce steel. So much steel, in fact, that they reportedly have run out of space to store it and have resorted to leaving coils on the ground out in the weather. As its steel-consuming industries struggle to get back on their feet, China has an enormous incentive to export this excess production, at whatever cost, which will be a threat to global steel prices for many months to come.

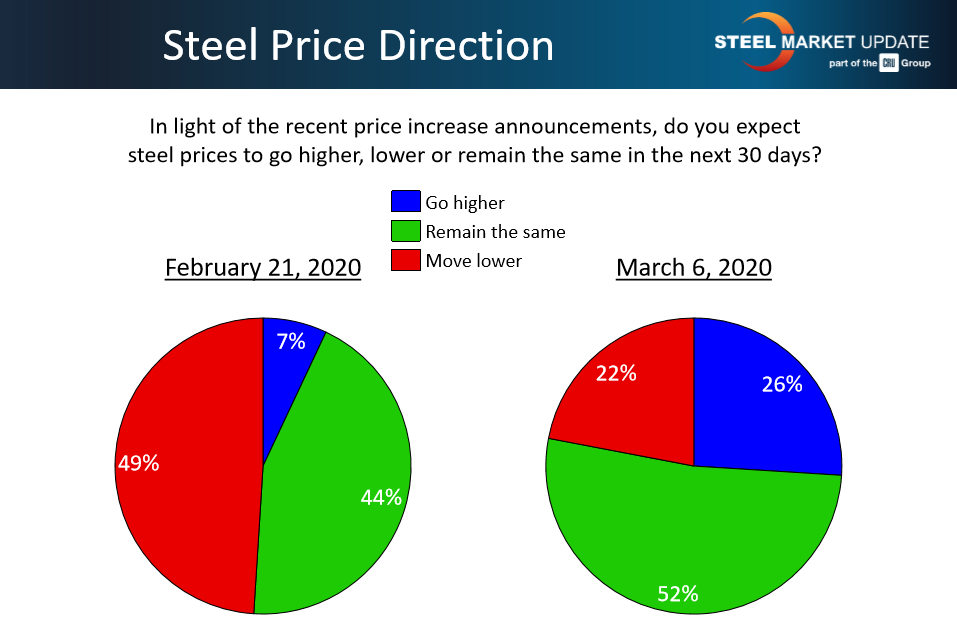

Steel buyers polled by SMU in the first week of March were clearly unsure of what to expect in terms of steel prices. Between the $40/ton flat-rolled increase announced by the mills on Feb. 27 and the doom and gloom predictions of economic disaster from the virus, most were at a loss to predict what would happen next (see Figure 2). Around half said prices would remain about the same. Another 22% expected prices to move even lower in the coming month, while just 26% anticipated higher prices.

Price War in the Energy Market

Since the turn of the year, global oil demand has been hit hard by the COVID-19 virus. Brent crude prices fell by 30% in a single day, taking the price below $34 per barrel as of March 9. CRU predicts oil prices could remain around $40 per barrel for some time. Oil prices that low offer little incentive for new exploration and will dampen demand for oil country tubular goods, line pipe, and other energy-related steel products.

Compounding the problem is the oil price war between Saudi Arabia and Russia. Instead of lowering production in line with the lower demand from COVID-19, Russia refused to cut back. In response, Saudi Arabia increased production and lowered prices, forcing other OPEC members to follow suit. Depending on how long it lasts, this energy price war will challenge shale oil producers in North America, as well as their steel suppliers.

Energy market experts at CRU reported the following: “U.S. crude production has been growing since the shale boom of 2014. The U.S. Energy Information Administration forecasts U.S. crude oil production to average 13.2 million barrels per day in 2020. While production has boomed, so have the debt levels of shale-producing companies. U.S. shale needs the crude oil price to be about $50 per barrel to break even. Companies that have not hedged their revenue against lower oil prices may see investors leave and their companies ultimately go out of business. Those that have hedged their output will be safe for now, but if the price war continues for a prolonged period, they could follow suit. Some U.S. shale companies have seen their share prices drop by more than a third following the decline in oil prices. Speculation is that this is Russia’s aim—to squeeze the U.S. shale companies and push the marginal suppliers to shut down.”

Steel Demand in Flux

Steel prices are a function of steel demand, of course. The extent to which the virus impedes manufacturing in the U.S. remains to play out. The latest figures from the Institute for Supply Management show their PMI registered 50.1 in February, just above the 50.0 level that indicates growth. The PMI was already trending down from 50.9 in January and, given the fallout from the virus, was likely to move into contraction in March. Comments from purchasing managers polled by ISM showed widespread concern about COVID-19:

- “Coronavirus continues to be front and center as a major supply chain risk to our company. Access to information in China—from our supply base and customers—is slow to come by,” said one fabricator.

- “Coronavirus is wreaking havoc on the electronics industry. Companies are delayed in starting up production, which is resulting in longer lead times, constraints and increased pricing. It's a mad dash to dual source stateside in case China isn't back online soon,” said another executive.

Automotive production has been a boon to the global economy for the past decade, but the virus represents a giant speedbump. China’s auto industry, which produces one-third of the world’s vehicles or 26 million cars and trucks per year, has been stalled by the virus. The effect on China’s auto industry has global implications because of the number of Chinese components that are used in auto production in other countries. Supply line disruptions due to plant closures, labor shortages, and transportation restrictions will cause problems in auto plants all over the world. The same holds true for agricultural equipment, electronics, and most other sectors.

Lead Times and Negotiations

Lead times for steel delivery are an indicator of demand at the mill level. The longer the lead time, the busier the mill is, and the less likely they are to negotiate on price. In the first week of March, the average lead time for spot orders of hot-rolled steel was about 4.6 weeks, while cold-rolled was at 6.4 weeks and coated steels were at just over seven weeks. The current lead times have not fluctuated much this year and are higher than at this time last year, which shows the mills sustaining relatively healthy order levels, at least through mid-March. If the virus proves to be the impediment to commerce that’s predicted, SMU would expect lead times to shorten somewhat in the coming weeks as activity slows down at the mills.

According to the majority of steel buyers polled by SMU in the first week of March, most mills remained open to price negotiations even after announcing their late-February price increase. That points to competitive market conditions and possibly lower steel prices as the threat from the virus take shape.

Ferrous Scrap Prices Surprise

How much the mills must pay for raw materials also factors into the price of steel. The iron ore market relies heavily on Chinese demand, which remains uncertain because of disruptions from the virus. Ferrous scrap prices were up just $10/ton in March, well below initial expectations of up to $30/ton. The mills were anticipating that higher scrap prices would lend support to their $40 increase in finished steel prices.What’s Ahead?

Many factors will figure into the price of steel in the coming months—the pace of recovery in China, the duration of the Saudi-Russia oil price war, the health of manufacturing in North America, scrap prices, moves by steel producers and distributors, and of course the persistence of the coronavirus. COVID-19 is the very definition of a “black swan” event. Its unexpected and unprecedented nature make its ultimate impact on the global economy and steel prices unknowable. What’s certain is that it has disrupted the lives of millions all over the world, with tragic consequences for thousands, and it is not done yet.

Upcoming Events

Registration is underway for the 2020 Steel Market Update Steel Summit, Aug. 24-26, in Atlanta.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

AI, machine learning, and the future of metal fabrication

Employee ownership: The best way to ensure engagement

Dynamic Metal blossoms with each passing year

Steel industry reacts to Nucor’s new weekly published HRC price

Metal fabrication management: A guide for new supervisors

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI