- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Tube® expo to highlight some of the many changes in store over next few years

Changes in policies, industrial markets, and technologies likely to expand tube, pipe applications and opportunities

- By Eric Lundin

- January 16, 2020

- Article

- Shop Management

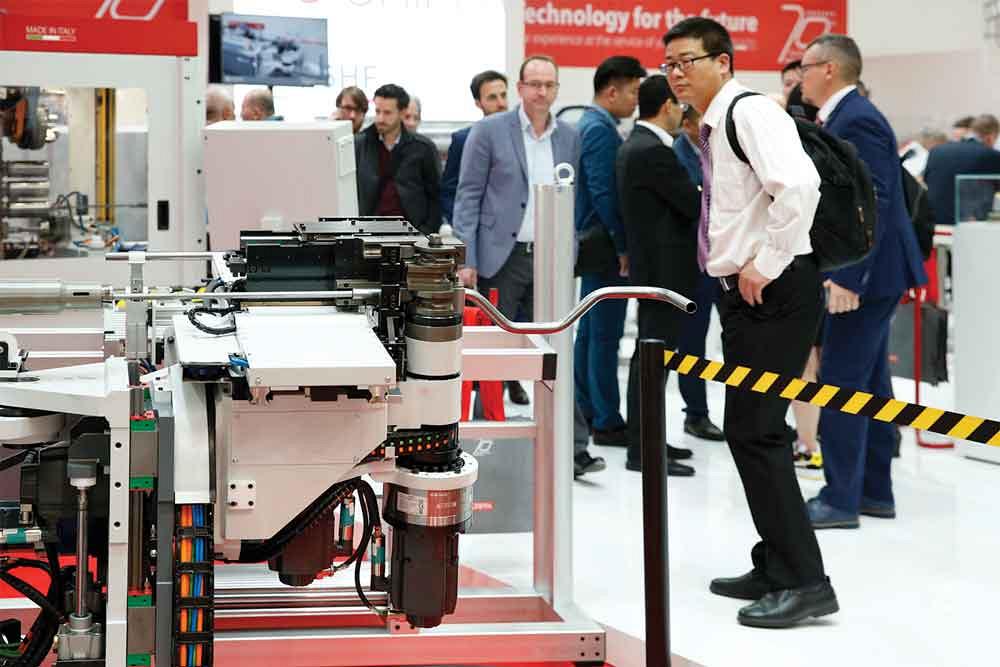

The biennial Tube® expo in Düsseldorf is always a reflection of the state of the industry, an up-to-date display of tube- and pipe-related production and fabrication technologies as they are used throughout the world. At the forthcoming expo, March 30 – April 3, visitors are likely to see a richer use than ever before of Industry 4.0 technologies, robotics, and the advanced materials that lead to ever-more-rigorous tube and pipe products.

It has been almost two years since the previous Tube® expo concluded, and as the next one approaches, March 30-April 3, evidence is mounting that substantial changes in manufacturing are under way. Changes in international policies, marketplace dynamics, and technologies are working their way through industry and altering the manufacturing landscape. These matters don’t concern just Germany or Europe but have repercussions that will affect manufacturing throughout the world.

Foremost among the impending changes is Britain’s exit from the European Union (EU). Although the British government initiated the country’s withdrawal from the EU on March 29, 2017, the U.K. and the EU made little substantial progress on the terms of Britain’s exit in the ensuing timeframe. With no trade agreement in place, it’s anyone’s guess as to what will happen next. If the two governing bodies can’t reach an agreement, or if the terms of the agreement upset the status quo, Britain’s exit might be a boon to the U.S. manufacturing industry as European and British manufacturers seek suppliers and customers to replace those they lost.

A second disruption, one that is likely to be much more monumental in how it impacts manufacturing, especially regarding tube and pipe, is energy consumption in Europe. This topic has a multitude of factors, not the least of which are energy security, price, and emissions.

It seems that for every country that enjoys the luxury of abundant domestic energy resources, there are several that don’t. This has been a concern among many countries throughout Europe for decades—as a whole, the EU imports about 55% of the energy it uses—and Russia’s invasion of Ukraine in 2014 brought to the forefront the many concerns about the stability of the natural gas supply in Europe.

About 40% of the natural gas imported by the EU originates in Russia, and about half of that moves through pipelines that run through Ukraine. After Russia annexed part of Ukraine in 2014, the EU passed regulation 2017/1938, which discusses the security of the gas supply, calling for enhanced cooperation among EU members, and specifically cites structural improvements and increasing the domestic supply, both of which are beneficial to tube and pipe producers: “A truly interconnected internal energy market with multiple entry points and reverse flows can be created only by fully interconnecting its gas grids, by building up liquefied natural gas (LNG) hubs in the union’s southern and eastern regions, by completing the north-south and southern gas corridors, and by further developing domestic production.”

The two other energy issues, which are closely related to each other, are price and greenhouse gas (GHG) emissions. The crude oil price jumped somewhat suddenly in the early 2000s as demand surged in Asia, notably in China and India. Higher prices inevitably led to more research into energy conservation and energy substitution, both of which resulted in improved or entirely new manufacturing processes that benefit metal producers and fabricators of all sorts, especially tube producers and fabricators. The ongoing efforts to make automobiles more efficient and decrease GHGs increase the use of materials with the most favorable strength-to-weight ratios, which supports two trends: research in new materials and an increased use of tube for structural components in automobile applications.

Furthermore, the ways in which energy is derived and used in Europe are changing. One of the EU’s targets for 2020 was to reduce GHGs by 20% as compared to the 1990 level. Part of this goal was an increase in wind power. Building towers, specifically the lengthy supports needed for offshore towers in ever-deeper waters, has been a benefit to manufacturers in the metals industry.

Europe hit the 20% reduction mark early, actually achieving a 23% reduction in GHGs by 2018, but more is to be done to meet the next target, a 30% reduction by 2040.

In addition to these big-picture trends, other changes are working their way through the manufacturing industry and have earned a place in the equipment and among the processes currently in use. Market studies released by the Tube expo organizer, Messe Düsseldorf, discuss the big technology trends that visitors can expect to see at the tradeshow.

Technology Trends on Display in Düsseldorf

Just a few years ago, Industry 4.0 was more of a vision than a reality; now it is a viable technology that is enhancing and shaping production processes. The German Federal Ministry of Economics (GFME) expects that planned annual investments in Industry 4.0 applications will total nearly $44.5 billion in 2020. In research initiated some time ago, the GFME found that German companies that adopted Industry 4.0 technology early on are part of the trend toward smart factories, with more than 80% reporting a high degree of digitization in their value chains by 2020.

While the largest companies have the most resources to adopt new technologies, Industry 4.0 initiatives have been working their way through the entire metal fabrication supply chain, from steel suppliers to OEMs to equipment vendors.

Digital Processes Shine Upstream. One of the characteristics of Industry 4.0 technology is that it’s scalable throughout industry, useful for small manufacturing shops and large enterprises such as steel mills. The SMS Group, an equipment builder with headquarters in Düsseldorf, Germany, uses networked systems, self-learning process models, intelligent assistance systems, artificial intelligence (AI), and virtual reality in the design, production, and maintenance of its steel and rolling mills. A digital smelting works is already reality.

According to SMS, AI has proven its value in troubleshooting. In one particular case, AI determined that the strip temperatures on the coil occasionally and suddenly differed greatly from the intended temperature. The temperature swings were so extreme that they affected the material’s properties. The solution was simple—adjust the flow of cooling water—but the problem was complex. The strength of the system is its ability to detect unknown correlations among various inputs, and thereby to detect interference factors early on, according to SMS. The problem wouldn’t have been uncovered without an advanced digital system.

While working in cooperation with Jacobs University, Bremen, Germany, the SMS Group developed the X-Pact® Performance Enrichment Analysis, a method backed by AI, that detected an unexpected correlation between a faulty work roll in a roll stand and the temperature differences in the cooling system, and it verified the correlation precisely—more so than would have been verified by a standard analysis.

Steel manufacturer Hüttenwerke Krupp Mannesmann, Duisburg, Germany, likewise uses Industry 4.0 technology, enabling the company to produce hot-rolled strip to order. Customers book orders directly into the plant’s IT system and then schedule it for processing. Changes in dimensions such as width and thickness are allowed until shortly before production begins.

Digitizing Data for Fabricators. Among fabrication equipment manufacturers, Industry 4.0-capable communication is a reality. Tube bender manufacturer transfluid Maschinenbau, Schmallenberg, Germany, has been researching Industry 4.0 for some time.

“In line with our customer base, we are converting our products gradually to 4.0-capable communication and are offering software that is able to read and process parameters used in the process,” said Benedikt Hümmler, managing director of design and production for transfluid.

Meanwhile, tube bender manufacturer Schwarze-Robitec GmbH, Cologne, Germany, has delivered a fully electric, multiradius tube bending machine with transport boost technology to a U.S. customer working in the automotive sector. According to the company, its NxG controller achieves time, displacement, and speed optimizations of all CNC axes, accompanied by a reduction of production time of up to 35%. With the current development in mind, Schwarze-Robitec prepared this tube bending machine for future requirements in the context of Industry 4.0. Intelligent remote maintenance capability is built into the machine.

A Connected Assembly Line. Companies also are cooperating to accomplish large-scale goals. For example, Nuremberg, Germany-based Leoni AG and relayr GmbH, Pullach, Germany, entered into a strategic partnership to increase production efficiency in the automotive industry. The former, a manufacturer of wire, cable, and communication network systems, complements the latter, a service provider that specializes in industrial internet of things technology.

The goal of the partnership is to help automotive makers and suppliers reduce unscheduled standstills of robot lines, increase production efficiency, and improve overall equipment effectiveness.

Robots and Cobots

The driving force behind the ever-increasing demand for robots is the automotive sector, where robot use continues to gain momentum. They also are used in electrical and electronics manufacturing, metal processing, plastics and chemical products production, and food and beverage processing. In other words, robot use has increased across numerous industries.

For many years, manufacturers in China have led the way in robot purchases. Although China was long thought to have an inexhaustible supply of inexpensive labor, this isn’t necessarily true. Even if it were true, robots work with levels of precision and repeatability that can’t be matched by workers. According to International Federation of Robotics estimates, China acquired 133,000 robots in 2018, followed by Japan with just over 52,000 units. The U.S., the third largest market for robots, made a notable 15% leap to a total of 38,000 units in 2018.

The size of the company plays a key role in the use of robots. In 2018 nearly one out of every six companies in the manufacturing sector in Germany with at least 10 employees used industrial or service robots.

Flattery or Function. It won’t be long before robots join forces with humans, take on even more tasks, and assist their human colleagues to accomplish specific difficult tasks.

“The challenge is to be able to use the robots even for very small production volumes, which is only partially possible today,” said Stephanie Flaeper, managing director of marketing for transfluid. If successful, it will open up a new field of activity for robotics. The next step would be less reliance on programming.

“It would also be interesting if the robot could very precisely mimic the movement of a person in a production process without having to be programmed,” Flaeper said.

While it’s said that imitation is the most sincere form of flattery, this isn’t flattery; in the world of robotics, this is function. The potential of an intelligent robot that can sense its environment would be immeasurable.

“Because specified processes which can be simulated digitally and undergo corresponding evaluations are important in Industry 4.0, a robot is superior to humans,” Flaeper said. Because the robot provides the security that the processes are always the same and could be simulated accordingly, the processes could be represented and checked via a digital twin.

Fabricating with Robots. As manufactured parts become increasingly sophisticated, they become increasingly challenging for robots (or robot programmers) to handle. This hasn’t stopped Wafios AG, Reutlingen, Germany, from using Kuka robots to develop its TWISTER® bending systems.

Two models, RB20 and RB30, are available with up to five bending heads and up to 16 robotic grippers. Intended to bend tube up to ¾ inch and 13/16 in. OD, respectively, they perform right- and left-hand bending to radii as tight as 2.25 in. and 47/8 in., respectively. It goes without saying that as the bends become more complex and tubular components become more sophisticated, the challenges and opportunities for using a robot increase exponentially.

MiiC Opton (Europe) GmbH, Ismaning, Germany, also is continuously developing its robots. For example, its 6-axis robot with bending head is guided on a bed and traverses a guideway to bend a workpiece, which is held by the chuck in a fixed location.

In its driving mode, the robot performs loading, unloading, all movements of the feed between two bending points, and rotation and bending.

Kasto Maschinenbau, based in Achern-Gamshurst, Germany, has incorporated robots into its KASTOsort material handling system. The system uses a decentralized, self-organizing program logic that doesn’t require a teach-in phase or any kind of programming. The robot obtains all required information by communication with the company’s enterprise resource planning system.

The core function of the KASTOsort is the palletizing of workpieces for shipping. The robot calculates, according to the orders, the highest possible packing density in the deposit container. The software also can integrate sequential processes, such as deburring, length measurement, and marking.

Extracting and Transporting Crude Oil and Natural Gas

Easily accessible offshore oil deposits are running out, so drilling needs to go much deeper than in the past, which is an unending technical challenge and a reward to pipe producers that invest in the research and development necessary to deal with this challenge.

Oil Extraction in the North Sea. In many cases, fixed oil rigs are accompanied by floating ones. According to Essen, Germany-based materials manufacturer Evonik Industries AG, that requires laying flexible pipelines instead of using rigid steel. These lines need to be protected against seawater corrosion on the outside and against oil, gas, and water damage from within, and weight needs to be reduced as the depth increases.

Pipes that are suitable for this purpose have been unrolled and laid some 7.5 miles off the Scottish coast, where oil now is being extracted using a floating rig. Although synthetic polymers play a role, Evonik has found that layers of steel and polymer provide the optimal construction—steel for strength and polyamide polymer for weight reduction and corrosion resistance.

Made from eight layers, some of steel and some of a the proprietary VESTAMID® NRG polyamide, the pipes have a wall thickness that exceeds 2.4 in. and are resistant to salt water and to any of the chemical compounds in the oil.

Another pipe manufacturer, H. Butting GmbH & Co. KG of Knesebeck, Germany, delivered a vast order of duplex and superduplex pipe for a project in the North Sea. It went to one of Norway’s biggest deposits, the Johan Sverdrup Oil Field, which contains between 1.7 billion and 3.0 billion barrels. The deposit is situated 400 feet below sea level and is 2,600 ft. deep. The entire area covers around 77 square miles.

About $13.3 billion is being invested in the first stage of development. This includes drilling wells; installing feed pipes; and setting up four fixed platforms, one each for drilling, processing, living quarters, and a riser, all connected by bridges. Butting received a contract for the production of longitudinally welded pipes for all four platforms and also for the connecting bridges.

“The requirements on materials at sea are very high due to the enormous stress caused by the salty air,” said Christian Schenk, head of project sales of stainless steel welded pipes for Butting. The company used 6 moly, 316L duplex, and superduplex as materials for these applications in diameters from 2 to 30 in. in lengths from 20 to 40 ft. In total, the company delivered more than 1,400 tons of pipe material for the project.

Norway is expecting to extract oil from this field until 2050. Production is expected to exceed 500,000 barrels per day

Pipes for uses other than extraction also are needed at great depths. Tube maker Schoeller Werk GmbH & Co. KG, Hellenthal, Germany, has developed some highly robust control line and chemical injection pipes, made from stainless steel and nickel-based alloys, that can be used at a depth of 33,000 ft. below sea level. They pump chemicals into the oil reservoir and serve as hydraulic control lines for safety valves.

“Thanks to the excellent quality of their surfaces and especially also their welding seams, these pipes can withstand extreme conditions, such as high pressure, temperatures up to 300 degrees C [570 degrees F], aggressive media, and salt water,” said Markus Zimmermann, head of energy sales at Schoeller Werk. “Users benefit from secure installations with above-average lifetimes.”

Trans-Adriatic Pipeline Update. Energy transportation is a major focal area in nearly all of Europe, and the Trans-Adriatic Pipeline (TAP) is a substantial piece of this puzzle. Part of the Southern Gas Corridor, it originates in Azerbaijan and terminates in Europe. Covering about 540 miles, it connects with the Trans-Anatolian Pipeline (TANAP); runs through Greece, Albania, and the Adriatic Sea; and eventually reaches Italy.

Almost one-third of the TAP was supplied by Salzgitter AG, located in Salzgitter, Germany, via its international trading organizations. This included 168 miles of large-diameter pipes in a joint venture with Europipe and 1,559 pipe bends for a total weight of 170,000 tons for the onshore area in Albania. More than 71,000 tons of large-diameter pipes are scheduled for a 65-mile-long offshore stretch of this pipeline along the Albanian coast to Italy.

Petroleum’s Changing Role

While efforts in the EU to increase energy efficiency, increase the use of renewable energy sources, and reduce greenhouse gases and have brought about many changes in how energy is derived and consumed, more changes are on the horizon. Rather than wait on market forces to decrease reliance on fossil fuels for transportation, legislators throughout the world are hastening the transition away from gasoline- and diesel-powered vehicles. The first jurisdiction is in the U.K. In 2021 privately owned diesel-powered vehicles will be prohibited from use in Bristol from 7:00 a.m. to 3:00 p.m. That’s just the tip of the tip of the iceberg.

In 2025 all diesels will be banned in Athens and Madrid. In 2030 various cities throughout the world will go further, banning both diesels and gasoline vehicles: Amsterdam; Barcelona, Spain; Brussels; Cape Town, South Africa; Copenhagen, Denmark; Hainan, China; Heidelberg, Germany; London; and—hang onto your hat—Los Angeles.

This trend will continue as time goes on. Sales of new diesel and gasoline vehicles will be prohibited in 2025 in Norway; in 2030 in Denmark, Ireland, Netherlands, Sweden, and Israel; in 2032 in Scotland; and in 2040 in England, Wales, and Northern Ireland.

Do such changes mean that petroleum and its derivatives are being phased out? No. They will have a smaller role in road transportation, which currently accounts for 48% of their use in Europe and about 63% in the U.S., but passing a few laws won’t disconnect modern society from petroleum.

Drilling and extracting petroleum will continue to be a viable market for tube and pipe producers long into the 21st century.

The exposition organizer, Messe Düsseldorf GmbH, commissioned several reports that formed the basis of this article. Several of the companies mentioned herein are planning to exhibit at Tube 2020, including:

H. Butting GmbH & Co. KG – Hall 1, Booth C57

Kasto Maschinenbau GmbH – Hall 6, Booth A07

Salzgitter AG – Hall 4, Booth H42

Schoeller Werk GmbH & Co. KG – Hall 3, Booth G03

Schwarze-Robitec GmbH – Hall 5, Booth E31

SMS Group – Hall 7a, Booth B03 and B04

transfluid Maschinenbau GmbH – Hall 5, Booth G34

Wafios AG – Hall 5, Booth B26

Tube 2020 (colocated with Wire 2020)

• Place, Dates, Times

–Messe Düsseldorf, Düsseldorf, Germany

–March 30 to April 3, 2020

–Monday to Thursday: 9:00 a.m. - 6:00 p.m.

–Friday: 9:00 a.m. - 4:30 p.m.

• Website: tube-tradefair.com

• The Tube App

–Provides exhibitor and product search (on- and offline)

–Offers site map and hall maps

–Includes all exhibitor and product details from the organizer’s database

–Supports full-text searches

–Allows bookmarking exhibitors and products

–MyOrganizer synchronizes personalized contacts and notes

• Matchmaking (available at www.tube-tradefair.com)

–Generates personal contacts

–Facilitates appointments before the start of the trade fair

–Makes personalized suggestions according to your interests

-Intelligent algorithm adapts to your interests

• Admission Ticket Prices

–One-day ticket: 42.00 € online, 60.00 € at the door

–Weeklong ticket 82.00 € online, 100.00 € at the door

Students, retirees, and others qualify for discounts; see tube-tradefair.com for details.

About the Author

Eric Lundin

2135 Point Blvd

Elgin, IL 60123

815-227-8262

Eric Lundin worked on The Tube & Pipe Journal from 2000 to 2022.

About the Publication

Related Companies

subscribe now

The Tube and Pipe Journal became the first magazine dedicated to serving the metal tube and pipe industry in 1990. Today, it remains the only North American publication devoted to this industry, and it has become the most trusted source of information for tube and pipe professionals.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Team Industries names director of advanced technology and manufacturing

3D laser tube cutting system available in 3, 4, or 5 kW

Corrosion-inhibiting coating can be peeled off after use

Zekelman Industries to invest $120 million in Arkansas expansion

Brushless copper tubing cutter adjusts to ODs up to 2-1/8 in.

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI