President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Flat-rolled steel spot prices keep falling

Could prices finally hit bottom in October?

- By John Packard

- September 27, 2016

- Article

- Metals/Materials

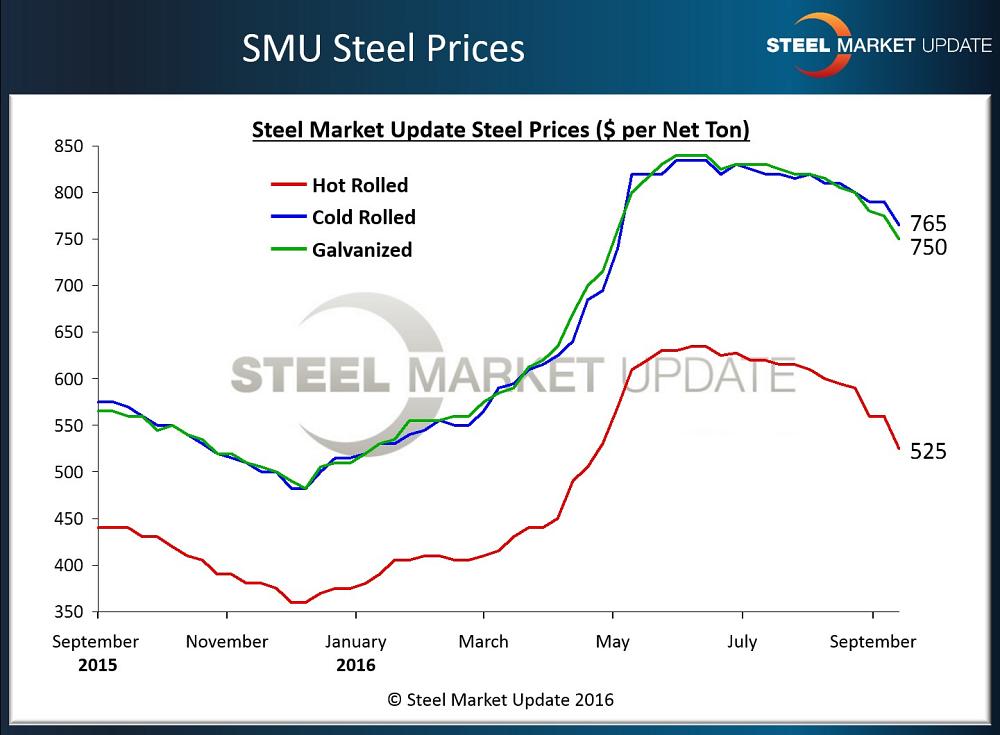

Figure 1. Hot-rolled, cold-rolled, and galvanized average “base” prices (before extras) slowly increased over the first half of 2016 before peaking this summer.

Since late June the flat-rolled steel markets have softened. By that I mean spot prices out of the domestic steel mills reversed course and began moving lower.

At first we saw hot-rolled prices as being the most affected since hot-rolled coil (HRC) has been the weakest product because of the slowdown in the energy, agriculture, and mining segments of the market. More recently spot pricing on other flat-rolled steel products, including cold-rolled, galvanized, and Galvalume®, have joined hot-rolled by moving lower.

As of mid-September the pace of the decline has quickened, and by the time you read this article in October, we may well see hot-rolled spot prices out of the domestic steel mills below $500/ton ($25.00/cwt) on the “Steel Market Update” HRC price index average. If we assume correctly, prices will have declined by $135 (or more) since the market peaked during the middle of June 2016 (see Figure 1).

This could well be good news for fabrication companies that are buying in the spot or that have contracts tied to indexed-based contracts.As of today in mid-September, the SMU Price Momentum Indicator is pointing toward lower flat-rolled prices over the next 30 to 60 days. Once steel mill lead times slip into late December and early January, we expect that prices will reverse course and head higher.

Steel mill production lead times for new orders placed today are one to four weeks for hot-rolled and three to seven weeks for cold-rolled, galvanized, and Galvalume. By the time we get into early October, lead times could be into November on hot-rolled and late November/December on cold-rolled and coated. In other words, prices could be close to the bottom of the market by the time you read this article in October.

Quite often we are asked which keys we watch to determine when prices are about to change course (higher or lower). SMU produces a number of key market indicators for its premium-level clients, but one proprietary product that we developed and has stood out over the past eight years is called Steel Service Center Spot Prices to their End Customers.

Twice per month SMU conducts a flat-rolled steel market trends analysis. This analysis includes mill pricing trends, changes in purchasing habits at key end-user industries, and the Steel Buyers Sentiment Index. One of the items we watch carefully is spot pricing out of the domestic steel service centers and wholesalers to their end-user customers.

When steel service centers are raising their spot prices to their customers, they are confident that domestic mill prices are also rising and will continue to do so for a period of time. When distributors lose confidence in the mills’ abilities to collect price increases, they tend to move their excess inventories at whatever pricing the market will bear. As more companies move inventory, spot prices drop more quickly.

Over time we were able to develop inflection points, points at which the trend had moved too far and a reversal in pricing was due to follow. As service centers dump prices in the marketplace, they eventually capitulate, begging the mills to raise prices as they can no longer afford to have prices slide any further.

If you look at Figure 2, you can clearly see how one year ago the service centers were lowering prices (red bars) until they reached the point of capitulation, which we calculate to be when 75 percent of the distributors admit they are lowering spot prices to their end customers.

The black ovals with numbers in them are AK Steel price increase announcements. We use AK Steel because it publishes its price announcements as a press release on its website. (This provides transparency.) Once price increases began to be announced, you will see the service centers supporting those increases (green bars) by raising their spot prices.

About the Author

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Trending Articles

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Fabricating favorite childhood memories

How laser and TIG welding coexist in the modern job shop

Robotic welding sets up small-batch manufacturer for future growth

Ultra Tool and Manufacturing adds 2D laser system

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,