- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices remain top concern in 2007

- By Vicki Bell

- February 12, 2007

- Article

- Shop Management

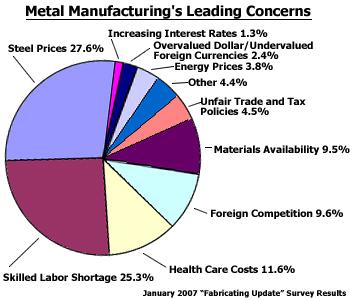

In January 2007 steel prices remained metal manufacturing's No. 1 concern, according to a "Fabricating Update" survey that asked subscribers to choose their companies' main concern from a list of factors affecting metal manufacturing. The skilled labor shortage and health care costs were No. 2 and No. 3, respectively. The top three concerns are the same as those reported in the previous survey conducted in December 2005.

Steel prices captured 27.6 percent, up from the previous survey's 22.6 percent, and the skilled labor shortage was chosen as No. 1 by 25.3 percent, up from 18.7 percent. Health care costs were cited as the No. 1 concern by 11.6 percent, down from the previous survey's 16.3 percent.

Foreign competition retained the No. 4 position at 9.6 percent, down from 13 percent in the previous survey, followed by materials availability (No. 5, 9.5 percent, no change). Unfair trade and tax policies ranked No. 6 with 4.5 percent (up from 3.3 percent in the previous year), replacing energy prices, which fell to No. 8 at 3.8 percent (down from 9.1 percent).

The category other captured 4.4 percent; overvalued dollar/undervalued foreign currencies, 2.4 percent (No. 9, down from 3.3 percent); and increasing interest rates received 1.3 percent (No. 10, down slightly from 1.8 percent)

Taking Care of No. 1

Although he chose the skilled labor shortage as his No. 1 concern, a "Fabricating Update" subscriber who works for a company that makes hydraulic presses and fabricating equipment said, "Material availability and steel prices are still major concerns and are a competitive disadvantage against foreign competition."

A subscriber who works for an Ohio-based steel manufacturer said, "Steel prices are still too high compared to the balance of the world, but they are starting to align, especially as the consolidation continues."

Where are steel prices headed? A glimpse of one supplier's pricing plans in the near future can be seen in a recent blog entry on thefabricator.com, "What's ahead for the steel industry?"AK Steel said it anticipated that its first-quarter 2007 average per-ton selling price would be 4 percent to 5 percent higher than in the fourth quarter of 2006.

According to the article "Metals upsets, offsets, and onsets in 2007"on thefabricator.com, prices will be volatile. The article includes advice for buyers from Patrick McCormick, World Steel Dynamics (WSD) managing partner, who cautions metal fabricators to avoid chasing price or lean their inventories too aggressively. "Since the market price will continue to be volatile, your company's ability—or lack of ability—to pass on steel price changes to your customers should determine the balance between fixed and variable price agreements in your buying portfolio. That is the smart play."

A subscriber from Arkansas addressed his shop's experience with passing on costs: "The increased costs of metals, welding consumables, and shipping, combined with not being able to proportionally increase our prices and still win bids, have been major concerns at this job shop."

Closing Fast

While the percentage of respondents citing steel prices as their No. 1 concern increased 5 percentage points from the previous survey, the percentage of those who chose the skilled labor shortage increased by almost 7 points. Difficulty finding skilled workers continues to plague the metal fabricating industry.

A subscriber who chose the skilled labor shortage as his leading concern said, "I feel that the lack of skilled workers in our country is critical. Young people do not want to get 'down and dirty' at work. We are going full-speed into desktop poverty as far as hands-on work is concerned. We need welders, fitters, sheet metal workers, pipe fitters not excess engineers."

Another subscriber from a steel-producing company said, "After a decade of shrinking the organization, we have an aging work force with no backfill in sight. We are struggling to hire engineers and hourly workers both."

Help From Congress?

The "Fabricating Update" survey also asked subscribers whether they believed the new U.S. Democrat-controlled Congress sworn in Jan. 4 would have a positive, negative, or no effect on their businesses. The overwhelming majority said that Congress would have a negative or no effect, with only 18.4 percent anticipating a positive effect.

Although none of the subscribers who reported that Congress would have a positive effect on their businesses elaborated on why, many who held an opposing view commented. One said, "Additional costs for minimum wage, health benefits, and taxes that the Democrats are known to champion will cripple industries that compete with offshore suppliers. Restrictive defense budgets will only exacerbate the problem."

Another subscriber echoed these comments: "Higher taxes and increasing material costs are detrimental to business growth. So are liberal Democrats, who see taxpayers as a never-ending source of revenue."

A subscriber from a company that provides structural steel components commented on several concerns and his view of Congress: "In the steel fabrication industry we have the concern of finding material, but we then have the growing problems of health care costs and the skilled labor shortage. With the growing health care costs, we cannot afford the more skilled labor, or we have to put the cost of health care back on the labor force to pay more of their own insurance. Being a small company, it is hard to balance both skilled labor and health care. As for Congress, they do not have a clue as to the real world and what is being done for small companies to stay open."

A subscriber from a Michigan fabrication company who felt that Congress will have no effect on his business did note a factor that will greatly affect his business: "The problems in our domestic auto industry will have a negative impact on me."

One in Every Crowd

One subscriber who chose other among the listed concerns raised a new concern: "loss of productivity due to excessive online surveys."

About the Author

Vicki Bell

2135 Point Blvd

Elgin, IL 60123

815-227-8209

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,