Senior Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Strategic investors are scaling up metal fabrication

AOC Metal Works’ growth strategy could be a harbinger

- By Tim Heston

- June 1, 2019

- Article

- Shop Management

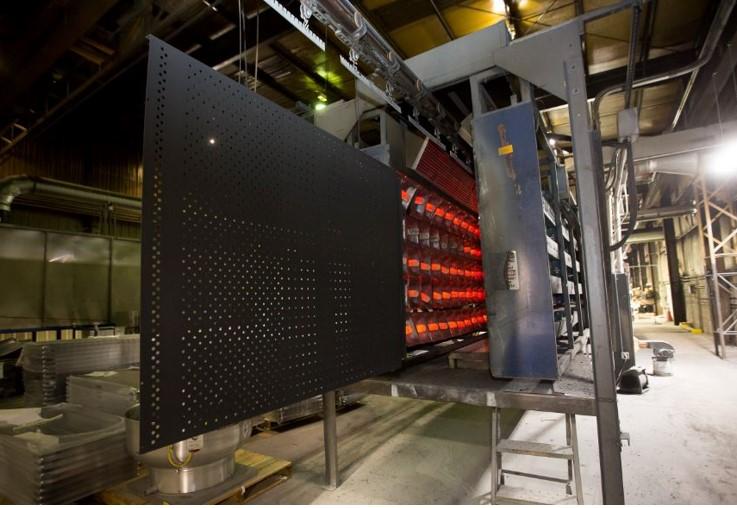

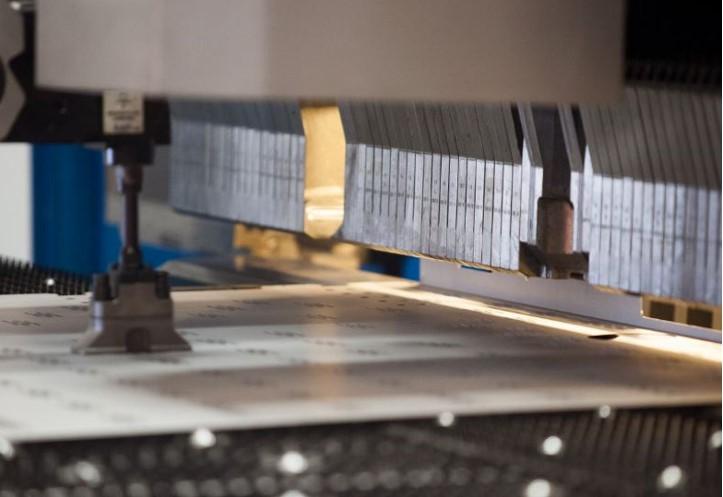

AOC Metal Works has a diverse process offering, from laser cutting and punching to bending (with press brakes and panel benders) to stamping.

If you’re lucky enough to visit the island of Trinidad and Tobago or Martinique, and when you’re not enjoying the turquoise serenity of the Caribbean beach, turn on the TV. The cable company delivering your shows has an indirect connection to a growing southeastern U.S. custom metal fabricator called AOC Metal Works.

The business might be a harbinger of what more large metal fabrication companies will look like in the coming years. AOC didn’t grow through periodic acquisitions over years and decades. Instead, it was formed by investors who see long-term opportunities of scale in a business dominated by small shops.

From Cable to Metal

The story begins in Canada, where Gerry Kazma operated a cable TV business in the early 1970s, and by 1979 he had expanded to the U.S. In the 1990s he sold his cable operations in the U.S. and purchased cable companies in the Caribbean and Venezuela.

He later sold his interest in those companies and, with his son Mike, worked to expand another cable company, eventually making it the largest in Central America. The family sold that business in 2008 and at this point transitioned from being a cable operator into an investment manager, launching Amzak Capital Management based in Boca Raton, Fla. The firm invests in various markets, including commercial staffing and, of course, manufacturing.

“The Kazmas basically love manufacturing,” said Joe Vidmar, operating partner at Amzak. “Mike Kazma was an owner and operator in the cable industry, and he loves being on the shop floor.”

Considering all this, it wasn’t surprising that Assurance Operations Corp., a custom stamping operation in Lawrenceburg, Tenn., came across the Kazmas’ radar. The company was owned by European investors who bought the operation just after the Great Recession. “They managed the turnaround of the two facilities in Lawrenceburg,” Vidmar said. “Amzak Capital Management, which owned several other industrial properties in different industries, was presented with the opportunity to look at the company. We acquired the Assurance business in the spring of 2015 and then created AOC Metal Works.”

In the middle of 2017 Amzak began discussions with StampTech Inc., which had two Virginia facilities, one in Chester and another in Lynchburg. “We worked to acquire those businesses at the end of 2017 and merged those operations with the two facilities in Lawrenceburg in January 2018,” said Vidmar, who is now AOC’s president and CEO. He added that this year the company began a laser fabrication division, which offers laser cutting and bending.

All this activity has created a company that offers a full suite of forming and fabrication processes. Its stamping division focuses on the heavy truck as well as residential and commercial appliance markets. The company’s metal fabrication division focuses on tube, serving the racking and returnable dunnage market for the automotive segment. Finally, its laser fabrication division offers laser cutting, punching, and bending—the usual suspects for a sheet metal and plate operation.

Each operation also has downstream processes that complement the primary upstream operations. The stamping division doesn’t just stamp; it offers welding and other secondary operations. The same thing goes for the laser cutting and tube divisions.

“Each location operates independently from a P&L standpoint, but we also manage capacity across the organization, so we can go broader and deeper within an existing customer base,” Vidmar said, allowing AOC to offer and sell existing customers more services. This helps AOC make life easier for its customers while at the same helps customer retention.

Since the beginning of 2018, Tom Weed, co-head of sales, has been working with AOC’s sales team to identify broader sales opportunities. “It’s an ongoing process,” Weed said. “Our salespeople are continuing to visit various locations and seeing all of our capabilities.”

“We’ve hired individuals who might concentrate on a specific region,” Vidmar added, “but they sell across the portfolio and they are educated on all of our capabilities. We do have salespeople who specialize in stamping, but they’re not in stamping sales [exclusively]. They also understand laser fabrication, weldments, and more.”

Protecting Employees

Both Vidmar and Weed aren’t metals industry rookies. Vidmar worked for 23 years at Alcoa, where most recently he was general manager at Alcoa Architectural Products. Weed has been selling stampings and fabrications for more than 30 years and was one of the principals at StampTech.

Both explained that the timing is right for a company like AOC. Many owners in metal fabrication are looking for an exit strategy, but the best among them aren’t just looking to cash out. They don’t want to sell the business to just anyone, nor do they want to close their doors. They want to protect their employees.

“What’s more important to them than anything else is their employee base,” Vidmar said. “Yes, they might want to exit the business at some point, but they don’t have the next generation that wants to run a manufacturing facility. It takes a certain type of individual to do that. But they want to make the handoff seamless and ensure their employees are protected. And that’s really what gave us the opportunity to work with the StampTech team. The principals wanted to transition into the portfolio company [AOC]. But at the same time, they wanted to ensure the security of their existing employees.”

Diverse Process Portfolio

Scaling up has its advantages. A larger company usually offers more services and process options, from laser cutting and bending to stamping. Moreover, AOC is in the middle of an ERP upgrade—and modern software has made information and operational management across a diverse, complex, high-product-mix operation much better than it used to be.

This also helps with inventory management, which is more critical than ever considering the material pricing roller coaster of late. Like many large fab shops, AOC has diverse inventory requirements. Its fabrication division that focuses on returnable racks operates on a job shop model, producing and shipping individual orders rather than replenishing inventory regularly for a large customer, like the stamping division does.

“We get EDI [electronic data interchange] feeds from our customers [in the stamping division],” Vidmar said, “which we use to establish the minimum and maximum [inventory levels] as well as the replenishment points. The ERP investment will allow us to look at the different SKUs and make sure we identify and reduce the slow-moving inventory.”

Career Opportunities

Another factor that makes the timing right for AOC has to do with attracting employees. A larger company often offers more career opportunities for ambitious talent. A small fab shop might have a chief executive, an operations manager, and other top people who aren’t retiring anytime soon.

If someone on the shop floor wants to climb the ladder in a serious way, he or she often needs to jump ship and find another ladder to climb at a different company. The small fab shop could be a great place to work; it’s just small, and there can be only so many chiefs.

“A top engineering graduate might be a little hesitant to go to a $10 million company,” Vidmar said. “But if you have five manufacturing locations, that individual has the opportunity to grow within the company. And we’re always looking at our benefits package to ensure we’re competitive with the larger companies we’re competing with for talent.”

Revenue Diversification

Finally, building a larger company with multiple locations helps reduce revenue concentration—a common challenge in the custom fabrication business, and one that’s particularly difficult to overcome for small companies that have grown on the backs of a few large accounts. As reported in the annual “Financial Ratios & Operational Benchmarking Survey,” published by the Fabricators & Manufacturers Association, the average fabricator’s top four accounts make up more than half of its overall revenue.

As Vidmar explained, building a larger organization mitigates this problem. “Some of our larger blue-chip customers don’t want us to have one location that has, say, 35 percent of the work coming from one customer. So when we created the portfolio company, the concentration issue was diluted, so it has provided us with more opportunities to grow with existing customers.”

A Hybrid Approach

Metal fabricators owned by investors are part of an organizational structure that sits on a spectrum. On one end is the passive holding company. Each company in the portfolio might work together to some degree, but each maintains its own brand. Externally, customers work with the individual companies and brands, not the parent organization.

On the other end of the spectrum, investors purchase companies, group them under one brand, and integrate the operations. AOC Metal Works falls into this part of the spectrum. Each organization maintains operational independence and its own profit and loss statement, but leaders collaborate. Externally, customers see the operation as one brand offering various services.

The integration itself occurs on a spectrum too. On one end is the center-of-excellence approach, where each plant specializes in a specific range of processes tailored for specific markets. At the other end, each plant has virtually identical processes, giving redundant capacity to ensure topnotch on-time-delivery performance.

As Vidmar explained, AOC sits right about in the middle of the spectrum. “We have a hybrid strategy,” he said. “We want specialization, but we also want redundant capacity, so we have a business continuation plan to continue to serve customers.”

The Future of the Portfolio Company

AOC and Amzak Capital Management don’t hide the fact that they’re looking for buying opportunities. As Vidmar explained, the company has its eye on a variety of different kinds of companies in the metals business, but it does want to stay within the custom and contract manufacturing arena. It’s not looking to assemble and distribute its own products. “We like to be contract manufacturers,” he said. “That’s our niche, and we function well in it.”

Visit AOC’s website and you’ll notice a page dedicated to acquisitions. As the page reads, “At AOC Metal Works, we believe in growing by purchasing other metal fabricators and stampers like ourselves. We target plants in the Southeast, Mid-Atlantic, and Southwest generating between $10 million and $100 million in revenue with gross margins of at least 20 percent. The greater scale resulting from these acquisitions allows us to standardize best practices, lower transportation costs, and, ultimately, provide a better service to our customers.”

It’s an open invitation that might become more common as more strategic investors turn to the custom metal fabrication market.

About the Author

Tim Heston

2135 Point Blvd

Elgin, IL 60123

815-381-1314

Tim Heston, The Fabricator's senior editor, has covered the metal fabrication industry since 1998, starting his career at the American Welding Society's Welding Journal. Since then he has covered the full range of metal fabrication processes, from stamping, bending, and cutting to grinding and polishing. He joined The Fabricator's staff in October 2007.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,