President/CEO

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Steel prices on the decline, but for how long?

Material bargains may be available for fabricators as service centers look to clear inventory

- By John Packard and Tim Triplett

- September 20, 2018

Fabricators and manufacturers may find some bargains on raw materials in the fourth quarter as spot steel prices continue to moderate and service centers look to reduce their higher-cost inventories.

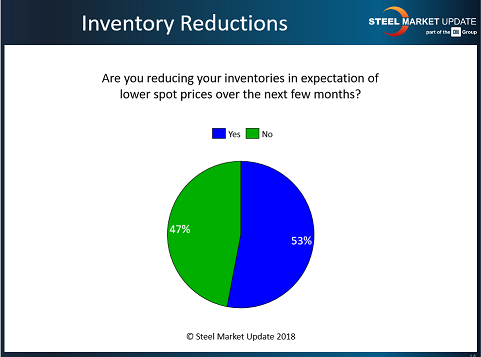

Flat-rolled market surveys from Steel Market Update (SMU) show that service centers are in the process of working down their inventories in response to declining prices and softening demand (see Figure 1). Flat-rolled steel distributors now average 2.6 months of supply on hand, down from 2.7 months at the end of July, according to SMU proprietary data.

Spot prices in the market appear to be correcting from near-historic highs on weaker demand in some sectors. In the past three months, the price of hot-rolled steel has declined by about 9 percent. Service centers report that many customers are buying only for their immediate needs and postponing large orders in anticipation of cheaper steel in the months to come.

In the past year the benchmark price for hot-rolled steel jumped by more than 50 percent, from a low of $615 per ton last October to a high of $930 per ton on June 1. Spot prices in the U.S. got a major boost from the 25 percent tariff on steel imports first announced by the Trump administration in March. As a result, steel imports into the U.S. have declined by about 10 percent this year, compared with the same period in 2017.

SMU regularly canvasses the flat-rolled steel market. Following were SMU’s benchmark steel prices, FOB the mill east of the Rockies, as of Sept. 18:

- SMU’s price range on hot-rolled coil was $810/ton to $890/ton ($40.50/cwt to $44.50/cwt) with an average of $850/ton ($42.50/cwt) and lead times of three to six weeks.

- SMU’s price range on cold-rolled coil was $920/ton to $990/ton ($46.00/cwt to $49.50/cwt) with an average of $955/ton ($47.75/cwt) and lead times of four to eight weeks.

- SMU’s price range on galvanized coil was $920/ton to $990/ton ($46.00/cwt to $49.50/cwt) with an average of $955/ton ($47.75/cwt) and lead times of four to nine weeks. The galvanized 0.060-inch G90 benchmark price ranged from $998/ton to $1,068/ton with an average of $1,033/ton. The mills all lowered their coating extras last month in response to the declining price of zinc.

- SMU’s price range on Galvalume coil was $930/ton to $990/ton ($46.50/cwt to $49.50/cwt) with an average of $960/ton ($48.00/cwt) and lead times of six to nine weeks.

Steel plate is the exception. Plate supplies were tight with upward price momentum as plate mills remained on controlled order entry. SMU’s price range on steel plate was $980/ton to $1,030/ton ($49.00/cwt to $51.50/cwt) with an average of $1,005/ton ($50.25/cwt) FOB the customer's facility for orders to be delivered during the month of November. Plate lead times for allocations were seven to 10 weeks.

Domestic flat-rolled and plate mills are operating near full capacity. In the week ending Sept. 15, the industry hit an average capability utilization rate of 79.4 percent, within striking distance of the 80 percent level the industry says it needs for sustained profitability. That percentage includes idled capacity and slower long-product fabrication, which makes it misleading. Major flat-rolled mills are operating well above the 90 percent level. U.S. crude steel production for the year to date was up 4.3 percent, according to the American Iron and Steel Institute.

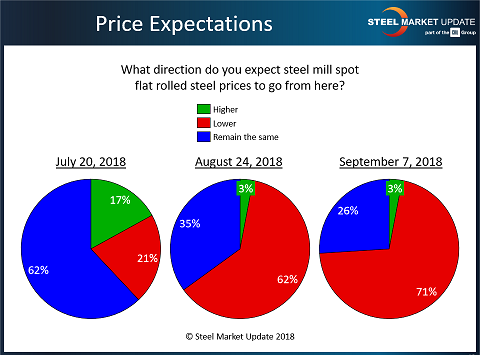

Whether the current downtrend in steel prices is temporary or will continue into next year depends on a number of factors (see Figure 2). On the political front, the Trump administration is engaged in a tit-for-tat trade war with China that goes far beyond steel. The U.S. has imposed three rounds of tariffs on various Chinese products this year totaling $250 billion and has threatened an additional $267 billion in tariffs if China retaliates further. If negotiations with China fail, the U.S. possibly could subject virtually China’s exports to the U.S. to duties next year. That has serious implications for consumer prices, the growth of the U.S. economy, and steel demand.

Also factoring into steel prices is the cost of ferrous scrap that is remelted by steel producers. The benchmark price of shredded scrap peaked in April at about $390/ton but has since declined to around $340/ton, contributing to the recent dip in steel prices.

Another wildcard to keep an eye on are the negotiations between the United Steelworkers (USW) and the nation’s two largest integrated steel producers, U.S. Steel and ArcelorMittal. The contract talks could become especially contentious as the two sides debate how to split the big gains the mills have enjoyed as a result of President Trump’s steel tariffs. Ironically, contract negotiations when the mills are reporting record profits may prove more difficult than in the past when the mills were struggling and seeking concessions from the union. USW members have authorized the union to strike, if necessary, to ensure that the workers get their fair share of today’s windfall. A work stoppage at one or both mills could tighten steel supplies and boost steel prices fairly quickly.

Figure 1. Steel service centers are looking to clear out their high-priced inventories in the face of what is expected to be reduced customer demand.

On Dec. 11-12 SMU will conduct another one of its “Steel 101: Introduction to Steel Making & Market Fundamentals” workshops in Toledo, Ohio. Attendees will tour North Star BlueScope’s electric-arc furnace and rolling mills.

Information about any of these workshops can be found at www.steelmarketupdate.com/events.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Authors

John Packard

800-432-3475

John Packard is the founder and publisher of Steel Market Update, a steel industry newsletter and website dedicated to the flat-rolled steel industry in North America. He spent the first 31 years of his career selling flat-rolled steel products to the manufacturing and distribution communities.

Tim Triplett

Executive Editor

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,