Sr. Digital Editor

- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Manufacturing slowdown continues as ISM index hits worst level in decade

Despite industry’s consecutive contracted month and global trade concern, recession talk premature

- By Gareth Sleger

- October 3, 2019

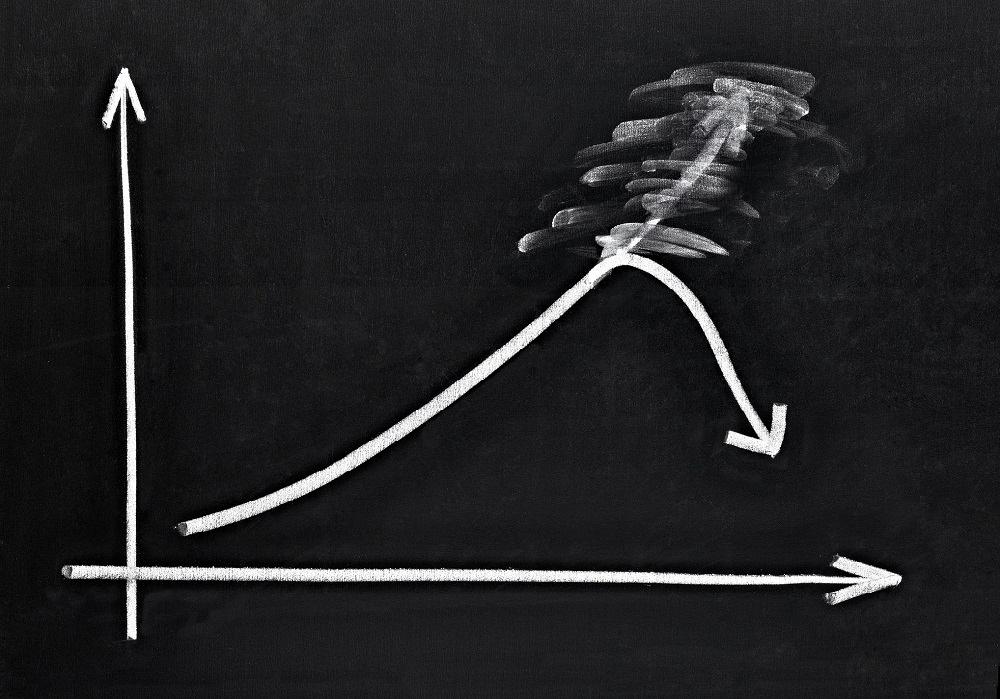

Following August’s 49.1 PMI – the index’s first contracted month in three years – industry experts predicted September would bounce back to an estimated 50.2. Clearly, not so much. Manufacturing’s gradual softening over the last six months only extended its trend. Getty Images

The manufacturing industry’s recent slide into contraction has hit its worst slowdown in a decade.

September’s Institute for Supply Management (ISM) Report on Business not only registered a contracted Purchasing Managers’ Index (PMI) for the second consecutive month, but the 47.8 percent reading hit a more than 10-year low. In fact, the most recent PMI is the worst it’s been since June 2009 (46.3 percent), the final month of the Great Recession. As always, a PMI 50 or higher indicates growth in manufacturing; less than 50 means contraction.

Following August’s 49.1 PMI – the index’s first contracted month in three years – industry experts predicted September would bounce back to an estimated 50.2. Clearly, not so much. Manufacturing’s gradual softening over the last six months only extended its trend.

“Comments from the panel reflect a continuing decrease in business confidence,” ISM Manufacturing Business Survey Committee Chair Timothy Fiore said. “September was the second consecutive month of PMI contraction, at a faster rate compared to August. Overall, sentiment this month remains cautious regarding near-term growth.”

As expected, many of the report’s key subindices indicated contraction across the board, which also lead to Tuesday’s poor showing at the stock market. Production, New Export Orders, and Inventories subindices all had noticeably much faster contractions than in recent months. And even though the New Orders Index was up from last month, it was only by 0.1 percent.

Of the 18 manufacturing sectors, 15 reported contraction, including metal fabrication. “General market is slowing even more than a normal fourth-quarter slowdown,” said the panel’s anonymous representative from the fabricated metal products sector.

This, of course, has sparked even more discussion about whether the U.S. economy is nearing another recession. And while significant economic downturns are ultimately inevitable, many industry insiders feel fears should be eased.

Chris Kuehl, co-managing director of Armada Corporate Intelligence and economic analyst for the Fabricators & Manufacturers Association Intl., says the manufacturing slowdown has less to do with an impending recession and more to do with the trade war finally catching up with the U.S.

“I don't think it's a huge emergency yet. We have been waiting for the impact of the global trade war for months, and now we're actually seeing it. I guess the only real surprise is that it took this long to start manifesting,” Kuehl said in a phone interview. “Everybody else's PMI had been declining. At one point, I think it was two months ago, of the 15 U.S. major trading partners, only two had a positive PMI. Germany, France, Britain, Japan, China – their indices were all in the forties.”

Even though some estimations predicted September’s PMI to rise back above 50, the steady slowdown of manufacturing growth was just inevitable given the tumultuous state of trade. Meaning, of course, manufacturers were going to start planning accordingly.

"I call it 'unforgiving growth.' It's going to make companies cautious,” Kuehl said. “If they do something to expand or invest and it doesn't work out, there's not enough growth in the economy to get them out of that bind. But everything I've been seeing now shows that nobody is exactly giving up, but they're cautious and figuring out how to live on 1.8 percent growth.”

Weirdly enough, Kuehl added, is that initial mention of tariffs over the past year may have actually helped to boost manufacturing’s production as it was also riding the waves of an exceptionally robust overall economy.

"We were carried along by a lot of expectations,” Kuehl said. “The threat of tariffs drove the economy pretty well for about six months. Companies were realizing it's going to get bad and started to load up inventory. It’s kind of pushed a lot more production than demand justified."

But one of the biggest reasons Kuehl and other analysts aren’t worried about a recession hitting anytime soon is because of what the National Association of Credit Management (NACM) is forecasting. The most recent Credit Managers’ Index (CMI) report, released at the end of September, had a healthy expanded score of 54.1 percent, showing that a manufacturing rebound may be on the horizon.

“The NACM modeled this index after the PMI,” Kuehl said. “It kind of predicts the PMI because credit managers are thinking two, three, four months down the road. And we’ve had a good month.”

Even though the CMI was down less than a percentage point from August, it still beat July’s 53.4 reading. The good news is that what CMI considers “unfavorable factors” on the manufacturing side (categories like accounts out for collections and disputes as well as bankruptcies) remained stable in September. The only noteworthy reductions on the index were sales numbers and applications for credit.

“There's not a lot of forward movement, but you're not seeing a crisis either,” Kuehl said. “So, until the CMI goes in that same direction, I'm not overly concerned with the PMI. But two or three more months of this [PMI contraction]? Then it’s a different story.”

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscriptionAbout the Author

- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/30/2024

- Running Time:

- 53:00

Seth Feldman of Iowa-based Wertzbaugher Services joins The Fabricator Podcast to offer his take as a Gen Zer...

- Industry Events

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI

Precision Press Brake Certificate Course

- July 31 - August 1, 2024

- Elgin,