- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

U.S. manufacturing could need as many as 3.8 million new employees by 2033, says Deloitte

- April 3, 2024

- News Release

- Shop Management

The U.S. manufacturing industry has emerged from the pandemic on a strong growth trajectory, and continued growth is expected over the next 10 years as companies work to meet evolving customer demands, improve their supply chains, and leverage government incentives and policies. Despite substantial growth in the sector, U.S. manufacturing faces a skills gap and tight labor market.

Deloitte and The Manufacturing Institute's new report, "Taking charge: Manufacturers support growth with active workforce strategies," examines the workforce challenges that manufacturers are facing as well as the investment and skills likely required to drive continued growth across the industry. According to the study, workforce challenges are among the top concerns for U.S. manufacturers and have been since Q4 2017, except during the pandemic.

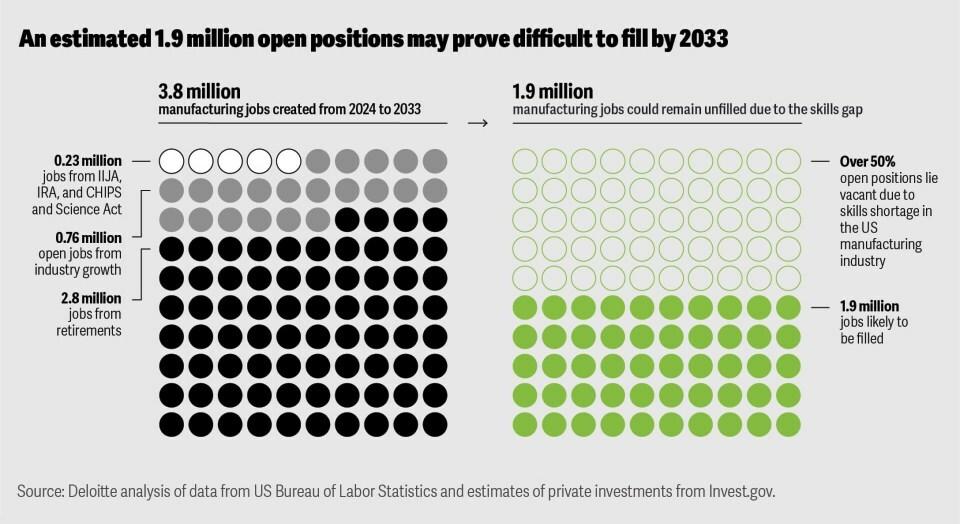

Deloitte projects that as many as 3.8 million additional employees could be needed in manufacturing between 2024 and 2033. Filling these positions, and keeping them filled, is a top concern for many manufacturers: 65% of respondents in the National Association of Manufacturers' 2024 Q1 outlook pointed to attracting and retaining talent as their primary business challenge.

As the need for higher-level skills grows, Deloitte predicts that as many as five in 10 of the skilled open positions, 1.9 million jobs, could remain unfilled if manufacturers are not able to address the skills and applicant gaps.

The demand for digital skills is accelerating as operations and products become more complex and information from smart connected devices and systems needs to be integrated and analyzed. Deloitte and The Manufacturing Institute's analysis shows that in the last five years, there has been a 75% increase in demand for simulation and simulation software skills, sought mostly for technology-enabled production or testing roles. Roles like statisticians, data scientists, engineers, logisticians, computer and information systems managers, software developers, and industrial maintenance technicians are likely to grow at the fastest pace between 2022 and 2032.

For production roles, the fastest growing are likely to be those that require higher-level skill sets like semiconductor processing technicians, machinists, first-line supervisors, welders, and electronics and electromechanical assemblers.

Manufacturers are increasing and varying investments to meet the needs, skills requirements, and values of the evolving workforce while also creating strategies to increase existing employee retention. Nearly half (47%) of respondents in the study indicated that flexible work arrangements (including flexible shifts, shift swapping, and split shifts) are most impactful for retaining employees.

Employees are 2.7 times less likely to leave the organization in the next 12 months if they feel they can acquire necessary skills that are important for the future, according to Deloitte research. More than nine in 10 surveyed manufacturers said they are forming at least one partnership to improve job attraction and retention, and on average, they are partnering with four or more. These include technical colleges, industry associations, universities, state and regional economic development agencies, and K-12 schools. Many partnerships are geared towards building, leveraging, and supporting training programs, helping address the needs to develop new talent.

The report is based on an online survey of more than 200 U.S. manufacturers, interviews with senior executives from manufacturing organizations of all sizes and across all sectors, analysis of secondary data on labor supply and demand, and analysis from Deloitte's economic team.

subscribe now

The Fabricator is North America's leading magazine for the metal forming and fabricating industry. The magazine delivers the news, technical articles, and case histories that enable fabricators to do their jobs more efficiently. The Fabricator has served the industry since 1970.

start your free subscription- Stay connected from anywhere

Easily access valuable industry resources now with full access to the digital edition of The Fabricator.

Easily access valuable industry resources now with full access to the digital edition of The Welder.

Easily access valuable industry resources now with full access to the digital edition of The Tube and Pipe Journal.

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

Tips for creating sheet metal tubes with perforations

Supporting the metal fabricating industry through FMA

JM Steel triples capacity for solar energy projects at Pennsylvania facility

Fabricating favorite childhood memories

Omco Solar opens second Alabama manufacturing facility

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI