- FMA

- The Fabricator

- FABTECH

- Canadian Metalworking

Our Publications

Categories

- Additive Manufacturing

- Aluminum Welding

- Arc Welding

- Assembly and Joining

- Automation and Robotics

- Bending and Forming

- Consumables

- Cutting and Weld Prep

- Electric Vehicles

- En Español

- Finishing

- Hydroforming

- Laser Cutting

- Laser Welding

- Machining

- Manufacturing Software

- Materials Handling

- Metals/Materials

- Oxyfuel Cutting

- Plasma Cutting

- Power Tools

- Punching and Other Holemaking

- Roll Forming

- Safety

- Sawing

- Shearing

- Shop Management

- Testing and Measuring

- Tube and Pipe Fabrication

- Tube and Pipe Production

- Waterjet Cutting

Industry Directory

Webcasts

Podcasts

FAB 40

Advertise

Subscribe

Account Login

Search

Report: despite global uncertainty, additive manufacturing shows no signs of slowing in 2020

New companies and technologies suggest AM is moving toward industrialization

- June 2, 2020

- Article

- Additive Manufacturing

An excellent snapshot of the state of the global additive manufacturing industry has been published by Autonomous Manufacturing Ltd., a producer of AM workflow software. The whitepaper, titled “The Additive Manufacturing Landscape 2020,” can be downloaded at AMFG’s website.

The AM industry has made “huge leaps forward” since AMFG published its first report in April 2019, says the London-based company. These include new companies and investors entering the market, development of advanced materials and technologies, and the emergence of new applications. These advances indicate industry’s move toward industrialization, say the authors.

The report estimates that at the end of 2019 the global AM economy totaled slightly more than $10 billion.

Keyvan Karimi, CEO of AMFG, said, “While the start of 2020 has ushered in much uncertainty globally, the progress within the 3D printing industry shows no signs of slowing down. In these extraordinary times, we are witnessing the continued maturation of 3D printing into an industrialized technology, driving digital transformation.”

The 28-page report includes an overview of each of the key segments within the additive manufacturing industry, a look at 3D printing adoption rates globally, and identifies trends expected to unfold in the coming year. It also features insights from SmarTech Analysis’ vice president of research, Scott Dunham, and Additive Manufacturing Technologies’ CEO, Joseph Crabtree.

Segments analyzed

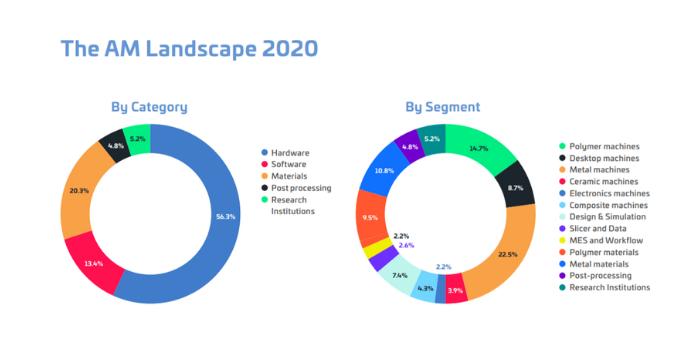

More than 230 organizations contributed information to the 2020 AM report. They were drawn from assorted industry segments, including hardware, materials, software, postprocessing, and research. Only organizations involved in industrial AM were included.

Following are some key takeaways from the paper:

• The hardware category accounts for 56% of the $10 billion-plus AM economy, with metal 3D printers representing 40% of hardware revenue. “The continuous influx of new 3D printing hardware companies means that the segment has become more diverse (and competitive) than ever before,” state the authors.

• The materials market will continue to grow steadily. The market is predicted to exceed $2 billion in 2020, with strong growth expected from the polymer and metal segments.

• AM software developments historically have occurred more slowly than other 3D printing segments. However, according to the authors, the software “segment is catching up, driven by the demand to streamline and simplify 3D printing workflows.” Simulation software remains a major focus, with most simulation solutions directed toward metal 3D printing because of its complexity.

A new report from software supplier AMFG says that despite challenging times, 3D printing continues to transform into an industrialized technology. AMFG

• Postprocessing accounts for up to 60% of the total cost of 3D-printing parts. A number of companies have developed technologies aimed at eliminating postprocessing problems. Among them are automated solutions for parts-cleaning, depowdering, surface finishing, and dyeing.

• As of 2020, according to researchers, North America remains the largest adopter of 3D printing technologies. It accounts for 35% of all installed industrial AM systems. Following North America are Europe, Asia-Pacific, Africa, and the Middle East.

Rapidly maturing

“The Additive Manufacturing Landscape 2020” depicts an industry that is maturing rapidly and becoming more diverse. As the industry continues to mature, the authors identify three key themes coming into play this year:

1. A renewed focus on enabling manufacturing at scale with AM through industrial solutions.

2. A drive toward greater workflow and process connectivity.

3. Industry collaboration that drives AM adoption.

As demand for greater connectivity across hardware, materials, and software increase, collaboration, in addition to competition, will be key to furthering adoption of the technology and moving the industry forward, the authors conclude.

“For this reason, it’s encouraging to see partnerships and collaboration continue to flourish. We expect to see this accelerate in 2020, as materials suppliers, hardware manufacturers and software vendors work together to establish connected, integrated solutions for AM.”

About the Publication

- Podcasting

- Podcast:

- The Fabricator Podcast

- Published:

- 04/16/2024

- Running Time:

- 63:29

In this episode of The Fabricator Podcast, Caleb Chamberlain, co-founder and CEO of OSH Cut, discusses his company’s...

- Trending Articles

- Industry Events

16th Annual Safety Conference

- April 30 - May 1, 2024

- Elgin,

Pipe and Tube Conference

- May 21 - 22, 2024

- Omaha, NE

World-Class Roll Forming Workshop

- June 5 - 6, 2024

- Louisville, KY

Advanced Laser Application Workshop

- June 25 - 27, 2024

- Novi, MI